ForexChief Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.4 2.5/5 | 137th  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like:

By integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies ForexChief as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

ForexChief Review

Forex brokers are pivotal in enabling traders to access the foreign exchange markets. These platforms provide the tools necessary for trading a variety of financial instruments, such as currencies and precious metals. A reliable forex broker is essential for successful trading, offering both a robust trading platform and comprehensive support.

ForexChief stands out as an all-encompassing online platform for margin trading in currency contracts and precious metals. Utilizing a STP/NDD (straight-through processing/no dealing desk) model, ForexChief ensures transparency and speedy execution of trades, which are crucial for traders looking to capitalize on the volatile forex market.

In this detailed ForexChief review, we delve into the broker's offerings, highlighting its unique selling propositions and potential drawbacks. Our goal is to provide you with a thorough understanding of ForexChief, including its account options, deposit and withdrawal processes, commission structures, and more. By blending expert analysis with real trader feedback, we aim to equip you with all the necessary information to make an informed decision about whether ForexChief is the right choice for your trading needs.

What is ForexChief?

ForexChief is a comprehensive online broker that specializes in margin trading of currency contracts and precious metals. Operating on a STP/NDD (straight-through processing/no dealing desk) model, ForexChief is designed to facilitate an unbiased trading environment. This model eliminates potential conflicts of interest between the broker and its clients, thereby enhancing the trustworthiness and reliability of the platform.

The STP/NDD model not only ensures transparency but also contributes to the high quality of service by allowing for tight spreads and fast execution of trades. These features are critical for traders who need quick responses to market movements. ForexChief focuses on maintaining a stable operation of its trading platform and software, which is vital for continuous trading without interruptions. This dedication to operational reliability and competitive trading conditions makes ForexChief a strong contender in the forex brokerage industry.

Safety and Security of ForexChief

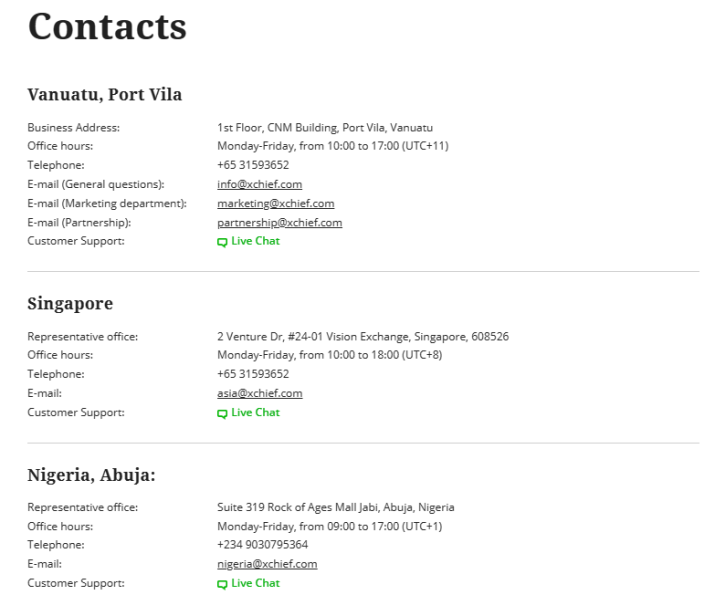

ForexChief prioritizes the safety and security of its clients' investments, as verified through extensive research by Dumb Little Man. The broker is regulated by the VFSC (Vanuatu Financial Services Commission), which guarantees that ForexChief adheres to stringent regulatory standards. This compliance ensures that the company meets its obligations to its clients and provides a secure environment for their assets.

To further safeguard client funds, ForexChief adheres to the practice of keeping client deposits in segregated accounts. This separation prevents the company from using these funds for any of its operational purposes. Additionally, the broker offers protection from negative balance, which protects traders from losing more money than they have deposited, a crucial safety feature in the volatile world of forex trading.

In the event of disputes, ForexChief ensures fairness and transparency by involving independent third-party experts to resolve conflicts. This approach helps maintain trust and ensures that any issues are handled impartially and professionally, reinforcing the broker's commitment to upholding the highest standards of security and client service.

Pros and Cons of ForexChief

Pros

- Global account opening with no high minimum deposit required

- Low to zero spreads on certain assets

- Multiple deposit and withdrawal options such as credit/debit cards, cryptocurrencies, and bank transfers

- Advanced trading platforms for fast, seamless execution

- Excellent customer support and multilingual website

Cons

- Best for experienced traders; not ideal for those needing managed accounts

- Lacks a proprietary trading platform

- Limited investor education resources

Sign-Up Bonus of ForexChief

ForexChief currently does not offer a sign-up bonus for new clients. This information is accurate as of the latest update, highlighting that the broker focuses on other aspects of service enhancement rather than promotional bonuses. Potential traders should consider this when evaluating the overall value and benefits of opening an account with ForexChief.

Minimum Deposit of ForexChief

ForexChief has set a minimum deposit amount, which starts at $0. This low entry barrier makes it accessible for a wide range of traders, from beginners to those with more experience who are looking to explore the forex market without committing a large sum initially.

ForexChief Account Types

ForexChief offers a variety of account types to cater to different trading needs and preferences. Based on thorough research conducted by the team of experts at Dumb Little Man, here is a structured and SEO-optimized overview of the account types available:

CENT Account

- Minimum Deposit: None

- Account Currency: USD, EUR

- Max Leverage: 1:500

- Spread: From 0.9 pips

- PAMM: No

Classic+ Account

- Minimum Deposit: $10 (or equivalent)

- Account Currency: USD, EUR, GBP

- Max Leverage: 1:1000

- Spread: From 0.6 pips

- PAMM: Yes

DirectFX Account

- Minimum Deposit: $50 (or equivalent)

- Account Currency: USD, EUR, GBP

- Max Leverage: 1:1000

- Spread: From 0.3 pips

- PAMM: Yes

xPRIME Account

- Minimum Deposit: $2000 (or equivalent)

- Account Currency: USD, EUR, GBP, CHF, JPY

- Max Leverage: 1:1000

- Spread: From 0 pips

- PAMM: No

ForexChief Customer Reviews

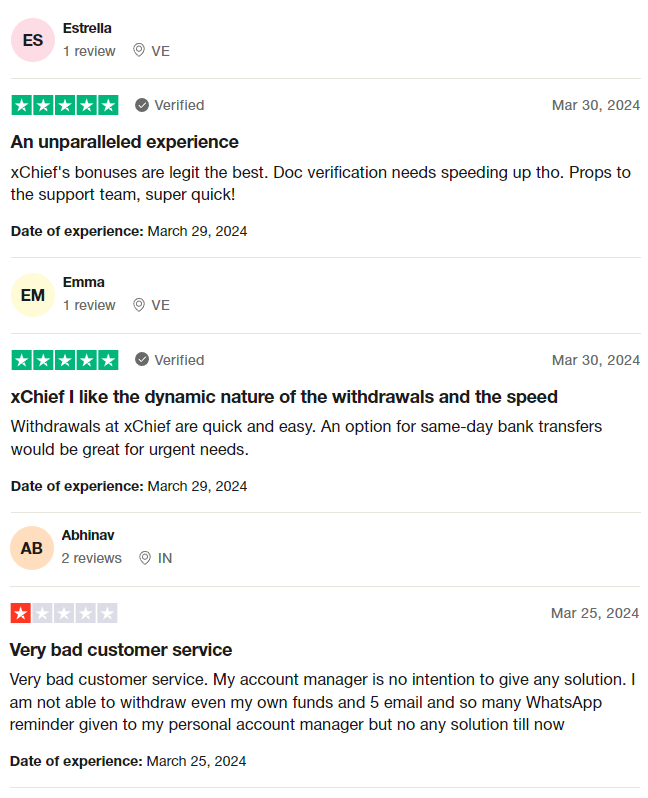

Customer feedback for ForexChief reveals a mixed spectrum of experiences. On the positive side, many users commend the legitimacy and appeal of the bonuses offered and the efficiency of the support team. However, some have noted that the document verification process could be faster. While withdrawals are generally quick and easy, there are suggestions for introducing same-day bank transfers to accommodate urgent financial needs. Conversely, a notable concern among some customers is the poor quality of customer service, with issues such as difficulties in withdrawing funds and unresponsive account managers, which detract from the overall satisfaction with the broker.

ForexChief Fees, Spreads, and Commissions

ForexChief operates with a range of fees, spreads, and commissions that vary depending on several factors including account type and the type of asset traded. Generally, ForexChief offers low spreads, which can range from 0 to 0.9 pips across its four different account types. This feature positions it competitively in terms of spread costs.

However, it's important to note that ForexChief charges high fees compared to many other online brokers, especially for specific assets. For instance, trading precious metals incurs a commission of $15, which is significantly higher than average. Additionally, a fee of 0.1% of the total trade value is applied when trading stocks and cryptocurrencies. These fees apply universally across all account types, irrespective of whether traders have access to the personal area.

Deposit and Withdrawal

ForexChief offers versatile deposit and withdrawal options for traders. Users can efficiently manage their finances using bank transfers, Visa, or MasterCard. Moreover, the platform supports several electronic wallets including WebMoney, Skrill, Crypto, QIWI Wallet, Advanced Cash, Alipay, Neteller, and Perfect Money. This information has been verified by a trading professional at Dumb Little Man after thorough testing.

Withdrawal timelines are optimized for prompt access to funds. Transactions to bank cards are completed within 2–7 business days, while transfers to electronic wallets are processed within one business day. Bank transfers are equally efficient, generally clearing within 5 business days. These features highlight ForexChief's commitment to providing convenient and reliable financial transactions for its users.

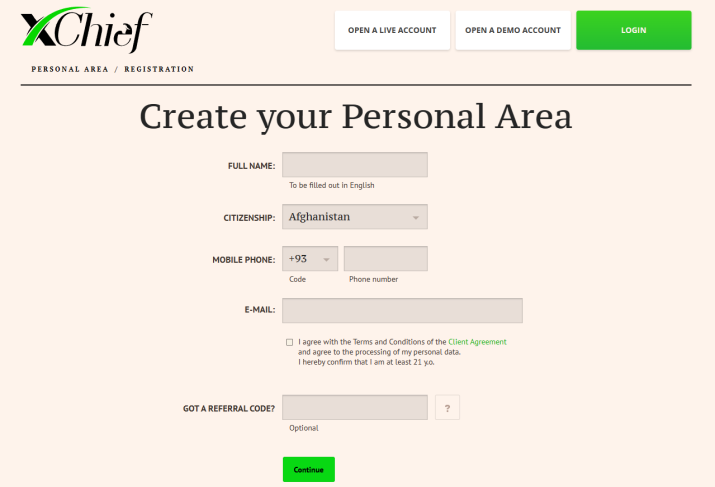

How to Open a ForexChief Account

- Visit the ForexChief website and click the login button.

- Enter your email and password to access your existing account.

- If you're new, select Open a Live Account to start the registration process.

- Fill out the registration form with your personal information and complete the verification process.

- After registering, log in to your new ForexChief account.

- Make your first deposit into your account using the available methods.

- Download and install the MT4 or MT5 trading platform.

- Within your account, choose trading instruments and explore the available broker bonuses.

- Manage your finances by making deposits and withdrawals as needed.

ForexChief Affiliate Program

ForexChief offers innovative ways for individuals and businesses to earn through its affiliate programs, enhancing opportunities within the currency markets. The programs are designed to cater to different needs, from startups to large institutions, providing flexible pathways to generate revenue alongside Forex trading.

The White Label program is ideal for those looking to become Forex brokers with minimal expense, leveraging ForexChief's established technical infrastructure. This program eliminates many of the hurdles associated with setting up a brokerage, such as licensing and technology costs. It's an excellent option for new companies aiming to make a mark in the market or established firms looking to outsource part of their business processes. Partners in this program benefit from a robust support system that fosters long-term business collaborations.

The Introducing Broker program targets individuals or entities that earn primarily through commissions from referring new clients to ForexChief, rather than from trading. This two-part reward system includes a CPA (cost-per-action) reward of up to $300 for each new client introduced, and an additional commission based on the trading volume of the referred clients. This structure makes it an attractive option for agents looking to maximize their earnings through a reliable affiliate partnership.

ForexChief Customer Support

ForexChief is dedicated to providing robust customer support, equipped with advanced analytical tools and comprehensive trading assistance to meet the needs of its clients. The support team is a crucial component of ForexChief's service, notable for the variety of communication methods available to users. This flexibility ensures that every trader can find a convenient way to receive help and guidance.

Clients can choose from several contact options including live chat, email, and phone support, and ForexChief also embraces modern communication by offering support through popular messaging apps like Whatsapp, Wechat, and Telegram. This array of options is part of what makes their customer service stand out.

However, according to the experiences gathered by Dumb Little Man, while the support options are comprehensive, the response times could be faster. The time it takes to resolve issues at ForexChief is somewhat longer than other brokers in the industry. This aspect of customer service is something potential clients might want to consider when choosing ForexChief as their broker.

Advantages and Disadvantages of ForexChief Customer Support

| Advantages | Disadvantages |

|---|---|

ForexChief vs Other Brokers

#1. ForexChief vs AvaTrade

ForexChief operates with competitive spreads and offers various trading platforms like MT4 and MT5, suitable for traders interested in a straightforward trading approach with access to both currency and precious metal markets. On the other hand, AvaTrade has established a strong reputation since 2006, providing a wide range of financial instruments across multiple trading platforms. AvaTrade stands out with its heavy regulation and global presence, offering a robust trading environment.

Verdict: AvaTrade may be preferable for traders looking for a heavily regulated broker with a rich selection of trading instruments and global accessibility. The established trust and comprehensive support make it a better choice for those seeking stability and a diverse trading environment.

#2. ForexChief vs RoboForex

ForexChief offers low to zero spreads on some accounts but is noted for its high fees on certain trades, such as precious metals. RoboForex, established in 2009, shines with its vast array of over 12,000 trading instruments and diverse trading platforms, including MetaTrader, cTrader, and RTrader. RoboForex's approach caters to a wide variety of trading styles and volumes, enhanced by its flexible account types and competitive trading conditions.

Verdict: RoboForex is likely the better option for traders who value technological diversity and a broad selection of trading instruments. Its ability to serve a wide range of traders’ needs and preferences, combined with competitive terms, makes it more versatile and appealing than ForexChief.

#3. ForexChief vs FXChoice

ForexChief is known for its straightforward platform options and competitive conditions for traders interested in Forex and metals. FXChoice, since 2010, has been focusing on providing quality services to both active and passive traders and is popular in Western markets. FXChoice does not offer cent accounts or zero spreads, which might limit its appeal to beginners, but it excels with professional ECN accounts and a loyalty program designed for high-volume traders.

Verdict: FXChoice might be the better choice for experienced traders who can leverage the benefits of its ECN accounts and loyalty programs. The broker's commitment to professional traders and its regulatory framework make it a more attractive option for seasoned traders compared to ForexChief, which has simpler offerings and higher fees on certain assets.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

If you are eager to build a successful career in forex trading and are aiming for significant financial rewards, Asia Forex Mentor is the perfect choice for you. Led by Ezekiel Chew, a prominent figure in the world of trading education who regularly secures seven-figure trades, Asia Forex Mentor is distinguished by its expert leadership.

Comprehensive Curriculum: Asia Forex Mentor delivers a detailed educational program that includes forex, stock, and crypto trading. This curriculum is designed to thoroughly prepare traders for success across various financial markets.

Proven Track Record: Asia Forex Mentor's reputation for excellence is backed by its history of creating consistently profitable traders. This success underscores the effectiveness of their educational approaches and mentorship.

Expert Mentor: Students at Asia Forex Mentor receive direct guidance from Ezekiel Chew, who brings extensive experience and success in trading. His personalized support helps students confidently understand and navigate the complexities of each market.

Supportive Community: Enrolling in Asia Forex Mentor grants access to a community of ambitious traders. This network is invaluable for collaboration, sharing ideas, and peer learning, which enhances the educational journey.

Emphasis on Discipline and Psychology: Trading success requires a disciplined mindset. Asia Forex Mentor emphasizes psychological training to aid traders in managing emotions and making sound decisions under pressure.

Constant Updates and Resources: With the ever-changing nature of financial markets, Asia Forex Mentor ensures that students stay informed with the latest trends and strategies, providing ongoing access to essential trading resources.

Success Stories: Many traders have achieved financial independence and transformed their careers through the robust education provided by Asia Forex Mentor in forex, stock, and crypto trading.

For those aiming to excel in the competitive trading landscape, Asia Forex Mentor offers the best resources and guidance to help you achieve financial prosperity and become a skilled trader in diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

>> Also Read: Tradiso Review 2024 with Rankings By Dumb Little Man

Conclusion: ForexChief Review

In conclusion, the team of trading experts at Dumb Little Man has thoroughly assessed ForexChief and offers a balanced view of its services. This broker provides a range of account types and competitive spreads, which are appealing features for traders seeking flexibility and affordability in their trading operations. The use of STP/NDD technology ensures transparent and swift trade execution, enhancing the trading experience for its users.

However, potential clients should be aware of some drawbacks. ForexChief's fee structure can be notably high, particularly for trades involving precious metals, which might deter those looking for cost-efficiency. Additionally, the customer support response times are slower compared to industry standards, which could be a significant inconvenience for traders requiring timely assistance.

ForexChief Review FAQs

What types of accounts does ForexChief offer?

ForexChief provides several account types to cater to various trading preferences and needs. These include the CENT account, Classic+ account, DirectFX account, and the xPRIME account. Each account type offers different conditions regarding minimum deposits, leverage, spreads, and access to trading instruments, allowing traders to choose the one that best fits their trading strategy and experience level.

How does ForexChief ensure the security of my investments?

ForexChief prioritizes the security of client funds by adhering to strict regulatory standards set by the VFSC (Vanuatu Financial Services Commission). Additionally, the broker uses an STP/NDD model to eliminate potential conflicts of interest, ensuring transparency and fairness in all transactions. Client deposits are kept in segregated accounts, separate from the company’s funds, which protects them from being used for any other purpose.

Are there any fees or commissions I should be aware of when trading with ForexChief?

Yes, while ForexChief offers low spreads on many trades, it is important to note that there are significant fees associated with certain transactions, especially in trading precious metals, stocks, and cryptocurrencies. For example, trading precious metals incurs a commission of $15, and a fee of 0.1% of the total trade value is charged for stocks and cryptocurrencies. Prospective traders should consider these fees when planning their trading strategies and managing their budgets.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.