Yen Update: USD/JPY Dips Following BoJ Minutes, Concerns Over Volatile Changes

By Daniel M.

March 25, 2024 • Fact checked by Dumb Little Man

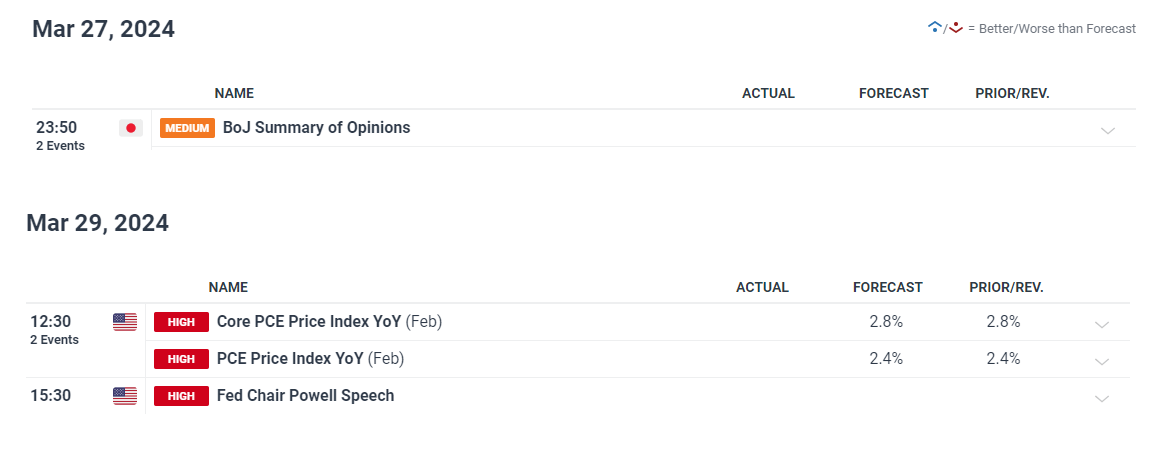

BOJ Minutes Provide Scarce New Information

Following the Bank of Japan‘s (BoJ) pivotal decision to conclude its negative interest rate policy, the yen experienced a noticeable decline, reaching a four-month trough. This move, which ended eight years of unorthodox monetary stimulus, did not introduce new insights as per the BoJ minutes, largely because of the Bank’s proactive communication strategy before and after the March assembly.

Despite the historic nature of this policy shift, the yen depreciated by over 1% against the dollar, signaling the market had already adjusted its expectations.

The BoJ’s minutes confirmed that Japan’s 2% inflation target remains unmet, and the anticipated pace of rate hikes will diverge from trends observed in Western countries.

This approach suggests a continued disparity in interest rate differentials favoring carry trades, potentially keeping the yen under pressure. Furthermore, upcoming BoJ reports and the final Q4 GDP data from the US could heighten market volatility, especially with reduced liquidity expected around Good Friday.

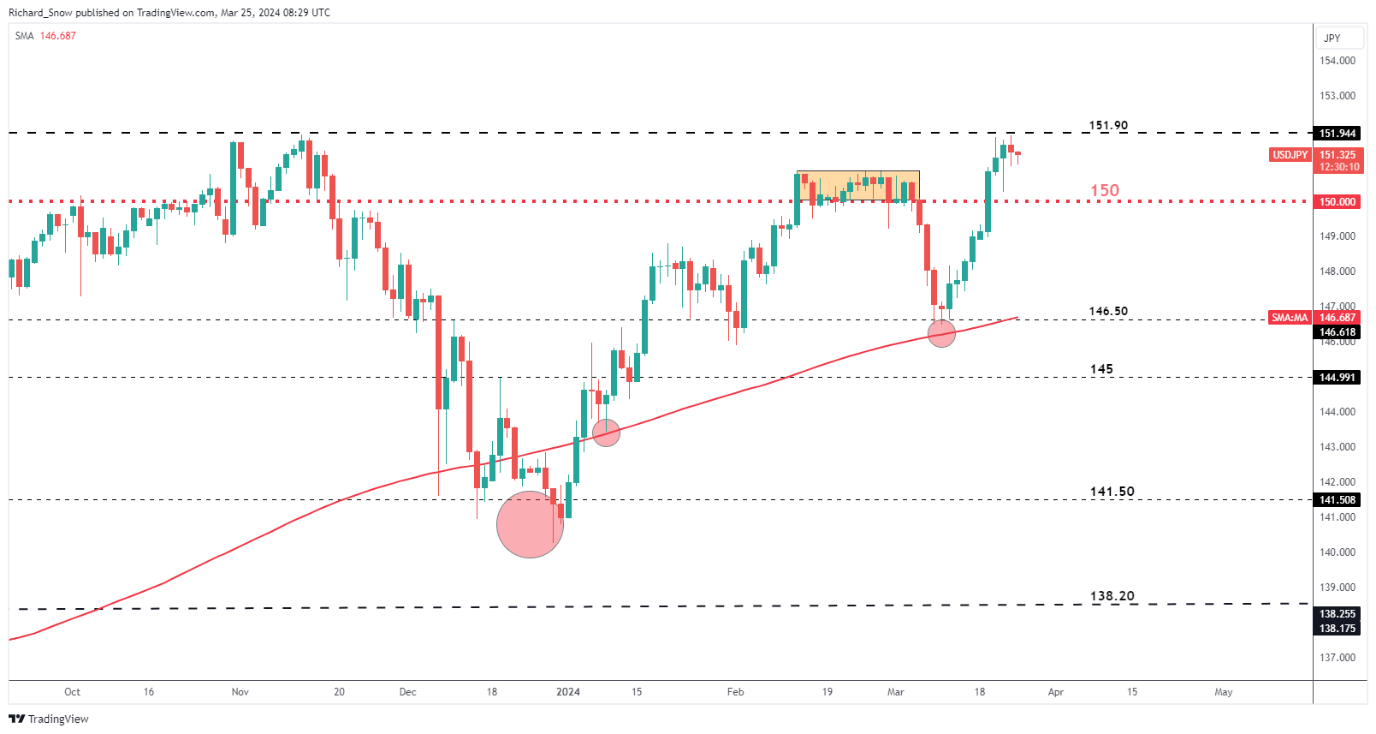

USD/JPY Edges Down From Resistance

In terms of trading, the USD/JPY pair has shown resistance around the 151.90 level, hinting at a challenging path back to the 150.00 mark without significant influences from BoJ forecasts or US PCE data.

Japan’s potential for another rate hike later this year, spurred by inflation and growth prospects, contrasts with the keen market watch on the US PCE data for potential seasonal impacts. The data’s outcome reinforces the dollar’s strength or contributes to a downward adjustment in the USD/JPY pair.

USD/JPY Daily Chart

The sentiment among retail traders remains mixed, with a substantial short positioning on USD/JPY, although recent shifts suggest a further complex trading outlook. This sentiment analysis, coupled with the yen’s performance post-BoJ’s announcement and ahead of the Federal Reserve’s policy outlook, underscores the intricate dynamics influencing the USD/JPY exchange rate.

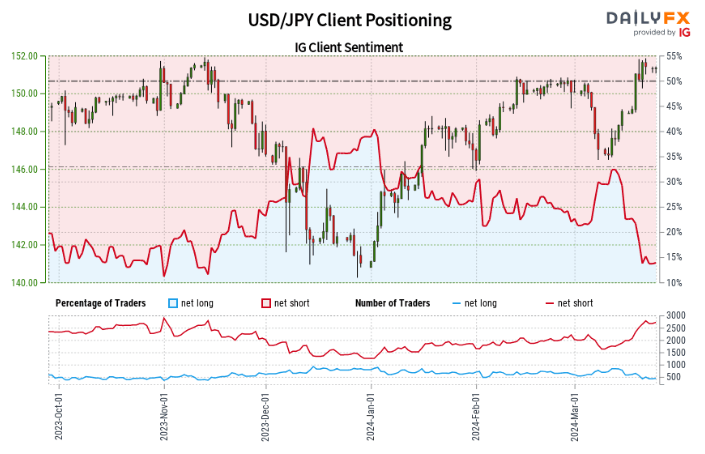

IG Client Sentiment ‘Mixed’ Despite Massive Short Positioning

We normally adopt a contrarian approach to crowd mood and the fact that traders are net-short signals that USD/JPY prices may continue to climb.

The number of traders net-long is 12.74% higher than yesterday and 27.58% lower than the previous week, while the number of traders net-short is 4.19% higher than yesterday and 34.04% higher than last week.

Positioning is less net-short than yesterday, but more net-short than the previous week. The combination of current emotions and recent adjustments creates a more mixed USD/JPY trading inclination.

The global currency market is now focusing heavily on central bank decisions, with the Federal Reserve’s next policy outlook expected to dominate. The dollar’s strength is bolstered by robust US economic indicators, which point to continued inflation, perhaps limiting any swift Fed rate decreases.

This scenario has far-reaching consequences, influencing currencies worldwide, from the Australian dollar to the euro and sterling, and even affecting cryptocurrency valuations. infrastructure may spark retaliation and raise global oil prices, complicating the geopolitical environment and the global energy market’s stability.

Final Thoughts

As the market navigates these events, traders pay particular attention to the consequences of monetary policy shifts in key economies. The BoJ’s plan to normalize monetary conditions is a huge step forward.

The immediate impact on the yen highlights the intricate interplay between global financial circumstances and market mood. With Fed decisions on the horizon, the currency market is set for major changes in trading behavior.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.