EasyMarkets Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.4 2.5/5 | 119th  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, consisting of financial experts, experienced traders, and private investors, utilizes a sophisticated algorithm to conduct detailed evaluations of brokerage services. Their analysis centers on crucial aspects such as:

|

EasyMarkets Review

Forex brokers play a vital role in the Forex market by offering individuals and companies the platform to trade currencies and other financial instruments. EasyMarkets stands out as an international broker with over 20 years of experience in the financial services industry. This broker offers a comprehensive range of trading instruments, including currency pairs, indices, cryptocurrencies, commodities, CFDs, and options, catering to the diverse needs of traders worldwide.

In our detailed review of EasyMarkets, we aim to provide an exhaustive evaluation of the broker, highlighting its unique selling propositions and potential drawbacks. Our review is designed to give you essential insights into the various account options, deposit and withdrawal processes, commission structures, and other critical details. By integrating expert analysis and actual trader experiences, we strive to offer a balanced perspective that can aid you in making an informed decision about choosing EasyMarkets as your preferred brokerage service provider.

What is EasyMarkets?

EasyMarkets is an esteemed international broker with a solid footing in the financial services industry for over 20 years. This broker prides itself on adhering to strict regulatory standards, being monitored by reputable authorities including the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC). Additionally, the Financial Services Commission of the British Virgin Islands and the Seychelles Financial Services Authority also oversee its operations, ensuring a high level of trust and security for its clients.

One of the key features of EasyMarkets is its commitment to safeguarding client funds through the use of segregated accounts. This critical safety measure prevents the broker from accessing clients' funds, thus offering an added layer of financial security. EasyMarkets caters to a wide array of trading preferences by offering a diverse range of tools including currency pairs, indices, cryptocurrencies, commodities, CFDs, and options. Notably, it does not offer passive investment programs, focusing instead on active clients regardless of their experience level.

For traders at every stage of their journey, EasyMarkets provides valuable educational resources. The broker features a tutorial platform complete with materials and a course designed to help beginners grasp the basics of trading. Meanwhile, professionals can leverage these resources to expand their knowledge, making EasyMarkets a versatile choice for traders aiming to enhance their trading skills and strategies.

Safety and Security of EasyMarkets

EasyMarkets, a well-established international broker, underscores its commitment to safety and security for its clients. This information, gathered after thorough research from Dumb Little Man, highlights EasyMarkets' strong regulatory framework. The broker is regulated by notable bodies including the Cyprus Securities and Exchange Commission (CySEC) and the Australian ASIC regulator, along with the Seychelles Financial Services Authority and the British Virgin Islands Financial Services Commission. These regulations ensure that EasyMarkets adheres to strict financial standards and ethical trading practices.

A key aspect of EasyMarkets' approach to client security is the maintenance of client funds in segregated accounts. This critical safety measure ensures that clients' funds are kept separate from the company's own operational funds, providing an additional layer of security. Such accounts are designed to protect client assets, preventing the broker from accessing these funds for its own uses. This structure aligns with industry best practices and offers traders peace of mind, knowing their investments are safeguarded by stringent regulatory standards and oversight.

Pros and Cons of EasyMarkets

Pros

- Diverse trading instruments available

- Multiple options for account funding and withdrawals

- Tools for market analysis, risk management, and financial news

- Choice of trading platforms including MetaTrader 4 and mobile options

- Quick and easy account registration process

Cons

- Lack of investment and copy trading services

- Limited customer support channels

- Variable spreads based on asset, account type, and platform

Sign-Up Bonus of EasyMarkets

EasyMarkets offers an enticing sign-up bonus to welcome new traders. Upon making their first deposit, clients are eligible for a 50% tradable bonus, which can go up to $2000. This bonus provides traders with additional capital to explore the wide range of trading opportunities available on EasyMarkets. It's designed to enhance the trading experience by increasing the potential trading volume right from the start. This offer makes it more appealing for new users to begin trading with EasyMarkets, giving them a head start in the forex and financial markets.

Minimum Deposit of EasyMarkets

EasyMarkets sets an accessible entry point for traders with its minimum deposit amount of $25. This low threshold encourages individuals from various financial backgrounds to start trading without the need for a significant initial investment. Offering such a moderate minimum deposit aligns with EasyMarkets' commitment to making financial markets more accessible to a broader audience. It allows newcomers and experienced traders alike to explore trading opportunities with minimal financial risk.

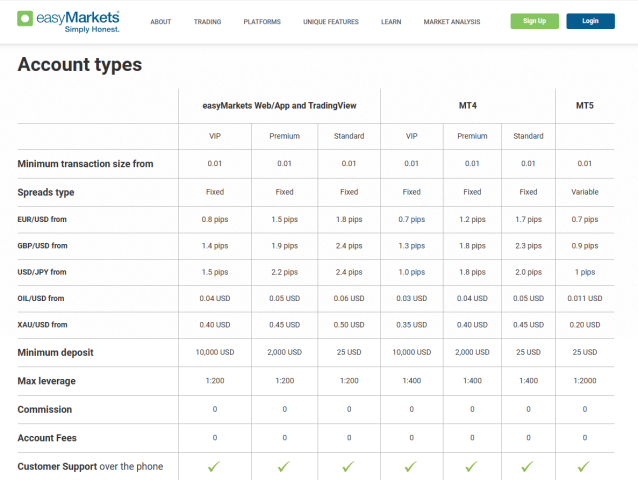

EasyMarkets Account Types

Based on thorough research and testing by our team of experts at Dumb Little Man, EasyMarkets offers three distinct trading account designed to cater to a wide range of traders. Each account type is tailored to fit different trading styles and investment levels, ensuring that traders can select the option that best suits their needs. Here is a clear and organized list of the account types offered by EasyMarkets:

Standard Account

- Minimum deposit: $25

- Leverage: Ranges from 1:200 to 1:500

- Commission: None for account maintenance, replenishment, or withdrawal

- Spread: Varies by asset, from $0.05 to 2.4 pips

- Platform: Slippages may occur on the MT4 platform; no guaranteed stop loss (available only on the broker's platform)

- Extras: Personal manager support and technical/fundamental analysis mailing lists

Premium Account

- Minimum deposit: $2,000

- Leverage: 1:200 to 1:500, depending on the platform

- Spread: $0.04 to 2.2 pips

- Commission: No non-trading commission

- Extras: Analytical mailings, manager support, and 24/7 trading

VIP Account

- Minimum deposit: $10,000

- Leverage: 1:200 (web and mobile trading) to 1:500 (MT4 platform)

- Spread: As low as $0.03

- Commission: No fees for account maintenance, withdrawal, or deposit

- Extras: Access to all features available in Standard and Premium accounts

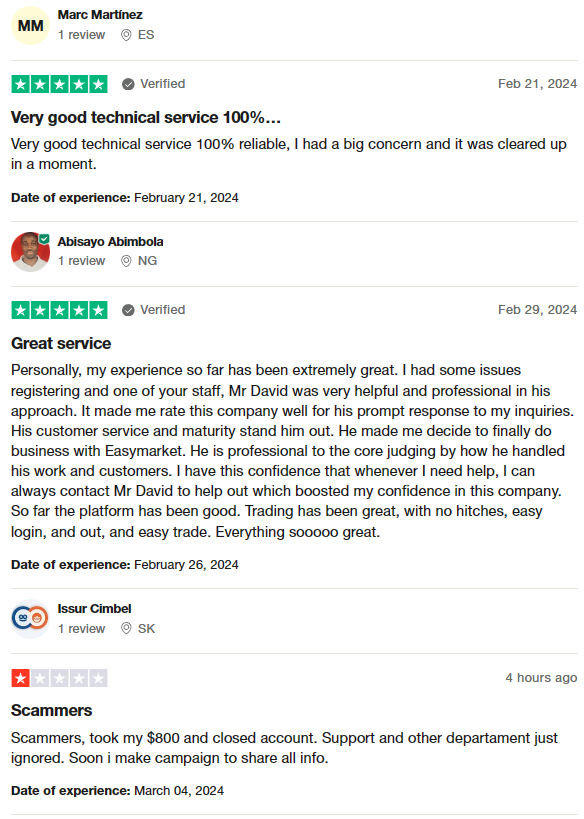

EasyMarkets Customer Reviews

EasyMarkets customer reviews reveal a mixed bag of experiences. Many users praise the platform for its excellent customer service, notably highlighting instances where staff members, such as Mr. David, provided exceptional support and professionalism. This level of service has significantly contributed to a positive trading experience, with clients appreciating the ease of use, seamless trading, and the reliability of the technical service. These aspects have built a strong level of trust and confidence among its users. However, there are reports of dissatisfaction as well, with a few customers facing issues such as account closures and lost funds, labeling the experience as dealing with scammers. Despite these concerns, the predominant feedback focuses on the platform's usability and the quality customer support, making EasyMarkets a noteworthy option for many traders.

EasyMarkets Fees, Spreads, and Commissions

EasyMarkets stands out for offering competitive pricing, especially through its VIP account. This premium account, accessible with a deposit of $2,500 ($100 for EU and UK residents), along with utilization of the web platform, showcases EasyMarkets' commitment to providing value to its clients. Notably, the broker boasts fixed spreads as low as 0.77 pips on EUR/USD, whether trading is conducted on MT4 or directly through their website.

One of the key advantages of trading with EasyMarkets is the inclusive trading costs within the fixed spread, ensuring 0 commissions. This straightforward structure is tailored across different account types, aiming to cater to various trading needs and preferences. Additionally, all account holders benefit from daily emails featuring technical and fundamental analysis, enhancing their trading strategy with valuable insights. EasyMarkets further enhances trader security with guaranteed stop loss, negative balance protection, and a suite of additional trading tools. This comprehensive approach to trading costs, combined with a robust support structure, positions EasyMarkets as a preferred choice for traders looking for transparent and effective trading conditions.

Deposit and Withdrawal

Based on extensive testing by a trading professional at Dumb Little Man, EasyMarkets offers a seamless and straightforward deposit and withdrawal process. The platform's client area facilitates easy account funding, highlighting EasyMarkets' user-friendly approach. A wide array of payment options is available, accommodating traders globally with methods including bank transfer, credit, debit, online cards, and a variety of eWallets such as Sofort, giropay, iDeal, WebMoney, BPAY, Neteller, Skrill, and fasapay. This diversity ensures that traders can easily manage their funds with their preferred payment method.

For withdrawals, traders need to navigate to their personal account and select the Withdraw Funds section. After specifying the necessary details for withdrawal, such as amount and payment system, the application is submitted. Traders can track the status of their request in the Withdraw Status section. Deposit and withdrawal methods encompass a broad spectrum, including Visa, MasterCard, Maestro, American Express, JCB, AstroPay, various electronic payment systems, and e-wallets. It's important to note that availability may vary by region, with certain methods exclusive to Europe, America, or China.

Transaction times can vary: instant transactions for bank cards, EPS Neteller, and Skrill; two hours for giropay transfers; 3-5 days for European bank transfers; and 1-2 days for UnionPay transfers. Most other payment systems will credit funds within 24 hours or 1 business day. Available currencies for transactions include EUR, CAD, CZK, JPY, NZD, USD, SGD, CHF, GBP, MXN, AUD, PLN, TRY, CNY, HKD, NOK, SEK, ZAR, providing extensive flexibility for international traders. To initiate financial transactions, traders are required to verify their accounts by uploading identity documents, ensuring a secure trading environment.

How to Open an EasyMarkets Account

- Visit EasyMarkets official website and click Create Live Account on the homepage.

- Press the Sign-Up button in the upper right corner; for existing users, select Login.

- Register by entering your email and a password, or use your Google or Facebook account for quicker access.

- Specify your country of residence during the registration process.

- Once registration is complete, access your personal account.

- In your account's lower right corner, find options to continue registration, fill out your profile, or make a deposit.

- Take a quick electronic tour to familiarize yourself with the account interface.

- Complete the registration by uploading necessary documents for account verification.

- Begin trading by exploring EasyMarkets' trading platforms and tools.

EasyMarkets Affiliate Program

The EasyMarkets affiliate program offers an opportunity for traders to gain additional bonuses and unique trading offers. To join, participants must register in the affiliate program and adhere to straightforward conditions. The core responsibility of an affiliate is to attract new active clients to EasyMarkets. Rewards are granted for every referral that actively trades on the platform.

Upon registration, affiliates can specify the type of clients they plan to refer, which influences the reward conditions. Each affiliate is provided with an individual referral link, alongside professional support and marketing materials to aid in their promotional efforts. The program is designed to be flexible, acknowledging that different types of clients necessitate varied remuneration and conditions. Interested parties can discover the detailed terms during the registration process, ensuring clarity and transparency in the affiliate partnership with EasyMarkets.

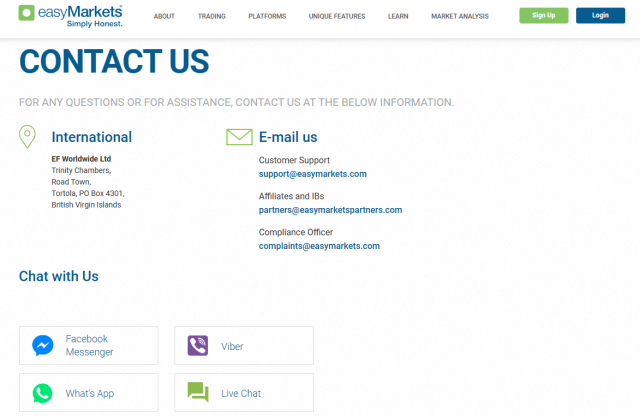

EasyMarkets Customer Support

Based on the experience of Dumb Little Man with EasyMarkets Customer Support team, the brokerage provides multiple channels for clients to reach out for assistance. Clients can contact support staff through email or by sending a message to the online chat on EasyMarkets' official website. This ensures that help is readily available for any queries or issues that may arise.

Furthermore, EasyMarkets maintains a presence on social networks and messengers, including Facebook, Viber, and WhatsApp. This variety of contact methods highlights EasyMarkets' commitment to accessible and responsive customer support. By offering several avenues for communication, EasyMarkets ensures that traders can receive support in the manner most convenient for them, reinforcing the broker's dedication to providing an excellent customer service experience.

Advantages and Disadvantages of XBTFXEasyMarkets Customer Support

| Advantages | Disadvantages |

|---|---|

EasyMarkets vs Other Brokers

#1. EasyMarkets vs AvaTrade

EasyMarkets and AvaTrade both offer a wide range of trading instruments and platforms, catering to a global clientele. EasyMarkets is known for its strong regulatory framework, user-friendly trading conditions, and innovative risk management tools like guaranteed stop loss. AvaTrade, on the other hand, stands out for its extensive selection of financial instruments, higher transaction volume, and global reach, with a significant presence in multiple jurisdictions. While EasyMarkets focuses on simplifying the trading experience with features like fixed spreads and comprehensive educational resources, AvaTrade appeals to traders looking for diversity in trading instruments and a well-regulated trading environment.

Verdict: For traders prioritizing a wide range of trading instruments and global regulatory assurance, AvaTrade may be the better option. However, for those valuing easy-to-use platforms and innovative risk management tools, EasyMarkets offers a compelling choice.

#2. EasyMarkets vs RoboForex

RoboForex distinguishes itself with its technological advancement and wide selection of trading platforms, including MetaTrader, cTrader, and RTrader, catering to various trading styles and volumes. Its strong emphasis on cutting-edge technology and personalized trading conditions makes it appealing to both novice and experienced traders. EasyMarkets, while offering a competitive range of platforms and tools, focuses more on risk management features and fixed spreads to enhance trading safety and predictability.

Verdict: If technology and a wide selection of trading platforms are your priority, RoboForex emerges as the superior choice. For traders seeking enhanced risk management features and fixed spreads, EasyMarkets is preferable.

#3. EasyMarkets vs FXChoice

FXChoice focuses on serving experienced traders, offering ECN accounts with tight market spreads and a range of services for automated trading. Its trading conditions, including the limitation of the demo account validity and a loyalty program aimed at high-volume traders, are tailored towards a more professional clientele. EasyMarkets, with its user-friendly interface, fixed spreads, and robust educational resources, caters to both beginner and experienced traders looking for a straightforward trading experience.

Verdict: For experienced traders seeking tight spreads and professional trading conditions, FXChoice offers an attractive proposition. However, for a broader audience including beginners seeking an easy start and risk management tools, EasyMarkets provides a more suitable platform.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

If your goal is to build a thriving career in forex trading and aim for significant financial success, Asia Forex Mentor is your top pick for mastering forex, stock, and crypto trading. The foundation of this premier educational platform is Ezekiel Chew, a distinguished figure known for his expertise in guiding trading institutions and banks. Notably, Ezekiel's track record includes consistently securing seven-figure trades, distinguishing him from his peers in the educational sphere. The following points highlight why we endorse this choice:

Comprehensive Curriculum:Asia Forex Mentor provides a thorough educational package that spans forex, stock, and crypto trading. This curriculum is designed to furnish learners with the critical skills and knowledge needed to thrive in various financial markets.

Proven Track Record: The reputation of Asia Forex Mentor is solidified by its success in nurturing traders who consistently profit in different market environments. This success underscores the high caliber of their teaching methods and mentorship.

Expert Mentor: Students at Asia Forex Mentor receive guidance from a mentor with a proven track record in forex, stock, and crypto trading. Ezekiel's hands-on support ensures that students confidently tackle market challenges.

Supportive Community: Enrollment in Asia Forex Mentor includes entry into a community of ambitious traders focused on success in the forex, stock, and crypto arenas. This network encourages collaboration and learning from peers, enriching the educational journey.

Emphasis on Discipline and Psychology: Achieving trading success requires a disciplined mindset. Asia Forex Mentor emphasizes psychological training to equip traders with strategies for emotional control, stress management, and informed decision-making.

Constant Updates and Resources: Keeping pace with the ever-evolving financial markets, Asia Forex Mentor ensures students have access to the latest trends, strategies, and insights, offering resources that keep them informed and competitive.

Success Stories: The legacy of Asia Forex Mentor is its wealth of success stories, showcasing students who have dramatically improved their trading careers and attained financial freedom through their comprehensive education in forex, stock, and crypto trading.

For those dedicated to excelling in forex, stock, and crypto trading, Asia Forex Mentor stands out as the foremost educational resource. It offers a rich curriculum, expert mentorship, a practical learning approach, and a supportive community, all designed to transform novices into skilled traders in the diverse world of finance.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: EasyMarkets Review

In conclusion, the team of trading experts at Dumb Little Man has thoroughly reviewed EasyMarkets, revealing a platform that stands out for its user-friendly interface, comprehensive range of trading instruments, and innovative risk management features. EasyMarkets is celebrated for its commitment to simplifying the trading experience for both novice and seasoned traders, with a special emphasis on education and customer support.

However, it's crucial to acknowledge the platform's limitations, such as the support being available only in English and undefined support service hours. These cons may pose challenges for a global audience seeking assistance in various languages and time zones.

>> Also Read: HugosWay Review 2024 with Rankings By Dumb Little Man

EasyMarkets Review FAQs

What types of accounts does EasyMarkets offer?

EasyMarkets provides a variety of account options to cater to different trader needs and preferences. These include the Standard, Premium, and VIP accounts. The Standard account is ideal for beginners with a low minimum deposit, while the Premium and VIP accounts offer more benefits such as lower spreads and additional services for more experienced traders. Each account type is designed to enhance the trading experience, whether you're new to trading or have extensive experience in the markets.

Can I trade cryptocurrencies with EasyMarkets?

Yes, EasyMarkets offers cryptocurrency trading as part of its wide range of trading instruments. Traders can engage in cryptocurrency trading alongside forex, commodities, indices, and options. This diversity allows traders to explore and invest in the volatile crypto market while having access to other trading opportunities within the same platform. Cryptocurrency trading with EasyMarkets is streamlined and secure, catering to both beginners and experienced traders looking to diversify their portfolios.

How does EasyMarkets ensure the safety of my funds?

EasyMarkets prioritizes the safety of client funds through strict adherence to regulatory standards and the use of segregated accounts. Being regulated by reputable organizations such as the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC) ensures that EasyMarkets operates with transparency and integrity. Segregated accounts and negative balance protection ensure that client funds are kept separate from the company's operating funds, providing an additional layer of security and peace of mind for traders.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.