US Dollar Pauses Rally, Key Setups Identified

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

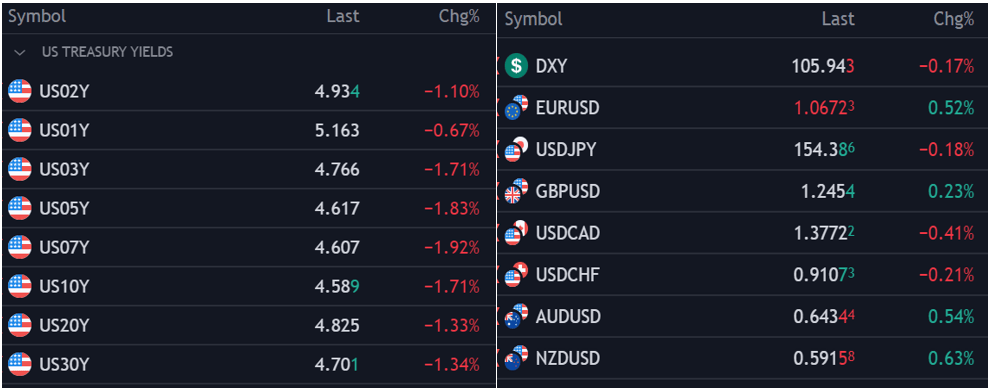

The US dollar, as measured by the DXY index, fell from multi-month highs on Wednesday, owing mostly to a drop in Treasury yields.

Despite this setback, the DXY is on the rise, encouraged by suggestions from top Fed officials that the easing cycle may be delayed. These signs follow previous months of strong economic data and inflation readings that exceeded expectations.

Hawkish Fed Stance Offers Support Amid Downward Momentum

The US Dollar Index (DXY) fell below 106.00 during the American session, signaling a pullback. However, bullish predictions about the Federal Reserve's hawkish stance may function as a buffer.

Despite Wednesday's negative movement, it is viewed as a mild correction in the face of favorable economic signs.

Positive Economic Activity Amidst Fed's Hawkish Tone

Since late February, the Fed's Beige Book has suggested a small economic uptick. Powell's hawkish tone highlights the Fed's reliance on data and suggests a delayed monetary policy shift.

Bullish Momentum Despite Overbought Conditions

On the technical front, the DXY's Relative Strength Index (RSI) indicates overbought conditions, which could foreshadow a correction or consolidation.

However, its position above significant Simple Moving Averages (SMAs) indicates bullish dominance, which supports a favorable medium- to long-term forecast.

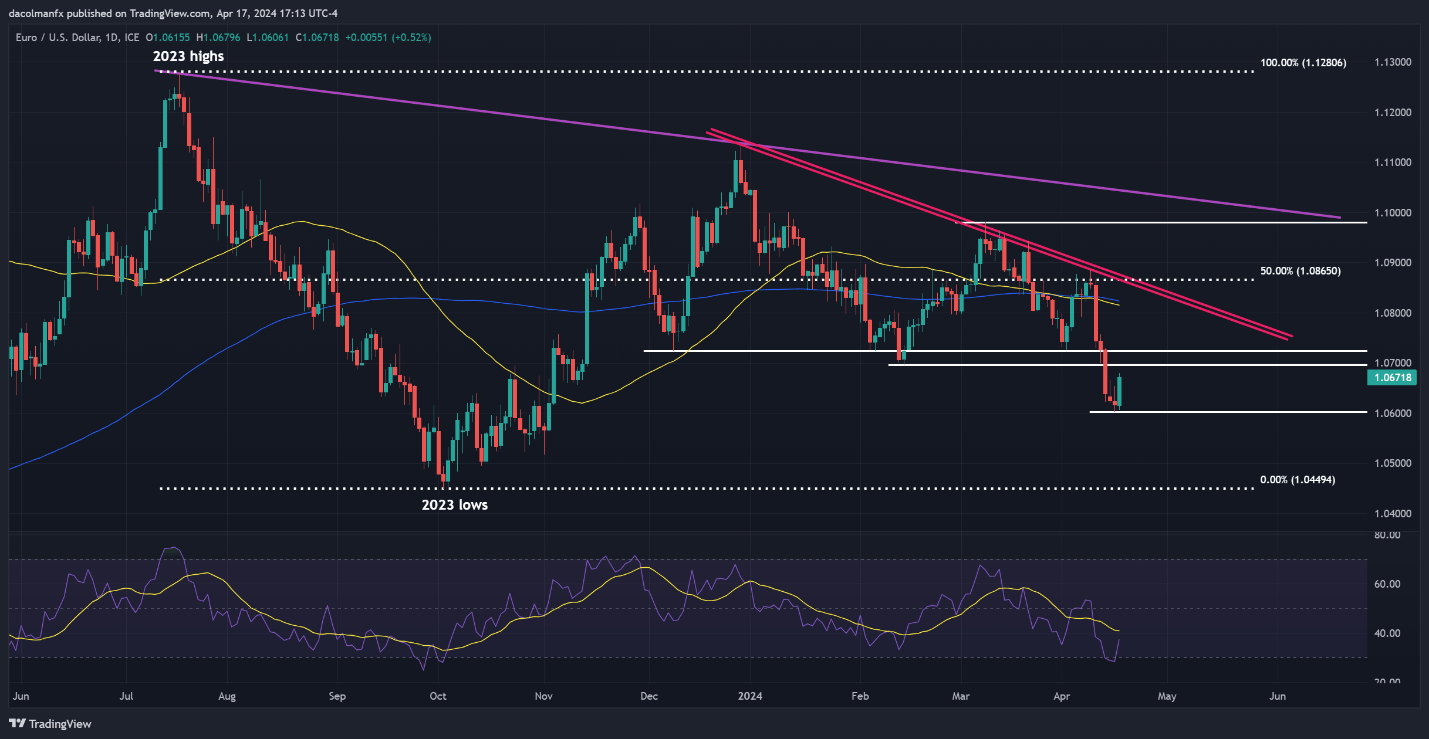

EUR/USD Technical Outlook

EUR/USD held near the psychological barrier of 1.0600 before recovering past 1.0650. Resistance levels are at 1.0695 and 1.0725, while support is at 1.0600, which is essential for mitigating bearish pressure.

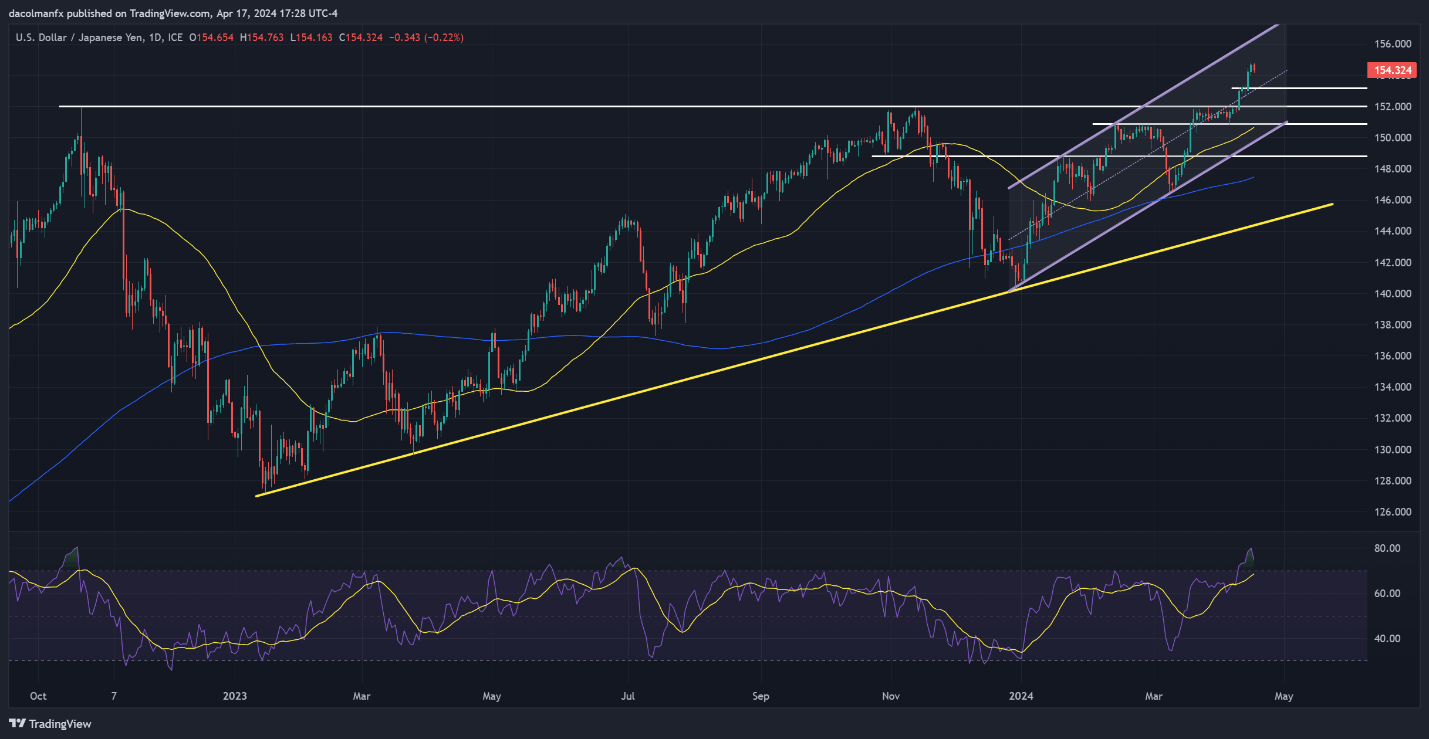

USD/JPY Technical Outlook

USD/JPY fell off multidecade highs, with support at 153.20 and 152.00. Resistance levels are at 154.78 and 156.00, however caution is advised owing to overbought conditions and possible FX intervention by Japan.

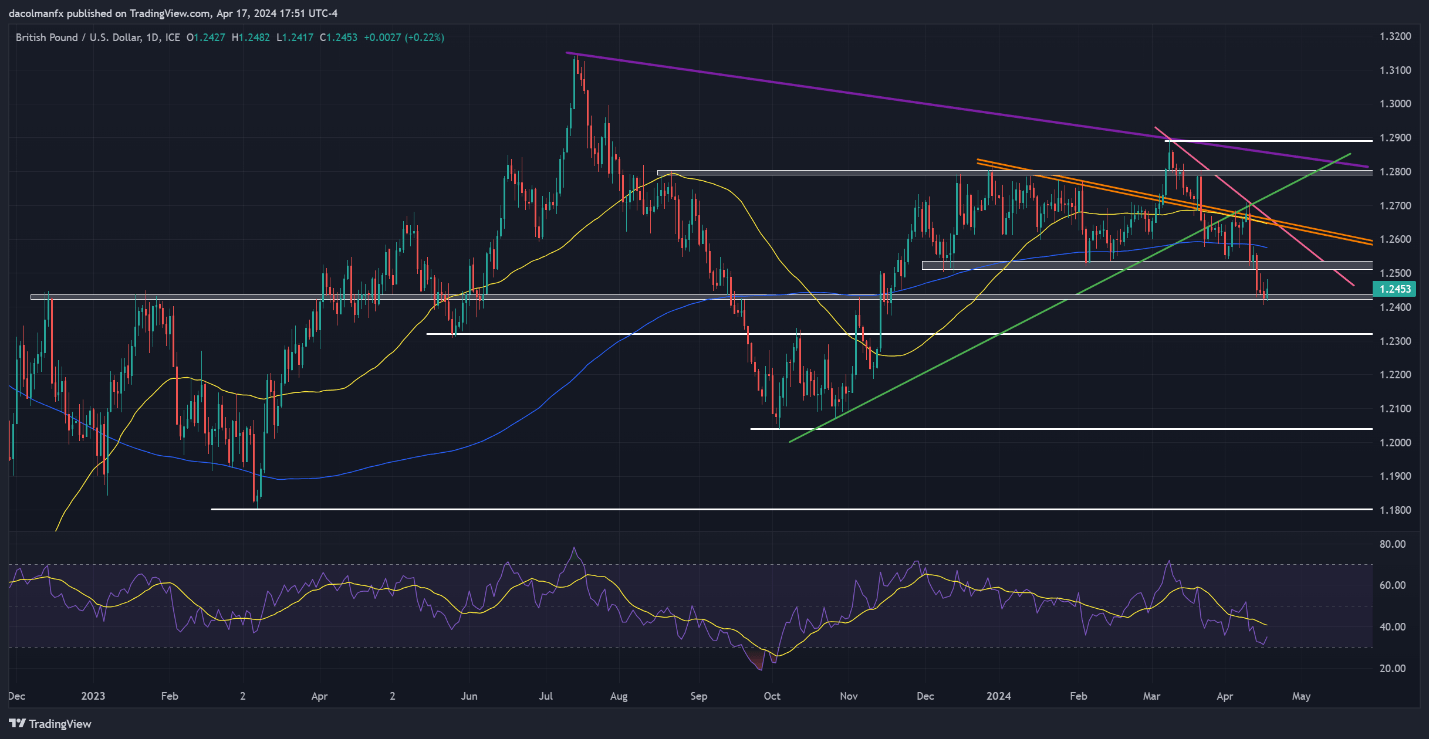

GBP/USD Technical Forecast

GBP/USD rallied from support at 1.2430, with resistance at 1.2525 and 1.2575. The pair's action shows a moderate rebound, with more upside potential if it breaks through resistance levels.

However, failure to break through resistance could lead to a consolidation phase or a fresh slump. Bulls must keep support at 1.2430 to avoid more losses and preserve bullish momentum.

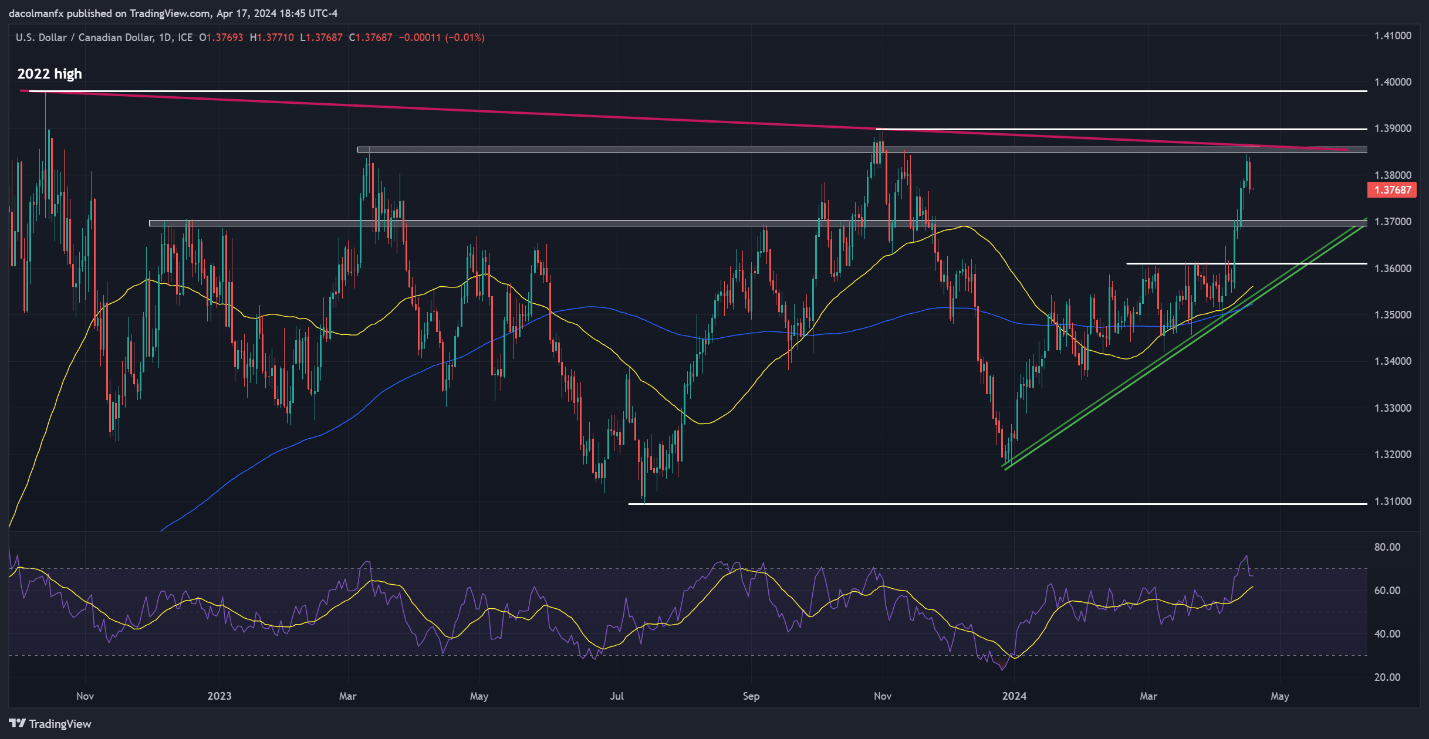

USD/CAD Technical Forecast

USD/CAD failed to break over confluence resistance at 1.3850, causing a pullback towards support at 1.3765. The pair's failure to break through resistance indicates underlying selling pressure, with further downside possible if support levels are breached.

However, if bulls recover control and drive prices higher, the initial resistance is at 1.3850, followed by the psychological threshold of 1.3900. Traders should keep an eye on price behavior near these critical levels for possible trading opportunities.

Final Thoughts

The US dollar's advance has paused, coinciding with technical setups across major pairings, providing traders with opportunities within market dynamics. Despite setbacks, the dollar's upward trend remains intact, bolstered by fundamental and technical indications.

Traders should be vigilant, taking into account both short-term volatility and long-term patterns in their trading methods. As geopolitical and economic issues shift, remaining aware and adaptive will be critical in navigating the volatile currency market landscape.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.