Dizicx Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.4 2.5/5 | 123rd  |  |

| Evaluation Criteria |

|---|

The team at Dumb Little Man, comprising financial specialists, seasoned traders, and private investors, employs a specialized algorithm for thorough evaluations of brokerage services. Their analysis focuses on key areas such as:

|

Dizicx Review

Forex brokers play a crucial role in the world of online trading, offering access to the foreign exchange market. They act as intermediaries between traders and the market, enabling individuals and institutions to buy and sell currency pairs and other financial instruments. Dizicx stands out in this competitive landscape, having served clients with a broad spectrum of trading opportunities since 2016.

In our comprehensive Dizicx review, we aim to deliver an exhaustive analysis, highlighting both the unique selling propositions and potential drawbacks of the broker. Our goal is to present essential details, including account options, deposit and withdrawal processes, and commission structures, combining expert analysis and actual trader experiences. This balanced approach aims to furnish readers with the insights needed to decide if Dizicx is the right brokerage service provider for their trading needs.

What is Dizicx?

Dizicx is a prominent broker in the online trading industry, known for its currency pairs and CFD (Contract for Differences) trading services since 2016. It offers a comprehensive range of assets and account types, enabling traders to tailor their trading experience according to their individual needs and preferences. This flexibility makes Dizicx a preferred choice for many traders seeking a customized trading approach.

As an international brand, Dizicx extends its services across the globe, catering to a diverse client base. The broker distinguishes itself by offering 9 deposit funding methods without imposing any commission, which significantly lowers the barrier to entry for many traders. Furthermore, Dizicx provides accounts with spreads starting from 0 pips, alongside investment solutions and various trading calculator types, enhancing the trading experience for its users. This wide array of features underscores Dizicx's commitment to meeting the varied needs of international traders.

Safety and Security of Dizicx

Based on meticulous research from Dumb Little Man, the safety and security of Dizicx reveal critical insights for potential traders. Dizicx Ltd, the legal entity behind Dizicx, is registered on the island of Mauritius with registration number 188402 and operates under the jurisdiction's laws. This establishes a legal framework for its operations, which is a fundamental aspect of a broker's credibility.

However, a notable concern is that Dizicx is not a member of any compensation funds. This absence means that client deposits are not protected in the event of the company's financial failure, posing a potential risk to traders' investments. Additionally, the broker offers trading with leverage up to 1:1000, which, while attractive for its high-profit potential, also carries a high level of risk.

Dizicx facilitates the deposit and withdrawal of funds through e-wallets, providing a degree of convenience and flexibility in managing finances. However, it's important to note that negative balance protection is only available on Standard and Premium accounts, limiting this safeguard to certain account types. Furthermore, client investments are not protected by compensation funds or insurance programs, highlighting a significant aspect of risk concerning the security of investments with Dizicx.

Pros and Cons of Dizicx

Pros

- Advanced order types, one-click, and copy trading support

- Multiple execution types: instant or market

- 24-hour Forex technical support

- Liquidity from 25 institutional providers

- Swap-free accounts and negative balance protection

- Diverse funding options: e-wallets, cards, cryptocurrencies

- PAMM services for passive income

Cons

- No MetaTrader 4 platform, less beginner-friendly

- Unlicensed, registered offshore in Mauritius

- Standard account minimum deposit: $100; no cent accounts

Sign-Up Bonus of Dizicx

As of the current time, Dizicx does not offer a sign-up bonus for new clients. This means that traders looking to join Dizicx will not receive an initial monetary bonus upon opening an account. While some brokers use sign-up bonuses as an incentive for new traders, Dizicx focuses on other aspects of their service to attract and retain clients.

Minimum Deposit of Dizicx

The minimum deposit required to open an account with Dizicx is $100. This amount enables traders to access the broker’s trading platform and start trading in a variety of markets. The $100 minimum deposit is designed to make trading accessible to a wider audience, balancing the need for accessibility with the provision of quality trading services.

Dizicx Account Types

Our team of experts at Dumb Little Man conducted thorough research to test the account types offered by Dizicx. They also offer risk-free demo accounts for those who want to practice trading. Here's a clear and organized list of the account types based on their findings:

- Standard Account:

- Minimum deposit: $100

- Leverage up to 1:1000

- Spreads start from 1.5 pips

- No additional trading commission

- Premium Account:

- Minimum deposit: $300

- Leverage up to 1:400

- Spreads start from 1 pips

- Commission: $3

- Star VIP Account:

- Minimum deposit: $2,000

- Leverage up to 1:300

- Spreads start from 0.5 pips

- Commission starting from $3

- ECN Pro Account:

- Minimum deposit: $500

- Leverage up to 1:200

- Spreads start from 0.0 pips

- Commission: $3

Dizicx Customer Reviews

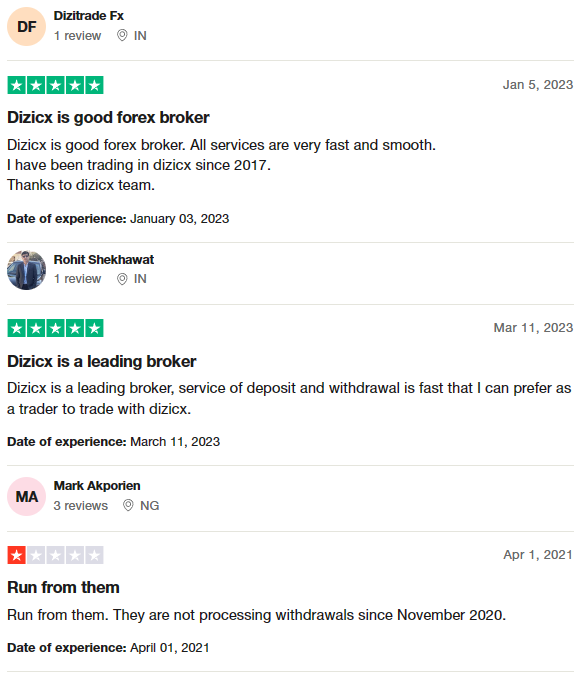

Customer reviews on Dizicx reveal a mixed reception. Many traders commend the broker for its fast and smooth services, highlighting the efficiency of deposits and withdrawals as a strong point. Some have been loyal clients since 2017, expressing gratitude towards the Dizicx team for their support. However, there are also negative comments, with one reviewer advising others to avoid the broker due to withdrawals not being processed since November 2020. This contrast in experiences suggests that while Dizicx has strengths in service speed and support, potential issues with withdrawal processing may need to be considered by prospective clients.

Dizicx Fees, Spreads, and Commissions

Dizicx employs a structured approach to fees, spreads, and commissions, catering to various trading preferences. For Standard accounts, the broker's main form of revenue comes from the spread, which is the difference between the buying and selling prices. This means no additional trading commission is charged on these accounts. In contrast, other account types, such as Premium and ECN Pro, incur both the spread and a flat commission of $3.

The most competitive spreads are found on the ECN Pro accounts, starting from 0.0 pips, appealing to traders looking for tight spreads and high liquidity. For those interested in trading CFDs on stocks, Dizicx charges a commission starting at 0.08% of the position size, providing a clear, low-cost structure for stock CFD traders.

Dizicx stands out for not charging fees for depositing or withdrawing funds, although it's important to note that payment providers may impose their own fees. Additionally, Star VIP and ECN Pro accounts benefit from no swap fees, and Standard accounts offer a swap-free option for Islamic clients, ensuring flexibility and fairness across trading conditions.

Deposit and Withdrawal

After thorough testing by a trading professional at Dumb Little Man, it was found that Dizicx has a minimum withdrawal amount of $25 for all its available methods. This policy ensures a straightforward and accessible withdrawal process for traders. Clients have the flexibility to withdraw funds to cryptocurrency wallets in USDT and BTC, in addition to using popular e-wallets like Skrill and Neteller. For certain regions, Perfect Money and WebMoney are viable options, and notably, residents of India have the convenience of withdrawing earnings directly to a local bank account, allowing for cash retrieval.

Dizicx mandates a phone, email, and identity verification process for all its clients, involving scanned copies of documents. This mandatory procedure underscores the broker's commitment to ensuring security and compliance with regulatory standards, safeguarding both the company and its clients against fraud, and ensuring the integrity of transactions.

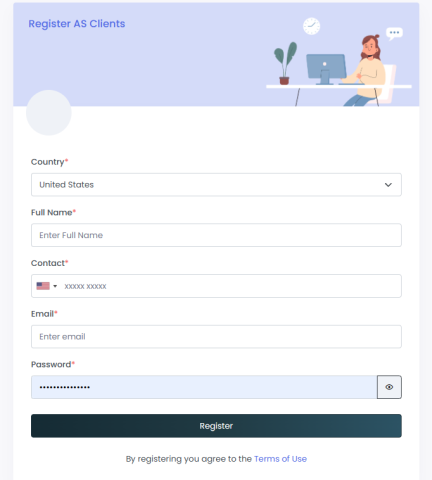

How to Open a Dizicx Account

- Click on “Open Live Account” to start the process.

- Fill in personal details including name, surname, phone number, and email.

- Confirm your email and phone number for verification.

- Provide your residential address and date of birth.

- Create a password for your user account access.

- Submit the form with all the required information.

- Complete the verification process through the link sent to your email.

- Log in to your new account using the created password.

- Start trading by depositing into your account.

Dizicx Affiliate Program

Dizicx offers an Introducing Broker (IB) program designed for marketers, trading educators, signal providers, and individuals or companies involved in investment services. IBs are rewarded with compensation for each trade executed by their clients, offering a lucrative opportunity for those with an established client base or audience. Dizicx provides individual conditions for each IB, along with marketing tools customized to their specific target audience, ensuring the effectiveness of promotional efforts.

The White Label solution by Dizicx enables partners to run a brokerage business under their own brand, offering significant autonomy and brand visibility. Partners receive comprehensive support throughout the process, from website creation to the provision of a back office, facilitating smooth operation and promotional activities.

It's important to note that Dizicx does not offer affiliate programs for retail traders, focusing instead on partnerships that involve a more structured business model or those that provide direct investment services to a broader audience.

Dizicx Customer Support

Based on the experience of Dumb Little Man with Dizicx Customer Support, traders have multiple channels to reach out for assistance. Customers can initiate a chat directly on the Dizicx website, offering immediate interaction with support personnel. Alternatively, questions can be sent via email, providing a convenient method for those who prefer to document their inquiries or issues.

For more direct communication, Dizicx also offers phone support, allowing for real-time conversation and the opportunity to resolve queries more efficiently. Additionally, traders with a user account on the official Dizicx website have the option to create a support ticket in the support request section, ensuring their concerns are formally logged and tracked until resolution. This multifaceted approach to customer service demonstrates Dizicx's commitment to providing accessible and effective support to its clients.

Advantages and Disadvantages of Dizicx Customer Support

| Advantages | Disadvantages |

|---|---|

Dizicx vs Other Brokers

#1. Dizicx vs AvaTrade

Dizicx focuses on currency pairs and CFD trading, offering accounts with spreads from 0 pips and leveraging up to 1:1000. It provides services globally but lacks the extensive regulation and licensing that AvaTrade boasts. AvaTrade, established in 2006, serves over 300,000 registered customers and is heavily regulated, with four global locations and a strong commitment to customer confidence and efficient trading.

Verdict: AvaTrade may be better for traders prioritizing regulatory security and a wide range of financial instruments. Its established reputation and commitment to regulation provide a more secure trading environment, especially for those cautious about the regulatory stance of their broker.

#2. Dizicx vs RoboForex

RoboForex, operating since 2009 and regulated by FSC, offers a vast selection of over 12,000 trading options across eight asset classes. It's recognized for its cutting-edge technologies and flexible trading conditions, suitable for all types of traders. Dizicx, with its competitive spreads and leverage, caters to traders looking for specific account types and conditions but lacks the broad asset variety and technological offerings of RoboForex.

Verdict: RoboForex stands out as a better choice for traders seeking technological diversity and a wider range of trading instruments. Its extensive platform selection and asset variety cater to a broader spectrum of trading strategies and preferences.

#3. Dizicx vs FXChoice

FXChoice, established in 2010, is known for its commitment to high-quality brokerage services, focusing on both active and passive trading. Licensed by the International Financial Services Commission of Belize (FSC), FXChoice offers classic and professional ECN accounts with tight market spreads. While Dizicx provides competitive leverage and spread options, it may not match FXChoice's focus on professional trading services and regulatory compliance.

Verdict: FXChoice is likely a better option for experienced traders due to its professional accounts, regulatory oversight, and services tailored to active and passive trading strategies. Its commitment to high standards and focus on customer service make it a preferable choice for those with more advanced trading needs.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

For those passionate about forging a prosperous path in forex trading and aiming for significant financial achievements, Asia Forex Mentor is the premier selection for top-tier forex, stock, and crypto trading courses. Ezekiel Chew, celebrated for his contributions to the training of institutions and banks, spearheads Asia Forex Mentor. Notably, Ezekiel's consistent delivery of seven-figure trades marks a significant distinction from other educators in the industry. The reasons that reinforce our endorsement are:

Comprehensive Curriculum:Asia Forex Mentor provides a broad and detailed educational program encompassing stock, crypto, and forex trading. Its structured curriculum is designed to arm budding traders with the essential knowledge and skills to thrive in these varied markets.

Proven Track Record: The reputation of Asia Forex Mentor is solidified by its track record of nurturing traders who consistently profit in different market sectors. This success underscores the quality and effectiveness of their educational approach and mentorship.

Expert Mentor: Students at Asia Forex Mentor receive instruction from a mentor with a proven history of success in stock, crypto, and forex trading. Ezekiel offers personalized guidance, empowering students to confidently tackle the complexities of the markets.

Supportive Community: Membership in Asia Forex Mentor includes entry into a supportive community of fellow traders focused on success in the stock, crypto, and forex markets. This environment encourages cooperation, exchange of ideas, and learning from peers, enriching the educational journey.

Emphasis on Discipline and Psychology: Achieving trading success requires a strong mental approach and disciplined strategy. Asia Forex Mentor emphasizes psychological training to assist traders in managing their emotions, coping with stress, and making informed decisions while trading.

Constant Updates and Resources: Recognizing the dynamic nature of financial markets, Asia Forex Mentor ensures students stay informed with the latest trends, strategies, and market analysis. Ongoing access to invaluable resources positions traders for continued success.

Success Stories:Asia Forex Mentor boasts numerous testimonials from students who have dramatically improved their trading careers and reached financial autonomy through their all-encompassing forex, stock, and crypto trading education.

Asia Forex Mentor stands out as the definitive option for individuals seeking an unparalleled forex, stock, and crypto trading course to navigate a lucrative career and secure financial success. With its extensive curriculum, skilled mentor, applied learning, and engaging community, Asia Forex Mentor equips aspiring traders with the tools and support needed to become proficient professionals in various financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Dizicx Review

In conclusion, the team of trading experts at Dumb Little Man has thoroughly reviewed Dizicx and found it to be a broker with a range of appealing features. Dizicx offers a wide variety of account types, competitive spreads, and high leverage options, catering to the needs of diverse traders. Its commitment to flexibility and a broad selection of trading instruments positions it as a noteworthy choice in the competitive forex and CFD trading landscape.

However, potential clients should be mindful of the cons associated with Dizicx. The broker's registration in an offshore jurisdiction and the absence of a regulatory license might raise concerns about security and the protection of client funds. Additionally, the lack of MetaTrader 4 support could deter beginners looking for a familiar and user-friendly trading platform.

>> Also Read: Admiral Markets Review 2024 with Rankings By Dumb Little Man

Dizicx Review FAQs

Is Dizicx regulated?

Dizicx operates under the jurisdiction of Mauritius, with registration number 188402. However, it's important to note that Dizicx is not currently a member of any compensation funds, which may concern some traders regarding the protection of their deposits. Potential clients should consider this factor when evaluating the security and reliability of Dizicx as their broker choice.

What account types does Dizicx offer?

Dizicx offers a variety of account types to cater to different trading styles and preferences, including Standard, Premium, Star VIP, and ECN Pro accounts. These accounts vary in terms of minimum deposits, spreads, leverage, and commission charges, providing options for traders at all levels of experience. Whether you're a beginner or an experienced trader, Dizicx has account options designed to meet your trading needs.

How can I deposit and withdraw funds with Dizicx?

Dizicx supports multiple methods for depositing and withdrawing funds, including cryptocurrencies (USDT and BTC), e-wallets (Skrill and Neteller), and in some regions, Perfect Money and WebMoney. For residents of India, there's the additional option to withdraw earnings directly to a local bank account. It's noteworthy that Dizicx does not charge fees for depositing or withdrawing funds, although fees from payment providers may apply. The minimum withdrawal amount is set at $25 for all available methods, ensuring a straightforward and accessible process for managing your funds.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.