Deriv Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

2.0 2/5 | 76th  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of financial consultants, trading professionals, and individual investors, uses a unique algorithm for detailed evaluations of brokerage firms. Our review criteria are consistent and include:

Customer opinions are also considered to provide a well-rounded view, helping to minimize personal biases for a neutral assessment. Based on our extensive analysis, Deriv has emerged as a reliable choice for those seeking a dependable financial broker. While the platform has many strong points, it's important to also recognize its limitations. We advise potential users to read this article carefully to fully grasp these downsides. |

Deriv Review

Forex brokers act as intermediaries between retail traders and the interbank forex market. They facilitate currency trading and offer a platform where traders can execute buy or sell orders. Deriv is one such broker, striving to offer a first-class experience to its traders through expert market analysis.

Deriv isn't limited to just forex trading. It expands its trading instruments to include derivatives on stocks and indices, commodities, cryptocurrencies, and CDFs. This diverse product range aims to suit the varying needs and strategies of traders, making it a one-stop shop for multiple assets.

Before diving into trading with Deriv, it's crucial to perform a thorough review.

The review aims to offer essential insights into various aspects of the broker. These include account options, deposit and withdrawal processes, and commission structures. By combining expert analysis and actual trader experiences, we equip you with the information needed to make an informed decision on whether Deriv should be your go-to brokerage service.

What is Deriv?

Deriv is an online broker with a history dating back to 1999. It aims to make trading accessible to all traders, achieving this through low deposit requirements and a user-friendly interface. The platform has garnered global popularity, allowing traders to engage in various assets including stocks, forex, options, CDFs, indices, commodities, and cryptocurrencies.

The broker goes a step further by offering multiple trading platforms like DMT5, DBot, and DTrader. These platforms make it easier for traders to navigate the trading environment. Moreover, they provide market analysis, helping traders gain a better understanding of market conditions. This feature allows traders to make informed decisions and potentially maximize profits.

What makes Deriv stand out is its regulatory compliance. The platform is licensed by several international bodies, including the VFSC, UK Financial Conduct Authority (FCA), Malta, and Labuan Financial Services Authority. Additionally, Deriv is a member of the Financial Commission, which aims to protect traders' rights during trading activities. This membership adds an extra layer of trust and respectability to the broker.

Safety and Security of Deriv

According to thorough research by Dumb Little Man, Deriv is recognized as a legitimate Forex broker. Operating since 1999, it is under the regulation of well-respected financial authorities. These include the UK Financial Conduct Authority (FCA), Vanuatu Financial Services Commission (VFSC), Malta Financial Services Authority (MFSA), and Labuan Financial Services Authority (Labuan FSA).

These regulatory bodies enforce strict standards and oversight to safeguard client funds and promote fair trading. Deriv's membership in the Financial Commission adds another layer of credibility, offering a mechanism for dispute resolution. Despite these safety measures, individuals are advised to conduct their own research and due diligence before making any investment with a broker.

Sign-Up Bonus of Deriv

In the world of online trading, sign-up bonuses can often attract new users. However, Deriv does not offer a sign-up bonus, deposit bonus, or welcome bonus for traders who open a real account. The absence of such promotional incentives is worth noting.

While the lack of bonuses or rewards might seem like a drawback, it should not be a deal-breaker. Traders should focus on other crucial factors like security, asset variety, and trading platforms when choosing a broker. Deriv's absence of bonuses does not necessarily reflect on its overall quality or reliability.

Minimum Deposit of Deriv

When it comes to funding your trading account, Deriv offers varying minimum deposit and withdrawal amounts based on the payment method used. If traders opt for e-wallets, they can benefit from a lower threshold. Specifically, the lowest deposit and withdrawal amount for these platforms ranges from 5 to 10 USD/EUR/GBP/AUD.

This flexibility in deposit amounts accommodates traders with different budget constraints. It means that traders can start with a relatively small investment, making the platform accessible for beginners and those who prefer to trade with lower stakes.

Deriv Account Types

After comprehensive research and testing by our team of experts at Dumb Little Man, various live tradingaccount types offered by Deriv have been identified. These are tailored to suit different trading needs and come with unique features.

Standard Account

This account type is suitable for both beginners and professional traders. It offers a wide range of assets like cryptocurrencies, commodities, and exotic and major currency pairs. The leverage is flexible, up to 1:1000, making it accessible for traders at different levels. Educational resources are also available to guide traders on platform tools and effective market strategies.

Financial STP Account

Targeted at forex traders, this account provides access to exotic, minor, and major currency pairs. It features low spreads and high trade volumes, allowing traders to engage in over 150 assets. Transactions are quick and cost-effective, making it a reliable option for forex traders globally.

Synthetic Account

Known for its transparency, this account undergoes third-party inspection for reliability and fairness. It's geared towards traders looking to profit from indices and CDFs. Offering leverage of up to 1:1000, it also has a 100% margin call level and a 50% stop-out level to protect investments from risks and losses.

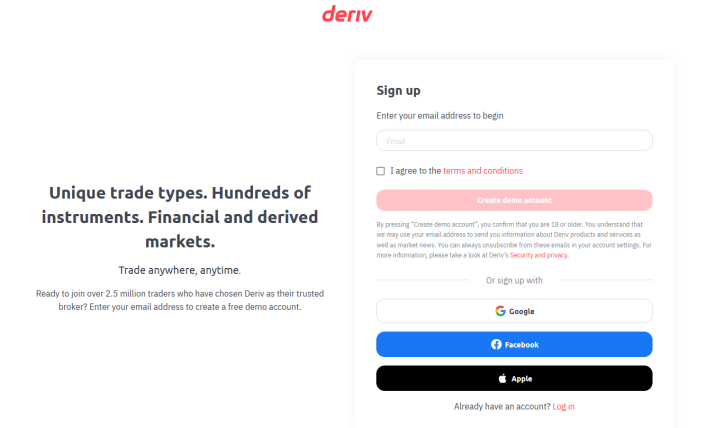

Demo Account

Ideal for newcomers, this account lets you practice trading without risking money. It is free to all users and provides a thorough understanding of Deriv's trading tools, fees, and commissions. This account also allows traders to practice market analysis and trading strategies.

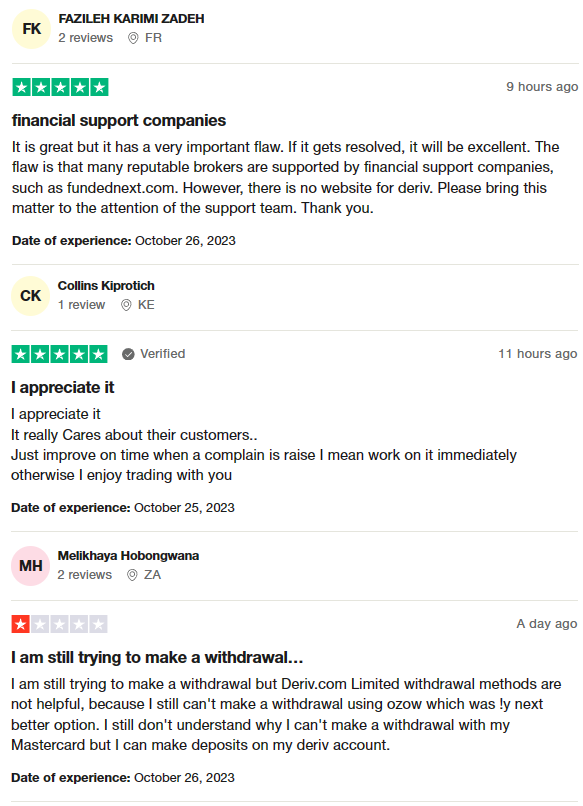

Deriv Customer Reviews

Customer feedback on Deriv presents a mixed bag of experiences. While some users appreciate the platform for its customer-centric approach, others express concerns. Notable is the lack of financial support companies usually found with other brokers, which some customers hope will be addressed by the support team.

Additionally, there's room for improvement in the timeliness of complaint resolution. Also mentioned are the limited withdrawal options, particularly issues with using specific methods like Mastercard, which allows deposits but not withdrawals. Overall, while Deriv garners positive comments for caring about its customers, it also faces calls for improvements in certain areas.

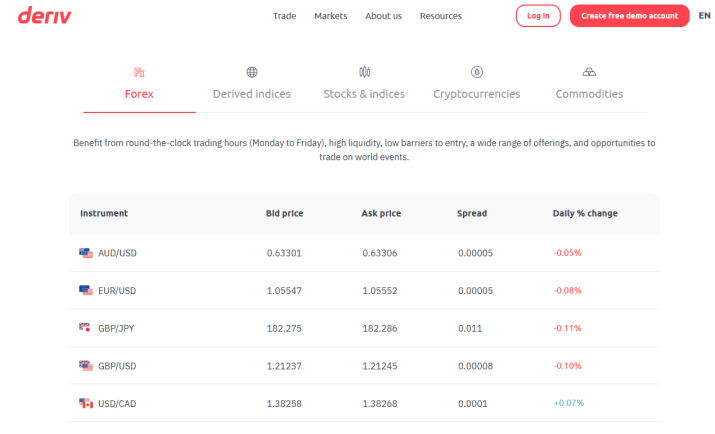

Deriv Fees, Spreads, and Commissions

For traders conscious about costs, Deriv stands out for its competitive spreads. The platform offers spreads as low as 0.5 pips on forex pairs like USD/EUR. These spreads level the playing field, giving traders at all expertise levels a fair shot at profitability. Moreover, the spreads allow for better control over losses and profits and are sourced from multiple venues on the DMT5 platform for the best pricing.

Deriv's flexibility in commissions and fees also deserves attention. The broker does not charge fees for account maintenance. However, an inactivity fee applies if the account remains unused for 12 consecutive months. Withdrawals are free, but third-party charges may apply, allowing traders to retain most of their profits.

Swap fees are another consideration. These are charges for carrying positions into the next trading day. Notably, Deriv does not offer Islamic accounts, so Muslim traders would incur overnight fees for open positions. Finally, it's essential to know that commissions at Deriv are fixed, although they may vary depending on the account type and asset being traded.

Deposit and Withdrawal

Based on information verified by a trading professional at Dumb Little Man, Deriv‘s deposit and withdrawal processes are secure and user-friendly. The broker offers a variety of options for both, including banking solutions, bank cards, cryptocurrencies, and e-wallets. This diverse range allows traders to select the payment method that suits them best.

Transaction processing times can differ based on the chosen payment agent. For example, debit card deposits are instant, while withdrawals are generally complete in one business day. The typical time frame for processing transactions is either immediate or up to three working days.

Importantly, Deriv itself does not charge transaction fees. However, fees may be incurred from the payment agents involved. Each payment agent also has its own set of minimum and maximum limits for deposits and withdrawals. Lastly, identity verification is a mandatory step for all traders, both novice and professional, wishing to conduct any transactions with Deriv.

How to Open a Deriv Account

- Visit Deriv‘s official website to start the account creation process.

- Choose the type of account you want to open, whether it's demo, synthetic, or financial STP.

- Pick your trading currency based on your preference and trading needs.

- Enter personal information such as your full name, phone number, and email address.

- Review and accept the terms and conditions provided on the platform.

- Confirm you are 18 years or older and reside in an eligible country.

- Submit identification documents for verification purposes.

- Wait for account approval from Deriv's verification team.

- Once approved, log in and start exploring the trading platform.

Deriv Affiliate Program

Deriv‘s Affiliate Program offers a lucrative opportunity for affiliates to earn up to a 45% lifetime commission. With a history of reliable referral programs, Deriv Group Ltd ensures timely payouts.

In terms of Revenue Share, commissions are tiered based on the monthly net revenue your clients generate. Earn a 30% commission for net revenue up to USD 20,000 per month and 45% for anything above that.

For Turnover Options, affiliates can earn based on each contract's payout probability. Multipliers allow you to earn 40% of commissions generated from your clients' trades. With Lookbacks, earn 0.8% on each trade's stake via SmartTrader.

CPA (EU only) is another earning avenue. Affiliates get USD 100 for each successful referral that deposits a total of USD 100 into their Deriv account. Note that this option is only available for EU-based clients, excluding those from Portugal and Spain.

Deriv Customer Support

Deriv‘s Customer Support stands out for its round-the-clock availability, providing assistance 24/7, even during weekend trading. According to experience gathered by Dumb Little Man, Deriv ensures that traders get the answers they need. For basic issues and questions, Deriv offers a Help Centre, a self-service portal to assist with platform issues and account-related queries.

Additionally, live chat support is available directly from Deriv's official website. For those who prefer face-to-face assistance, Deriv's business centers are strategically located in various countries including France, Malta, and Malaysia, among others.

Advantages and Disadvantages of Deriv Customer Support

| Advantages | Disadvantages |

|---|---|

Deriv vs Other Brokers

#1. Deriv vs AvaTrade

Deriv excels in regulatory oversight, being governed by multiple financial authorities. It also offers a wide range of account types tailored for different traders. AvaTrade, on the other hand, focuses on automated trading solutions and has a less diverse account offering.

Verdict: Deriv is better for those seeking stronger regulatory protection and more account options.

>> Also Read: AvaTrade Review: Is it the Best Overall Broker?

#2. Deriv vs RoboForex

Deriv stands out for its long-standing reputation, having been in the market since 1999. RoboForex specializes in providing cryptocurrency trading, with a wide range of crypto pairs. Deriv has a more comprehensive asset offering, encompassing more than just cryptocurrencies.

Verdict: Deriv is better for traders looking for a well-established broker with varied asset options.

#3. Deriv vs FXChoice

While Deriv shines in asset variety and regulatory compliance, FXChoice specializes in Forex trading and offers MetaTrader platforms exclusively. FXChoice has limited asset options compared to Deriv.

Verdict: Deriv is better for those wanting a more diversified portfolio and multiple regulatory protections.

Choose Asia Forex Mentor for Your Forex Trading Success

If you're aiming for a profitable career in forex, stock, or crypto trading, Asia Forex Mentor is the go-to educational platform. Highly recommended by the trading experts at Dumb Little Man, the platform is spearheaded by Ezekiel Chew, a trading guru with a track record of seven-figure trades.

Asia Forex Mentor offers a comprehensive curriculum that covers all key trading sectors. This in-depth training ensures you have the skills and knowledge needed for success. The platform has a proven track record of turning students into profitable traders, attesting to the effectiveness of their methodology.

Ezekiel Chew, the expert behind the platform, offers valuable, personalized mentorship. His expertise helps you navigate the complexities of the trading world. Adding to this is a supportive community of fellow traders. This network promotes collaboration and shared learning, enriching your educational experience.

Psychological discipline is another strong focus at Asia Forex Mentor. The platform teaches you how to manage emotions and stress, key elements for long-term trading success. Furthermore, you gain access to constant updates and resources, keeping you ahead in the rapidly changing financial markets.

Asia Forex Mentor has numerous success stories to its name. These success stories showcase students who have achieved financial independence through the platform’s comprehensive training.

In conclusion, Asia Forex Mentor stands as an excellent choice for anyone looking to succeed in forex, stock, or crypto trading. With its well-rounded curriculum, expert mentorship, and focus on practical skills and emotional discipline, it equips you for success across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Deriv Review

Based on an extensive review by the trading experts at Dumb Little Man, Deriv emerges as a strong contender in the trading platform landscape. With its low spreads and zero withdrawal fees, it offers traders an affordable way to engage in Forex and other financial markets. Its multiple account types give you the flexibility to trade according to your expertise and preferences.

However, potential users should be cautious of the platform's inactivity fees and the limited ways to reach customer support. While the platform charges no account maintenance fee, inactive accounts are subject to fees. And while customer support is available 24/7, the absence of phone support might be a drawback for some.

>> Also Read: JustMarkets Review 2025 with Rankings By Dumb Little Man

Deriv Review FAQs

Is Deriv a good platform for beginners?

Yes, Deriv is suitable for both beginners and experienced traders. The platform offers demo accounts to help new traders get accustomed to the system. Additionally, its low spreads and zero withdrawal fees make it cost-effective for those just starting out.

What are the fees associated with Deriv?

Deriv boasts competitive spreads and no withdrawal fees. However, it does charge inactivity fees if your account remains dormant for 12 consecutive months. It's important to read the fee structure carefully to avoid unexpected charges.

How reliable is Deriv's customer support?

Deriv offers 24/7 customer support and has offline offices in multiple countries for direct assistance. However, the platform does not offer phone support, so all queries must be handled either through live chat or their Help Centre.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.