Alpha Capital Group Review with Rankings 2025 By Dumb Little Man

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

Dumb Little Man's trading and financial experts carefully evaluate proprietary trading companies based on strict standards and a detailed methodology. Their analysis highlights important elements, such as:

They found that Alpha Capital Group performed exceptionally well in these crucial areas. Alpha Capital Group is a prominent player in the proprietary trading space thanks to its extensive knowledge of the brokerage industry and unwavering support for its traders. |

Because they enable traders to use the firm's money and split the gains, a proprietary trading firm, or a prop firm, is essential to the finance sector. Alpha Capital Group distinguishes itself by offering a wide range of instruments and instructional materials to improve traders' abilities and comprehension of the market.

This review of Alpha Capital Group combines user feedback with in-depth research by Dumb Little Man's trading experts. It seeks to give a fair assessment of the company's performance and capabilities in the cutthroat realm of proprietary trading.

What is Alpha Capital Group?

Alpha Capital Group is a specialist financial organization made up of extremely knowledgeable individuals committed to providing traders with the expertise and tools they need. Their goal is to enable traders to succeed in their trading journey with remarkable success. This is made possible by cutting-edge technologies and extensive support for both novice and seasoned traders.

The business offers a high-tech trading dashboard with extensive statistics to enable traders to carefully examine their performance. This tool enables traders to pinpoint areas in need of development and pinpoint successful patterns. Furthermore, Alpha Capital Group offers a special platform that optimizes traders' everyday activity by combining all required trading instruments in one easily accessible area.

With the addition of 0 commission accounts, real-time pricing, and unlimited trading days, Alpha Capital Group guarantees that traders may do business without the time limits and financial responsibilities that come with using other platforms. Their technology lets traders test and improve strategies in real-time settings by simulating institutional trading environments.

In order to ensure ongoing professional development and learning, the group also provides individualized help, such as one-on-one risk reviews for traders who have had difficulties with their evaluations. This customized method supports traders in adjusting and refining their tactics within predetermined risk parameters, fostering long-term success in markets such as indices, commodities, and forex.

Pros and Cons of Alpha Capital Group

Pros

- All-inclusive Learning Materials

- Cutting-Edge Trading Technology

- Standard Accounts Have No Commission

- Diverse Trading Evaluations and Difficulties

- Encouragement-Rich Trading Community

Cons

- Strict Regulation Monitoring

- Limitations on Retractions

- Problems with Customer Service

- Restricted In-person Presence

Safety and Security of Alpha Capital Group

Alpha Capital Group was founded mainly as a training and teaching organization to provide clients with efficient trading methods via simulation. Their platform, which is centered on virtual trading, enables users to trade without the financial dangers that come with actual trading situations. With the aid of this instructional strategy, traders can hone their abilities in a secure environment.

Alpha Capital Group does not participate in any regulated investment activity because all of its operations are limited to simulated trading. As such, they are not under the Financial Conduct Authority's (FCA) supervision. As a result, even while they offer a forum for learning, they do not give the same safeguards as regulated investing services, such as access to the Financial Ombudsman Service for complaints.

It is vital that customers comprehend the extent and constraints of the safety and security protocols furnished by Alpha Capital Group.

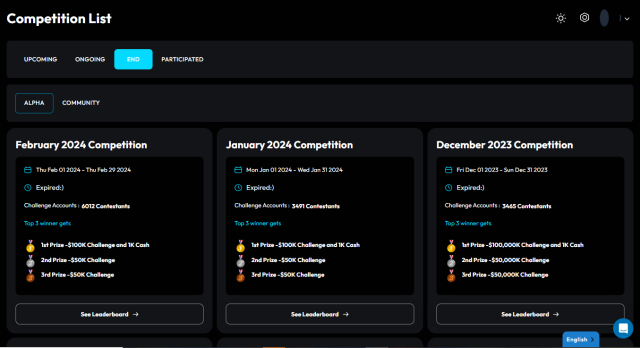

Alpha Capital Group Bonuses and Contests

Every month, Alpha Capital Group organizes tournaments that draw more than 6,000 participants, demonstrating their dedication to energizing and inspiring their community. Because these competitions have large payouts, traders are encouraged to improve their abilities and fight for big prizes. These tournaments' awards are designed to offer both challenges and instant financial rewards.

Winners of these tournaments receive $1,000 in cash as well as entry into the $100K Challenge, which presents a substantial opportunity for them to enhance their trading skills. More participants will be able to test their methods in a significant trading environment thanks to the second and third awards, which offer participation into the $50K Challenge. This tier-based reward structure encourages traders to compete with one another in addition to providing incentives for participation.

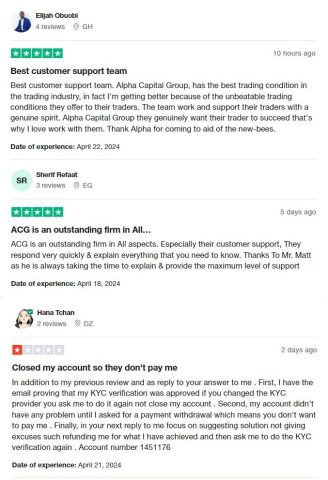

Alpha Capital Group Customer Reviews

As of right now, Alpha Capital Group's Trustpilot rating is 4.3 stars, indicating a mixed degree of user satisfaction. Clients have given the company high marks for its outstanding customer service, praising the team's helpfulness and responsiveness—among them, Mr. Matt, who offers in-depth support—among them.

Nonetheless, a few clients have voiced concerns about account administration, especially when it comes to situations involving payment withdrawals and accounts that were abruptly canceled following such requests. The company's complicated customer experience environment is shown in this contrast between positive feedback for customer service and worries about payment procedures.

Alpha Capital Group Commissions and Fees

To meet varying trading preferences, Alpha Capital Group offers two separate account types: the Standard Assessment and the Raw Assessment. During the checkout process, traders can select the account that best fits their trading style and financial plan thanks to these alternatives.

Traders benefit from 0% commission fees on trades in the Standard Assessment account, irrespective of the asset type. This charge structure is especially beneficial for novice and infrequent traders who want to cut expenses. Those who might like lesser spreads but are okay with per-transaction fees, however, can choose for the Raw Assessment account, which charges a commission fee of $2.5 per lot for each transaction in both directions.

Notably, commission-free index trading is still available for both account types, giving traders of all stripes the chance to work with these assets without having to pay extra. This strategy fits with Alpha Capital Group's mission to provide affordable and adaptable trading solutions.

Alpha Capital Group Account Types

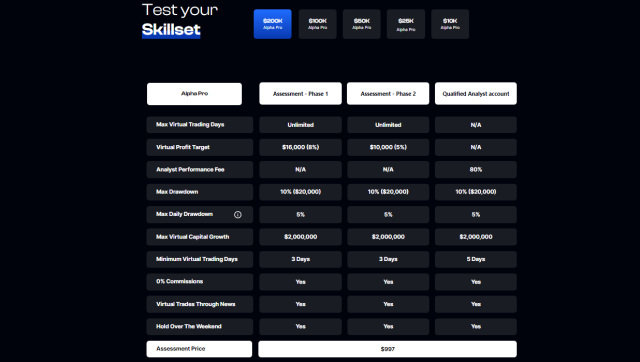

In order to meet the demands of virtual traders, Alpha Capital Group provides a variety of account types, all of which are intended to give a scalable and realistic trading environment. Dumb Little Man experts have studied these narratives in great detail, emphasizing both their special qualities and common advantages. The following characteristics are shared by all trading accounts:

- Unlimited Maximum Virtual Trading Days for both assessment phases, with no virtual trading in the Qualified Analyst account.

- Analyst Performance Fee of 80% in the Qualified Analyst account; no fees in assessment phases.

- Maximum Drawdown and Daily Drawdown rates are consistent across all accounts, reflecting the account’s limit as a percentage of the total capital.

- Maximum Virtual Capital Growth potential up to $2,000,000.

- Minimum Virtual Trading Days are set at 3 for assessment phases and 5 for the Qualified Analyst account.

- 0% Commissions, permission for Virtual Trades Through News, and the ability to Hold Over The Weekend are standard across all accounts.

Account Types

Alpha Pro 200k

- Virtual Profit Target: $16,000 (8%) in Phase 1, $10,000 (5%) in Phase 2

- Assessment Price: $997

Alpha Pro 100k

- Virtual Profit Target: $8,000 (8%) in Phase 1, $5,000 (5%) in Phase 2

- Assessment Price: $497

Alpha Pro 50k

- Virtual Profit Target: $4,000 (8%) in Phase 1, $2,500 (5%) in Phase 2

- Assessment Price: $297

Alpha Pro 25k

- Virtual Profit Target: $2,000 (8%) in Phase 1, $1,250 (5%) in Phase 2

- Assessment Price: $197

Alpha Pro 10k

- Virtual Profit Target: $800 (8%) in Phase 1, $500 (5%) in Phase 2

- Assessment Price: $97

Opening an Alpha Capital Group Account

Opening an account with Alpha Capital Group is a straightforward process, simplified into eight clear steps:

- Visit the Alpha Capital Group website and click on the Sign Up button.

- Input your first name followed by your last name in the designated fields.

- Provide your contact information, including your phone number and email address.

- Select your country from the dropdown menu.

- Create and enter a secure password.

- Click the Submit button to finalize your registration.

- Check your email for a verification message from Alpha Capital Group.

- Follow the instructions in the email to verify your account and complete the setup process.

Alpha Capital Group Customer Support

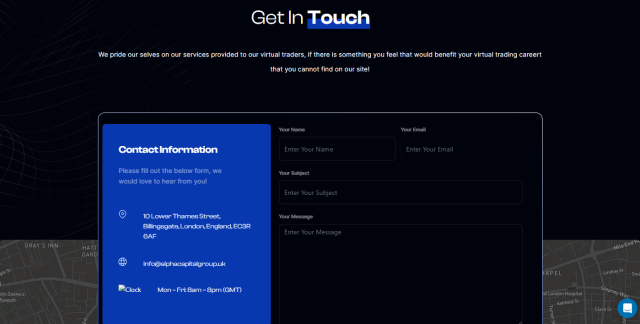

Alpha Capital Group is committed to providing outstanding customer service, giving its virtual traders' requirements and recommendations top priority. Dumb Little Man's experiences suggest that the company's responsive and interactive support structure demonstrates its dedication to providing excellent customer support team. Traders are welcome to contact the support team if they need help or have ideas on how to improve their virtual trading career.

Alpha Capital support invites traders to submit their questions or comments via a contact form on their website for direct communication. This guarantees that every trader has an easy way to get in touch with help. The company can be reached by email at [email protected], or in person at 10 Lower Thames Street, Billingsgate, London, England, EC3R 6AF.

Customer service is open Monday through Friday from 8 a.m. to 8 p.m. (GMT). These extended hours are a reflection of Alpha Capital Group's dedication to being reachable by traders during the majority of trading hours and to offering prompt, efficient service that caters to the requirements of virtual traders worldwide.

Advantages and Disadvantages of Alpha Capital Group Customer Support

| Advantages | Disadvantages |

|---|---|

|

Alpha Capital Group Withdrawal Options

Alpha Capital Group ensures flexibility and convenience for its traders by offering several withdrawal alternatives for performance fees. A trading expert at Dumb Little Man who evaluated these services provided insights, saying that the withdrawal procedure is easy to use and meets the requirements of profitable traders. Three main methods are available to traders to earn their performance fees: WIRE (bank transfer), Wise (wise.com), and Rise (Riseworks.io).

To be eligible for withdrawals, qualified traders who are entitled to performance fees must rigorously abide by the trading guidelines and account criteria. After being qualified, traders have the option to request withdrawals every two weeks, beginning 14 days following the first trade.

Requests must be made using the Profile > Payout option on the trader's dashboard, and the company promises to process them in two business days. $100 is the minimum withdrawal amount for performance fees, meaning that the account must generate a corresponding minimum profit.

It is noteworthy that, although Alpha Capital Group can not directly handle bitcoin withdrawals because of regulatory issues, traders who would like to utilize this technique can do so by contacting Riseworks, a third-party payment service provider. With this provision, traders are guaranteed a range of options to access their earnings in the way that best meets their requirements and preferences.

Alpha Capital Group Challenges and Difficulties

Take on the Phase 1 trading challenge of Alpha Capital Group to start your adventure as an Alpha Prop virtual trader. In order to reach the virtual profit target of 8% without going over the maximum drawdown restriction, this stage entails initiating virtual trades without any time constraints. Reaching these objectives will position you for the next step up in your trading career.

In Phase 2, you'll continue honing your trading techniques as you aim to achieve a 5% virtual profit target, once more without any time constraints. This stage is essential for building your reputation and showcasing your skills in online trading industry. Successful traders in this assessment, you will be considered ready to advance inside the Alpha Prop framework.

Once you pass both the Phase 1 and Phase 2 exams, you will be eligible to work as a Virtual ACG Analyst. The ACG Markets Team gives you a funded account with a 0% virtual profit target in this role, but you can also earn an 80% performance fee. This is your chance to put your virtual trading tactics to use and hone them even more, increasing your chances of making substantial profits.

How to Pass the Alpha Capital Group Evaluation Process

Because of the review process's stringent requirements and high standards, Alpha Capital Group can be difficult to navigate. To improve your chances of success considerably, preparation is essential.

It is strongly advised that you enroll in a comprehensive training program because it will equip you with the knowledge of trading strategy insights needed to satisfy the firm's expectations. This preparation guarantees that you are prepared to successfully address the obstacles encountered throughout the assessment stages.

Asia Forex Mentor – Rated Best Comprehensive Course Offering by Investopedia

If one wants to be successful in the assessment procedure of Alpha Capital Group, Asia Forex Mentor comes highly recommended. This platform, which Investopedia has recognized as the Best Comprehensive Course Offering Award, has assisted thousands of traders in navigating the demanding requirements of proprietary firm evaluations.

Asia Forex Mentor is a well-known forex trading expert with over twenty years of expertise. It was founded by Ezekiel Chew, who also offers the well-regarded One Core Program. The goal of this program is to give traders the tools they need to trade forex profitably.

Known for turning a six-figure profit on each deal, Ezekiel Chew founded Asia Forex Mentor to impart his wealth of knowledge and profitable trading techniques. Teaching friends was the first step in his mentorship path, which gradually developed into a complete online platform.

Under his direction, traders pick up sophisticated tactics that can result in substantial success in the financial markets in addition to the foundations of forex trading. Asia Forex Mentor is a great resource if you're wanting to improve your trading abilities or are getting ready for the challenge offered by Alpha Capital Group.

How Could Asia Forex Mentor Help You Pass Alpha Capital Group Challenge?

Because Asia Forex Mentor has been approved by reliable financial education platforms, it is a highly credible resource for traders hoping to clear the Alpha Capital Group challenge. Leading source of financial education, Investopedia, named the One Core Program the Best Comprehensive Course Offering. This recognition demonstrates the curriculum's depth and scope, which are intended to give traders a comprehensive understanding of forex trading.

Furthermore, Benzinga—a reliable source of financial news and analysis—named Asia Forex Mentor the Best Forex Trading Course for novices. This recognition highlights how beneficial the curriculum is for both novices and experienced traders wishing to improve their abilities.

Also, Asia Forex Mentor was named the Best Forex Mentor of 2021 by the BestOnlineForexBroker website, which praised the program for its ability to assist traders in making significant gains in the currency market.

These testimonials and the overwhelmingly favorable feedback from traders who have finished the One Core Program—both novice and experienced—establish Asia Forex Mentor as a top learning resource. Its thorough and efficient training methodology can greatly increase a trader's chances of success throughout the Alpha Capital Group assessment procedure.

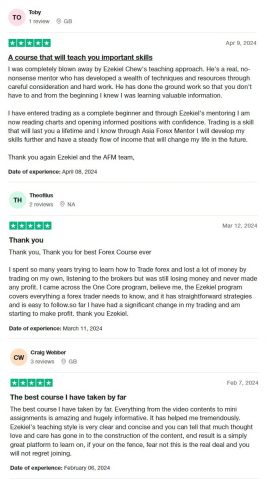

Asia Forex Mentor Members' Testimonials

Ezekiel Chew's One Core Program has been praised by members of the Asia Forex Mentor program time and time again for its efficacy in helping them succeed with prop firm evaluations. Testimonials emphasize the thoroughness of the course, which covers all crucial facets of forex trading, and Ezekiel's straightforward, hands-on teaching style.

Both novice and seasoned traders praise the program for improving their trading abilities and giving them the ability to interpret charts, open well-informed positions, and generate a consistent income from trading. After years of difficulties, many people have finally made money thanks to the comprehensive, clear, and easy-to-understand training materials and simple tactics. All things considered, participants say the Asia Forex Mentor has been a transformative training experience that has given them enduring trading capabilities.

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: Alpha Capital Group Review

In conclusion, the wealth of training materials and cutting-edge trading technologies provided by Alpha Capital Group demonstrate the value of this platform for traders. For those wishing to improve their trading abilities and market knowledge, these features along with the assistance of a friendly trading community make it an appealing option. Potential traders should take into account some of the disadvantages, though, as they may have an impact on their trading experience. These disadvantages include the absence of regulatory control and sporadic problems with customer service.

Enrolling in top courses like Asia Forex Mentor can greatly improve possibilities for people hoping to pass Alpha Capital Group's evaluation procedure. This program improves overall trading proficiency by offering in-depth training and strategic insights that are essential for passing the firm's demanding evaluations.

>> Also Read: BluSky Trading Company Review with Rankings 2024 By Dumb Little Man

Alpha Capital Group Review FAQs

Is Alpha Capital Group legit?

Yes, Alpha Capital Group company is a reputable platform that focuses on offering traders training and instruction. Its primary focus is on simulated trading environments, which enable traders to enhance their abilities without incurring any financial risk, whatever type of trading they want to pursue, news trading and all. The organization's goal of education is supported by the fact that it doesn't engage in regulated investment activities.

Does Alpha Capital Group payout?

Alpha Capital Group offers payouts to traders through performance fees, but only to those who qualify as external analysts after successfully completing evaluation phases. These payouts are contingent upon achieving specified profit targets and adhering to the trading rules. The process for requesting payouts is clearly defined, involving submission via the trader’s dashboard.

Which broker does Alpha Capital Group use for its trading activities?

Alpha Capital Group does not utilize a broker for its trading activities as it provides a platform for virtual trading only. This setup is part of its educational approach, designed to offer a risk-free environment for learning trading strategies. Traders engage in simulated trades to develop their skills without the need for a broker.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.