USD/CHF Sentiment Analysis: Lowest Net-Long Position Since September

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

USD/CHF Overview

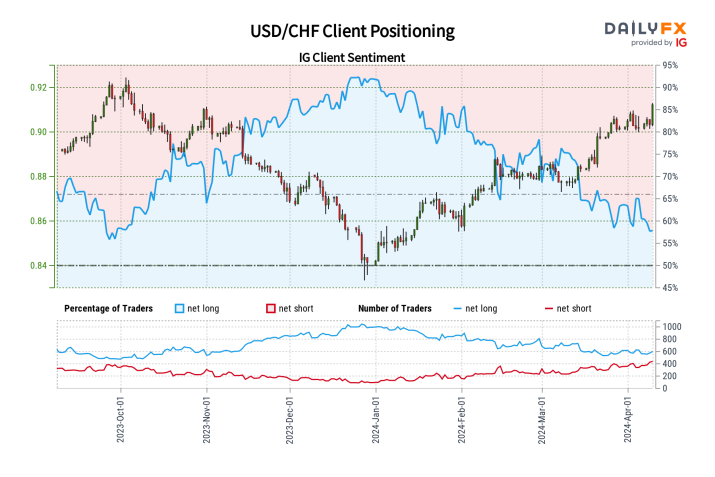

The latest data from retail traders indicates that 54.42% are positioned net-long on USD/CHF, with the long-to-short ratio standing at 1.19 to 1. This marks the lowest level of net-long positions seen since September 26, when USD/CHF was trading around 0.92.

Comparatively, net-long positions have decreased by 18.78% from yesterday and 17.67% from last week. Conversely, net-short positions have seen a decline of 2.43% from yesterday and 4.51% from last week.

In our analysis, we often adopt a contrarian stance to crowd sentiment, which suggests that USD/CHF prices might fall given the net-long bias.

However, the reduction in net-long positions both from yesterday and the past week hints at a potential reversal in the USD/CHF trend upwards, despite the continued net-long sentiment.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.