FXIFY Review with Rankings 2025 By Dumb Little Man

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

The skilled financial and trading specialists at Dumb Little Man rigorously assess proprietary trading firms using a comprehensive algorithm and strict standards. Their evaluation emphasizes important aspects like:

|

Proprietary trading firms let traders use the firm's money to trade, splitting gains while lowering the traders' own financial risk. In this very competitive market, FXIFY prop trading firm stands out because it offers traders accounts from $15,000 to $400,000, with the ability to grow up to $4 million. This one-of-a-kind method lets traders use a lot of borrowed money to increase their chances of making money.

This review will use information from trading pros at Dumb Little Man as well as customer reviews to give a full picture of FXIFY. This piece aims to give readers a fair and well-informed view of what FXIFY has to offer the trading community by combining professional analysis with user experiences.

What is FXIFY?

FXIFY is a proprietary trading company that changes the way traders do business by letting them manage accounts with up to $4 million in capital and starting amounts ranging from $15,000 to $400,000.

With FXIFY, you can get the freedom of a brokerage and the support of a prop company at the same time. When traders do this, they can get to a lot of different financial products, like Forex, stocks, commodities, Crypto, and indices. With this new method, dealers will have the tools they need to do well in the tough dealing world.

The business is unique because it lets traders customize their accounts and doesn't enforce a strict rule, so they can trade in a way that fits their trading style, and as long as it is a viable trading strategy. FXIFY is also proud of how quickly and easily it pays out. Within 24 hours, Deel payment solutions takes care of withdrawals. Because of this, FXIFY is better than others in the prop trading industry where withdrawals can take a lot longer.

When FXIFY was started, the goal was to provide a unique trade experience that would set it apart from others. The company offers customizable and adaptable account management because they know that traders have different needs and trading plans.

Traders can get their payouts right away after making their first successful trade, which helps them quickly get their initial sign-up fee back or keep trading. This fast payout method is one of the main things that sets FXIFY apart. It gives traders unmatched access to their earnings and improves their trading journey.

Pros

- Instant Payouts

- No Consistency Rules

- Unlimited Trading Days

- Expert Advisors (EAs) allowed

- Up to 90% profit share

- Backed by FXPIG

- 125% refund of assessment fee

Cons

- Minimum assessment fee of $175.

Safety and Security of FXIFY

It is very important to FXIFY that traders' information and funds are safe and secure. Dumb Little Man's thorough investigation echoed this worry. The fact that prop trading firms like FXIFY has a strict Know Your Customer (KYC) process shows how serious it is about security.

To pass the KYC check, traders must show a clear picture of themselves with their ID next to their face. When someone opens an account, this is done to make sure that they really own the papers they are showing.

Traders who want to use FXIFY need to show proof of where they live. They need to be valid and not more than three months old. Energy bills, bank or credit card statements, tax bills, or government-issued residential statements or certificates are all recent examples of papers that can be used to prove your address.

They don't let you use screenshots, cell phone bills, hospital bills, receipts, or insurance records for this, which is big news. You can use your ID as proof of address if it has your full home address on it. You will still need a different ID to show who you are, though.

IDs must be valid and in color to be used for verification. For passports, both pages must be visible, and for ID cards, both the front and back must be seen. In order to keep things safe, FXIFY stresses the value of live photo formats over scanned or screenshot documents.

It is also strongly advised by the company not to send in fake papers, as doing so could result in accounts being closed and people not being able to open new ones. This strict method shows that FXIFY is serious about keeping its users' trading environments safe.

FXIFY Bonuses and Contests

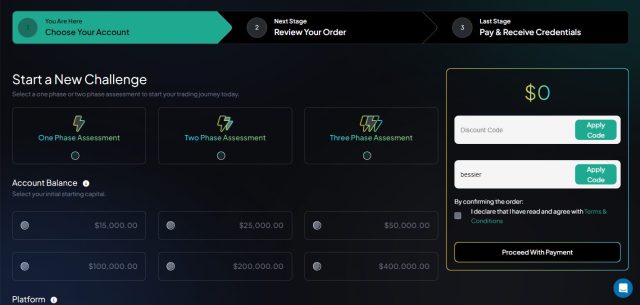

To make trading more fun for its users, FXIFY offers bonuses and events that look very appealing. One of these is FXIFY discount codes, which can save you a lot of money on challenge fees, which are an important part of starting with the prop company.

Traders can save 15% to 20% by using certain coupon codes. Traders can do FXIFY's work more easily and for less money with these codes. This shows that the company cares about its clients.

People who want to join the FXIFY prop business challenge can sign up with the coupon code “AUG15” and get 15% off the challenge fee. The code “SOCIAL20” gives a 20% discount to traders who want to save even more money.

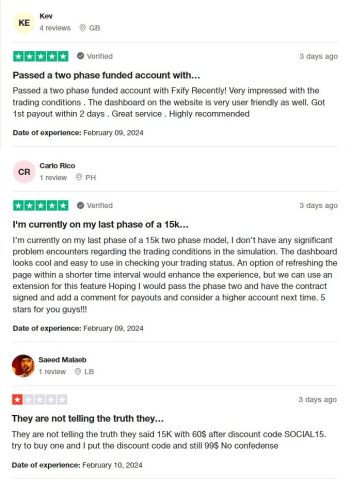

FXIFY Customer Reviews

The fact that FXIFY has a 4.6-star review on Trustpilot shows that customers are mostly happy with it, but there are some things that could be done better. Customers have said good things about FXIFY's dashboard, trade conditions, and payout process. Some customers got their first payout just two days after asking for it.

Many traders say they are happy with FXIFY's service and would suggest it to others. The two-step process for funding an account is easy to understand and follow. However, there are complaints about how clear the prices are, especially when it comes to discount codes not working as promised, which makes some users confused and unhappy.

FXIFY Commissions and Fees

When it comes to proprietary dealing, FXIFY stands out because it offers a variety of payment options and clear fee structures. When traders are ready to cash out their profits, they can do so in a number of convenient ways, such as using cryptocurrency or Deel, a flexible platform that works with Skrill, PayPal, and different coins.

The company's pricing is easy to understand: fees range from $175 to $1,999, based on how much money is put in at the start. The Evaluation Fee, which ranges from $99 to $325 depending on the size of the account, pays for the challenge and proof steps.

The Assessment Fee is another one-time fee that shows how much money is needed. This is another example of how the company is committed to being open about its pricing. Importantly, FXIFY doesn't charge any monthly fees, which makes it more appealing to traders who want a cheap trading tool.

In the future, FXIFY wants to start a prepaid branded card program for traders who have funded it. This will give traders quick access to their profits and make them even less reliant on outside payment services. The company also lets traders trade Forex, stock indices, and precious metals without having to pay any fees. This means that traders keep more of their gains.

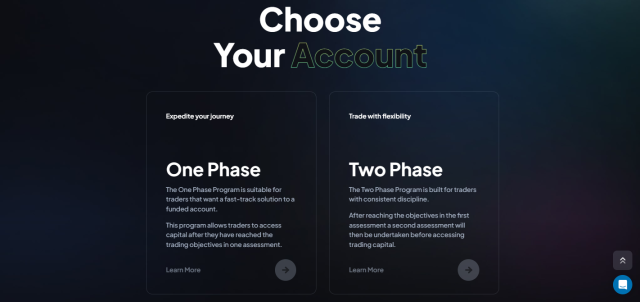

FXIFY Account Types

The team of experts at Dumb Little Man did a lot of testing and study to come up with the following FXIFY Account Types. These make it easier for traders to get a funded account. There are different amounts of starting capital for each account so that it can fit a wide range of beginners and experienced traders.

If traders are thinking about FXIFY's 1 Phase, 2 Phase, or 3 Phase plans, they should know that the fees are the same for all of them and for all trading accounts. This means that the amount of money needed to start trading with a certain capital option stays the same no matter which program is picked.

- $15,000 Account Size – one-time fee of $99

- $25,000 Account Size – one-time fee of $175

- $50,000 Account Size – one-time fee of $325

- $100,000 Account Size – one-time fee of $475

- $200,000 Account Size – one-time fee of $999

- $400,000 Account Size – one time fee of$1,999

One Phase Evaluation Program

Traders can easily use the FXIFY One Phase Evaluation Program, which has features that are the same for all capital options. These features include a Daily Loss Limit of 5%, a Max Trailing Drawdown of 6%, and a Trailing Drawdown Type. The program needs at least five trade days to start working, and it offers a Performance Split of up to 90% and Leverage of up to 50:1. This gives you a lot of freedom and the chance to make a lot of money.

Account sizes vary, and each one has its own goals for how much money traders want to make. For the $15,000 Capital Option, the goal is to get a 10% profit, which is $1,500. The goal rises to $2,000 if you pick the $25,000 Capital Option. For the $50,000 Capital Option, the goal is $5,000. For the $100,000 Capital Option, the goal is $10,000. This time, the goal is $20,000 for the $200,000 Capital Option and $40,000 for the $400,000 option.

Two-Phase Evaluation Program

Traders with any size FXIFY account can expect the same rewards. The goal for Step 1 is to make 10% and the goal for Step 2 is to make 5%. The goals are different for accounts of different sizes. It also lets you lose up to 5% per day, draw down up to 10% at most, and use a static drawdown type.

On top of that, traders must stick to at least 5 days of selling, but not more than that. Performance Split of up to 90% and Leverage of up to 50:1 are both options. This gives buyers a lot of freedom and the chance to make money. Here's what the profit goal is:

- For the $15,000 Capital Option, the Profit Target for Step 1 is $1,500, and for Step 2, it's $750.

- For the $25,000 Capital Option, the Profit Target for Step 1 is $2,500, and for Step 2, it's $1,250.

- For the $50,000 Capital Option, the Profit Target for Step 1 is $5,000, and for Step 2, it's $2,500.

- For the $100,000 Capital Option, the Profit Target for Step 1 is $10,000, and for Step 2, it's $5,000.

- For the $200,000 Capital Option, the Profit Target for Step 1 is $20,000, and for Step 2, it's $10,000.

- For the $400,000 Capital Option, the Profit Target for Step 1 is $40,000, and for Step 2, it's $20,000.

Three-Phase Evaluation Program

Traders with any size FXIFY account can expect the same features, like a Daily Loss Limit and Max Drawdown of 5%, a Static Drawdown Type, and at least 5 trading days, up to an endless maximum of trading days. Traders can also get a Performance Split of up to 90% and Leverage of up to 50:1. This gives them a lot of freedom and income potential.

Steps 1 and 2 for the Profit Target are the same for all account amounts when the profit goal is set at 5%. For the $15,000, $25,000, $50,000, $100,000, $200,000, and $400,000 Capital Options, this is true. The Profit Target can be $750 in both Step 1 and Step 2. This is true for all account amounts.

The Profit Target stays the same for all account sizes as buyers move through the steps. As long as the 5% rate is used, buyers can keep aiming for a Profit Target of $700 in Step 3. This consistency makes sure that the evaluation program always takes the same method to meeting profit goals.

Opening a FXIFY Account

You can easily open an FXIFY account by following a few easy steps. This will allow you to begin investing right away. The process makes sure that traders can easily and quickly choose the type of task they want to take, enter their billing information, and make a payment.

- Choose the preferred challenge type: whether it's 1 Phase, Two or Three.

- Select the desired account balance.

- Choose the trading platform, price feed, and any additional add-ons.

- Enter your billing address details, starting with name, email address, phone number, and physical address.

- Apply any discount codes, if available, then proceed to payment.

- Review your order details and agree to the terms and conditions.

- Make the payment.

- Await receipt of your account credentials.

FXIFY Customer Support

FXIFY gives people more than one way to get in touch with their customer service team. Email [email protected] or fill out a contact request form on the company's website to get in touch with someone about common questions. There is also a button in the bottom right corner of the FXIFY homepage that lets you access live chat help.

From 4 a.m., the email inbox and live chat are both constantly monitored. to 1 p.m. EST. Even though these hours might not work well for traders in the US, users can expect accurate and prompt answers from FXIFY's customer service staff during these hours.

Soon, FXIFY wants to grow its customer service team in both the US and other countries so that it can offer live help 24 hours a day, five days a week for its prop traders. The goal of this project is to make things easier for people to get to and make sure that people who need help get it quickly.

Advantages and Disadvantages of FXIFY Customer Support

| Advantages | Disadvantages |

|---|---|

|

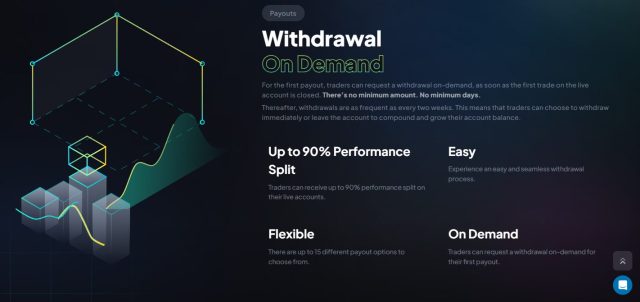

FXIFY Withdrawal Options

Traders who use FXIFY can easily request payouts from their trader dashboard. The first withdrawal can be made at any time after the first profitable deal is closed, and after 30 days, traders can request another withdrawal. Traders can also choose to switch to payouts every two weeks during checkout, which gives them more control over how they manage their earnings.

When traders want to cash out their gains, they can choose to leave them in the account to grow their trading capital. It is important to know, though, that the account will be locked and can't be accessed until the withdrawal is accepted. This is done to protect the funds and ensure the account's integrity.

When you get paid out on a 1-phase live account, the maximum drawdown stays at the starting amount. For example, if a trader asks for a withdrawal after making money, the maximum loss limit is set based on the original balance. This prevents the trading account from incurring significant losses.

Withdrawals from FXIFY are processed during business hours, which are Monday through Friday, 9 AM to 9 PM GMT. Traders should be aware that withdrawal requests made over the weekend will be processed on Monday, and requests made after 9 PM GMT will be processed the next business day. Also, payments may take longer to process during UK holidays. Traders must fill out or update the withdrawal request form that comes with the payout email to ensure the process goes smoothly.

FXIFY Challenges and Difficulties

Each assessment account at FXIFY uses a unique set of flexible trading rules and guidelines specific to that account's phase structure.

The profit goal for Phase 1 of the 1 Phase program is 10%, with a daily drawdown of no more than 5% and a total drawdown of no more than 6%, based on a trailing estimate. Traders have an unlimited number of trading days in Phase 1, and leverage ratios range from 10:1 to 30:1 based on the type of asset.

Phase 1 of the 2-Phase program also aims for a 10% profit, and Phase 2 targets a 5% profit. The daily drawdown limit remains at 5%, but the maximum total drawdown limit increases to 10%, calculated statically based on the starting balance. Like the 1 Phase Account, traders can trade for as many days as they wish and can use leverage rates specific to each asset class.

With the 3 Phase structure, the profit goals are evenly split between three stages, with a 5% goal for each stage. The minimum trading days, daily drawdown, and maximum total loss are the same as in the 2 Phase Account. Leverage rates are consistent with those for other account types as well.

In addition to the rules specific to each phase, all accounts require at least 5 trading days per phase, and a trade must be made within 60 days to avoid a hard breach scenario.

How to Pass FXIFY Evaluation Process

Due to its strict rules, entering the review process of FXIFYcan be challenging. To improve your chances of success, it's crucial to acquire the right knowledge and strategies. Enrolling in a comprehensive training program is essential to ensure you're prepared to meet and exceed the evaluation standards of prop firms like FXIFY.

Asia Forex Mentor – Rated Best Comprehensive Course Offering by Investopedia

Asia Forex Mentor is your best bet for navigating through FXIFY's evaluation process. Its stellar reputation is endorsed by experts at Dumb Little Man. Founded by Ezekiel Chew, a seasoned forex trading expert with decades of experience and a track record of six-figure trades, Asia Forex Mentor has successfully guided many traders through prop firm evaluation programs.

The proprietary One Core Program, based on Ezekiel's expertise, is designed to equip traders with the trading skills needed for successful forex trading. Starting as a small business teaching trading techniques to friends, Asia Forex Mentor has evolved into a comprehensive platform that supports individuals aspiring to excel in the forex market.

How Could Asia Forex Mentor Help You Pass FXIFY Challenge?

For forex enthusiasts aiming to conquer the FXIFY Challenge, Asia Forex Mentor (AFM) stands out as the premier learning destination. AFM arms traders with the necessary tools for success in FXIFY's evaluation process with its array of awards and unmatched educational offerings. Let's explore how AFM can facilitate your success in the FXIFY Challenge.

The One Core Program, celebrated as the “Best Comprehensive Course Offering” by Investopedia, showcases the depth and breadth of the program, making it an excellent choice for traders eager to master forex trading. This comprehensive training ensures participants gain a well-rounded understanding of forex trading, vital for successfully navigating the FXIFY Challenge.

Benzinga has also recognized the One Core Program as the “Best Forex Trading Course for Beginners”. This accolade signifies AFM's capability to support traders across all skill levels. For individuals starting the FXIFY Challenge with diverse experiences, AFM lays down the foundational knowledge essential for tackling complex forex trading evaluations.

Moreover, being named the “Best Forex Mentor” in 2021 by BestOnlineForexBroker reflects the quality of AFM's mentorship and its impact on traders' ability to make “massive gains from forex.” In the context of the FXIFY Challenge, where expert guidance and strategic insights can make a significant difference, such mentorship proves invaluable.

Further validation comes from AFM's recognition as the “Best Forex Trading Course” by prominent forex traders and popular trading platforms. The focus on effective trading systems and strategies equips traders with the necessary tools to excel in the demanding FXIFY Challenge review process.

Traders looking to pass the FXIFY Challenge will find Asia Forex Mentor's One Core Program an essential resource. This program's award-winning curriculum and expert mentorship offer the best pathway to forex trading success.

Asia Forex Mentor Members' Testimonials

Members of Asia Forex Mentor have shared positive feedback on the One Core Program and its founder, Ezekiel, for aiding them in passing various prop firm evaluation processes. Reviews highlight the program's thoroughness in teaching all the required skills for profitable trading. Students appreciate Ezekiel's clear and straightforward teaching approach and the well-constructed course materials, from videos to assignments.

The effort and care invested in the program make it an effective learning platform. Users also report gaining extensive knowledge about trading, boosting their confidence in managing real accounts. This program is highly recommended for anyone seeking to delve into forex trading, offering a structured, easy-to-follow format with straightforward examples.

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: FXIFY Review

The trading experts at Dumb Little Man endorse FXIFY for its intuitive interface and thorough evaluation process. They recognize the platform's efficiency in identifying skilled traders adept at profiting in the forex market. While they rate FXIFY highly, they warn of the evaluation's complexity, requiring a profound understanding of trading strategies and market analysis, which may pose a challenge for novices.

Experts suggest that engaging in top-quality training, such as the Asia Forex Mentor's One Core Program, can significantly enhance your chances of passing the FXIFY evaluation. Such educational resources provide traders with the essential skills and knowledge, markedly increasing their success prospects. This approach not only prepares traders for FXIFY's stringent review but also builds a strong foundation for sustained success in forex trading.

>> Also Read: My Funded FX Review with Rankings 2024 By Dumb Little Man

FXIFY Review FAQs

Does FXIFY offer any risk management tools or strategies to help traders minimize losses?

Yes, FXIFY as a proprietary trading firm has many tools and strategies for traders to help them control their risks and keep their losses as low as possible. This includes setting stop-loss orders and giving advice on how to handle leverage and exposure, which are very important for keeping a profitable trading plan within the limits of the platform.

Can beginners participate in FXIFY's trading challenges, and what support is available?

Yes, people who are new to trading can take part in FXIFY's tasks, but they should know that they are tough. FXIFY prop firm helps new traders get started by giving them educational materials and guidance. This increases their chances of success.

What are the initial funding requirements to start with FXIFY?

Traders must first go through an evaluation process with FXIFY. Depending on the size of the account they choose to handle, this process may cost money. This first step makes sure that traders are serious and skilled enough to use the trading cash that FXIFY gives them.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.