AMarkets Review 2024 with Rankings by Dumb Little

By Peter Vanderbuild

January 10, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.8 1.5/5 | 91st  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, composed of financial specialists, seasoned traders, and personal investors, employs a distinctive algorithm to conduct an in-depth assessment of brokerage services. Their review focuses on key factors:

Incorporating customer feedback, their reviews provide a balanced and thorough viewpoint. After a detailed examination, they identify AMarkets as a reliable choice for those seeking a dependable financial ally. However, Dumb Little Man advises prospective users to thoroughly read their detailed article to be aware of any potential drawbacks associated with the broker. |

AMarkets Review

A “Forex broker” is an essential player in the international financial markets because they provide venues for trading currencies. By acting as middlemen, these brokers make it possible for institutional and individual traders to acquire and sell foreign currencies. One of the leading companies in this space is AMarkets.

AMarkets distinguishes itself with a variety of account options catered to various trading styles. The broker provides a variety of account kinds, one of which is an ECN account. This account is a competitive option for traders looking for inexpensive trading costs because of its floating spreads, which start at just 0 pip.

This evaluation of AMarkets is based on in-depth research, expert observations, and firsthand knowledge. It seeks to give a fair synopsis of the broker's services and achievements in the Forex trading industry.

What is AMarkets?

AMarkets, established in 2007, is a seasoned entity in the forex and CFD industry. The broker, licensed offshore on Mwali Island in Comoros, offers traders a gateway to various financial instruments. These include CFDs on currency pairs, commodities, indices, shares, ETFs, bonds, futures, and cryptocurrencies.

Having already established its presence globally, especially in regions like Latin America, Asia, and the CIS, AMarkets caters to various trading needs. It offers multiple account types, including the already mentioned ECN account with competitive features like floating spreads starting from 0 pips.

The broker’s technological edge is evident in its provision of three robust trading platforms: the renowned MetaTrader 4 and MetaTrader 5, along with an intuitive web-based platform, which give access to a vast library of automated trading strategies. For those interested in copy trading, AMarkets offers its proprietary platform, complemented by third-party tools such as AutoChartist.

This blend of technological sophistication and a wide range of instruments potentially makes AMarkets a viable choice for traders seeking a comprehensive trading environment.

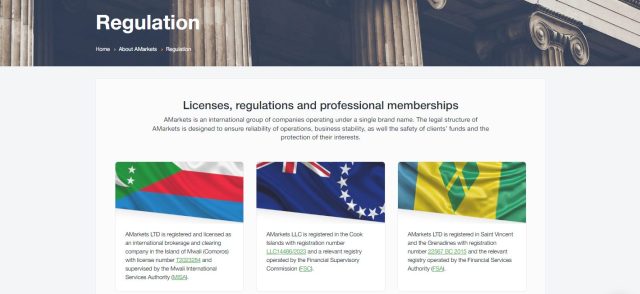

Safety and Security of AMarkets

The safety and security of a broker are critical factors for traders, and AMarkets addresses these concerns with its registration. The broker is registered with St. Vincent and the Grenadines' Financial Services Authority (FSA). It's crucial to remember that even though AMarkets is registered with the FSA, the agency does not regulate the broker.

Dumb Little Man conducted a lot of studies before compiling this crucial information for traders thinking about AMarkets. It emphasizes how important it is for traders to comprehend the regulatory landscape of the broker of their choice.

In the forex market, it is important to understand the difference between registration and regulation since it affects the level of control and security measures put in place to protect traders' interests.

Pros and Cons of AMarkets

Pros

- Several account types

- Lower ECN account spreads

- Higher leverage to 1:3000

- $100 minimum deposit

- Worldwide clients

Cons

- Possible problems with withdrawal

- Account number required for email support

- Minimal supervision by regulators

- Fees for some trading transactions

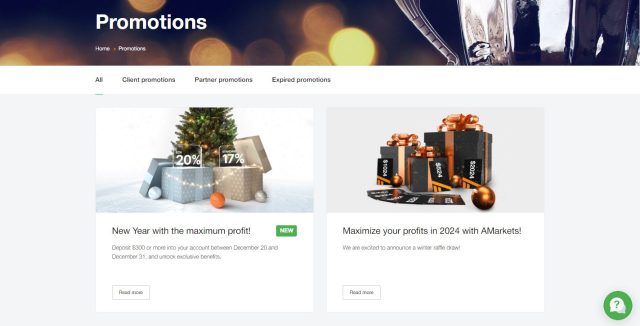

Sign-Up Bonus of AMarkets

AMarkets‘ Sign-Up Bonus is one of the main factors that improve users' trading experiences. With this bonus and cashback, traders can open more positions, which could result in larger winnings. These bonuses are intended to increase the enjoyment of trading for both new and returning customers.

AMarkets moreover provides a noteworthy 20% discount on ECN fees, which increases the affordability of trading. Because it lowers the cost of each trade, traders using the ECN account stand to gain the most from this discount.

These three benefits—bonuses, cashback, and fee discounts—combine to highlight AMarkets' dedication to offering its customers value-added services.

Minimum Deposit of AMarkets

$100 is the minimum deposit needed to begin trading with AMarkets. It is accessible to a broad spectrum of traders, from novices to more seasoned ones, thanks to its very cheap deposit requirement. AMarkets makes sure traders may trade in the forex market without having to make a sizable initial commitment by establishing a manageable entry point.

One important aspect that demonstrates AMarkets' dedication to offering trading possibilities to a wide range of clients is the $100 minimum deposit. It is a desirable choice for individuals who are new to the market or want to take more precautions with their investment risks because it enables traders to experience the waters of forex trading with a smaller financial commitment.

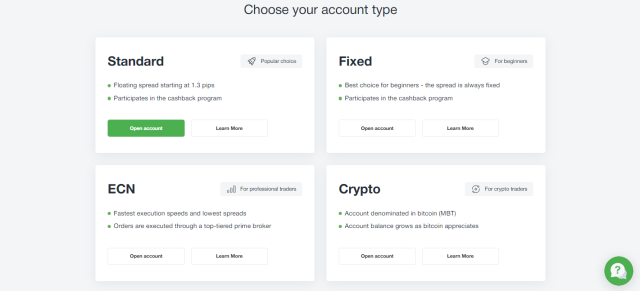

AMarkets Account Types

Here is a concise and well-structured list of AMarkets Account Types, compiled by our team of professionals at Dumb Little Man after a great deal of research and testing. Every kind of account accommodates various trading inclinations and styles.

To accommodate different trading techniques, AMarkets provides these separate account types, including both STP and ECN options. Since client orders are sent straight to liquidity providers, STP accounts are more in line with traditional trading.

The ECN account, on the other hand, connects trades directly to ECN networks and is designed for high-frequency professional traders. For those who are interested in cryptocurrencies, the Crypto account is a special service that is valued in Bitcoin.

Here is a more detailed view:

- Standard Account:

- A classic account for day, medium, and long-term trading

- Market and instant order execution at approximately 70 ms

- Minimum deposit: $100

- Leverage: Up to 1:3000

- Fixed Account:

- Ideal for trading on MT4 trading platform with a focus on stability

- Order execution speed around 100 ms

- Leverage: Up to 1:3000

- ECN Account:

- Designed for professional high-frequency and algorithmic trading

- Fast order execution from 30 ms

- Minimum deposit: $200

- Spreads from 0 pips

- Leverage: Up to 1:3000

- Crypto Account:

- Specialized for trading assets, other than stocks, denominated in BTC

- Account unit is MBTS, equivalent to 0.01 BTC

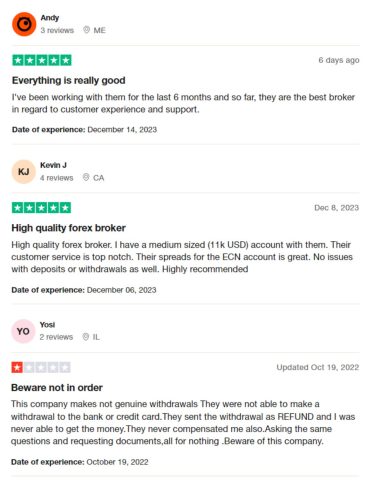

AMarkets Customer Reviews

AMarkets Customer Reviews offer diverse perspectives. Many clients commend the broker for its exceptional customer support and user experience, particularly valuing the efficient customer service and favorable ECN account spreads. Positive remarks also include smooth deposit and withdrawal processes.

However, some reviews indicate issues, especially concerning withdrawals. These clients report difficulties in receiving funds, with problems in bank or credit card withdrawals, and describe a lack of resolution despite multiple document requests. This range of feedback highlights the need for a balanced view of AMarkets' services.

AMarkets Fees, Spreads, and Commissions

AMarkets Fees, Spreads, and Commissions vary based on the account type, but generally, the fee ranges from 0.5% to 1.8%, regardless of the account type. The Standard Account at AMarkets comes with a spread starting from $13 and includes a withdrawal commission.

The Fixed Account has a slightly higher spread, beginning at $30, also with a withdrawal commission.

The ECN Account is distinctive, offering a spread from as low as $0, along with a withdrawal commission. This account type also incurs an additional fixed fee of $2.5 in one direction, equating to $5 per full standard lot.

For traders interested in cryptocurrency, the Crypto Account mirrors the Standard Account in terms of spread, starting from $13, and includes a withdrawal commission as well.

In addition to these fees, AMarkets charges single and triple swaps for overnight position transfers. When comparing AMarkets' spreads with other brokers, particularly for the EUR/USD pair in an ECN account or its equivalent, AMarkets stands on the higher side with an average commission of $4, considered high compared to other brokers.

For traders to compare the cost-effectiveness of trading with AMarkets to other forex brokers, this information is essential.

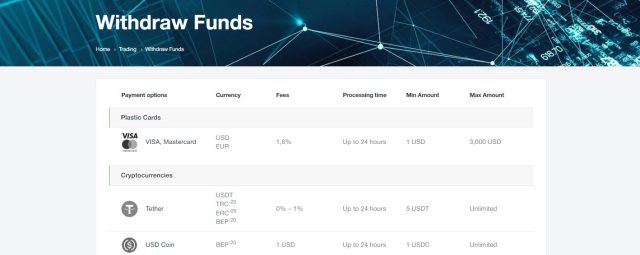

Deposit and Withdrawal

AMarkets offers multiple payment options for both deposits and withdrawals; this was tried and tested by a Dumb Little Man trading expert. Popular choices including their bank account from Visa and Mastercard, bank transfers, MIR, UZCard, HUMO, Perfect Money, Neteller, FasaPay, and Bitcoin are among these methods; Ethereum, Litecoin, and Tether (USDT TRC20 and ERC20) are also included.

Clients also get negative balance protection, meaning traders can never lose more than their deposits.

Furthermore, in some areas, AdvCash, Skrill, and QIWI are accessible. It's crucial to remember that different payment methods may be offered in different regions. After registering, merchants can access the full list for their area in their user account.

USD, EUR, RUB, UZS, KZT, and several cryptocurrencies like USDT, LTC, ETH, and BTC are among the currencies that may be deposited and withdrawn. Depending on the payment method being used, the withdrawal charge might vary from 0.5 to 1.8%, with certain systems charging a flat price for each transaction.

Because funds are usually credited within 24 hours, dealers can expect a quick process.

The minimum withdrawal amount varies based on the selected payment method; it is often set between $5 and $10. The minimum withdrawal amounts for cryptocurrencies are given separately.

Together with the thorough pricing schedule, this extensive selection of payment methods and currencies demonstrates AMarkets' commitment to serving a wide range of customers with different demands and budgets.

How to Open an AMarkets Account

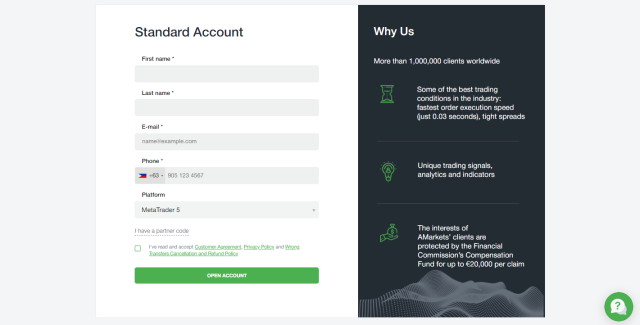

AMarkets offers a simple account opening process that is meant to be user-friendly for traders of all experience levels.

It's important to remember that AMarkets provides a demo account prior to entering the live trading environment. Beginners or those looking to practice trading methods without taking financial risks may especially benefit from this.

Users can get more comfortable and confident with the platform by using the demo trading account, which replicates actual market conditions.

The steps to create a live account are as follows:

- Go to the account signup page on the AMarkets website.

- Enter your contact details (name, email address, and phone number).

- Choose your preferred trading platform, either MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

- Select your account's base currency, with options like USD, EUR, or BTC.

- Complete the required verification process for identity and residency.

- Review and agree to the terms and conditions of AMarkets.

- Deposit the minimum required amount based on your chosen account type.

- Set up any trading preferences or limits within your account settings.

- Start trading on the AMarkets platform with your new account.

AMarkets Affiliate Program

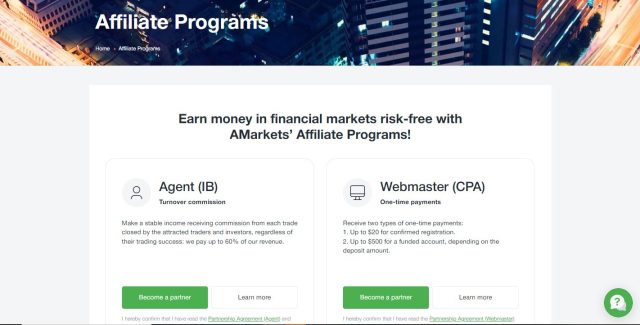

AMarkets’ Affiliate Program offers individuals an opportunity to earn from the financial markets without direct market risk.

The process of the affiliate program involves the partner referring clients using the promo materials provided by AMarkets. As these clients deposit funds and engage in trading or investment activities, the partner earns remuneration based on the chosen partnership model.

The program is designed with two main streams:

- Agent (IB):

-

- Earn stable income through turnover commission.

- Receive up to 60% of AMarkets' revenue for each trade closed by referred traders and investors, irrespective of their trading success.

- Webmaster (CPA):

-

- Benefit from one-time payments.

- Get up to $20 for each confirmed registration.

- Earn up to $500 for each funded account, depending on the deposit amount.

AMarkets' achievements in its affiliate program:

-

- Over 3,000 partners worldwide.

- Total payouts amounting to $30,000,000 to date.

- More than 1,000,000 clients were referred.

Advantages of joining their Partnership Programs:

-

- High remuneration rates.

- Unlimited daily commission payouts.

- A monthly bonus for the most active partners.

- Access to unique marketing tools and exclusive promo materials.

- A reliable referral system.

- A contemporary and intuitive Personal Area designed for partners.

AMarkets Customer Support

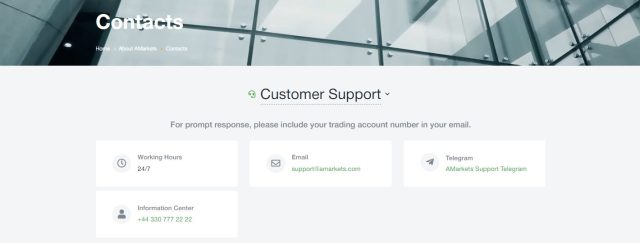

AMarkets Customer Support is an essential component of the broker's offering, guaranteeing that customers get efficient help when they need it. Drawing from Dumb Little Man's experience, the support system is designed to accommodate a range of client requirements.

When emailing support at [email protected], it is recommended to provide your trading account number for a faster response. This particular detail aids in the prompt discovery and effective resolution of questions or problems. The Live Chat feature, which is accessible around the clock, gives traders worldwide round-the-clock support and prompt assistance.

With a dedicated AMarkets Support Telegram channel, AMarkets further provides client support via Telegram. For additional individualized assistance, customers can also contact the Information Center at +44 330 777 22 22.

These numerous avenues for communication demonstrate AMarkets' dedication to providing its customers with dependable and easily accessible support, which improves the trading experience as a whole.

Advantages and Disadvantages of AMarkets Customer Support

| Advantages | Disadvantages |

|---|---|

AMarkets vs Other Brokers

#1 AMarkets vs AvaTrade

AMarkets is a global broker known for its variety of account types and ECN accounts with low spreads. AvaTrade, founded in 2006, is a Dublin-based broker offering a wide range of instruments and platforms for both manual and automated trading. Notable are AvaTrade's dedication to protecting negative balances and its own AvaProtect offering. It isn't FCA-regulated, though, and it doesn't take US traders.

Verdict: AvaTrade could be a better choice for traders seeking more trade protection features and a larger array of instruments than AMarkets, which is a better choice for those seeking more account types and lower spreads.

#2 AMarkets vs RoboForex

AMarkets offers a variety of trading accounts, including a competitive ECN option, to a global clientele. RoboForex, which has been in operation since 2009, is renowned for its wide range of platforms, which includes cTrader, R Stock Trader, MT5, and MT4, as well as its personalized trading conditions. RoboForex provides a range of software choices to accommodate different trading needs and tastes.

Verdict: AMarkets is a better option for traders who value account diversity and international reach, while RoboForex might be a better fit for those seeking a wider selection of trading platforms and personalized trading conditions.

#3 AMarkets vs FXChoice

AMarkets is renowned for its extensive customer base and variety of account options. Contrarily, FXChoice focuses on emerging markets when offering Forex and CFD trading. It gives users access to a variety of currency pairs and commodity CFDs, such as those in significant energy and precious metals markets. The distinctive feature of FXChoice is its availability in uncommon currencies and commodities.

Verdict: AMarkets is more suited for traders seeking a variety of account kinds and a worldwide perspective, whilst FXChoice is more noteworthy for traders interested in emerging markets and a greater range of commodities.

Choose Asia Forex Mentor for Your Forex Trading Success

Trading professionals at Dumb Little Man heartily recommend Asia Forex Mentor to anyone hoping to make a profitable career out of forex trading. It is acknowledged as the top trading education platform because of its all-encompassing strategy and knowledgeable mentoring.

Extensive Curriculum: The educational curriculum offered by Asia FX Mentor encompasses stock, cryptocurrency, and FX trading. Its program is meant to give prospective traders the fundamental know-how and abilities needed for these markets.

Proven Track Record: The platform has a strong track record of turning out profitable traders, which attests to the potency of its mentoring and training programs.

Expert Mentor: The founder and accomplished trader Ezekiel Chew provides insightful advice. His achievements in individual trading set him apart as an excellent teacher.

Community: Students have the opportunity to become a part of a friendly trading group of traders who share a common goal of helping one another succeed in the stock, FX, and cryptocurrency markets. In this environment, peer learning and cooperation are promoted.

Emphasis on Psychology and Discipline: In order to help traders handle pressure and make rational decisions, the course also places a strong emphasis on psychological training.

Frequent updates and materials: Asia Forex Mentor provides its students with a plethora of resources by regularly updating its curriculum to reflect the latest advancements in market patterns and strategies.

Success Stories: The platform is home to a multitude of stories about students who have become financially independent as a result of their education in stocks, forex, and cryptocurrency trading.

In conclusion, the greatest resource for in-depth trading guidance in the stock, forex, and cryptocurrency markets is Asia Forex Mentor. Because it combines a thorough curriculum, expert coaching, and a welcoming community, it is an excellent choice for those who wish to become profitable traders.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

>> Also Read: 9 BEST Forex Brokers For 2024: Reviewed By Dumb Little Man

Conclusion: AMarkets Review

In conclusion, Dumb Little Man specialists' AMarkets Review identifies AMarkets as a broker with both noteworthy advantages and disadvantages. Its primary benefit is the variety of account kinds it offers, particularly the low-spread ECN account. Potential drawbacks include worries about the withdrawal procedure and the requirement for an account number in order to receive effective email support.

Even if AMarkets provides competitive trading conditions, prospective customers should carefully weigh the drawbacks in addition to the benefits. It's appropriate for people who value affordability and a variety of account alternatives, but understanding its drawbacks is essential for making an informed choice.

>> Also Read: AdroFx Review 2024 with Rankings by Dumb Little Man

AMarkets Review FAQs

Is AMarkets a good broker?

AMarkets is regarded as a decent broker for traders who appreciate a wide range of trading alternatives and competitive pricing because of its variety of account kinds, which includes the well-liked ECN account with minimal spreads. It's crucial to be informed about any possible problems with the withdrawal procedure and a few areas of customer service, nevertheless.

What is the minimum deposit for AMarkets broker?

$100 is the minimum deposit needed to begin trading with AMarkets. AMarkets' reasonably accessible amount allows a diverse group of traders to participate in forex trading.

What is the leverage of AMarkets?

AMarkets extends its leverage offer to 1:3000. With a corresponding increase in risk, this high leverage ratio gives traders the opportunity to enhance their exposure to the forex market.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.