US Dollar Set for Q2 Rally Amid Potential ECB Rate Cuts in 2025

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

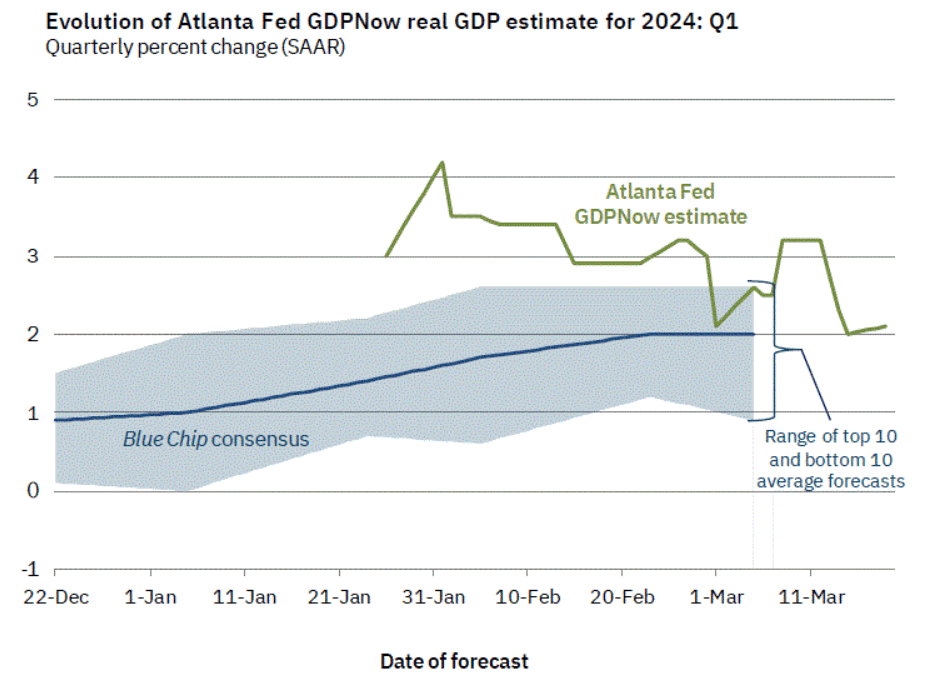

Despite moderate growth, the US economy remains stronger than its worldwide peers. The Atlanta Fed's GDPNow projection predicts 2.1% growth in Q1 2024, following a 3.2% increase in the previous quarter.

This result, which outperformed Europe's lackluster growth and the UK's technical recession, prepares the US dollar for a strong rally in the second quarter.

High activity levels and a strong labor market are expected to keep inflationary pressures high, implying that interest rates may remain high for an extended period.

Labor Market Resilience Demands Federal Reserve's Caution

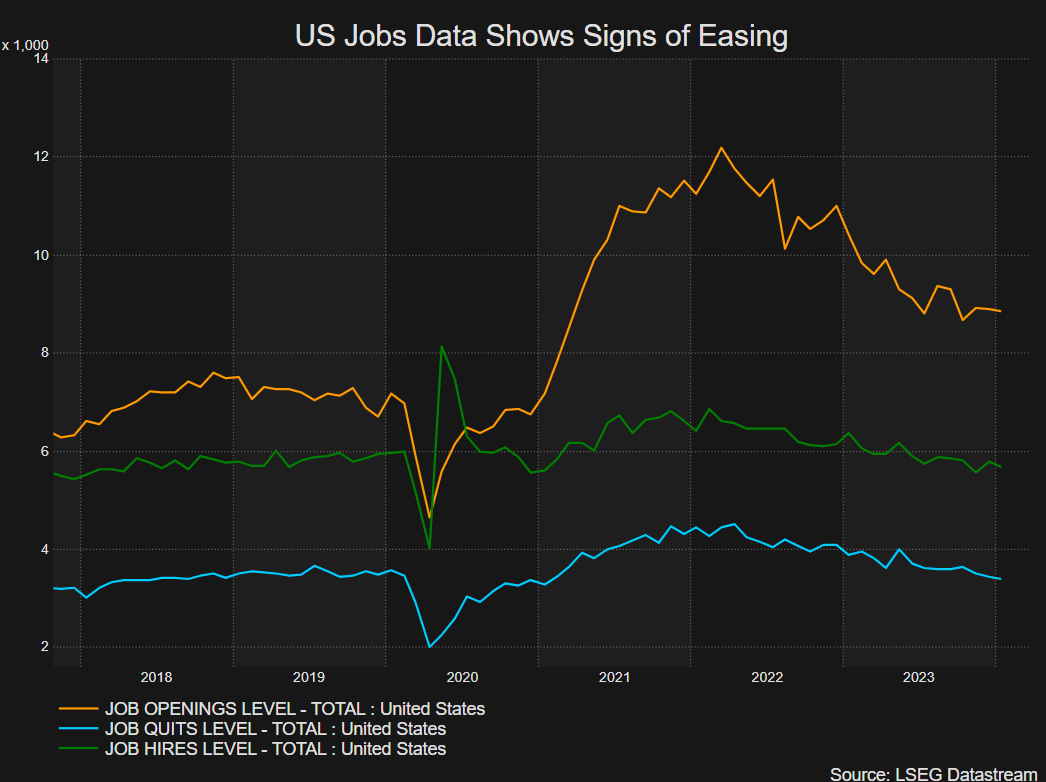

The Federal Reserve recognized the labor market's resiliency, boosting hopes for a ‘soft landing'. Employment numbers, particularly the increase of 229k and 275k jobs in January and February, demonstrate this strength.

Despite early signals of easing in the labor market, as evidenced by the JOLTs survey‘s findings of reduced job postings and hiring, the actual impact on employment figures remains limited for the time being, implying that the Fed will proceed cautiously with rate cuts.

Rate Cuts on the Horizon with Uncertain Timing

While the Fed has accepted the likelihood of rate cuts, the timeframe remains uncertain, with market forecasts pointing to mid-2024.

In contrast, given the European economy's stagnation, the European Central Bank (ECB) has indicated that rate cuts could begin as early as June.

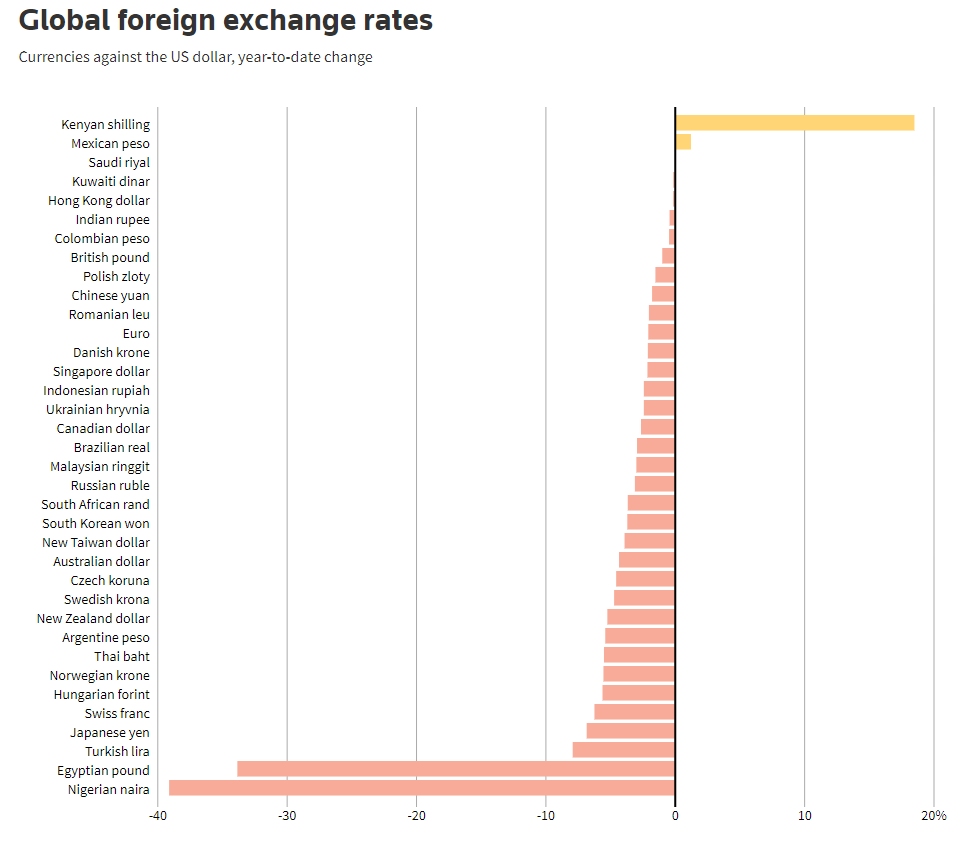

With the EUR/USD exchange rate substantially influencing the US dollar index (DXY), the ECB's monetary policy tweaks may boost the dollar's performance in Q2, particularly given the present interest rate differential favoring the US.

ECB’s Rate Cut Projections and Market Implications

Yannis Stournaras, an ECB Governing Council member, has indicated that up to four interest rate cuts totaling 100 basis points (bps) will be implemented by the end of 2024, which has ramifications for the EUR/USD pair.

This news has already put bearish pressure on the euro, emphasizing the importance of central bank policies on currency valuations.

Risks and Challenges: Economic Slowdown and Inflationary Trends

Inflation fears and the likelihood of an economic slowdown jeopardize the US dollar's optimistic outlook. Unexpected inflationary dynamics, as well as a strong labor market, call into question the justification for keeping interest rates high.

However, signals of economic weakness or a major drop in employment may encourage the Fed to explore rate cuts sooner to reduce recession risks.

Final Thoughts

The US dollar's trajectory in Q2 appears to be positive, underpinned by strong domestic economic indicators and a cautious Federal Reserve.

However, the developing global economic landscape, particularly the ECB's monetary policy tweaks, will have a significant impact on the dollar's performance.

Traders should be watchful, watching both domestic and international economic trends, to properly navigate any currency market volatility.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.