FreshForex Review 2024 with Rankings By Dumb Little Man

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

A broker can make or break your trading journey; their services, fees, and withdrawal process play a crucial role in your forex profitability. We understand the significance of finding the right broker; hence, we use a keen eye to analyze a broker in multiple aspects. Our analysis includes vital factors that help determine a broker's service and reliability.

Our review of FreshForex has bought mixed opinions. It has popular services for forex traders; however, it lacks AI support and an intuitive interface. We will discuss FreshForex in the following sections. Let's go! |

FreshForex Review

The trading world is changing rapidly; we have seen a massive influx of new traders hoping to make it big. The changing infrastructure also demands an updated interface from brokers to suit newer users. Amongst the developments, FreshForex promises to meet customer demand and assist them in reaching their dreams.

Freshforex is a popular broker in the forex trading market; its high leverage ratio and diverse asset classes offer a profitable trading opportunity for new and advanced traders. The company has spent over 15 years in the forex trading market and has established a name for its services.

However, we have also found some critics complaining about an obsolete trading experience with FreshForex due to a lack of AI trading options. Are you looking to trade with FreshForex? Well, you're at the right place.

In the following sections, we will go through a detailed analysis of FreshForex, including its services, platforms, charges, and reliability. We also use customer reviews and our expert analysis to assist you in making a good decision.

What is FreshForex?

The simplest approach to understanding FreshForex is by using the 5 Ws- what, who, when, where, and for whom.

What– FreshForex is a forex trading broker that allows both newbies and advanced traders to trade in over 130 different securities. Its assets include forex and CFDs for crypto, stocks, commodities, metals, and oils.

Who– Freshforex was founded by Riston Capital Limited; the parent company has multiple subsidiaries catering to different trading segments. Some are exclusively for high-capital investors and manage their funds and portfolios.

When– It was founded in 2004 and has managed a positive reputation in the trading industry for over a decade. Freshforex has received many accolades and rewards for its efficient services, low prices, and profitable affiliate programs. During the Shanghai Forex Expo, they were rewarded with the best trading conditions award in 2015.

Where– FreshForex has expanded its operations in over 200 countries, including South Africa, Nigeria, Pakistan, and India. Their expansion in the European market has been slower than other brokers.

We believe their slow growth is primarily due to weak European licenses that negatively impact a trader. The company operates with an SVG license obtained by Riston Capital. FreshForex uses a registered address of Griffith Corporate Centre in Kingstown; the location is quite popular amongst offshore brokers operating in the United States.

For Whom– In our view, Freshforex is a good option for low-capital forex traders looking to actively engage in technical and fundamental analysis of their preferred securities.

The broker has decent technical indicators and tools, which will assist users in putting their trading knowledge to the test. The accounts can also be opened with a minimum investment of $1. Let's dive deeper into their services and determine whether they fit your trading journey.

Safety and Security of FreshForex?

Our broker rating is heavily dependent on a broker's reliability and legitimacy. If a broker isn't legitimate, they'd ultimately lead to severe losses for the traders. We judge a broker's legitimacy on three grounds.

Firstly, the broker must have credible licenses in its operational regions; a trading license is a safe way for traders as they can be compensated even if a broker defaults. The PAUSE scheme is a popular compensation fund as it has helped create a safer network for traders. FreshForex is registered in Beachmont, Kingstown, and they have obtained an SVG trading license for their operations.

An SVG license isn't perceived at the same rank as other FCA and SEC licenses. Instead, some of the latest brokers have used an SVG license to disguise their nefarious activities and make a trustable image amongst customers. Secondly, FreshForex is located at Griffith Corporate center; the location is shared between many offshore brokers, including Smart Trade Solutions and CCX Markets.

However, some brokers at the site have had a poor reputation amongst customers, impacting other brokers there too. The plus point for FreshForex's security is its long history and expansion in South African and Asian markets. The company has been providing forex trading services for over ten years, and we haven't witnessed any problematic reviews from existing customers.

Although there have been some customer problems, FreshForex's reputation has largely stayed intact. Also, they have been recognized with different global awards; hence, we can trust their services.

Sign Up Bonus of FreshForex

A lucrative reason for most traders to sign up with FreshForex is their exciting bonuses. The company has created an unparalleled bonus scheme that is irresistible for most traders. As a result, they were rewarded as the ‘Best Forex Bonus Program' by ProfitF in 2017. The company has diverse bonus types to assist traders in maximizing their trading potential.

Once a trader signs up for a trading account, their first deposit bonus can be as massive as 300% of their investments. Similarly, traders can also get their funds insured by the broker, and if a loss occurs, Freshforex can compensate up to 50% of the amounts lost. Hence, you can trade with an unfair advantage compared to other traders.

The broker also offers a 101% drawdown bonus, a 10% cryptocurrency reward, and multiple other rebates and rewards for their traders. Their bonuses have been the primary reason behind the rapid expansion in the Asian market, as no similar broker offered competitive returns.

Minimum Deposit of FreshForex

As we mentioned earlier, Freshforex doesn't have a proficient license collection, and they compensate by allowing traders to experience their services without investing a significant chunk. They have three base account types and over four subsidiary accounts.

None of the account types has a minimum deposit requirement, and you can open your account for as low as $1. However, the company has set a prescribed deposit amount to help traders benefit fully from their trades. The $1 deposit is kept mainly to give maximum traders a real-time feel of the brokers' services and processes.

Account Types

Account types play an important role in assisting your everyday trades. Brokers tend to design their account types comprehensively to engage their targeted audience. We always recommend traders select an account type based on their trade frequency and strategic requirements.

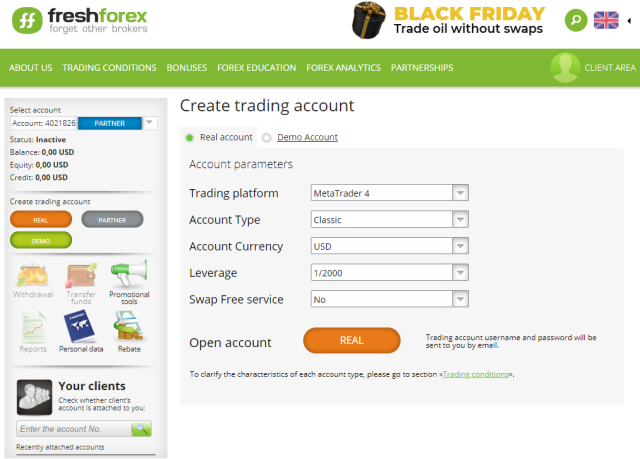

- The classic account is designed for low-capital traders looking to trade actively using their previous learning and current market information. It gives you access to MT4 and MT5, where you can create strategies and make efficient trades. The classic account has a four-digit quotation, and the spreads are fixed, starting from 2 pips.

- The Market Pro account is typically for traders transitioning from newbies to full-time trading. It has a prescribed investment of $1000, and you can trade over 130 trading assets. However, the account doesn't offer an MT5 trading platform which may affect the trader's strategic calculations. It has floating pips starting from 0.9 per lot, and traders can use up to 1:1000 leverage.

- ECN account lets traders enter the global markets and trade with no limitations. The account has spreads starting from 0 pips; however, a commission of 0.003% is charged per contract. Traders can use up to 1:1000 trading leverage based on their skill set. Unlike market pro accounts, ECN accounts offer different trading platforms for traders to suit their preferences.

These three accounts are the primary account types, and once traders have signed up, they can opt to partner and swap-free accounts. FreshForex has also offered cent accounts for the forex market, but they haven't been popular amongst users.

We suggest users start with a FreshForex demo account to understand the real-time market fluctuations and practice their strategies without putting their investments at stake.

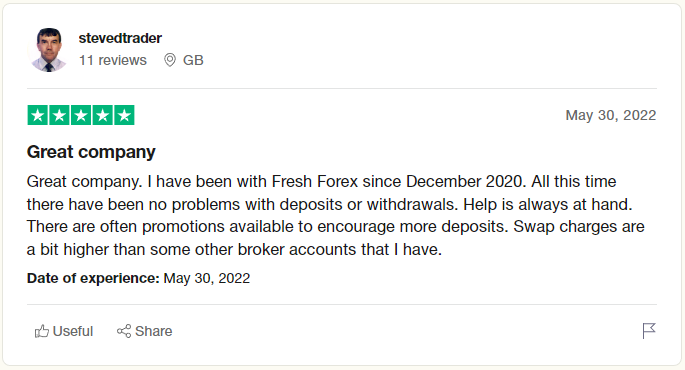

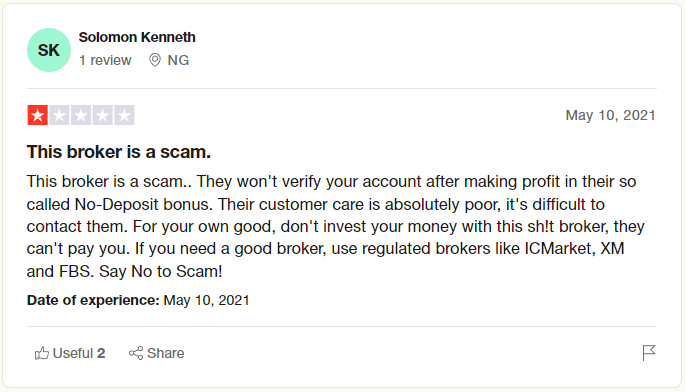

FreshForex Customer Reviews

|

|

|

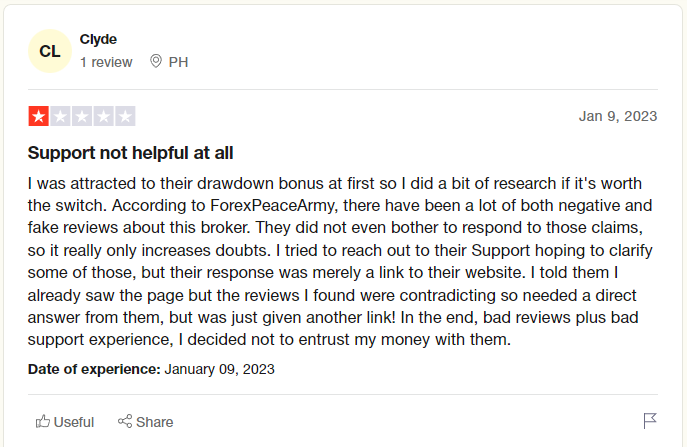

Customer reviews present first-hand experience about any service, and we can't neglect their presence in judging a broker's legitimacy. Freshforex has mixed customer reviews; it has obtained a positive ratings across multiple websites and platforms. They are rated 2.7/5 stars on TrustPilot, with about 65% positive ratings.

The positive reviews have highlighted the ease of signing up with the broker; they have applauded how the broker processed their sign-up and withdrawal request without trouble. Some reviewers also mention they received impressive customer support to deal with their queries and present actionable solutions.

However, a 35% negative rating is an alarming sign regarding a broker, and FreshForex's negative reviews can't be ignored.

The users have complained about the false bonuses offered by the forex broker; users claim the drawdown and deposit bonus has complicated verification procedures that make it impossible for traders to claim them. Similarly, a reviewer mentions that the support wasn't supportive of their queries regarding the trading platforms.

Overall, Freshforex has mixed opinions in the trading community. Nonetheless, the reviews are poles apart, making it difficult to analyze their authenticity. However, after our research, we can suggest the problems of bonus withdrawals can partially be attributed to regional differences.

Asian security bodies generally have lesser red tape on brokers, which makes their processes seamless. In the UK and the US, the trading policies usually are stricter, and multiple additional documents are required as part of anti-money laundering policies.

FreshForex Spreads, Fees, and Commissions

Freshforex isn't an industry leader in the lowest trading costs; however, their overall bonus and cost system creates an excellent profit-making opportunity for traders. The broker offers three different account types that have different spreads and commissions.

If we look at the classic account, it has fixed spreads for foreign exchange market and CFDs; these spreads start at 2 pips per lot. The market pro account has floating spreads, starting at 0.9 pips, while the ECN account doesn't have any fixed spreads, but a commission of 0.003% is charged per contract.

As per the Freshforex website, the classic account has a 2-pip spread for EUR USD, 3 pips for GBPUSD, and 4 pips for USDCHF. The minor currency pairs have similar spreads but are usually higher than regular pairs. The market pro comes with lesser spreads; the EUR USD rate drops to 1.01 pip, GBPUSD is 1.2 pips, and USDCHF is 0.91 pips.

The difference in spreads between the two trading accounts is significant for everyday traders, and they should select the right account type to lower their costs. The trading fees with Freshforex are on the higher side of the industry.

They have a swap fee for overnight trades; the fee changes frequently based on your currency pair. The company also charges a $5 withdrawal fee, separately from the commission charged by the intermediary. Freshforex doesn't have a minimum deposit requirement, and traders can start trading with their preferred investment.

Deposit and Withdrawal

We are gradually navigating toward your first sign-up step, and before we learn about the process, it is essential to know about the deposit and withdrawal policies.

If you've been skeptical about trading, you may have viewed countless stories where the broker doesn't return the trading deposit. However, Freshforex is a trustable broker, and their website and platforms give a trustable outlook.

Freshforex broker supports 20 different methods for deposits and withdrawals. You can make your deposit through an e-wallet, MasterCard, VISA, bitcoin, or Rubell. Similar methods can also be used for withdrawal, with some exceptions.

However, their deposit requirement has a catch- although the broker explicitly mentions a no-minimum deposit requirement for their account types, traders have to abide by different limits fixed for different methods.

For instance, traders can't deposit less than $30 using any of the E-wallets. If you're using a crypto wallet, you can't make a deposit of less than 0.01 BTC.

The company hasn't set any fixed limit for withdrawals, but a $5 fee is charged on the transfer. Some banks may also allow a fixed amount or higher to process the withdrawal; thus, you may have to check with your designated bank. Usually, intermediaries charge a 2.5% fee for processing the withdrawal, which may be deducted from your total account.

FreshForex has been transparent about its costs, fees, and regulations, which makes it a trustable option. We haven't found any reports about hidden charges from its existing users, which add to its legitimacy.

How To Open a FreshForex Account – Step-by-Step Guide

FreshForex has a mix of positives and negatives; however, for most POVs, the pros overpower the cons. Thus, it can be an excellent choice to sign up. If you feel the same way, the sign-up procedure is easier than you think.

Freshforex and most other brokers in Saint Vincent and the Grenadines don't have to comply with strict documental complexities; thus, the account sign-up procedure is pretty simple, and you can start your trading operations instantly.

- You can start by clicking on the ‘Login' button on the official website. It will show a popup asking for your email and password.

- As you haven't created an account yet, click on the ‘Register' button at the bottom of the popup. You will be redirected to an account sign-up page.

- You will need to fill in your details, including your phone number, name, and other vital information. It is important to note that once you fill out the form, you are automatically complying with the T&Cs of fresh forex.

- You will receive an email to verify the sign-up process, and once you confirm it, your FreshForex ID will be live. You will have access to a website portal for demo account trading.

Once you've experienced the trading platforms using a demo account, you can start real-time trading by making your first deposit. The trading platforms contain a ‘Deposit' button, where you can enter your details to make the deposit. You will also be asked to select your preferred account type when you proceed.

The deposit bonus will also be available after you've made your deposit. Previously, the Fresh Forex broker used to send a code to add your bonus to the account, but now, the process can be completed through the client cabinet at the trading platform.

FreshForex Affiliate Program

Besides their perks for traders, Freshforex is also popular amongst finance bloggers and influencers. They host one of the best affiliate programs amongst forex brokers, which presents an excellent opportunity for influencers to make an income. Freshforex was regarded as the ‘best affiliate program' in 2012 by RACE.

The popularity of the affiliate program is due to its recurring nature; a user doesn't have to find new clients for freshforex every month; instead, they can make a handsome amount by having a few clients who regularly trade with Freshforex.

The broker doesn't pay a percentage of the deposit fee to its affiliates; instead, every time a referred trader trades using Freshforex, a floating portion of the spread is paid to the affiliate.

As per Freshforex's calculation, an affiliate can earn $1200 monthly simply by referring ten clients who trade six lots every month. As long as your referred traders indulge in trading, the affiliate keeps getting their cut.

The affiliate program has no restrictions for users; anyone can sign up for it.

- You can sign up for a ‘partner' account through the partnerships tab.

- Next, you will receive an email with promotional material about the broker, so you can learn how the broker works and general queries amongst traders.

- It can take a few hours to have a customer referral link, and it is emailed to your account.

- Once you have the link, you can start promoting the link using different strategies.

The affiliate can monitor their performance by signing into their account; you are notified every time a trader opens an account using your link.

FreshForex Customer Support

A broker is only as good as their customer support; if your broker's customer support isn't cooperative, you will be stranded when any problem occurs. Hence, we always recommend traders engage with the respective customer support to monitor the accuracy and efficiency of the response.

FreshForex's customer support takes a middle ground on our scale; it isn't exceptional, but it gets your job done in time. You can contact Freshforex through live chat, email, phone, and fax. The live chat support feature is decent; unlike other brokers, it requires extensive details before connecting you to an agent. However, the replies are prompt once you've connected with an agent.

Freshforex supports multilingual chat to cater to its diverse audience. You can contact them through their official numbers, and you will be connected to an agent within a few minutes during off-peak hours. However, the timing may vary on Fridays as they experience higher traffic, leading to delayed connecting times.

We usually recommend seeking responses using emails when you have a problem that must be recorded. The email responses are generally slow and may take up to 3 working days. If you've any questions regarding trading instruments, the best option is to seek a reply through live chat.

Overall, FreshForex has an average customer support experience for its users; it can improve the lead time by hiring more agents or activating an efficient call-transferring mechanism. However, customer support will satisfy you if you look actively for a response.

Advantages and Disadvantages of FreshForex Customer Support

| Advantages | Disadvantages |

|---|---|

|

|

FreshForex Vs. Other Brokers

#1. FreshForex vs. AvaTrade

AvaTrade is one of the most popular brokers in the European region, and their services have changed dynamically with time. Avatrade and Freshforex are direct competitors in the African markets, and users often have to compare the brokers while making the ultimate decision.

If we look in terms of reliability, AvaTrade has multiple regulatory licenses in the European Union, Australia, South Africa, and Japan. They also comply with numerous regulatory bodies beyond the EU. Freshforex doesn't have comparative licenses; their exclusive license comes from SVG.

The trading experience with Avatrade is necessarily better due to the user-intuitive platform and multiple AI-activated features. Avatrade has launched Zulutrade, which allows traders to copy other traders and bots to make profitable trades; it limits the time spent on research. FreshForex has no automated trading features that restrict its scope to active traders only.

However, traders can compromise on features if they get them at a lower cost. Unfortunately, the cost comparison between Avatrade's standard and FreshForex's classic accounts is also one-sided. AvaTrade's spread for popular pairs varies between 1-2 pips, while they start at 2.0 pips for FreshForex accounts. Nonetheless, traders can benefit by opting for a market pro account, but it doesn't have MT5 access.

Overall, AvaTrade looks like a better option than Freshforex in most aspects. However, we would still suggest experiencing FreshForex before signing up with another broker. Their low deposit requirement means account creation has a low cost, and you won't lose in the long run.

#2. FreshForex vs. RoboForex

Roboforex is similar to Freshforex in their market expansion; both brokers have spread rapidly across different continents and are dealing with clients in over 100 countries. Roboforex uses an FSC Belize license, while FreshForex uses an SVG license; in the trading community, a Belize and SVG license has similar ratings, and we can't differentiate them based on their licenses.

However, Roboforex has a clear lead in asset diversification; Freshforex offers up to 130 different currency pairs and CFDs, while Roboforex is an industry leader with over 12000 different CFD options for its traders. Nonetheless, the wider asset range comes with higher spreads for Roboforex users. On average, Freshforex offers about 10% cheaper spreads than Roboforex.

The biggest obstacle for Freshforex against Roboforex is the trading platforms. While FreshForex offers MT4 and MT5 only, Roboforex goes a step ahead by providing Ctrader, web trader, and a separate trader community alongside MT4/5. Roboforex also offers automated trading systems where traders can evaluate different trading strategies to select the best ones for their accounts.

In light of the evidence, Roboforex is a better option, but FreshForex isn't far off. Freshforex is a good choice for low-investment beginners looking to explore the forex world before taking riskier deals. Roboforex will be better for traders with experience and high investment.

#3. FreshForex vs. FXChoice

FXchoice and FreshForex are close competitors, and their marketing campaigns have been similar. FXchoice uses an FSC Mauritius license, which isn't highly reputed in the trading community, but it also has a 4.3-star rating at Trustpilot that compensates for its weakness.

Let's start the comparison with security offerings; like FreshForex, FXChoice also enables its traders to trade in CFDs and forex, but it also allows cryptocurrency trade. However, the portfolio of cryptocurrency is limited, and traders may have to sign with other specialized brokers for a better trading experience,

The trading platforms offered by FXChoice are also the same as FreshForex; traders with both brokers can trade using MT4/5 and a web portal. However, FXChoice provides an additional copy trading feature for its users. Both brokers offer similar affiliate programs; however, the payouts of Freshforex are significantly higher than FX Choice.

We should also pay heed to trading commissions and spreads for a fair evaluation. For FXChoice, the spreads start at 1.5 pip per lot for the optimum account and 0.5 pip for the classic account.

Although the low starting threshold may signal lower spreads, customers have shared a different experience. FXChoice customers have reported that once they open trades, the spreads skyrocket, and a profitable trade results in huge losses. We haven't heard such accusations regarding Freshforex; the bonus scheme is another perk that gives FreshForex an edge over FXChoice.

Overall, both brokers are similar, and traders need to compare their brokerage services in their respective regions for better decisions. The forex industry is rapidly changing, and brokers must also update their processes to suit customers' tastes.

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: FreshForex Review

We have reached the end of our Freshforex review. We hope the review has informed you about the pros and cons of signing up with Freshforex. If you're still uncertain, you don't need to worry. FreshForex is a good option for traders in the Asian and African regions; the reviews from existing areas have been positive and consistent, indicating the quality service of FreshForex.

In the European region, regulated brokers take up most of the market, and most traders don't sign up with offshore brokers. They often create undue vulnerabilities for their clients and are subject to bans and restrictions. Avatrade and Roboforex are good choices for traders in Europe, as they have better licenses and decent charges. Nonetheless, if you wish to go for FreshForex, it isn't a bad option.

You should know more about FreshForex by engaging with their customer support and exploring the trading community. Facebook and Twitter have popular communities where you can find existing FreshForex traders and their reviews about the broker.

FreshForex Review FAQs

Is FreshForex a trusted broker?

Freshforex is a reliable forex broker providing its services in 168 countries. They have won over 20 different awards and have expanded rapidly over the last decade. The educational resources are a good option for beginner traders.

Customer reviews have been largely positive, and their SVG license is sufficient to establish their legitimacy status. However, they don't comply with regulations in some jurisdictions; thus, if you're from those regions, you should sign up with other online trading services.

Is the FreshForex bonus withdrawable?

FreshForex bonuses are withdrawable after 30 days have passed since their credit. However, some bonuses have different policies, where a withdrawal is allowed only after you've traded the required threshold.

How do I withdraw money from my FreshForex?

FreshForex offers over ten different modes of withdrawing your amount. You can use an e-wallet, internet banking, and crypto to receive your funds.

The broker charges a $5 fee to process your withdrawal. Some intermediaries may charge up to 2.5% of your withdrawal amount to process the refund. The withdrawal request can be made through the client cabinet.

Dumb Little Man Recommends - Top 3 Best Forex Brokers in 2023 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.