eToro Review: Is it the Best for Novice Non-US Traders

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

eToro is a trading platform that is headquartered in Israel but trades US Stocks and ETFs. It is a platform with an easy user experience as it is created for beginners and passive investors to ensure they easily find their way around the platform. The platform is in two versions: web platform and mobile app. The other mobile app available relating to the trading platform and supporting the main mobile trading app and web platform is the eToro mobile wallet app that can be downloaded in your phone's store.

The user interface in eToro speaks of simplicity as technical indicators and terms are removed and replaced with easy-to-understand and easy-to-navigate tools. The trading platform understands the need to have a trading platform through which beginners traders and brokers will be able to trade and navigate without any difficulty because this would determine their first experience and belief about trading platforms. So, they created the eToro trading platform to provide all the necessary tools needed for a beginner to excel in trading.

eToro understands the difficulty of starting a journey in stocks, ETFs, CFDs, and crypto-assets trading. So, it made its trading platform different and distinct by including copy trading and social trading platform. The copy trading feature means that beginner investors will have the unique opportunity to see experienced traders' trading strategies and copy them. This would help them understand the market and the tricks involved in the market.

In this review, we will discuss what is eToro, its features, Commissions, Fees, and its competitors. Let's begin!

eToro Review: How does eToro work?

eToro has two platforms: the eToro web-based platform and the eToro mobile app.

eToro web-based platform is the major platform for this trading platform. It is a user-friendly platform that can be translated into 26 different languages. Its interface is so welcoming for the young audience. It has a clean design and great functions. Its buttons and menus are not redundant and are very easy to find. There is a two-step login system that adds more safety to the users' accounts. It does not, however, support biometric authentication.

The search functions on the web-based platform are predictive and easy to use. This means that before fully typing in the product, symbol, or other offerings, the search engine would have brought some options to select from.

It is easy to place orders on the web platform with price alerts and notifications features available. You get your portfolio and fee reports through the web platform. It is always in a pdf format, detailing your trade, income, profits, and balances. The web platform does not support customization.

Charts are also available on the mobile platform. eToro mobile app is also functional with the dark and light theme available for the users' preference. However, the tools and indicators available here are limited to the number of indicators available on the web platform.

The web platform has about 60 indicators, while the mobile platform has less than 10 indicators. This makes the use of the charting indicators on the mobile platform limited.

There are easy buy and sell orders on the mobile platform with the icon to buy or sell available around the list of currencies or offerings. You can also manage your watchlist just as much as you can with the web platform. You can add or remove from your existing watchlists or create new ones. Custom price alerts through your email or SMS can also be created.

There is the cryptocurrency wallet which is separate from the mobile app. Users can deposit and withdraw their coins there with eToro acting as the holder of their private keys and Broker.

What are the Features of the eToro trading platform

eToro Offerings

eToro has over 3,000 symbols up for trade, and it has offerings in stocks, ETFs, forex, CFDs, cryptocurrency, etc. These symbols are not all available in all countries the trading platform is located. For example, only cryptocurrencies symbols are available for trade in the United States.

Forex Trading is one of the major tradings currently traded by beginners and young traders. It involves the prediction of two currencies together using the tools and indicators available to determine the trades' support and other crucial points. In eToro, there are only 47 Forex pairs available for trading.

Trading CFD assets option is also available. However, it is a risky trade, with over 68% of eToro traders in this platform losing money when trading CFDs. As we know: high risk, high reward. eToro specializes in CFD trades and offers these trades even with other offerings such as cryptocurrency and stock.

Cryptocurrency trading is another available offering in eToro. About 29 available traded coins include AAVE, ALGO, BTC, LINK, DASH, MANA, DOGE, EOS, ETH, LTC, XLM, XRP, XTZ TRX, YFI, Bitcoin Cash, etc. Crypto assets trading can occur on the mobile or web platform and can be purchased using the eToro mobile wallet.

Order Types

eToro has four types of orders: Market, Limit, Stop-loss, and Trailing stop-loss.

The market order is executed at the exact price when the user clicks the buy or sell button. Instead of waiting for the price to come up or go down if the user believes the price is right, he can buy or sell at the moment.

A limit order is an order that sets the maximum or minimum price at which the offering should be bought. Where a user has done his research and believes that the market will react when it gets to a price, he can set that price as the limit order. The limit order will be triggered when the offering gets to that price, and the buy or sell order will be activated. To

Stop-loss is an order that activates the trade immediately and continues the trade until the trader stops it by clicking a button or the trade reaches some loss level. The trader makes a stop-loss thinking that the trade will continue his way, but where it does not, he will be stopped and lose only a limited and envisaged money.

Trailing stop-loss is an order that allows the trader to lock in gains to a certain point where the price does stop moving in his favor.

Customer Support

You will need to submit your inquiries using a support ticket through the crypto trading broker's online platform. Reply from eToro customer service may take as long as 7 days, which is longer than most other brokers.

There is eToro's live chat feature available to active eToro accounts users. If you have an active eToro account, you can access live chat through your brokerage account anytime during the weekdays.

It does not provide phone support, but you can visit their offices.

CopyTrader

eToro CopyTrader is a feature used for its social trading platform that allows you to copy the investment strategies of other people or vice versa. This feature allows you to search for other traders, particularly experienced ones, and see how they are performing and their trading decisions.

The copying is automated by the platform and does not need any extra work from the user.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

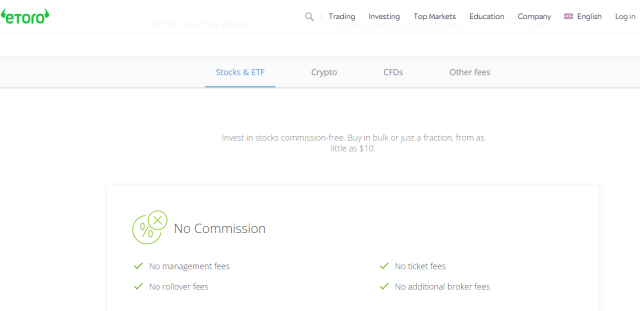

How much are eToro Commissions, Account Minimums, and Fees

eToro offers zero-commission real stock trading. When you buy the real stock and not CFD, you will get the commission-free policy to trade stocks as you wish. However, you cannot trade in any currency except USD. This means that trades made with other currencies will be converted to USD before the trade is activated. Also, when you sell, you are selling in USD.

eToro charges a percentage spread that varies by cryptocurrency. Typically, the spread is between 0.75% and 2.5%, depending on the cryptocurrency you choose to invest in.

eToro trading fees are quite unclear as there is difficulty in knowing exactly what percentage the trading platform charge.

eToro fees for inactivity are $10 per month after one year of inactivity, but simply logging into your account counts as an activity.

Who is eToro Best For

New cryptocurrency traders looking for an easy-to-use platform

Newbies who have discovered stocks, CFDs, forex, and cryptocurrency markets and would love to join in the game have a great opportunity of learning easily from the financial platform.

eToro provides them with the tools they need to grasp trading basics, trading topics, trading strategies, and markets. The dual tool of Copy Trader and CopyPortfolio makes trading quite easy for beginner investors as they gain mentorships from advanced traders and understands, in a practical sense, why trades are taken the way they are.

eToro provides beginner investors with a demo account furnished with $100,000 to practice their investment strategies and understand the market perfectly. The demo account has the same functions and tools as the real accounts, as it contains the same indicators and tools used to assess trade and make technical analyses.

Cryptocurrency Investors/Traders

This trading platform provides a series of cryptocurrency pairs for those interested in cryptocurrency trading. This trading platform trades over 30 cryptocurrencies. Also, there is the eToro wallet where traders can store their cryptocurrency, while eToro acts as the guide for their private keys and cryptos. The wallet links with your eToro trading portfolio and provides you with seamless connections and transfers.

Some of the cryptocurrency exchanges traded include:

- Aave (AAVE)

- Algorand (ALGO)

- Basic Attention Token (BAT)

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Chainlink (LINK)

- Compound (COMP)

- Dash (DASH)

- Decentraland (MANA)

- Dogecoin (DOGE)

- Enjin (ENJ)

- EOS (EOS)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Litecoin (LTC)

- IOTA (MIOTA)

- Polygon (MATIC)

- MakerDAO (MKR)

- NEO (NEO)

- Ripple (XRP)

- Stellar Lumens (XLM)

- Tezos (XTZ)

- TRON (TRX)

- Uniswap (UNI)

- Yearn.Finance (YFI)

Retail Traders and High experienced active traders

Copy Trading and CopyPortfolio are tools that will continue to give eToro an edge over its peers for a long time. Its ability to find crypto trading ideas and other securities decisions has made the trading platform a favorite for many traders, including retail traders.

eToro is great for retail traders who want to crowdsource investment ideas and decisions using the power of copy trading. It is also great for highly experienced active traders who want to be rewarded for sharing their ideas with other traders, as this is another way to make money, particularly when you have a strategy that works and has been proven to work.

eToro Pros and Cons

Pros

- A simple platform that is easy to master

- Social Trading features that allow new traders to copy the same strategies used by professionals

- Demo account that gives you $100,000 to practice trades

- Trade 30 different cryptocurrencies

Cons

- Unclear trading fees

- USA residents cannot access stock trading or CFDs

- Unresponsive Customer Service

eToro User Experience

One-Step Transaction Process:

There is only one page where the user buys or sells securities. While this helps the navigation and ease of using the web platform or mobile trading app, it may cause disinterest and dislike. An excellent personal finance app should have more than a page for transactions. This ensures that the users are sure and crosschecked the information, including the number of securities and the order type they have chosen.

To improve this, the first page could be the form page where the users select the buy/sell function, the order type, and the amount they prefer. The next page could bring all the information with two buttons stating: ‘confirm' and ‘cancel.' This would help the users make the correct transactions and limit mistakes.

Changing the order:

If you decide to alter the details of your order somehow, for example, if the market is moving in a favorable direction and you wish to increase order size, you need to open additional/ new orders and close the old ones if necessary. There is no option to amend your initial order that was not yet executed, and this could be a great potential addition to the platform.

User-friendly interface:

eToro has a user-friendly interface that you can navigate easily. It is created mainly for beginner investors and made simple for them. The Broker made two mobile platforms available, one as the trading platform and the other as the Broker's cryptocurrency wallet. The beginner investors' will find it easy to navigate without burdensome and complex instruments.

Indicator Tools on Mobile App:

The tools and indicators available here are limited to the number of indicators available on the web platform. The web platform has about 60 indicators, while the mobile platform has less than 10 indicators. This makes the use of the charting indicators on the mobile platform limited.

eToro vs Competitors

#1. eToro vs Interactive Brokers

Interactive Broker offers its brokerage services on its desktop, mobile, and web platforms. It has the Trader Workstation (TWS), which is the main platform for this Broker.

Its traders have access to more than 120 technical indicators and a suite of easy-to-use drawing tools.

It has several educational resources such as Trader Academy, which is an online, on-demand resource that features a structured, rigorous curriculum intended for financial professionals, investors, educators, and students who want to learn about asset classes, markets, currencies, tools, and functionality available on Interactive Brokers' trading platforms.

While Interactive Broker has more offerings from a larger market base and offers more comprehensive educational resources, eToro also has a lower and simple commission fee per trade. Interactive Brokers have complex instruments meant for experienced professionals, while eToro targets beginner investors, among others.

The financial platform provides a mobile wallet to save their cryptocurrencies in a secured and encrypted location. eToro also provides social trading such as CopyTrade, social media gathering, and CopyPortfolio for its users, missing in Interactive Brokers.

| Broker | Best For | More Details |

|---|---|---|

| securely through Interactive Brokers website |

#2. eToro vs Avatrade

AvaTrade is a multi-asset platform that offers its proprietary platforms AvaTrade WebTrader, AvaOptions and MetaTrader, and ZuluTrade and DupliTrade for social media copy trading.

This trading platform offers copy trading to its users. Its platform is on the web, desktop, and mobile platforms. It also has the demo account, proprietary platform (Webtrader), multi-asset platform hinged on (Metatrader, ZuluTrade, etc.), it has 51 charting indicators and 31 charting tools.

While Avatrade has more offerings from a larger market base and offers more comprehensive educational resources, eToro has a lower minimum account entry of $50. Avatrade offers only Cryptocurrency CFD, while eToro offers both Cryptocurrency CFD and real Cryptocurrency trading.

eToro platform provides a mobile wallet that allows users to save their cryptocurrencies in a secured and encrypted location. eToro also provides social trading such as social media gathering and CopyPortfolio for its users, missing in Avatrade.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: eToro Review

eToro trading platform is an amazing platform for investors, online brokers, and traders. It is a platform that provides these three groups with the right tools and features needed to excel in the market.

Investors

Investors can be active or passive investors who believe in the long-term game. Whether you wish to keep your portfolio active for a long time or you wish to invest in some securities for as long as possible, eToro has got you covered. It provides enough tools to enable your gainings and learn from your losses.

It also provides enough assurances for the security and safety of your account, even if you are interested in investment only. Cryptocurrency investors would love to hold as long as they wish because they have done their fundamental and technical analysis and believe in the growth of the coin. eToro wallet is safe and assures that your coins, address, and accounts are encrypted and protected from data breaches or loss on the trading platform.

Brokers

eToro trading platform is an amazing platform for other brokers to learn how to get beginner investors to their platforms and make trading easy for every user. The many attractive tools and features that eToro has had made its membership surpass the 10 million Rubicon.

This means that the trading platform is doing something right to make it the favorite of many people worldwide. This is even more substantial since it is a trading platform that does not open all its offerings to the residents of the United States, which is the home of the biggest stock exchange market in the world. It does not offer other derivatives like mutual funds and options but is still loved and patronized by millions. Brokers can learn about the social trading feature and how it has assisted all classes of traders and investors in the eToro trading platform.

Traders

Traders also have advantages on this trading platform as several strategies, decisions, and portfolios are up for grabs. A trader who wishes to trade and get others' views about trade and learn from other traders' strategies has the trading platform to thank for providing the right platform to ensure you get a series of trading strategies you can learn from.

Also, traders who are wholly interested in getting experienced traders' portfolios and copying them have the access and tools made available to them by this trading platform. You, as a trader, can clone other traders' portfolios and make gains and losses as he is doing.

All in all, eToro is a great platform for its users as it ensures the safety of their portfolio and data, ensures the user experience is great, provides adequate tools and features to bring its users together as a community, and low commission fees to accommodate everyone.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

eToro FAQs

Is eToro a US company (eToro USA LLC)?

eToro USA LLC is a registered company in the US. It was incorporated in March 2007 and carried out its financial services industry activities, particularly the asset management sub-sector.

It is a subsidiary of a multinational, eToro, an Israeli fintech company based in Tel Aviv-Yafo, Israel. The multinational has offices in Cyprus, the United Kingdom, and Australia too. It currently operates in over 120 countries and has over 10 million registered users. It offers CFDs, cryptocurrencies, stocks, ETFs, and forex offerings that operate as an online currency trading platform. eToro offers trading tools, charts, feeds, and software for trading currencies on the foreign exchange market. eToro serves customers worldwide.

EToro offers only cryptocurrency trades for its users in the US, as it does not offer equity trading. Several state agencies regulate it. It provides a series of cryptocurrency coins for trading by its users.

It is located at 1375 Broadway New York, NY 10018 United States. Its phone number is 1-888-993-8676.

How does cryptocurrency trading work?

eToro offers 35+ different coins to trade, and you also have the option to trade 14 crypto crosses (like ETH/BTC) and 63 currency crosses denominated in non-USD (like LTC/AUD).

You can trade and own cryptocurrencies through this trading platform through Crypto CFDs, Spot crypto, Crypto exchange (eToroX), and Crypto wallet.

The rule with eToro is that when you go long in any virtual currency, you will own the real coin. When you go short, it is a CFD. Where CFD is not allowed, it means you cannot go short in those countries. CFD cryptocurrency is not available in the US; you can only invest in cryptocurrency and not trade it like a futures trader or a spot trader.

Cryptoassets are volatile instruments that fluctuate and are therefore not appropriate for all investors.

However, not every method is available in each country. For example, UK and US residents don't have access to Crypto CFDs.

Do retail investor accounts lose money when trading?

Retail traders, often referred to as individual traders, buy or sell securities for personal accounts, also known as retail investor accounts. The question about why retail investor accounts lose money rapidly is simple and complicated.

Retail investor accounts lose money when trading because they trade against financial institutions and big traders in the market. For this trading platform, 68% of its retail investor accounts lose money when they trade CFD. This is to show that trading securities and coins involve some level of risk.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.