US Dollar Strengthens Ahead of Key Inflation Data, Setting Stage for EUR/USD and USD/JPY Setups

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Amidst declining U.S. rates, the US dollar saw a modest rebound, reversing its recent downward trend and exhibiting resilience. The Fed Chair Powell made dovish comments last week that suggested possible policy easing, but traders' attention was diverted as they awaited the publication of important inflation data.

Mixed employment figures and Chairman Powell's cautious optimism led to conjecture that the Fed would start cutting rates earlier than expected. Although this sentiment put pressure on the dollar, there was still an opportunity for a possible rebound in light of the impending release of the U.S. Consumer Price Index (CPI) data.

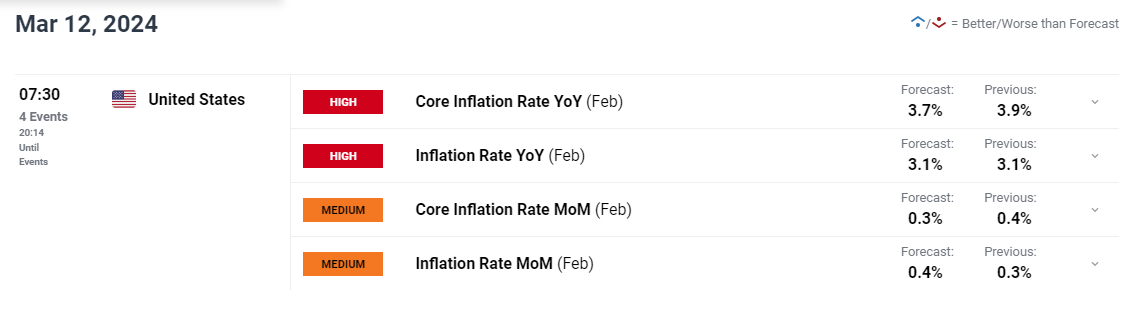

US CPI Data Key to Dollar's Direction

Market sentiment is expected to be greatly influenced by the impending CPI statistics, therefore traders are keeping a watchful eye on estimates for February's inflation numbers. Predictions indicate that the core index is expected to moderate somewhat to 3.7% annually, while the headline CPI is expected to remain unchanged at 3.1%.

A better-than-expected CPI number may cast doubt on the dovish narrative that is currently in place, which would strengthen the currency and cause rate cut expectations to be re-evaluated. On the other hand, a CPI number below consensus could confirm market predictions of impending rate cuts, which could drop bond yields and weaken the dollar even more.

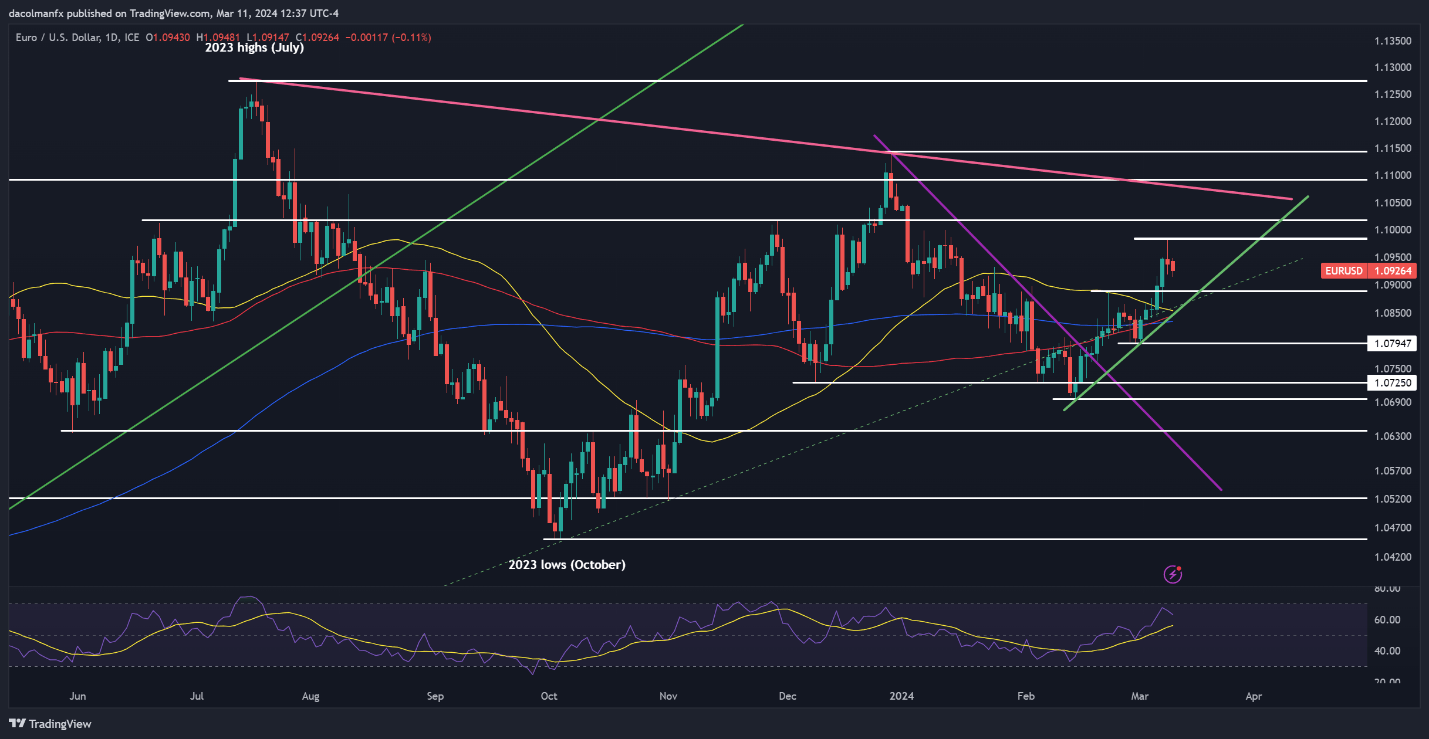

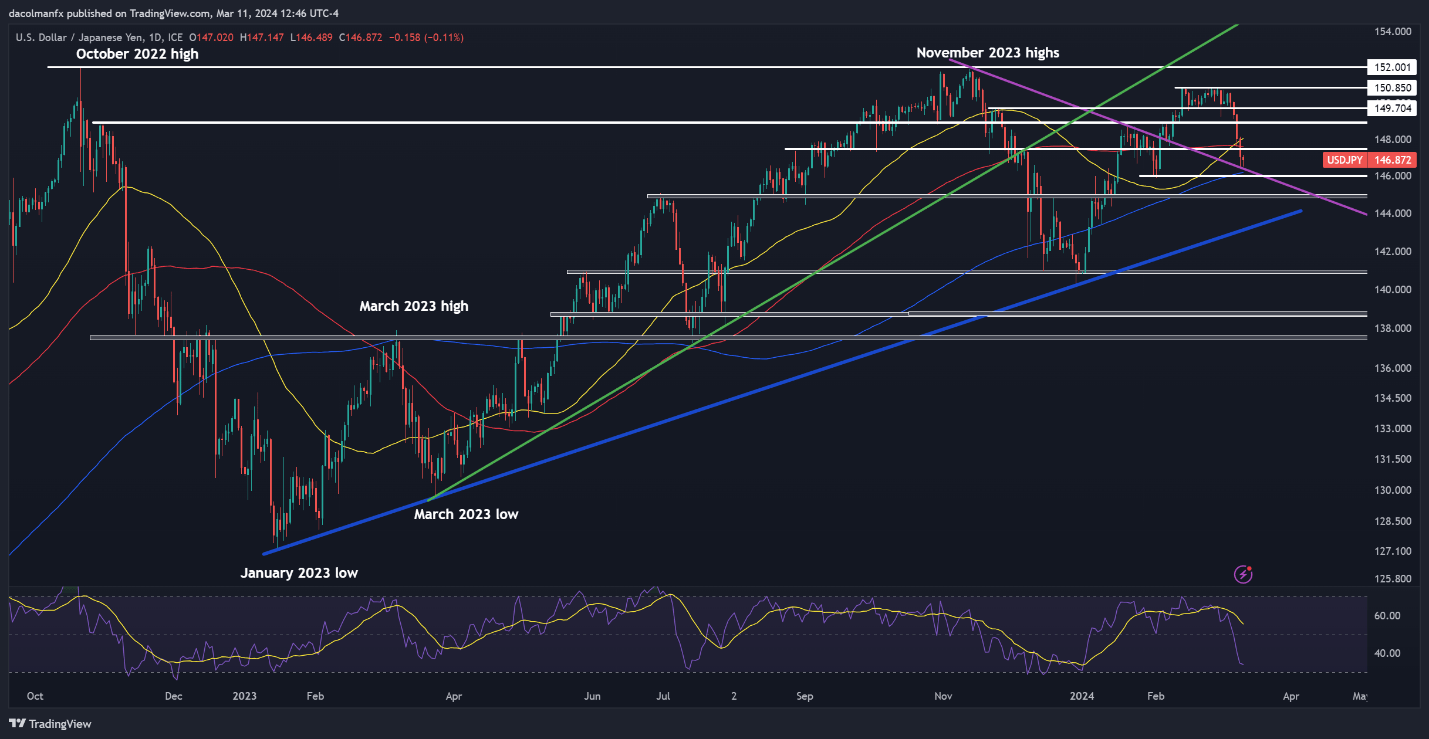

EUR/USD and USD/JPY Technical Outlook

The EUR/USD pair experienced a minor downturn on Monday, with support levels at 1.0890 and 1.0850 coming into sharp focus. With key resistance levels at 1.1020 and 1.1075, a rebound towards 1.0980 and beyond may result from a resurgence of buying pressure.

With further downside potential towards 145.00, the USD/JPY continued to fall approaching support at approximately 146.00. Resistance for a reversal can be found at 147.50 and 148.90, with upside goals at 149.70 and 150.90.

Final Thoughts

The US dollar's near-term trajectory is still unknown as the market waits for the CPI report. Although recent data suggest a bearish outlook, currency markets may experience considerable volatility if consensus CPI estimates differ. Traders must remain vigilant and modify their strategy accordingly in response to shifting market conditions.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.