US Dollar Watches Fed Signals with PPI and Retail Sales – EUR/USD Eyes 1.1000, USD/JPY Rebounds to 147.50

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

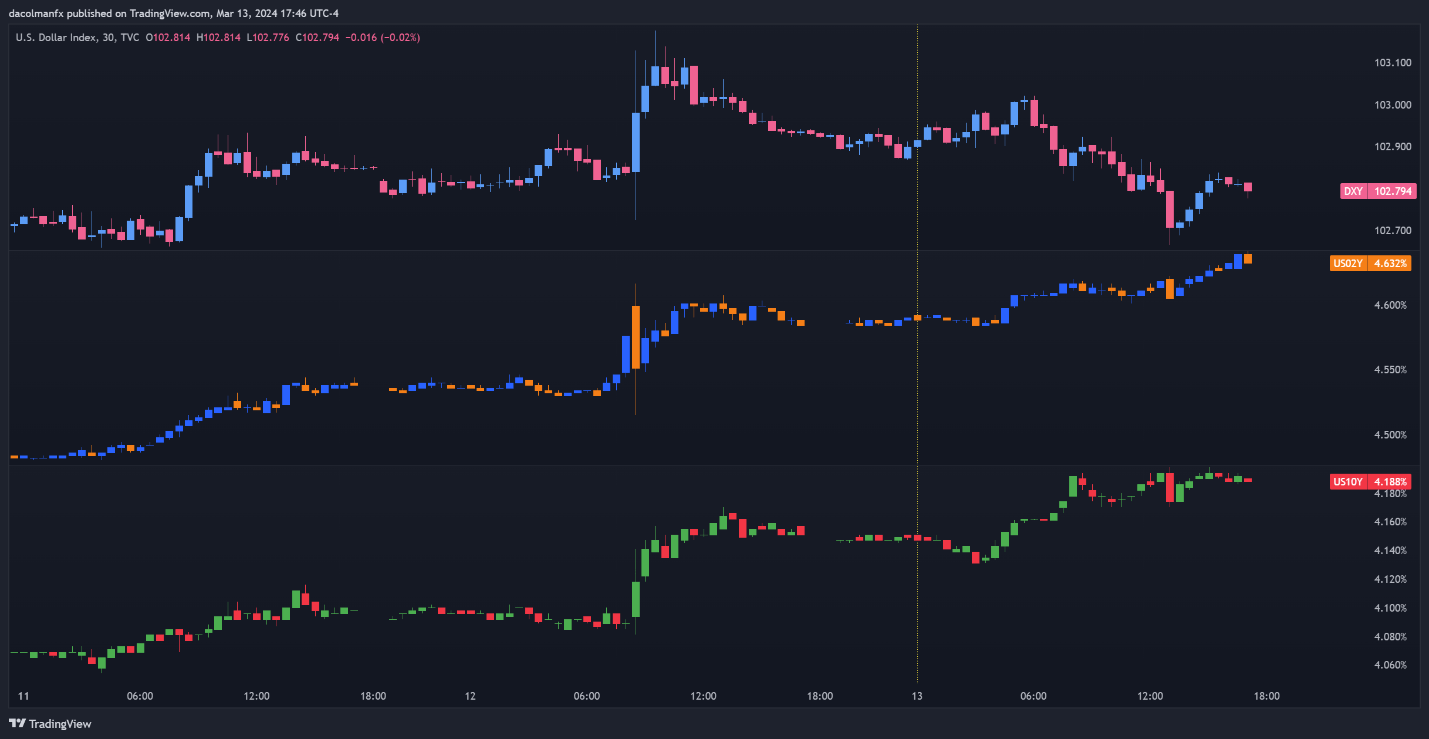

Wednesday's slight decline in the value of the US dollar was somewhat offset by an increase in the yield on US Treasury bonds. The release of the Producer Price Index (PPI) and advance monthly sales for retail and food services on Thursday are two of the major events on the U.S. calendar, so traders avoided taking up substantial directional positions, which kept FX volatility low.

Meanwhile, Wall Street was unmoved by the CPI report that came out earlier in the week, despite it exceeding market expectations and suggesting that the Federal Reserve should delay lifting policy constraints. Still, hot data can force the central bank to reevaluate its course.

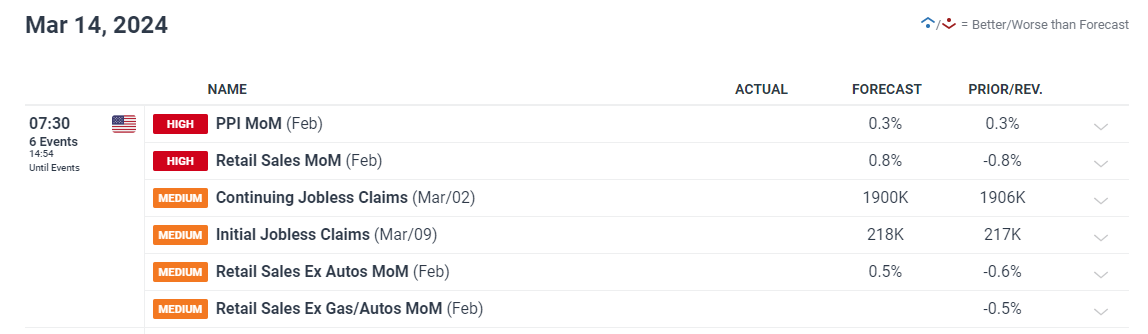

The PPI and retail sales numbers for February will be released on Thursday, shedding light on the American consumer health and general price patterns. A positive surprise would prompt a hawkish repricing of interest rate expectations, which would be favorable for the currency.

The current market predictions for both reports are shown in the following table.

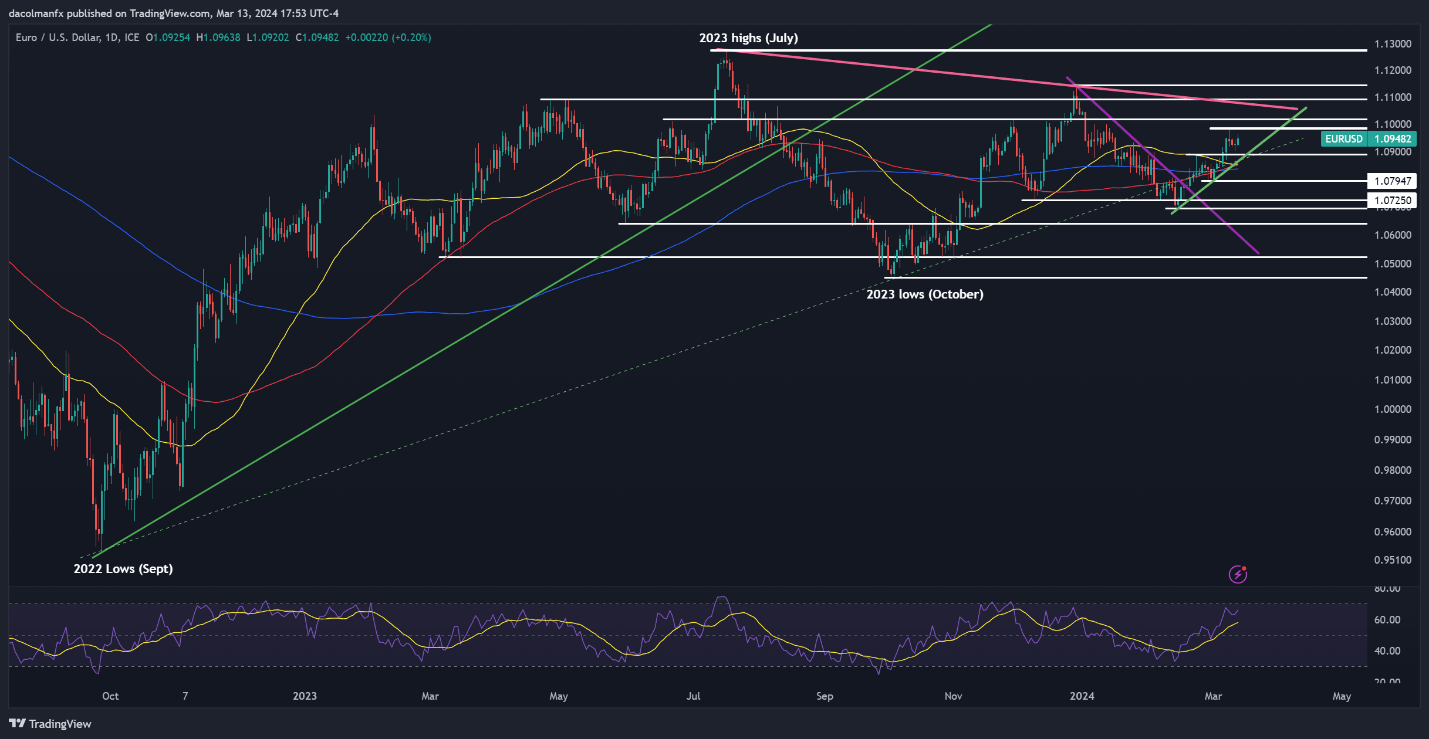

EUR/USD Forecast: Extra gains now look at 1.1000

A significant increase in EUR/USD has broken key levels. 1.0980, 1.1020, and 1.1075 are resistance levels, whereas 1.0890, 1.0850, and 1.0790 are support levels.

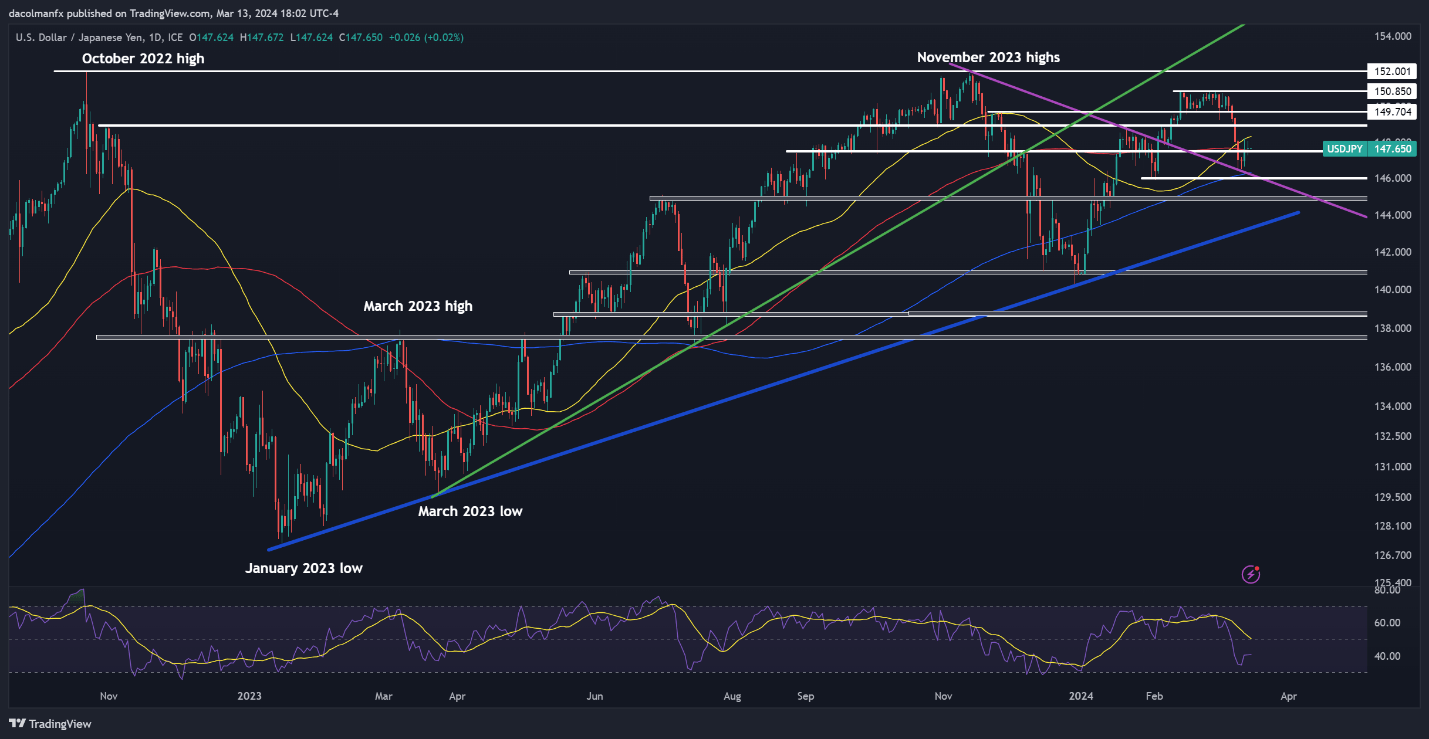

USD/JPY rebounds to 147.50 as BoJ rate hike bets wane

The USD/JPY increased little and found support at 147.50 before stabilizing. Potential targets include 148.35, 148.90, and 149.70. Support rests in a range of 146.30 to 146.00 with a With a psychological level of 145.00.

With the Bank of Japan (BoJ) voicing concerns about inflation and Japan's economic prospects, the pair began to rise again. Market sentiment was influenced by a decline in expectations for a BoJ policy change.

Final Thoughts

Waiting for the release of the U.S. Consumer Price Index data, market sentiments remain upbeat. Ultimately, this data will provide key insights into inflation patterns and the possible future course of US interest rates.

Higher expectations of a more aggressive tightening stance by the Federal Reserve could result from a stronger-than-expected inflation figure, which could further strengthen the US dollar.

On the other hand, there are persistent concerns about inflation and growth in the euro area due to sluggish economic fundamentals. The financial policy differences between the Federal Reserve and the European Central Bank (ECB) may lead to the euro's decline compared to the dollar. The ECB is also contemplating easing measures.

Under these circumstances, a more marked correction in EUR/USD might occur, with downside targets possibly centered around the current year's low of 1.0700 and previous lows in the 1.0500 zone observed in late 2023 or early 2025. For more information on the workings of the currency market, traders will be attentively observing statements made by central banks and the release of economic data.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.