US Inflation Report: Impact on Gold, Dollar, and Yields Anticipated

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

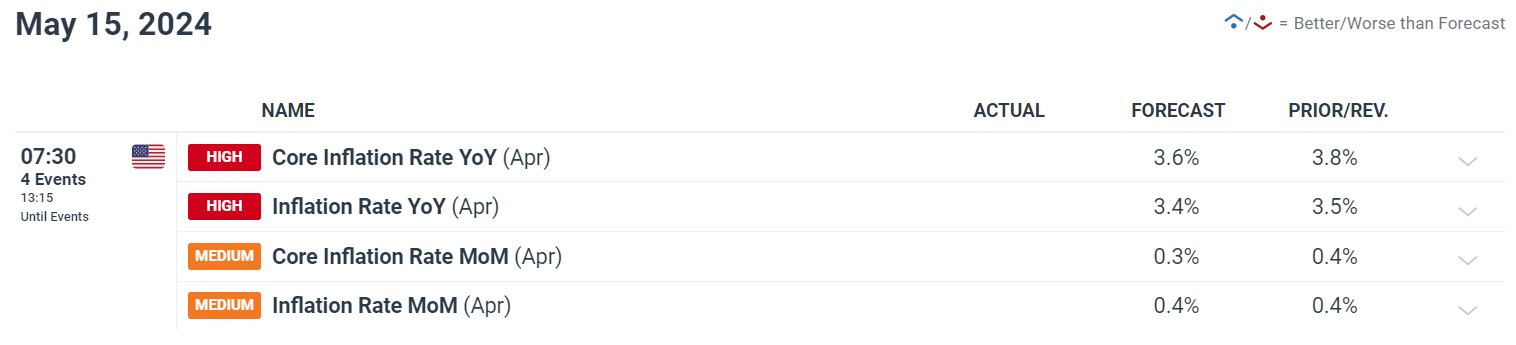

The Bureau of Labor Statistics will release the April consumer price index (CPI) figures on Wednesday. This major economic report, closely watched by market participants, is expected to show a 0.4% monthly gain, keeping the annual rate at 3.4%, slightly lower than March's 3.5%.

The core CPI, which excludes volatile goods such as food and energy, is forecast to gain 0.3%, bringing the year-over-year rate to 3.6%.

Expectations and Market Implications

Following a higher-than-expected producer pricing index (PPI) in April, questions have been raised about the sustainability of the disinflationary trend seen late in 2023. This could imply a reacceleration of inflation, influencing the Federal Reserve's monetary policy position.

Historically, strong CPI statistics have suggested higher interest rates for an extended period, strengthening the US dollar and increasing yields, potentially lowering gold prices.

Fed's Position and Market Reactions

Fed Chair Jerome Powell recently expressed cautious optimism about inflation slowing over the year, despite the unexpected persistence seen in early statistics. The Fed's present stance appears to favor holding the rate, with no quick increases expected.

However, any major departure in the CPI may provoke a reassessment, impacting market expectations for future rate adjustments.

Housing Market Focus

The CPI report will place a special emphasis on housing costs, which account for a significant chunk of the index. The indicator known as owners' equivalent rent, which assesses what homeowners may charge to rent their properties, has been an important element.

Despite a drop from last year's peak, the data remain strong, implying that housing inflation continues to put pressure on the overall inflation landscape, potentially influencing the Fed's policy decisions.

Final Thoughts

As traders and investors await the CPI report, the implications for financial markets are profound. A higher-than-expected inflation number may dampen prospects for a rate cut and shift the narrative toward persistent inflation pressures.

A report that falls short of forecasts, on the other hand, may revive optimism for monetary policy easing, which would be especially helpful to precious metals such as gold.

With the data likely to affect the Fed's next decisions, market participants should prepare for potential volatility in the trading environment.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.