Charles Schwab Bank Review: Is Charles Schwab a Good Bank?

By Peter Vanderbuild

January 12, 2024 • Fact checked by Dumb Little Man

Deviating from the predictable brick-and-mortar banks, Charles Schwab Bank was born in 2003. Charles Schwab Corporation has been a part of the American Financial landscape for more than 40 years. After establishing a good investment firm, Schwab moved to the banking sector. Charles Schwab is an online bank with several features of a traditional bank.

You can create your account online and avail several benefits of its checking account online. But don't expect high CD rates at Charles Schwab because it doesn't offer a Certificate of Deposit.

Instead, you get access to a marketplace where you can find different CD rates. There are some uncommon CDs at the Charles Schwab CD rates marketplace. But you might have trouble finding something of your liking.

We'll cover everything in this Charles Schwab bank review, including its checking accounts and savings accounts. So keep reading till the end to know all about online banks and Charles Schwab services.

Charles Schwab Bank Review: Topic Overview

Understanding how bank accounts work can be overwhelming at first glance, but we're here to help break it down so that anyone can understand it!

Check out our comprehensive review of Charles Schwab Bank's services below: -What are the benefits? -How does it compare against other banks? -What are the Pros and Cons? -Who is it best for?

Everything you need to know about Charles Schwab Bank in one place: we've got the details for you.

What is Charles Schwab?

Charles Schwab started as a brokerage firm with a multitude of investment options. Charles Schwab started providing online banking services in 2003. While you won't have the top features of a complete banking system, you might enjoy what Schwab has to offer. Charles Schwab Bank has an online savings account and an online checking account.

So you won't miss out on everything! Plus, it has a stellar ATM policy, making it perfect for people looking for better ATM services.

Click Here to Find Out More About Charles Schwab Bank.

How do Charles Schwab Checking Account and Savings Accounts work?

Charles Schwab is an ideal bank for brokers. You can conveniently transfer money between your Schwab One brokerage account and savings account. Unfortunately, Charles Schwab has only one checking account. It is called Charles Schwab high yield investor checking account. This account is automatically linked with your Schwab One brokerage account – a feature most online banks lack!

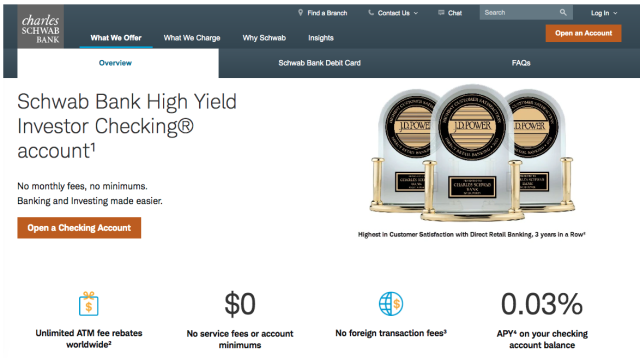

Charles Schwab Bank High Yield Investor Checking Account Online

The Charles Schwab high yield investor checking account has unlimited ATM fee rebates. So you can request all the reimbursements you ever wanted. Schwab bank's high-yield investor checking account doesn't have a foreign transaction fee either. After all, this bank is making millions in foreign currency, so a transaction fee won't make sense.

What's interesting about Charles Schwab bank's high-yield investor checking account is that it pays interest. Something we'd expect from an online savings account. So that's a nice bonus! But surprises don't end here. Charles Schwab bank high yield investor checking account has no monthly maintenance fee with unlimited ATM fee reimbursements. Plus, when you overdraft Schwab automatically pulls money from your linked Schwab brokerage account. Don't worry; each account has a separate account number.

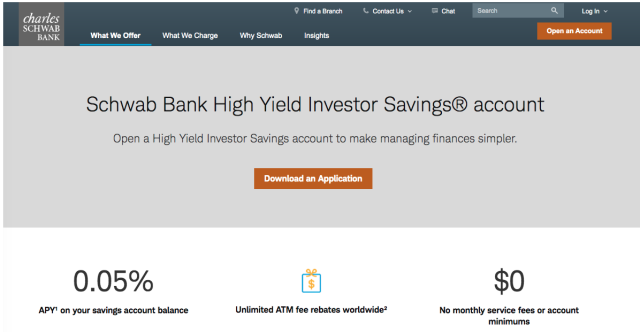

Charles Schwab Bank High Yield Investor Savings Account Online

Unfortunately, the list of features under this account isn't as long as its name. But it has a few notable qualities of a brick-and-mortar banks high yield savings account. At Charles Schwab Bank, you'll find only one Schwab savings account. It might be frustrating for people looking to save large sums of money. Because Schwab Bank offers flat APY rates for all clients. But not everyone despises this high yield savings account.

For instance, Schwab bank high yield investor savings account offers an ATM card, a feature lacking in most brick-and-mortar and online banks. Plus, a high yield investor savings account also offers the convenience of global unlimited ATM fee reimbursements. This is an excellent option for people who don't prefer sticking to a particular ATM network. Plus, no financial institution offers this service yet.

Since you get an ATM card with your savings account, you can use it anywhere you want. Your ATM card will work in foreign countries as well. Plus, Charles Schwab bank won't charge foreign transaction fees.

What are the Features of Charles Schwab Banking?

Charles Schwab was primarily known for its investing services. But the Schwab bank is making a name for itself in the market. Here are some notable features of Schwab Bank that will help you manage your personal finance.

Schwab Mobile Deposit

Right off the bat, this service takes the crown for the best way to deposit checks. The Schwab mobile deposit is fast and distinct from different online banking services. You won't find this in brick-and-mortar banks because they don't focus on online services.

If you are concerned about security, you might be wondering whether mobile deposits are safe. Don't worry; like all financial products, Schwab mobile is completely safe. It has the same firewall and other protection as most financial services provided by the Charles Schwab brokerage account.

Schwab Bank Mobile App

Schwab Bank's mobile app is your one-stop solution to all things banking and investing. That's right, Schwab bank doesn't shy away from luring its users into the world of investing. It makes us wonder whether this online banking service is to gain more investors?

You can make transfers and payments from your Charles Schwab bank accounts. Transfer funds have no additional or hidden fees. No minimum balance requirements to open an account through the app or any other way. Plus, you can view exotic Charles Schwab offers all from the mobile app.

How much does Charles Schwab Cost?

| Charles Schwab Accounts Types | Monthly Fees | Waiver Criteria | Minimum Deposit Amount |

|---|---|---|---|

| Charles Schwab High Yield Investor Checking Account | $0 | N/A | $0 |

| Charles Schwab High Yield Investor Savings Account | $0 | N/A | $0 |

Click Here to Know More About Charles Schwab Bank.

Who is Charles Schwab Best For?

Charles Schwab is a half brokerage and half bank. Therefore, it caters to a specific niche of banking customers. Here are the types of banking customers who'll benefit from Schwab Bank services.

Customers With Multiple Accounts

Schwab Bank doesn't have a range of banking services. But it's best for those who want multiple accounts. For instance, people who are already using Schwab Bank's brokerage service would love this bank. You can seamlessly transfer money between your Schwab One brokerage account and banking accounts. Plus, there aren't any additional charges for it. You can also directly transfer to your savings account – a nice bonus for people into brokerage accounts for savings.

Customers Who Are tired of Flawed Customer Service

Charles Schwab Bank's customer service earned a straight 5 out of 5 in the 2019 J.D. Power Direct Banking Satisfaction Study. Customers rarely praise a bank's customers service, let alone rate it as 10 out of 10. The bank also has a high rating on Trustpilot and Better Business Bureau. When you see high scores like these, it means Schwab Bank is doing something right. However, customer service isn't always a priority. But those who are tired of poor banking customer service will enjoy Schwab Bank services.

Customers Who Prioritise ATM services

Schwab Bank is known for its top-of-the-line ATM services. In fact, Schwab Bank offers unlimited ATM fee rebates to its customers. It's an excellent feature for people tired of paying unnecessary ATM fees. Plus, you get an ATM card with your Schwab Bank high yield investor savings account.

Charles Schwab Bank Pros and Cons

Schwab Bank has taken a distinct approach to banking. With online services and branchless banking, Schwab Bank is perhaps the future. However, there are a few pitfalls of having a Schwab Bank account. Here are the pros and cons of Schwab Bank to paint a clearer picture.

| ✅ PROS |

|---|

▶ No Monthly Fees ▶ No Minimum Deposit Needed It is nice to find a bank that's not after your money. Plus, it's comforting to know you don't have to keep a certain amount in your bank. Most banks will charge you if your account balance falls below their minimum. But not Charles Bank!

|

| 🚫 CONS |

|---|

✖ Deposits and Transfer Take a Long Time

|

Charles Schwab Compare to other Banks

| Bank | Minimum Deposit | Monthly Fee | Savings APY | Overdraft | Number of Branches |

|---|---|---|---|---|---|

| Charles Schwab | $0 | $0 | 0.05% | $25 | 360 |

| American Express | $0 | $0 | 0.40% | $34 | 1000 worldwide

|

| Axos | $o | $0 | 0.61% | $0 | N/A |

| CIT | $100 | $25 | 0.50% | $30 | N/A |

Charles Schwab vs. American Express

American Express and Charles Schwab are strong competitors, each with its own USP. However, where Schwab fails, Amex picks up. For instance, if you are expecting Schwab to boost your savings, then you best look elsewhere. However, Amex has good deals on savings accounts and a high APY. But, Amex charges several transaction fees that can be frustrating.

Charles Schwab Bank's customer service is phenomenal. On the other hand, get ready to be disappointed with Amex and its Customer service. You'll have to wait before your call is addressed. After that, you'll have to pray the customer service agent is capable of solving your problem.

While Amex lacks in customer service, Schwab has the least favorable accounts. You only have two options at Schwab. But its linked account features are pretty good. If you overdraft, your money will be deducted from your linked Schwab brokerage account.

Both banks are poles apart when it comes to their visa. While Schwab bank visa has all the features of keeping your COVID proof, Amex is on another path. With an Amex visa, you get fantastic deals and discounts. However, if you are tech-savvy looking for a cool card, a Schwab Bank visa should be your choice.

>>Read More About American Express Banking Reviews: Is Amex a Good Bank?

Charles Schwab vs. Axos

When it comes to branchless banking, no one can beat Axos. The bank has only 3 branches making it the most remote bank in the US. However, Axos lacks brokerage services, and that's where Schwab takes the lead.

The annual percentage yield at Axos is higher than Schwab. However, the difference isn't much. Cash withdrawals are almost similar between both banks. But things turn in Schwab's favor when we talk about retirement accounts. Yet Axos personal loan plan is highly customer-oriented and pretty straightforward. It's a feature Schwab lacks!

Charles Schwab corporation started as a brokerage firm. Its move to the banking industry is recent. Perhaps that's why this bank lacks most features Axos offers. But Schwab bank's platinum debit card steals the show from Axos.

Moreover, you also get a financial advisor with Schwab Bank. After all, it's a part brokerage firm, part bank. So you should have expected this. However, Axos and Schwab aren't that different as they both have no account minimums.

>>Read More About Axos Bank Reviews: Is Axos a Good Bank?

Charles Schwab vs. CIT

The limited account features of Schwab are an obstacle in this bank's growth. Its competitors like CIT offer various accounts such as custodian account. Plus, you get pretty much all the features of a brick-and-mortar bank with CIT.

However, you'll have trouble with CIT ATM services because they aren't widespread. Schwab has extensive ATM support. Therefore, cash withdrawals are pretty swift. There is no account minimum at Schwab bank, but you'll have to pay $100 at CIT. Plus, Schwab has unlimited ATM fee rebates while CIT doesn't.

For customers looking for excellent customer support, Schwabs is the best choice. But if you CDs, CIT is a better choice. The bank offers a variety of options, and you'll find what you like. CIT also provides personal loans – something Schwab doesn't.

>>Read More About CIT Bank Reviews: Is CIT a Good Bank?

Conclusion: Is Charles Schwab a Good Bank?

Deciding whether Schwab is a good or lousy bank depends on your preferences. If you value all the features of Schwab we mentioned above, you'll love this bank. However, for conventional banking features, Schwab isn't the best choice. If you want personal loans and retirement accounts, you'll need to look elsewhere. But for brokers, Schwab is the ideal bank.

Charles Schwab is a good bank with excellent customer service and an accessible website. It offers low-cost checking accounts and high-interest savings account options for those looking to invest their money. While not the best option available on the market today, it's certainly worth considering if you need a new banking institution!

Charles Schwab Bank FAQs

Is Charles Schwab Bank Safe?

Schwab is a safe and secure bank. All of its deposits have FDIC insurance. Plus, this bank is a Member FDIC. You don't have to worry about information leakage or cyberattacks at Schwab. The bank is secured like its brokerage services and doesn't steal or share customer data.

Does Charles Schwab have cheaper foreign transaction fees?

While most banks have a foreign transaction fee, Schwab doesn't. You don't have to worry about any cost when you have a Schwab account. Plus, you can request unlimited ATM fee rebates. So that's a beneficial feature yet to be offered by some other financial institution.

What bank is associated with Charles Schwab?

Charles Schwab Bank, Charles Schwab Premier Bank, and Charles Schwab Trust Bank are all associated with Charles Bank. These three bodies combined protect customer information and data.

Is Charles Schwab's debit card good?

Charles Schwab has excellent debit and credit card offers. Plus, the bank doesn't have hard pulls n your credit score. Therefore, you can confidently pay your bills. In addition, Schwab doesn't have any debit card fees and monthly fees.

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.