Will Gold’s Luster Persist Amid Homebuying Affordability Crisis?

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

The Elusive American Dream: A Home of One's Own

For many, the American dream of homeownership seems increasingly out of reach, thwarted by skyrocketing home prices, rising interest rates, and ongoing inflation. Owning a home has long been a key to building wealth in the U.S., with primary residences constituting over a quarter of U.S. household assets in 2022.

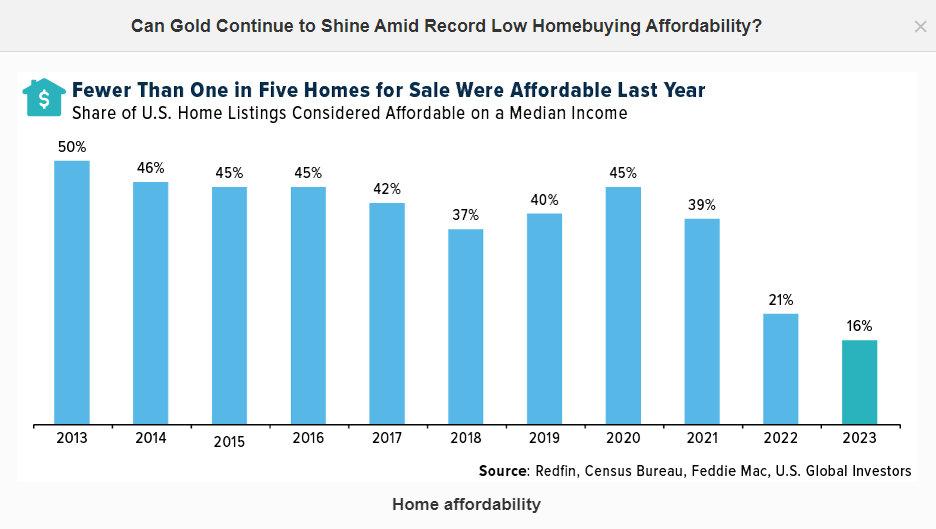

However, a Redfin analysis reveals a concerning trend: only 16% of homes on the market in 2023 were affordable to the average American household, a record low. This is a sharp decline from 21% in 2022 and a dramatic fall from the pre-pandemic era.

Challenges to Homeownership

A significant majority of renters, 81%, harbor aspirations of homeownership, yet 61% fear this dream may never materialize, per a Harris Poll survey. Among them, 57% declare the American dream of homeownership as effectively extinct, a sentiment less commonly shared by current homeowners.

Rising Mortgage Rates and the Housing Supply Dilemma

Mortgage rates, though slightly off their peak, remain high, adding roughly $250 to monthly home payments compared to last year. This hike has discouraged many from selling, fearing loss of low-rate benefits, thus exacerbating the housing supply shortage.

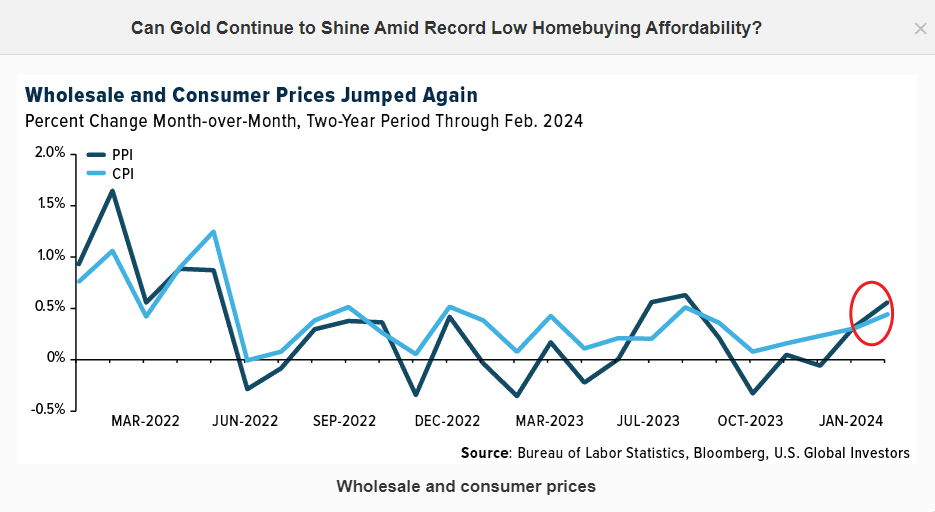

Economic Uncertainties and the Prospect of Rate Cuts

Recent economic data, including a surprising uptick in the producer price index (PPI) and consumer price index (CPI), complicates the Federal Reserve's path, potentially delaying hoped-for rate cuts. Despite these challenges, financial analysts from UBS and RBC anticipate rate reductions possibly starting in June, though Janet Yellen warns against expecting pre-pandemic rate levels.

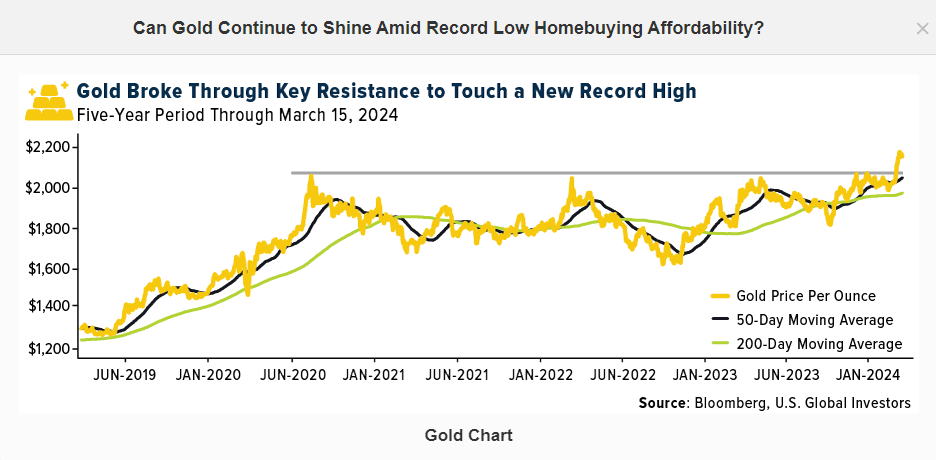

Gold's Rally Amid Economic Flux

Amidst economic and monetary uncertainties, gold has surged to a record high of $2,195 per ounce, buoyed by investor optimism for rate cuts and a declining U.S. dollar. The precious metal's performance, supported by central bank demand and ETF interest, questions the appeal of traditional interest-bearing assets.

Despite the solid performance of the U.S. stock market and prevailing interest rates, gold's allure remains, potentially poised for further gains amidst geopolitical tensions and economic challenges.

Final Thoughts

While past performance is not indicative of future results, gold's resilience in the face of economic headwinds and its potential for further appreciation offer investors a hopeful prospect amidst the challenges of today's financial landscape.

Disclaimer: The perspectives and data shared are subject to change and may not suit all investors. The links provided lead to third-party sites; U.S. Global Investors does not endorse their content.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.