FXPrimus Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.4 2.5/5 | 127th  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like:

By integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies FXPrimus as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

FXPrimus Review

In the world of online trading, selecting the right Forex broker and trading platform is crucial for success. Forex brokers act as intermediaries, providing traders access to the global currency markets. Among these brokers, FXPrimus stands out as a global financial trading broker, offering extensive access to Forex, Stocks, and Commodities. With its web and mobile platforms, FXPrimus caters to a broad audience, ensuring traders can operate anywhere, anytime. The inclusion of MetaTrader Suite and cTrader platforms underscores its commitment to providing advanced trading tools and features, catering to both novice and experienced traders.

This FXPrimus review is designed to offer a comprehensive analysis of the broker, focusing on its unique selling propositions and highlighting any potential drawbacks. With the aim of delivering essential insights, the review will cover live trading account options, deposit and withdrawal processes, commission structures, and more. By integrating expert analysis with actual trader experiences, our balanced approach aims to furnish readers with the critical information needed to make an informed decision. Whether you're considering FXPrimus as your brokerage of choice or simply exploring your options, this review seeks to provide valuable guidance in navigating the complex landscape of Forex trading.

What is FXPrimus?

FXPrimus is recognized as a leading online trading provider, specializing in Forex (FX) and Contracts for Difference (CFDs). It is notable for operating under the stringent regulation of multiple jurisdictions, which assures traders of a secure trading environment. FXPrimus distinguishes itself by prioritizing exceptional execution speeds and the utilization of innovative technology, aiming to furnish traders with an advanced and efficient trading experience.

Throughout its operation, FXPrimus has earned recognition and numerous awards, affirming its status as a premier Forex provider. The establishment of offices in Vanuatu, Cyprus, South Africa, and other locations underlines its commitment to addressing the needs of a global client base. This international expansion across continents like Europe, Asia, and Africa has contributed to a robust growth in its community, amassing over 300,000 traders worldwide.

Since its inception in 2009, FXPrimus has achieved substantial progress in the Forex trading industry. With its headquarters in Limassol, Cyprus, a key financial center, the company operates as the FXPrimus Group. This umbrella includes three main brands, offering clients access to deep liquidity from top-tier banks. Such liquidity is critical for competitive pricing and ample trading opportunities, enhancing the overall trading experience on the Forex market for its diverse clientele.

Safety and Security of FXPrimus

The safety and security of traders' investments are paramount in the online trading arena. FXPrimus stands out for its commitment to providing a secure trading environment, as evidenced by its dual licensing and offering negative balance protection. The broker is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Vanuatu Financial Services Commission (VFSC). This regulation is crucial for ensuring transparency in the over-the-counter (OTC) market, monitoring and regulating the relations among market participants, and lowering the risk of fraud. Such oversight also involves maintaining a “black list” of disreputable brokerage companies, a move that further bolsters trader confidence in FXPrimus's legitimacy.

However, it's important to note, based on research from Dumb Little Man, that FXPrimus does not handle claims for moral compensation. Despite this, the company's strict adherence to the regulations and requirements set by its regulators underscores its dedication to fulfilling the rights and obligations to its clients, ensuring proper protection of client funds. Additionally, FXPrimus insures the funds of its clients, offering an added layer of security. This approach highlights the broker's efforts to safeguard traders' investments, making it a trustworthy choice for those seeking a reliable and secure online trading provider.

Pros and Cons of FXPrimus

Pros

- Highly reliable broker with a strong reputation

- Holds a top-tier regulatory license from CySEC, ensuring trust and compliance

- Provides professional education and extensive research materials, great for beginners

- Impressive selection of trading platforms, catering to various preferences

- Accommodating to all trading styles, enabling diverse strategies

- Relatively low trading fees, making it attractive for beginner traders

- Commitment to competitive fees for a favorable trading experience

Cons

- Limited product offering, mainly focusing on Forex and CFDs

- Higher spreads for currencies compared to some brokers, affecting trading costs

- Trading conditions and offerings vary by entity, leading to service inconsistency

- Does not offer 24/7 support, potential delays in assistance

- International trading through an offshore entity, raising concerns for some traders

Sign-Up Bonus of FXPrimus

FXPrimus currently does not offer a sign-up bonus for new clients. This approach is consistent with a focus on long-term value and quality of service rather than short-term incentives. Traders considering FXPrimus as their broker should evaluate the platform's features, trading conditions, and educational resources as key factors in their decision-making process.

Minimum Deposit of FXPrimus

FXPrimus sets a minimum deposit amount at $15, making it an accessible option for a wide range of traders. This low entry barrier allows individuals to begin trading with a minimal initial investment, facilitating ease of access to the global trading markets. Potential clients of FXPrimus can leverage this affordable minimum deposit to explore the platform's features, trading tools, and educational resources without a significant financial commitment.

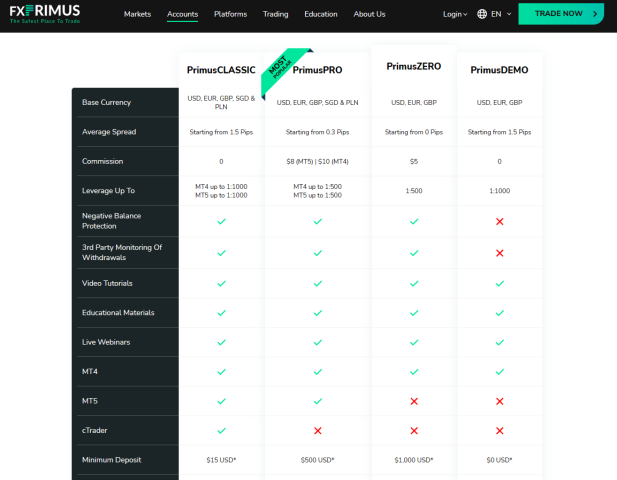

FXPrimus Account Types

After thorough research conducted by our team of experts at Dumb Little Man, the following FXPrimus account types have been identified, offering a range of options tailored to meet diverse trader needs:

PrimusCLASSIC

- Base Currency: USD, EUR, GBP, SGD, & PLN

- Average Spread: Starting from 1.5 Pips

- Commission: $0

- Leverage: Up to 1:1000 (MT4 & MT5)

- Minimum Deposit: $15 USD

PrimusPRO

- Base Currency: USD, EUR, GBP, SGD, & PLN

- Average Spread: Starting from 0.3 Pips

- Commission: $8 (MT5) | $10 (MT4)

- Leverage: Up to 1:500 (MT4 & MT5)

- Minimum Deposit: $500 USD

PrimusZERO

- Base Currency: USD, EUR, GBP

- Average Spread: Starting from 0 Pips

- Commission: $5

- Leverage: Up to 1:500

- Minimum Deposit: $1,000 USD

PrimusDEMO

- Base Currency: USD, EUR, GBP

- Average Spread: Starting from 1.5 Pips

- Commission: $0

- Leverage: Up to 1:1000

- Minimum Deposit: $0 USD

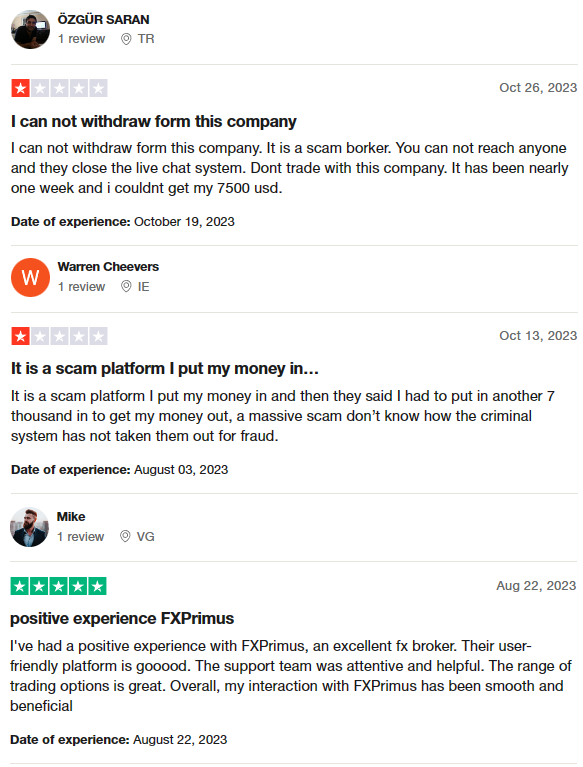

FXPrimus Customer Reviews

Customer reviews on FXPrimus reveal mixed experiences. Some customers have raised serious concerns about withdrawal issues and customer support availability, labeling the broker as a scam due to difficulties in accessing funds and inadequate communication channels. These negative reviews highlight frustrations with being unable to retrieve significant sums and facing demands for additional deposits to access their money.

On the other hand, other clients report positive interactions with FXPrimus, praising its user-friendly platform, responsive support team, and broad range of trading options. This divergence in customer feedback suggests that while some traders have benefited from a smooth and productive trading experience, others have encountered challenges that have significantly impacted their perception of the broker.

FXPrimus Fees, Spreads, and Commissions

When engaging in trading activities with FXPrimus, it's important for traders to understand the fees, spreads, and commissions that may apply. FXPrimus initiates fees starting at $5 USD, though these can fluctuate based on the trader's specific actions and the account type they have opted for. These fees are meant to cover a range of trading-related expenses, including execution, administration, and various operational costs, ensuring the broker can maintain high-quality service and execution.

Spreads with FXPrimus are competitive, ranging from 0 to 1.5 pips. This metric, the gap between the bid and ask prices for financial instruments, directly influences the cost of trade execution. Traders generally prefer lower spreads, as this indicates reduced transaction costs, enhancing the potential for profitability.

Regarding commissions, FXPrimus may impose charges up to $10 USD, contingent upon the account type a trader has. These commissions are levied for certain trading services, like engaging with particular instruments or leveraging advanced features. Understanding these fees, spreads, and commissions is crucial for traders to manage their trading strategy and budget effectively, ensuring a transparent and cost-efficient trading experience with FXPrimus.

Deposit and Withdrawal

The deposit and withdrawal processes at FXPrimus have been thoroughly tested by a trading professional at Dumb Little Man, providing credible insights into the efficiency and flexibility of financial transactions. Funds withdrawal to bank accounts typically takes between 2-5 days, with a minimum withdrawal amount set at $100. Traders have the option to withdraw in multiple currencies, including USD, EUR, SGD, GBP, PLN, and HUF, catering to a diverse global client base.

For those preferring local bank transfers, FXPrimus processes these within 24 hours, offering transactions in MYR, IDR, VND, and THB. This swift processing time enhances convenience for traders in specific regions, with a minimum transfer fee of $50.

Bank card transactions via Visa/MasterCard are remarkably fast, processed within 5 minutes, and maintain the minimum transaction amount of $100. The availability of multiple currencies for these transactions mirrors the broker’s commitment to accommodating traders’ preferences.

E-wallet withdrawals share a consistent minimum amount requirement of $100. UnionPay and Bitpay transactions, catering to those using CNY, euros, and dollars, are processed within 24 hours, ensuring timely access to funds. Similarly, withdrawals via Neteller, Skrill, giroPay, Itau, and ecoPayz are completed in just 5 minutes, showcasing FXPrimus’ efficiency. The withdrawal currencies for Neteller and Skrill include USD, EUR, GBP, PLN, and HUF, while giroPay, Itau, and ecoPayz transactions are limited to euros, and Fasapay to USD and IDR, demonstrating the broker's flexibility in meeting its clients' needs.

How to Open an FXPrimus Account

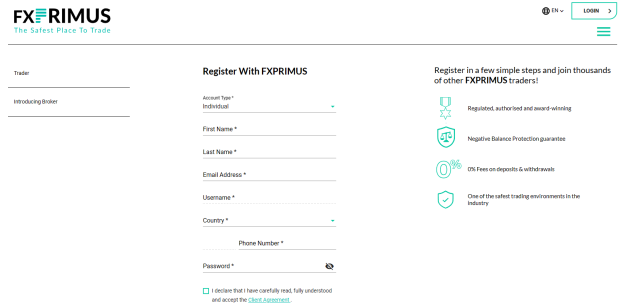

- Visit the FXPrimus website and choose between “Open a real account” or “Open a demo account” on the homepage.

- A registration form will be displayed.

- Fill in your personal details including first and last name, email, phone number, and region.

- Create a username and password for your account.

- Click “Register” to complete the sign-up process.

- Before funding your account, verification is required.

- Submit the necessary documents for account verification.

- Wait for approval from FXPrimus.

- Once verified, deposit funds to start trading.

FXPrimus Affiliate Program

The FXPrimus Affiliate Program offers various opportunities for partners to earn and benefit from referring new clients.

Introducing Broker (IB): This role involves connecting new clients to FXPrimus. Partners earn rebates based on the trading volume and/or deposits of the clients they refer. Benefits include exclusive privileges, an IB certificate, and support from a personal manager. This manager assists with marketing efforts, sponsored event organization, and other professional services.

Affiliate Program: Affiliates promote FXPrimus services to traders, with the potential to earn up to $600 in CPA commissions and loyalty rebates. FXPrimus ensures competitive cooperation terms, offering daily payments, a modern reporting system with real-time updates, and a comprehensive selection of advertising materials. A personal manager is also available to help maximize the affiliate's success.

White Label: This option allows partners to enjoy the benefits of FXPrimus' infrastructure while focusing on other priorities. The White Label program includes an individual reward scheme, a personal website, and effective client attraction tools. FXPrimus takes on the workload, converting traffic into clients, thus enabling partners to focus on growth and profit maximization.

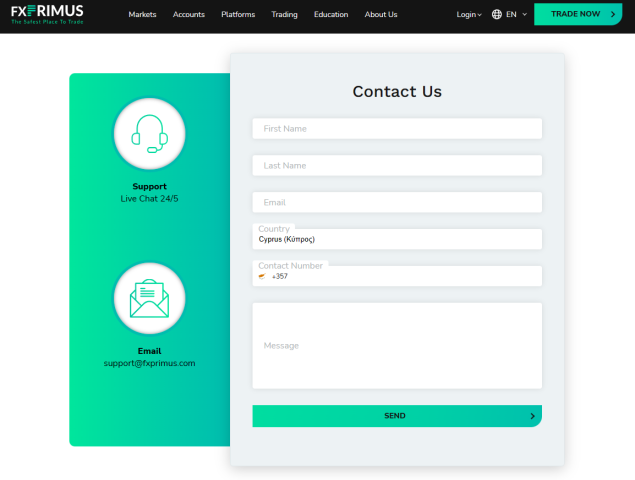

FXPrimus Customer Support

FXPrimus prioritizes excellent customer support, according to findings from Dumb Little Man's exploration of their service. This commitment is evident in the variety of channels made available for traders seeking assistance. The Live Chat feature stands out as a highly convenient option, enabling real-time conversations with a support representative directly through the broker's website. This immediate access to support enhances the trading experience by providing quick answers to queries or issues.

Additionally, FXPrimus facilitates international phone support, catering to clients across different regions who might prefer or require verbal communication. This option underscores the broker's effort to accommodate the diverse preferences of its global client base. Email support further expands the accessibility of FXPrimus' customer service, offering a way for traders to document and submit their inquiries or concerns at their convenience, with the assurance of receiving a thoughtful response from the support team.

Advantages and Disadvantages of FXPrimus Customer Support

| Advantages | Disadvantages |

|---|---|

FXPrimus vs Other Brokers

#1. FXPrimus vs AvaTrade

FXPrimus and AvaTrade differ significantly in their global reach and regulatory framework. AvaTrade has been around since 2006, serving over 300,000 customers in more than 150 countries with a wide array of more than 1,250 financial instruments. It is heavily regulated and licensed in multiple jurisdictions, including Australia, Ireland, and Japan, offering a robust trading experience with a strong emphasis on client confidence and efficiency. FXPrimus, on the other hand, emphasizes safety and advanced trading tools, offering services like MetaTrader and cTrader platforms.

Verdict: AvaTrade might be better for traders looking for a broker with a broader international presence and a more extensive range of instruments. Its heavy regulation and long-standing reputation offer a high level of security and a diverse trading experience.

#2. FXPrimus vs RoboForex

RoboForex focuses on providing superb trading conditions using cutting-edge technologies and has a vast selection of over 12,000 trading options across eight asset classes. Established in 2009 and regulated by the FSC, RoboForex caters to clients worldwide, offering a variety of trading platforms, including MetaTrader, cTrader, and RTrader. FXPrimus stands out with its safety measures, innovative technology, and the choice between MetaTrader and cTrader platforms, tailored to different trader needs.

Verdict: RoboForex may be the better choice for traders looking for diversity in trading instruments and platforms. Its extensive range of options and technologies provides a customized trading experience that can cater to various trading styles and preferences.

#3. FXPrimus vs FXChoice

FXChoice, established in 2010 and regulated by the International Financial Services Commission of Belize, focuses on offering brokerage services primarily suitable for experienced traders. It provides a mix of classic and professional ECN accounts, emphasizing the integrity of its business and customer-centric practices. FXPrimus offers a more general trading environment, with a focus on security and a variety of account types suitable for traders at different levels of experience.

Verdict: FXChoice stands out for traders with more experience, particularly those interested in ECN accounts with tight market spreads. Its focus on professional trading conditions and services tailored for automated trading make it a suitable option for seasoned traders. FXPrimus, with its broader appeal to various experience levels and emphasis on security, may be better for traders looking for a balanced offering with strong safety measures.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

For Forex traders passionate about forging a successful career in forex trading and aiming for significant financial success, Asia Forex Mentor is the prime selection for premier forex, stock, and crypto trading education. Ezekiel Chew, the mastermind behind this initiative, known for his advisory role to trading institutions and banks, stands at the core of Asia Forex Mentor. Ezekiel is distinct in the realm of trading education due to his consistent delivery of seven-figure trades, highlighting his exceptional expertise.

Comprehensive Curriculum: Asia Forex Mentor presents a thorough educational suite covering essentials of stock, crypto, and forex trading. This curriculum is meticulously designed to provide learners with the skills and knowledge to thrive in these varied markets.

Proven Track Record: The proven effectiveness of Asia Forex Mentor is showcased by its history of fostering consistently profitable traders, affirming the high quality of their teaching methodologies and mentorship.

Expert Mentor: Guidance at Asia Forex Mentor comes directly from Ezekiel, a seasoned mentor with a proven track record in stock, crypto, and forex markets. His personalized mentoring empowers students to confidently tackle the complexities of trading.

Supportive Community: Being part of Asia Forex Mentor offers entry into a community of ambitious traders. This environment encourages sharing, collaboration, and learning from peers, enriching the educational journey.

Emphasis on Discipline and Psychology: Recognizing the critical role of mindset and discipline, Asia Forex Mentor emphasizes psychological training. This prepares traders to manage emotions and stress, fostering rational decision-making.

Constant Updates and Resources: In the ever-evolving world of finance, Asia Forex Mentor ensures students stay informed with the latest trends and strategies, providing continuous access to vital resources.

Success Stories: The numerous success stories from Asia Forex Mentor bear witness to its transformative impact, with many achieving financial independence through their comprehensive education in forex, stock, and crypto trading.

Asia Forex Mentor stands out as the definitive choice for aspiring traders seeking a comprehensive and practical trading education. It offers a robust foundation, comprehensive trading tools, expert mentorship, and a supportive community, equipping students to excel in the competitive world of financial trading.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

>>Also Read: NS Broker Review 2024 with Rankings By Dumb Little Man

Conclusion: FXPrimus Review

In conclusion, the team of trading experts at Dumb Little Man has conducted a thorough review of FXPrimus, identifying both strengths and areas of concern. FXPrimus stands out for its strong regulatory compliance, offering traders a secure and reliable trading environment. The broker's variety of account types, competitive trading platforms, and commitment to trader education further position it as a top choice for individuals looking for a comprehensive trading experience.

However, it's important for potential traders to be aware of the cons associated with FXPrimus. The limited product offering and higher spreads on certain accounts may not suit all trading strategies or preferences. Additionally, the lack of 24/7 customer support could be a drawback for those who prefer round-the-clock access to assistance.

FXPrimus Review FAQs

What account types does FXPrimus offer?

FXPrimus caters to a diverse range of traders by offering several account types, including PrimusCLASSIC, PrimusPRO, PrimusZERO, and a PrimusDEMO account. These accounts are designed to meet different trading needs and preferences, with variations in spreads, commissions, and minimum deposit requirements. The PrimusCLASSIC account starts with a minimum deposit of $15, suitable for beginners, while the PrimusPRO and PrimusZERO cater to more experienced traders with higher minimum deposits and lower spreads.

Is FXPrimus regulated?

Yes, FXPrimus is regulated by multiple authoritative bodies, including the Cyprus Securities and Exchange Commission (CySEC) and the Vanuatu Financial Services Commission (VFSC). This regulatory framework ensures that FXPrimus adheres to strict standards of transparency, security, and fairness, providing a secure trading environment for its clients.

How can I contact FXPrimus customer support?

FXPrimus offers multiple channels for contacting customer support, ensuring traders can easily seek assistance. Clients can use the Live Chat feature for real-time conversations directly on the website, international phone lines for verbal communication, and email support for written inquiries. These options aim to provide prompt and helpful assistance, although it's worth noting that 24/7 support is not available.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.