Blueberry Markets Review 2024 with Rankings by Dumb Little Man

By Peter Vanderbuild

January 10, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.8 1.5/5 | 92nd  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, consisting of financial experts, experienced traders, and individual investors, utilizes a unique algorithm to conduct a comprehensive evaluation of brokerage services. Their assessment covers essential aspects, including:

By incorporating customer feedback, their reviews offer an unbiased and comprehensive perspective. Following a thorough analysis, they recognize Blueberry Markets as a trustworthy option for those in search of a reliable financial partner. However, Dumb Little Man recommends that potential users carefully read their detailed article to understand any possible disadvantages associated with the broker. |

Blueberry Markets Review

“Forex brokers” are essential in the global currency market, offering platforms for individuals and institutions to trade foreign currencies. They serve as intermediaries, enabling traders to access the dynamic world of Forex trading, which is crucial for both investment and international commerce.

Blueberry Markets, founded in 2016 by Dean Hyde, stands out in the Forex industry. The broker quickly distinguished itself by prioritizing low spreads and high-level client service. This review, based on expert findings and experiences, aims to provide an in-depth look at what Blueberry Markets offers to the Forex trading community.

What is Blueberry Markets?

Blueberry Markets is a Retail Forex broker established in 2016. Founded by Dean Hyde, the company set out to create a new benchmark in Forex trading with its focus on low spreads and superior client service. This approach has resonated with the trading community, leading to a significant milestone of 50,000 traders and recognition as an Australian finalist for Best Online Customer Service by Finder.

At the helm of Blueberry Markets is Dean Hyde, its managing director, who brings over a decade of industry experience. Under his leadership, the company has adapted and thrived, especially during the pandemic, which saw a surge in Forex trading sessions. \

Hyde's philosophy that “it’s always a good time to trade” reflects the dynamic and continuous nature of the Forex market and underpins the company's growth and success.

Safety and Security of Blueberry Markets

Safety and security are paramount in Forex trading, and Blueberry Markets addresses these concerns effectively. The broker is regulated by two major financial authorities: the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC).

These regulatory bodies ensure that Blueberry Markets adheres to strict financial standards and operates with transparency and integrity.

This information, confirming the regulatory compliance of Blueberry Markets, was gathered after thorough research by Dumb Little Man. Being under the supervision of ASIC and VFSC provides traders with the assurance that their investments are managed in a secure and well-regulated environment.

This dual regulation is a testament to Blueberry Markets' commitment to upholding the highest levels of safety and security in its operations.

Pros and Cons of Blueberry Markets

Pros

- Low spreads

- Regulated by ASIC and VFSC

- 24/7 customer support

- User-friendly interface

- Multiple account types

- No fees for FX or CFD products

- Comprehensive deposit and withdrawal options

- Strong emphasis on security and regulatory compliance

Cons

- No sign-up bonuses

- Limited range of tradable instruments compared to some competitors

- Potential delays in complex issue resolution

- Geographic restrictions for some services

- Limited in-person support options

- Occasional spread increases during market news events

Sign-Up Bonus of Blueberry Markets

Regarding the Sign-Up Bonus for Blueberry Markets, it's important to note that currently, they do not offer any such bonus. Their emphasis on other essential components of their service, such as competitive spreads, and excellent customer service, is reflected in the lack of a sign-up bonus.

In contrast to other brokers, Blueberry Markets places a strong emphasis on the caliber of their trading experience and customer support in order to draw in new customers. By using this strategy, traders are more likely to select them because of their stable trading environment as opposed to temporary incentives.

Minimum Deposit of Blueberry Markets

There is a $100 Minimum Deposit required at Blueberry Markets. From novices to seasoned traders, it is accessible to a broad spectrum of traders due to its comparatively low entrance barrier. It's a sensible sum that provides a way to trade the Forex and financial markets without needing to make a significant upfront investment.

The new Client Portal, an intuitive user interface that can be accessed through any web browser, is used to handle deposits. Traders may easily manage their cash with this site, which streamlines the account administration process.

To ensure security and compliance, it's crucial to remember that all deposits—aside from cryptocurrency—must come from bank accounts with the same name as the trading account.

In addition, all deposit-related bank accounts are maintained under the Blueberry Markets Group name, guaranteeing a safe and open transaction process.

Blueberry Markets Account Types

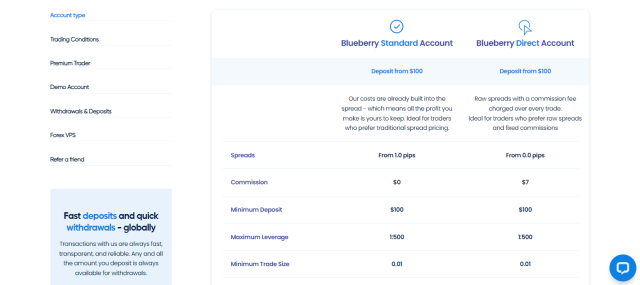

Based on thorough research and testing by a team of experts at Dumb Little Man, Blueberry Markets offers two distinct types of trading accounts, each tailored to different trading preferences.

These account types at Blueberry Markets offer flexibility and choice, catering to different trading styles and strategies. Whether traders opt for the Standard Account with its inclusive spread costs or the Direct Account with raw spreads and fixed commissions, they have access to a wide range of tradable instruments and advanced trading platforms.

Below is a clean and organized list of these account types:

Blueberry Standard Account

- Minimum Deposit: $100

- Spreads: From 1.0 pips

- Commission: $0

- Maximum Leverage: 1:500

- Minimum Trade Size: 0.01

- Tradable Instruments: 300+

- Trading Platforms: MT4, MT5, Web Trader

- Ideal For: Traders who prefer traditional spread pricing, with costs built into the spread.

Blueberry Direct Account

- Minimum Deposit: $100

- Spreads: From 0.0 pips

- Commission: $7 per trade

- Maximum Leverage: 1:500

- Minimum Trade Size: 0.01

- Tradable Instruments: 300+

- Trading Platforms: MT4, MT5, Web Trader

- Ideal For: Traders who prefer raw spreads and fixed commissions.

Blueberry Markets Customer Reviews

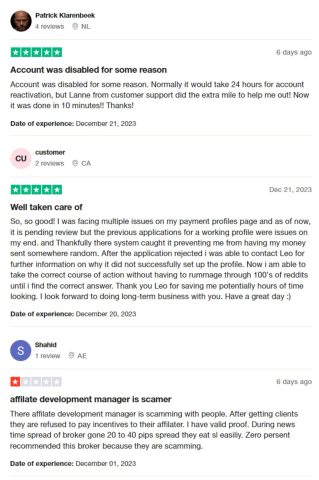

Customer reviews of Blueberry Markets reveal a mixed set of experiences. On the positive side, customers appreciate the efficient and helpful customer support. Instances like Lanne from customer service team swiftly resolving an account reactivation issue in just 10 minutes, and Leo assisting with payment profile issues, demonstrate their commitment to prompt and effective assistance.

However, there are also negative experiences reported. Some customers have expressed concerns about the practices of the affiliate development manager, alleging issues with incentives and accusing the broker of scamming. Additionally, there are complaints about significant spread increases during news events, impacting trading efficiency.

This contrasting feedback highlights the importance of considering both the strengths and potential areas of improvement for Blueberry Markets in customer service and operational transparency.

Blueberry Markets Fees, Spreads, and Commissions

Blueberry Markets structures its Fees, Spreads, and Commissions in a straightforward manner, catering to different types of traders. The spread, which is the difference between the buy (ask) and sell (bid) price, varies between account types.

For Standard Accounts, spreads start from 1 pip, offering a cost-effective option for traditional traders. On the other hand, Direct Accounts feature spreads as low as 0.0 pips, appealing to traders who prefer tighter spreads.

In addition to the spread, Direct Accounts incur a commission of USD $7 per standard lot per round turn. This means entering and exiting a trade (a round turn) with a volume of one lot costs a total of USD $7, broken down as $3.50 when opening and another $3.50 upon closing the trade.

For FX or CFD products, Blueberry Markets does not charge any fees, but traders should be aware of swap rates for positions held past the rollover time (23:58 – 00:02 platform time).

Furthermore, for those accessing ASX200 single-stocks on MT5, there is a monthly fee of AUD $28, plus a 0.1% commission on the notional value traded. However, this monthly fee can be waived if a trader’s commission exceeds $28 over the course of a month.

Deposit and Withdrawal

A trading expert at Dumb Little Man verified that Blueberry Markets' Deposit and Withdrawal procedures adhere to strict requirements for security and compliance. The card that was used to make the deposit must be used again to withdraw funds.

In order to stop fraud and guarantee financial security, this is a stringent policy. When more than one deposit method was used, withdrawals can only be made via the Visa/Mastercard method.

The order of deposits and withdrawals is chronological. This indicates that money is taken out in the same order as it was deposited. Any winnings can be taken out and will be transferred to the trader's preferred method after all deposits have been reimbursed.

Withdrawals of cryptocurrency are also handled via the TRC20 network.

Requests for withdrawals made by 4 PM AEST/AEDT on weekdays are handled the same day, Monday through Friday. After this hour, requests might be handled the following working day.

These transactions are handled by the Finance Department, which is open from 9 AM to 6 PM AEST/AEDT. Any withdrawal requests submitted over the weekend will be handled first thing on Monday morning.

The fact that card withdrawals are handled as “refunds” should be noted. Refund policies for certain cards may necessitate further effort and correspondence with the card issuer. The Accounts Department at Blueberry Markets will help look into other withdrawal options if a card refund is not possible.

On business days, all withdrawals are typically completed within 24 hours, and the time it takes for money to appear in an account varies depending on the withdrawal method chosen.

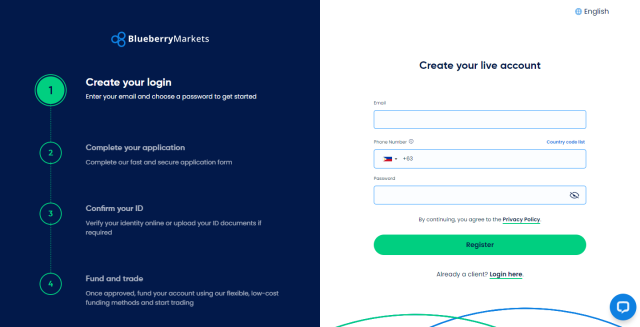

How to Open a Blueberry Markets Account

Applicants must fulfill several requirements in order to open a live account with Blueberry Markets. These requirements include being at least eighteen (18 years old), having a working email address and mobile number, having a valid passport or official government picture ID, and providing a legal residence address.

Sometimes, additional documents might be requested by the Compliance team.

Setting up an account is quick and straightforward. The Demo account can be set up in less than two minutes without requiring any documents. Live account applications typically take between 2 to 5 minutes to complete. Here is the breakdown of the creation process:

- Navigate to Blueberry Markets' website and click “Start Trading” located in the right top corner.

- Enter your email address and phone number.

- Verify your email address through the link sent to your inbox.

- Confirm your phone number with a verification code.

- Upload an ID from the government or a passport as identification.

- Make sure you have a valid residence address and are at least 18 years old.

- Select the account type that you want from the list of alternatives.

- Provide any more paperwork that Compliance may demand.

- To start trading, make a deposit into your account.

Blueberry Markets Affiliate Program

A profitable chance to monetize your network is provided by the Blueberry Markets Affiliate Program, also called the Introducing Broker program with Blueberry Partners. Multi-tiered commission plans are available to program participants, who can also get lifetime reimbursements of up to 60% of spread revenue for each client they recommend.

Real-time tracking and monitoring features that enable efficient management and evaluation of referral success are among the other advantages. Affiliates can increase the appeal to a diversified clientele by introducing consumers to a variety of trading instruments.

The program also gives users access to the renowned MetaTrader platform, which is renowned for its cutting-edge features and dependability.

In addition to guaranteeing effective conversion and retention, this extensive support system helps draw in new members, which makes the Blueberry Markets Affiliate Program a potentially lucrative endeavor for anyone hoping to increase their revenue through referrals.

Blueberry Markets Customer Support

Dumb Little Man, who used Blueberry Markets Customer Support, mentioned that they provided him with prompt, attentive support. They guarantee that help is accessible at all times, both during and outside of trading hours, by providing 24/7 online support.

Apart from offering live chat, Blueberry Markets also has a comprehensive FAQ section and Help Center. These tools are made to swiftly respond to frequently asked queries and offer useful information, enabling users to solve problems effectively.

Using a variety of channels, clients can get in touch for more individualized help. Email: [email protected]; phone: +61 2 7908 3946; fax: +61 2 8039 7480; physical address: Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, Saint Vincent and the Grenadines are all simple ways to get in touch with them.

Their customer care team can be contacted immediately away by clicking the “live chat” icon at the bottom right of the screen. This extensive support system demonstrates Blueberry Markets' dedication to giving its customers outstanding service.

Advantages and Disadvantages of Blueberry Markets Customer Support

| Advantages | Disadvantages |

|---|---|

Blueberry Markets vs Other Brokers

#1 Blueberry Markets vs AvaTrade

ASIC and VFSC-regulated Blueberry Markets is renowned for its minimal spreads and excellent customer care. Since its founding in 2006, AvaTrade has expanded its product offering to include FX, stocks, and cryptocurrencies in addition to a range of trading platforms. It is not bound by ESMA regulations and is not governed by the FCA, despite operating on a global scale.

Verdict: Blueberry Markets is the better option for traders that value tight regulatory monitoring and low spreads. AvaTrade, on the other hand, is better suited for a wide variety of tradable instruments and platform options.

#2 Blueberry Markets vs RoboForex

Competitive spreads and an easy-to-follow trading strategy are provided by Blueberry Markets. RoboForex has been providing trading platforms and circumstances to suit various trading styles and needs since 2009. The company has been serving clients since 2009.

Verdict: For individuals looking for a variety of platforms and personalized trading circumstances, RoboForex is the best option. On the other hand, traders that prefer a straightforward trading environment with competitive spreads might consider Blueberry Markets.

#3 Blueberry Markets vs FXChoice

Low spreads and an easy-to-use interface are the main priorities of Blueberry Markets. FXChoice focuses on emerging markets and major energy markets by providing a broad selection of currency pairs and commodity CFDs.

Verdict: For traders who are interested in commodities and emerging markets trading, FXChoice is a more enticing option. Conversely, buyers seeking a simple, low-spread trading platform can use Blueberry Markets.

Choose Asia Forex Mentor for Your Forex Trading Success

Trading professionals at Dumb Little Man strongly recommend Asia Forex Mentor for anyone looking to launch a profitable career in forex trading and make substantial financial advantages. This platform is acknowledged as the best option for thorough instruction in stock, cryptocurrency, and FX trading.

Asia Forex Mentor is spearheaded by Ezekiel Chew, a renowned individual recognized for his advisory services to banks and trading companies. Ezekiel stands out as an educator due to his personal trading prowess, which is demonstrated by his regular seven-figure trades.

The reasons for choosing Asia Forex Mentor include:

Comprehensive Curriculum: A comprehensive instructional course covering stock, cryptocurrency, and FX trading is provided by the software. It offers the fundamental information and abilities required for success in various areas.

Proven Track Record: Asia Forex Mentor's track record of turning out successful traders in a variety of market sectors attests to the efficacy of their teaching techniques.

Expert Mentor: A mentor with experience provides guidance to the students. With Ezekiel Chew's experience and individualized attention, students may effectively traverse a variety of marketplaces.

Supportive Community: The platform facilitates learning by providing a network of fellow traders who cooperate and exchange ideas.

Emphasis on Discipline and Psychology: Psychological components of the training teach traders how to control their emotions and make deliberate decisions.

Constant Updates and Resources: Having access to the most latest market trends, strategies, and insights helps to keep students knowledgeable and competitive.

Success Stories: Seeing how many of the students are able to attain financial independence and truly turn around their trade is something that AFM is proud of. It displays the power of effective instruction.

In conclusion, Asia Forex Mentor is a great option if you're wanting to start trading forex, equities, or cryptocurrencies. They offer a good education with knowledgeable instruction, a practical learning approach, and a really encouraging community. Becoming a successful trader is all about receiving hands-on training.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

>> Also Read: 9 BEST Forex Brokers For 2024: Reviewed By Dumb Little Man

Conclusion: Blueberry Markets Review

Based on the research of experts at Dumb Little Man, Blueberry Markets has shown that they have reasonable spreads, which is excellent for investors' earnings, which is also their number one priority. Additionally, they are strictly regulated by VFSC and ASIC, so investors can be sure that trading there is safe.

On the other hand, bear in mind that Blueberry Markets account selection isn't as extensive as some others', and they don't provide welcome incentives. Therefore, even while they're good for simple, affordable trading, you might want to seek elsewhere if you're looking for a wide variety of possibilities.

>> Also Read: AdroFX Review with Rankings 2024 By Dumb Little Man

Blueberry Markets Review FAQs

What trading platforms are available with Blueberry Markets?

Blueberry Markets offers their own Web Trader in addition to platforms such as MetaTrader 4 and 5. Whether you're just getting started or have been trading for some time, these are safe, easy to use, and equipped with all the sophisticated tools you require.

Can I use various trading strategies with Blueberry Markets?

Yes, you can. Blueberry Markets has a somewhat adaptable set of strategies. Their platforms are capable of handling day trading, rapid scalping, and longer-term strategies. Just keep in mind that every tactic has its hazards.

Does Blueberry Markets provide an account manager for traders?

Blueberry Markets assigns an account manager if you have a direct account with them. When it comes to support and guidance specific to your trading needs, they are really beneficial.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.