US Inflation Forecast: What’s Next for Gold, the US Dollar, and Stocks?

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

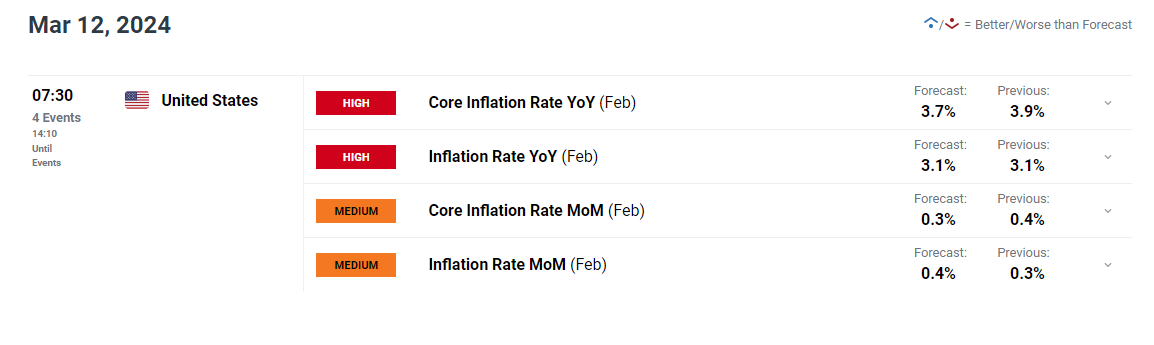

The United States released its Consumer Price Index (CPI) for February on Tuesday. The Bureau of Labor Statistics report is a watershed moment for investors, providing crucial insights into inflation dynamics and affecting the Federal Reserve's monetary policy.

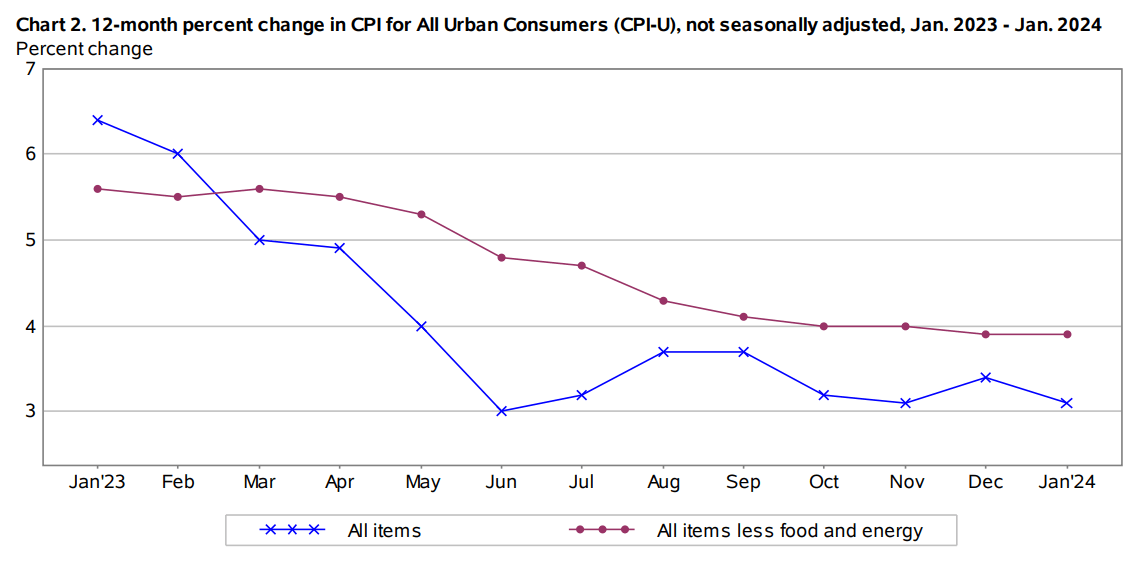

The CPI is forecast to climb by 0.4% due to higher energy expenses, maintaining the annual rate at 3.1%. The core CPI, excluding volatile goods such as food and energy, is expected to rise by 0.3% month on month, potentially reducing the year-on-year rate to 3.7% from 3.9%.

US Inflation Trend

Market Expectations – US CPI

The market's reaction to these findings may be crucial, particularly if the data differs from Wall Street's predictions. A report that closely matches forecasts may not produce much movement, while unanticipated discrepancies might trigger volatility across multiple market groups. Traders should pay particular attention to these developments, as they may have an impact on interest rate forecasts and, as a result, investment strategies.

Possible Scenarios For Key Assets

In the event of an upside surprise—a CPI report revealing higher-than-expected inflation—it could imply that inflation is reaccelerating, making it difficult to manage. This scenario could prompt the Fed to raise its Consumer Expenditures (PCE) inflation projection and reassess the pace of planned rate decreases. A higher-than-expected CPI could drive bond rates and the US currency higher, weighing on gold prices and stocks as investors react to a hawkish interest rate outlook.

A modest CPI data, with inflation figures falling below projections, would support the assumption that disinflation is proceeding, in line with the Fed's 2% target. This conclusion could confirm predictions for rate reduction in 2025, resulting in a drop in yields and the US dollar value. A scenario like this would most certainly help gold prices and risk assets, as lower interest rates often encourage non-yielding and riskier investments.

Final Thoughts

Investors and traders should plan for both possibilities by being aware and ready to alter their portfolios based on the most recent inflation data and its implications for Fed policy. The anticipation around the CPI publication emphasizes its significance as a short-term indicator of financial market direction.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.