USD/JPY Nearing Multi-Week Highs: Will the BoJ Intervene by July?

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Japanese Officials’ Comments Fail to Boost Yen

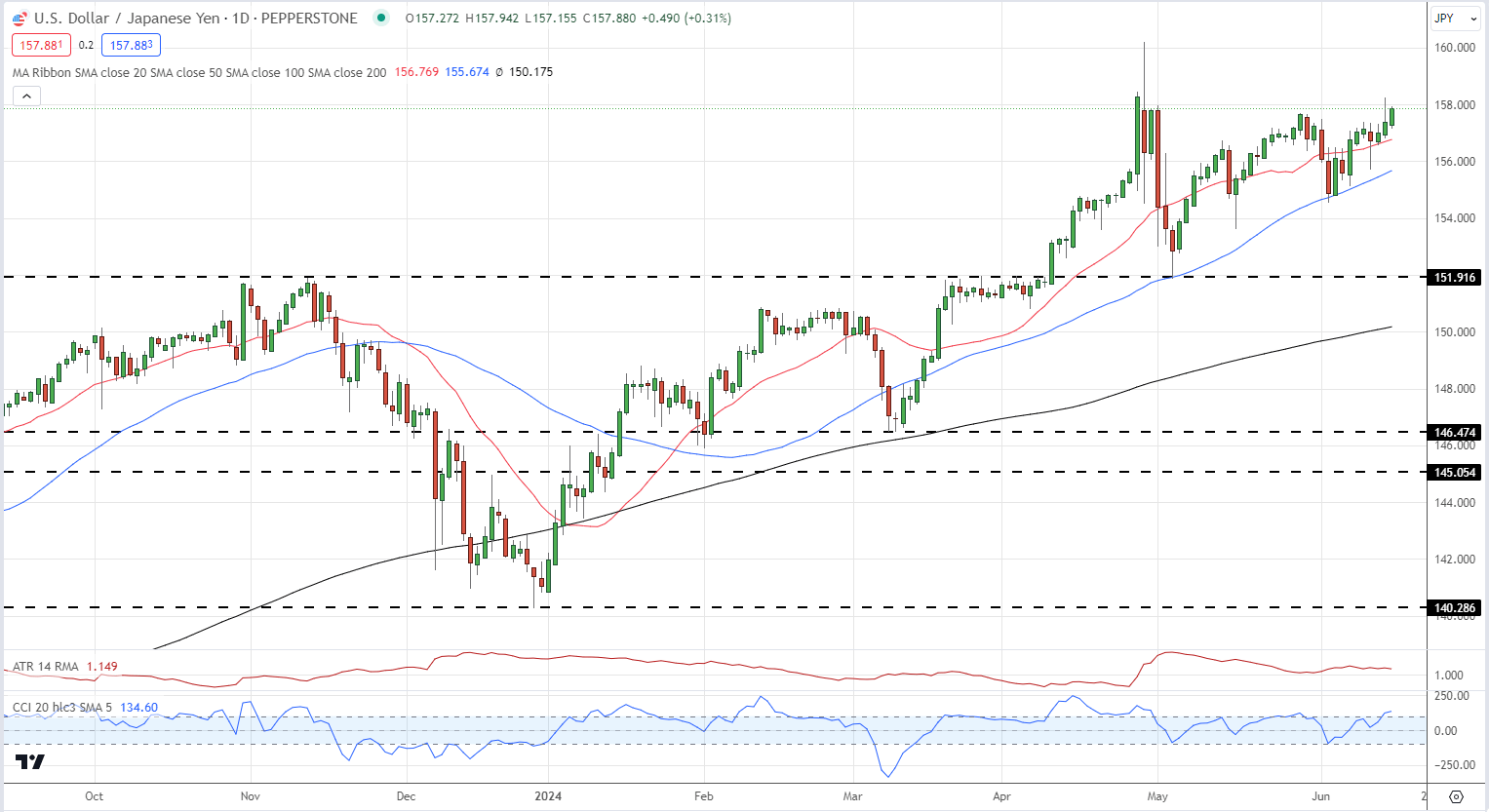

Overnight comments from Japanese officials failed to strengthen the Japanese Yen, with USD/JPY rising to highs last seen in late April. Bank of Japan Governor Kazuo Ueda highlighted his focus on FX levels and their impact on import prices.

Japan's PM Fumio Kishida emphasized the need for flexible policy to end deflation and spur growth. Despite these remarks, the Yen continued its decline, approaching levels previously subject to FX intervention.

The Bank of Japan recently announced a reduction in its bond-buying program, with specific details to be disclosed at the BoJ meeting on July 31st. Without a significant drop in the US dollar, the BoJ may need to intervene to support the Yen, as verbal interventions are proving ineffective.

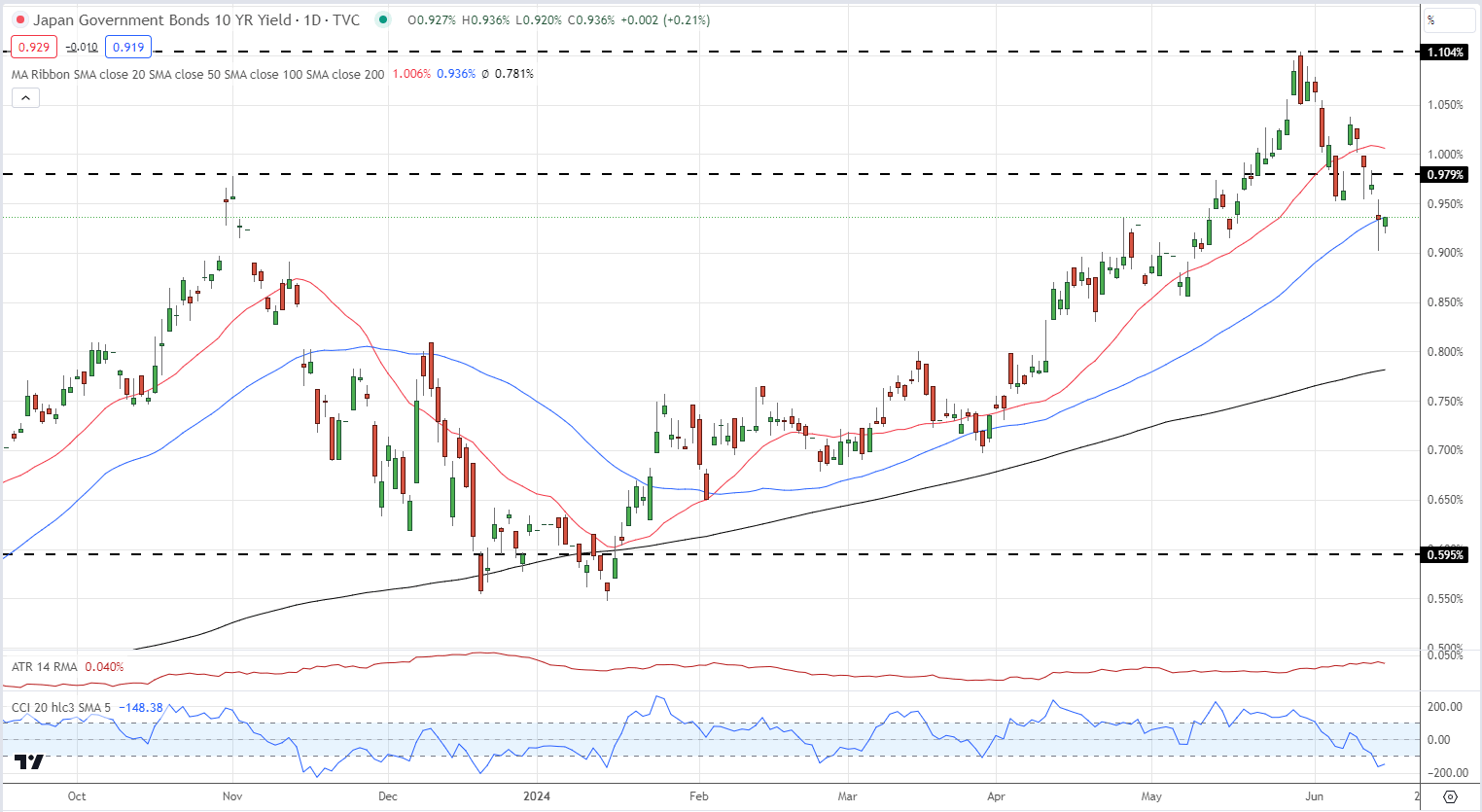

10-Year JGB Yield Faces Resistance

Since the start of 2024, the yield on the 10-year Japanese Government Bond (JGB) has been trending higher. However, this upward movement experienced a sharp reversal at the end of May, leading to market speculation about the timing of monetary policy tightening by the BoJ.

Investors are questioning when the BoJ will shift towards tightening, creating uncertainty in the bond market. This uncertainty is contributing to the yield struggling to make significant gains in the short term.

Additionally, the BoJ’s cautious stance on bond-buying reductions is adding to the resistance, as investors await clearer signals from policymakers. Without decisive action from the BoJ, the yield is likely to face continued resistance, preventing it from moving appreciably higher.

USD/JPY Daily Price Chart Signals Uptrend

The daily USD/JPY chart remains positive, despite the Commodity Channel Index (CCI) indicating overbought conditions. The pair are now above all three simple moving averages and are poised to hit a new multi-week high. Above the 158 level, resistance is minimal before reaching the recent multi-decade high at 160.215.

Retail trader data shows 25.87% of traders are net-long, with a short-to-long ratio of 2.87 to 1. The number of net-long traders has increased by 11.66% from yesterday and 4.94% from last week, while net-short traders are up by 5.87% from yesterday and 2.52% from last week.

Typically, a contrarian view suggests that the net-short position of traders may lead to further USD/JPY price increases. However, the decrease in net-short positions compared to yesterday and last week signals a possible trend reversal, despite traders remaining net-short.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.