FXCM Review 2024 with Rankings by Dumb Little Man

By Peter Vanderbuild

January 10, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.8 1.5/5 | 78th  |  |

| Evaluation Criteria |

|---|

The experts at Dumb Little Man, including financial advisors, seasoned traders, and retail investors, utilize a specialized algorithm to conduct thorough reviews of brokerage services. Our uniform assessment benchmarks include:

Customer reviews are also integrated into our analysis to provide a well-rounded view, mitigating personal biases for a fair assessment. After our detailed evaluation, FXCM is recognized as a dependable choice for those looking for a solid financial broker. Despite its array of benefits, it's important to acknowledge its deficiencies. We advise potential users to carefully read through our article to grasp these aspects fully. |

FXCM Review

Forex brokers act as entry points into the exciting and financially rewarding realm of currency trading. One notable operator providing a variety of forex and CFD trading alternatives is FXCM, a UK-based company.

FXCM offers traders easy-to-use account opening and extensive instructional resources to help them navigate the forex markets. Despite having a large array of technical tools, its portfolio only consists of trading CFDs; equities and ETFs are not included.

Reviewing FXCM's services, platform offers, regulatory compliance, and customer support, this report aims to present an objective, comprehensive review of the company. It seeks to provide prospective traders with essential information about FXCM's costs, account kinds, operations, and instructional materials so they may decide for themselves whether or not FXCM suits their trading requirements and tastes.

This evaluation acts as a thorough manual for anyone thinking about using FXCM as their trading partner by outlining the benefits and possible disadvantages of trading with them.

>> Also Read: 9 BEST Forex Brokers For 2023: Reviewed By Dumb Little Man

What is FXCM?

FXCM is a seasoned market-making broker that was founded in 1999 in New York and moved strategically to London, UK. FXCM guarantees a regulated trading environment because it is currently governed by the Financial Conduct Authority (FCA) and other international organizations like ASIC in Australia and FSCA in South Africa.

The broker provides competitive leverage choices and a range of account types with forex and CFD trading. Together with a variety of plugins that accommodate a wide range of trading styles and methods, its powerful technology stack also includes the in-house Trading Station, MetaTrader 4, and additional trading platforms like ZuluTrade and NinjaTrader.

A mainstay in the realm of online trading, FXCM offers instruments for forex, equities, commodities, and more with a focus on cutting-edge trading tools and instruction. Since 2015, FXCM has been owned by Leucadia National Corporation, giving it support from a company that has a strong track record in investing and financial services.

Safety and Security of FXCM

Operating since 1999 and governed by laws by prestigious authorities such as the FCA in the UK and ASIC in Australia, FXCM is acknowledged as a safe broker for trading. High leverage and low minimum deposits, however, should be used with caution by traders as they may result in a negative balance in their accounts.

Comparing trading with FXCM Markets Limited, which is overseen by the Bermuda Monetary Authority (BMA), offers less protection than dealing with regulators in Europe and Australia. FXCM offers protection against negative balances, leverage limitations, and compensation plans, but it does not separate client cash from operating capital.

According to this information, which Dumb Little Man thoroughly investigated, traders, should be aware of the risks associated with the possibility of losing more than their initial deposits due to high leverage—up to 400:1—and the possibility of negative balance when holding precarious trading positions with small deposits.

FXCM guarantees that client funds are held in segregated accounts with reputable banks.

Regulated by a number of esteemed organizations, such as the FSCA, ASIC, FCA, and CySEC, highlights FXCM's dedication to security. However, it's crucial that clients in Malaysia understand that FXCM is not licensed by the Securities Commission of Malaysia (SCM). The following is a list of the firm's regulatory credentials:

- FXCM LTD – FCA regulated since 2003, license: 217689.

- FXCM Australia Pty. Limited – ASIC regulated since 2007, license: 309763.

- FXCM South Africa (PTY) Ltd – FSCA regulated since 2016, FSP No 46534.

- FXCM EU LTD – CySEC regulated, license number 392/20.

- FXCM Markets Limited – Part of the FXCM Group, operating in Bermuda.

Sign-Up Bonus of FXCM

Traders who sign up with FXCM have no sign-up bonuses, which are a typical perk provided by many brokers. To make up for this, FXCM offers traders alluring promotions like the Rebate Program, which pays out cash rebates in accordance with traders' trading volume.

Furthermore, FXCM uses its referral program to incentivize current users to refer new traders. Clients now have the chance to profit monetarily from referring others to the platform.

Minimum Deposit of FXCM

FXCM's account opening procedure is simplified and easy to use, making it possible to start trading right away. It is a viable choice for individuals wishing to enter the forex broker market because the minimum amount needed to begin trading is $50 or the equivalent in their own currency.

FXCM Account Types

FXCM presents a straightforward account structure tailored to various trader types, as confirmed by Dumb Little Man's expert research team:

FXCM Standard Account

- Available to all clients, this account is commission-free with costs built into the spreads.

- Minimum deposit: $50 (may vary by payment method).

- Suitable for new and long-term traders who prefer a simpler cost structure without commissions.

FXCM Active Trader

- Ideal for high-volume traders, offering FXCM’s lowest spreads and discounted commissions.

- Features include dedicated support and depth of market insights.

- Commission savings can reach up to 62.4% with a tiered structure based on trade volume.

- Minimum equity: $25,000 to qualify for discounted commissions.

Interest-Free Account

- Designed specifically for Islamic traders, adhering to Sharia law by avoiding swaps.

- Extra cost: Adds 0.4 pips to the Standard account spread or a $2.00 commission per lot per side for commission-based accounts, replacing overnight fees.

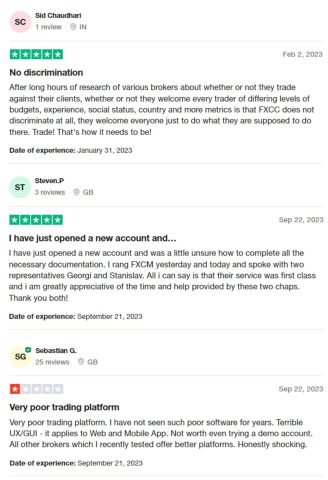

FXCM Customer Reviews

A mixed picture can be observed in FXCM's customer reviews. When using their retail investor accounts, some customers, like Steven, have praised the representatives' excellent customer service and expressed thanks for their help in setting up their accounts.

However, Sid values FXCM's friendly attitude, which accepts traders with different financial means, backgrounds, and experiences without bias. Sebastian, on the other hand, complains about the platform's antiquated UI and bad user experience on both web and mobile, and unlike other brokers, he even advises against opening a demo account.

The compiled reviews indicate that users have encountered the services and platform of FXCM in a variety of ways.

FXCM Fees, Spreads, and Commissions

The fee structure of FXCM is complex; standard spreads are typically average but can be attractive for some pairings, like as AUDUSD and AUDJPY. Better prices are available with the Active Trader account; FXCM's dealing desk, which has the ability to serve as a market maker, determines the execution.

In spite of this, Active Trader commissions are cheaper, with round-turn costs as low as $5. This represents a savings that increases the appeal of the effective spreads. The FXCM Active Trader account has the lowest spreads available, especially when the lowered commissions are taken into consideration.

The floating spread on indices and commodities is the main source of expense for traders when it comes to FXCM fees; the typical spread for instruments like as EURUSD is approximately 1.3 pips, which is comparable to or less than that of competitors. These spreads, however, are erratic and could experience delays.

Deposit and Withdrawal

While FXCM offers a range of funding and withdrawal choices, in comparison to other brokers, it has slower processing times and higher fees for bank transfer withdrawals. An expert trader at Dumb Little Man verified this by testing these services.

Anti-Money Laundering (AML) requirements are strictly followed by FXCM, guaranteeing that withdrawals are made to the original funding source.

Credit/debit cards, Skrill, Neteller, and EFT/bank wire transfers are available. Interestingly, FXCM does not charge administrative fees for deposits. Additionally, there is a $40 fee for bank wire withdrawals, but credit or debit card withdrawals are free.

Deposit timings differ: credit/debit card and e-wallet deposits happen instantly, while bank transfers take a few business days. Bank transfers take three to five days to process withdrawal requests; credit/debit card and e-wallet requests are processed in a day.

How to Open an FXCM Account

It may take longer than some other brokers, but the FXCM account opening process is totally digital and made for ease if you follow these nine steps.

- Go to the FXCM website and click the “Open Account” option to begin the process.

- Decide the country you live in and which trading platform you would like to use.

- Enter your name, email address, and preferred base currency on FXCM's secure server.

- Accept the terms of service and create a strong password.

- When asked, enter your contact, job, and financial details.

- Use a passport or government-issued ID to prove your identification.

- Use a utility bill or bank statement to confirm your address.

- Await the examination and verification of your account by the FXCM support team.

- To activate your trading account, make a minimum $50 deposit after verification.

FXCM Affiliate Program

The Affiliate Program at FXCM provides partnerships to leverage their deep industry knowledge, premium liquidity, and wide range of trading products to improve your business. Designed to meet the needs of different financial organizations, the program strives to provide tailored, turnkey solutions.

Those who are interested are urged to register at the website for more information about working with FXCM.

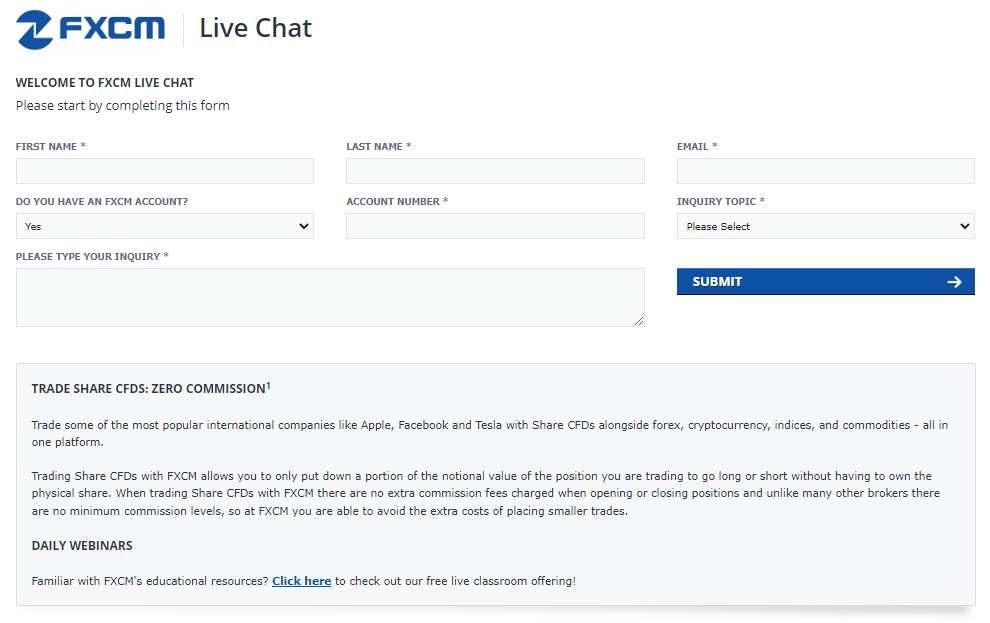

FXCM Customer Support

Live chat, email, phone, and SMS are just a few of the ways that FXCM's excellent customer service may be reached. It is available around-the-clock. Customers from South Korea to Venezuela, and many other countries in between, can contact us for assistance using 42 country-based phone lines.

FXCM offers a trading desk phone line for individuals who would like to talk to a trader personally, particularly in situations where there is internet issues. Although the website has a useful search function that makes self-service easier, it noticeably lacks a dedicated FAQ page for fast replies.

The customer service system is available in 19 languages and provides inclusive support to a worldwide audience; phone support is not currently offered in the Philippines. According to Dumb Little Man's experience, FXCM's customer care is educational and responsive, with quick email responses given within a day and extra resources offered as needed.

Advantages and Disadvantages of FXCM Customer Support

| Advantages | Disadvantages |

|---|---|

FXCM vs Other Brokers

#1 FXCM vs AvaTrade

FXCM appeals to traders who prioritize diverse platforms and detailed analytics, backed by top-tier regulators like ASIC and FCA. In contrast, AvaTrade, is known for its easy-to-use platform and low entry threshold with account openings from 100 base currency units, however, its lack of FCA regulation could be a deciding factor for those who value stringent regulatory oversight.

Verdict: FXCM is better for traders who value a regulated environment and a variety of platform options. AvaTrade might appeal more to people who value a wide variety of trading tools and cutting-edge trade protection measures.

#2. FXCM vs RoboForex

RoboForex has only been in business in 2019, but because of the extent of the trading platforms that it provides like MT4, MT%, cTrader, and R Stock Trader, it stands out compared to FMXC. Additionally, RoboForex is regulated by several respected agencies. RoboForex offers customized trading conditions that cater to different trading styles and sizes.

Verdict: For traders who value personalization and flexibility, RoboForex is the better option. On the other hand, since FXCM has already been in the market for far longer than ROboForex, it is a better choice for stability.

#3. FXCM vs FXChoice

FXCM is best for traders who look for extra security and intensive technical analysis support since it is under strong regulatory oversight and already has advanced trading capabilities. On the other hand, FXChoice stands out due to its access to different commodity CFDs like crude oil, precious metals, and more.

Verdict: If the focus is security and support, traders would rather opt for FXCM, but for those who are looking for a more diversified commodity CFDs, FXChoice is the better option.

Choose Asia Forex Mentor for Your Forex Trading Success

Experts at Dumb Little Man recommend Asia Forex Mentor for those who want to make a successful career in Forex trading. This platform is popular for its courses on stock, Forex, and crypto trading because of the following:

Extensive Curriculum: It provides an in-depth and intensive curriculum about the important aspects regarding stock, cryptocurrency, and Forex market.

Proven Track Record: The glowing reviews and recommendations of previous members of the program are a testament to how this program produces high-quality and profitable traders.

Expert Mentor: Learn from an experienced mentor, Ezekiel Chew, a trader who makes seven-figure transactions consistently.

Friendly Community: Be part of a supportive environment where everyone will work together, exchange ideas, and share learnings with each other.

Stress on Psychology and Discipline: Traders will not only learn the ins and outs of trading but the Psychology behind it, especially being disciplined and having a positive outlook in trading.

Regular Updates and Resources: Members are guaranteed updated resources and regular updates to stay up to date on the current market trends.

Success Stories: Be inspired by the number of success stories and the number of traders who have achieved financial independence and success in their trading careers, that stemmed from Asia Forex Mentor.

All these make Asia Forex Mentor a premier learning resource for traders who want to participate in more extensive training, not only in trading platforms like FXCM but also in stocks and cryptocurrency. Being part of the program will guarantee traders the assistance that they in order to succeed in today's ever-changing market.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: FXCM Review

Having built a good reputation for reliability since its foundation in 1999, FXCM group is an impressive competitor in the forex and CFD trading markets. Reputable organizations like the FCA, ASIC, and CySEC oversee it, which contributes to its global presence and guarantees traders of excellent security and adherence to financial standards.

First-rate technical tools and excellent instructional resources complement FXCM's large selection of platform alternatives, which include the well-renowned Trading Station, MetaTrader 4, and ZuluTrade, in addition to offering a wide range of trading preferences and styles. Being able to offer reduced commission rates and attractive spreads, particularly with the Active Trader account, puts the broker in a strong position compared to its rivals.

Prospective traders should exercise caution, though, as FXCM only provides trading CFDs as a product and does not provide two-step verification for additional account security. The high withdrawal fees and the length of time it takes to process deposits and withdrawals may also be a deal-breaker to some.

In conclusion, the experts at Dumb Little Man think that FXCM is a solid option for anyone looking to trade CFDs and forex, provided they are aware of the cost structure and accessible security features. The evaluation of FXCM as a whole carefully balances the company's established market position and wide range of trading options with the areas that are still in need of improvement.

>> Also Read: JustMarkets Review 2023 with Rankings By Dumb Little Man

FXCM Review FAQs

What types of accounts does FXCM offer?

To accommodate varying trading volumes and styles, FXCM, like other trading platforms offers a variety of accounts. The most popular account type, the Standard Account, has no commissions and is perfect for small traders. The Active Trader Account provides lower spreads and discounted commissions for high-volume traders. Additionally, Islamic traders can adhere to Sharia law by avoiding swaps with an interest-free account. It also offers a free demo account.

What is the FXCM Trading Station and what features does it offer?

FXCM's in-house trading platform, The Trading Station, is well-known for its comprehensive capabilities and easy-to-use interface. With a wide range of technical indicators, powerful order management tools, and sophisticated charting capabilities, it provides traders with an extensive toolkit.

How does FXCM's customer service stand out?

Reputable for providing award-winning customer service, FXCM is reachable via phone, email, SMS, and live chat around-the-clock. With dedicated phone numbers in 42 countries and support available in 19 languages, FXCM makes it simple for traders anywhere in the world to get the assistance they require.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.