Vio Bank Reviews: Is Vio a Good Bank?

By Peter Vanderbuild

January 12, 2024 • Fact checked by Dumb Little Man

As digitalization is growing rapidly, everything is going online including supermarkets, shopping malls, and gaming so how can banking services remain behind? Online banking is the need of today for fast transactions, secured shopping, remote bank services, and quick response.

Vio Bank is also an online bank that provides banking services such as savings account, CDs via mobile app and website. Unlike traditional national banks, Vio offers higher interest rates on all balance tiers with minimum opening deposits.

However, can Vio Bank be competitive with other online banking institutions, or what is Vio Bank perfect for? Let's know about the Vio Bank detailly through Vio Bank reviews.

Vio Bank Reviews: Topic Overview

Understanding how bank accounts work can be overwhelming at first glance but we're here to help break it down so that anyone can understand it!

Check out our comprehensive review of Vio Bank's services below: -What are the benefits? -How does it compare against other banks? -What are the Pros and Cons -Who is it best for?

Everything you need to know about Vio Bank in one place. We've got the details for you.

What is Vio?

Vio Bank is an online division of MidFirst Bank that is and known as the largest privately held bank in the US. This financial institution has strong capital support of a $24 billion asset via MidFirst Bank after being formed in 2018.

Unlike other traditional banks, Vio Bank is an online-only bank that operates online via mobile app and website. Thus, customers need not visit the physical branches and wait for their turn to open accounts or make transitions.

Vio Banks offers three banking products and here they are;

- High Yield Online Savings Account

- MMA (Money Market Account)

- CDs (Certificates of Deposit)

How do Vio Savings Account and CD Account work?

Vio Bank offers a range of online banking services that help customers grow digitally and ensure the fund is secured with a high-interest rate. Let's discuss the two different accounts that Vio offers.

High Yield Online Savings Account

It is easy to open this high-yield savings account with a small amount of money and get higher interest rates on your deposits. This account is extremely flexible to grow your money and you can access it whenever you need it.

No monthly maintenance fee and daily compound interest are some of the considerable features of a High Yield Online Savings Account. Below are some benefits of a High Yield Online Savings Account:

- No monthly fee

- Need only a $100 minimum deposit to open an account

- 0.51% online savings account APY

- FDIC insured account up to $250,000

- 6 free withdrawal facilities per monthly statement cycle

High Yield Online Certificate of Deposit (CD)

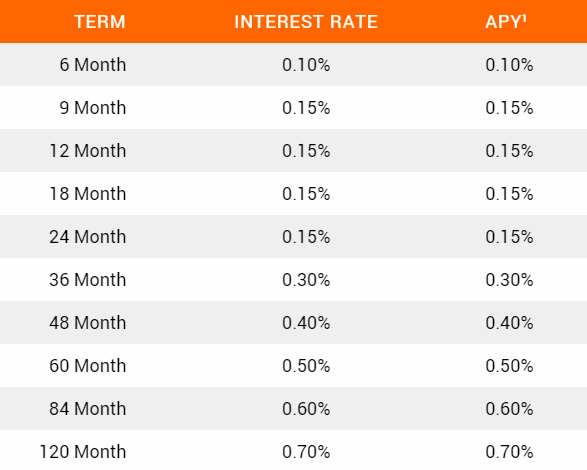

For those who are retired or invest their money to earn high-interest rates, a High Yield Online Certificate of Deposit (CD) can be a smart choice. The CD account that Vio Bank extends its term from 6 months to 10 years.

Based on the term of the CD, the bank offers rates as low as 0.10 percent and as high as 0.70 percent. Here is an overview of the term so that you can set your plan for this account.

With no monthly fee and a small amount of money, you can start the CD account to get benefits such as a guaranteed rate of return. The bank promises to monitor the competition while ensuring its rates are on the top.

Here are some benefits of a Vio Bank High Yield Online CD you can reap in the account.

- No monthly fee

- Terms ranging from 6 months to 10 years

- Need only a $500 minimum deposit to open an account

- FDIC insured balance up to $250,000

- Offers 0.10% to 0.70% APY depending on the terms

What are the Features of Vio Banking?

Vio Bank offers limited accounts but whitewashed the competitors by providing higher interest rates and online banking access. There are several other features that can steal customers from other banks to Vio.

Vio mobile app

Vio works online and helps make the transaction faster and easier. Customers can make deposits from other banks to Vio and vice versa.

The mobile app is pretty useful for customers so that the IOS users have placed 4/5 ratings while Android users keep it at 3/5 after giving reviews based on Vio bank customer service. Along with the mobile app, the account holders or those who need to create an account on Vio can simply access viobank.com.

Higher APY

Though the online bank doesn't charge a monthly fee, it offers a higher annual percentage yield on both savings accounts and CD account. This feature has attracted thousands of customers to join Vio and grow their money.

The Vio savings account offers 0.51% APY while the Vio CD account includes up to 0.70% APY to help the customers uplift their finance goals.

No monthly fee

Vio is a monthly fee-free online bank that doesn't charge for banking maintenance or service. This helps you be worry-free from finding the way to waive the bank overdraft fee or charge.

Customers can open accounts and earn compound interest depending on their balance tiers. However, Vio only allows six transactions per month and if you cross the limit, you' need to pay $10 per transaction.

How much does Vio Cost?

Vio doesn't charge a monthly service fee until you need paper sheets and additional banking facilities. If you're an average bank user and need to save and earn money through APY on your balance, Vio can be the perfect option.

Below are some considerable details of Vio Bank, which can help you decide whether Vio is perfect for your need or not. Here are two account overviews with fees and other banking parameters.

| Vio Bank Accounts Types | Monthly Fees | Waiver Criteria | Minimum Deposit Amount | Annual Percentage Yield |

|---|---|---|---|---|

| High Yield Online Savings Account | $0 | N/A | $100 | 0.51% |

| High Yield Online Certificate of Deposit (CD) | $0 | N/A | $500 | 0.10%- 0.70% |

Who is Vio Best For?

Vio is the best bank for those who want an easy option to save money without paying a monthly fee. The online banking service with higher interest rates and small minimum deposit requirements can facilitate the customers who want the banking services online.

- Vio can be the first choice for those who fall into the following categories;

- Customers who need a simple and online bank to put their money away

- Those who want to skip monthly service fees

- People who try hard to keep minimum balance on the account

- If you don't require checking accounts and debit card

Vio Bank Pros and Cons

Vio offers a huge opportunity to grow their money without worrying about any maintenance fee. But it has only three account options without room for checking accounts, which can disappoint several customers.

So there are also some limitations at Vio which the parent bank ponders over them to provide banking services to more groups. Let's know the pros and cons of Vio below.

| ✅ PROS |

|---|

▶ High APY ▶ No monthly fees Vio doesn't include a monthly fee for banking maintenance and service until you need extra service at Vio.

|

| 🚫 CONS |

|---|

✖ No branch and ATM access

|

Vio Compare to other Banks

| Bank | Minimum Deposit | Monthly Fee | Savings APY | Overdraft | Number of Branches |

|---|---|---|---|---|---|

| Vio | $100 | $0 | 0.51% | $0 | N/A |

| Varo | $0 | $0 | 0.50% | $0 | N/A |

| CITBank | $100 | $0 | 0.50% | $34 | N/A |

| Chime | $0 | $0 | 0.50% | $34 | N/A |

Vio vs. Varo

Vio can be a dominant competitor for Varo bank in terms of providing high APY. Vio is also great in relieving bank restrictions including maintaining a minimum balance.

Besides, Varo allows savings accounts only to customers who have checking accounts, and transition at Varo is restricted among the Varo account holders only.

>> Read More About Varo Bank Reviews: Is Varo a Good Bank?

Vio vs. CIT Bank

Both Vio and CIT bank are pretty similar in type and service but Vio appears dominant on CIT with some features. Vio is solely online whereas CIT has physical as well as online access without having ATM access.

Vio offers up to 0.70% APY whereas CIT is limited to 0.15%. It is where Vio stands above.

>> Read More About CIT Bank Reviews: Is CIT a Good Bank?

Vio vs. Chime

Though both Vio and Chime are online banks, Vio appears better with some banking facilities. Vio offers higher interest rates and includes CD and money market accounts which Chime lacks.

Besides, Vio offers an easy and useful mobile app and doesn't compel the customers to maintain a minimum balance. Unlike Vio, Chime lacks personal loans and may charge for wire transfer.

>> Read More About Chime Banking Reviews: Is Chime a Good Bank?

Conclusion: Is Vio a Good Bank?

Vio Bank is the smart choice for people to engage in their bank transition and banking services online. Without monthly fees but a higher interest rate at the bank is a great benefit for people who wish to grow their money with pace.

Vio Bank is a great bank to open your account with. They have competitive rates on their savings, and CD accounts. If you are looking for an online banking solution that offers everything from free ATMs anywhere in the world to mobile deposit capabilities, they might be just what you're looking for.

So if you want to open an account at a minimum deposit and earn a higher rate of interest than most banks offer, this could be your opportunity!

Vio Bank FAQs

Is Vio's Online Savings Account trustworthy?

Absolutely, Vio's online savings account is safe and trustworthy as it is backed by his parent bank, MidFirst which is one of the high profiled and reputed US banks.

What is the rating of VIO Bank?

In the 2020 U.S. Retail Banking Satisfaction Study by J.D. Power, Vio’s parent, MidFirst Bank, had scored fourth in Overall Customer Satisfaction in the Southwest. Likewise, many financial advisors give 3.5/5 ratings to Vio.

Is Vio Bank FDIC insured?

Yes, Vio Bank is a member of FDIC so it is FDIC insured. Vio Bank offers FDIC insured balance up to $250,000.

Who is Vio Bank owned by?

Vio Bank is an online division of MidFirst Bank so MidFirst has owned Vio Bank. MidFirst Bank was established in 1911, having a headquarter in Oklahoma City.

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.