US Dollar Outlook: Key Economic Reports on the Horizon

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

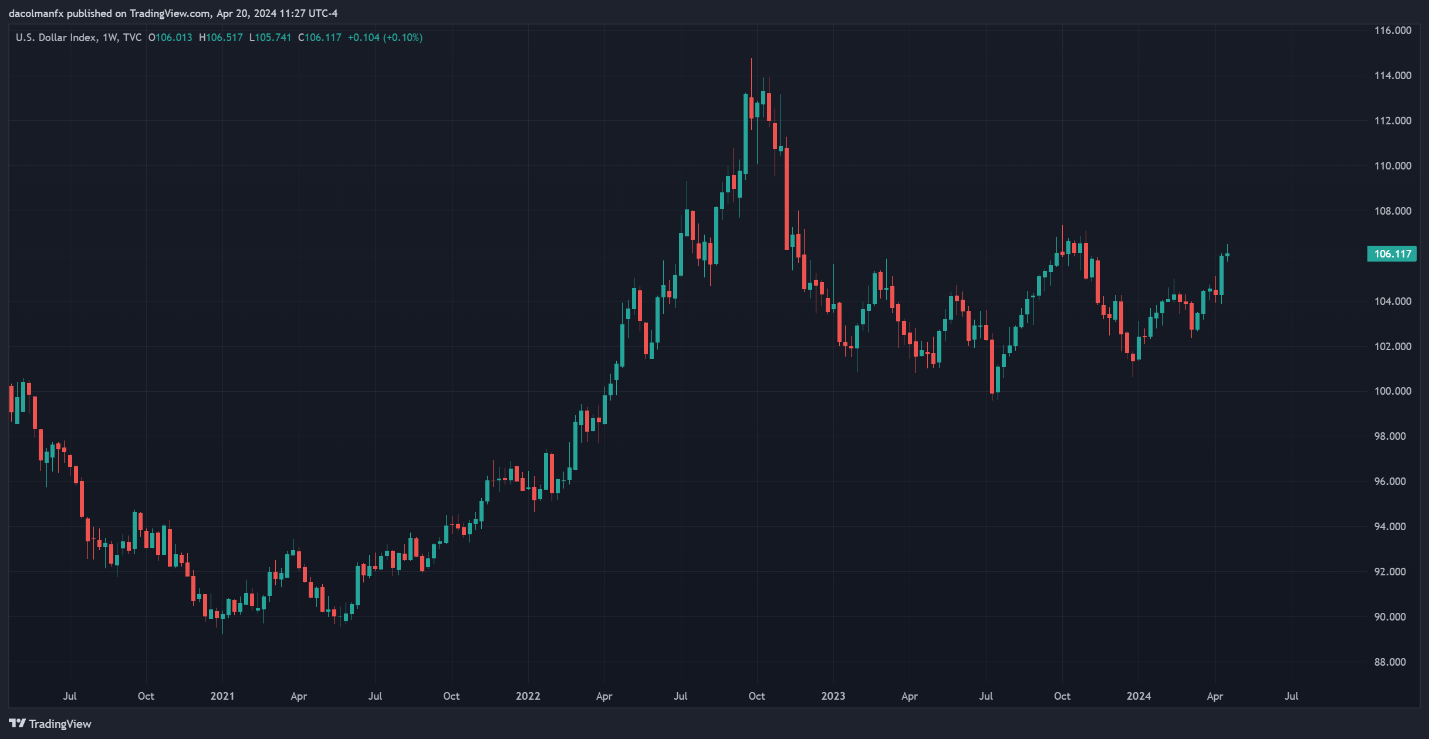

Last week, the US Dollar Index (DXD) reached multi-month highs, driven by increasing speculation that the Federal Reserve might delay easing its monetary policy. Factors such as a tight labor market and sustained inflation have dampened hopes for significant rate cuts later this year. Consequently, Treasury yields have surged, with the 2-year note nearing the critical 5.0% mark.

US Dollar Index Weekly Overview

Key Economic Indicators This Week

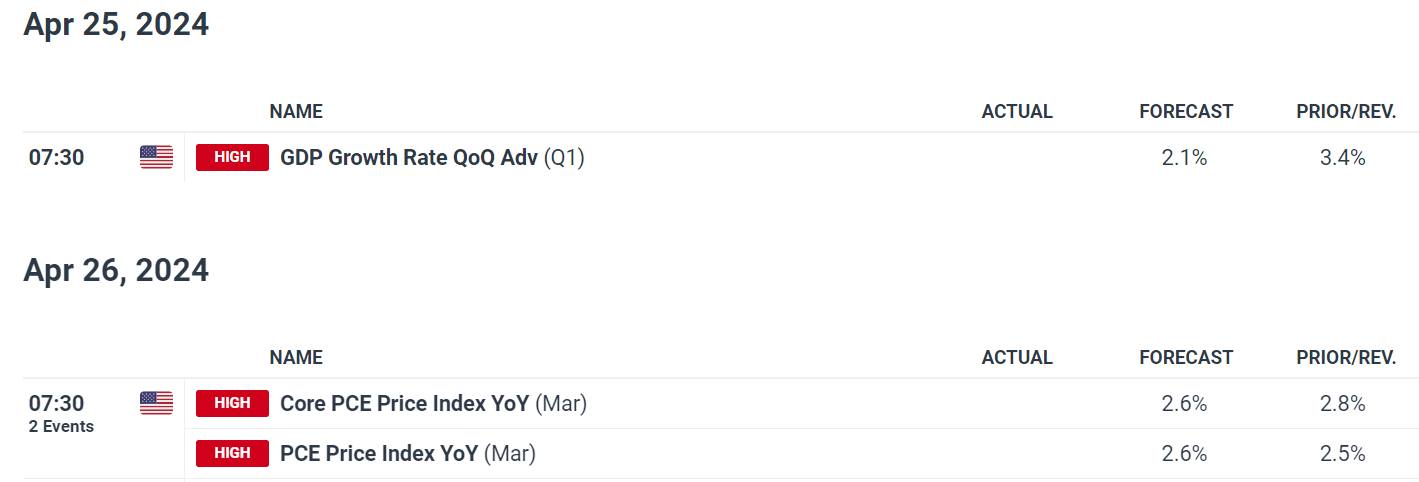

Investors are closely watching upcoming economic reports that could influence the US dollar's trajectory. Notably, the US GDP for the first quarter and the March Core PCE deflator, the Fed's preferred inflation gauge, are set to be released on Thursday and Friday, respectively.

Recent data, including strong retail sales and CPI and PPI figures, suggest that these reports might exceed expectations. Although forecasts indicate a slowdown in Q1 GDP growth to 2.1% from 3.4% in the previous quarter, this rate still exceeds the expected output and could hint at inflationary pressures.

The Core PCE is projected to rise by 0.3% month-over-month, with the annual figure adjusting to 2.6% from 2.8%, signaling persistent inflationary pressures despite the slight decrease.

Forecast of US Data Releases

Should the actual data exceed forecasts, it would likely confirm the economy's robust performance and the ongoing challenge of controlling inflation. This scenario could lead investors to anticipate a delayed and less aggressive rate-cutting cycle by the Fed, potentially driving interest rates higher for an extended period and supporting the dollar's strength.

Conclusion

Overall, the US dollar's outlook remains favorable. The unfolding economic landscape suggests the Federal Reserve may adopt a cautious approach to its monetary policy, prioritizing the fight against persistent inflation. This approach, coupled with a potential policy shift towards easing by the ECB and BoE, further bolsters the dollar's prospects for sustained gains.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.