US Dollar Drops Amid Powell’s Cautious Remarks and Weak Data

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Economic Data Underwhelms

A combination of weaker-than-expected economic data and dovish comments from Federal Reserve Chair Jerome Powell caused the U.S. dollar to decline.

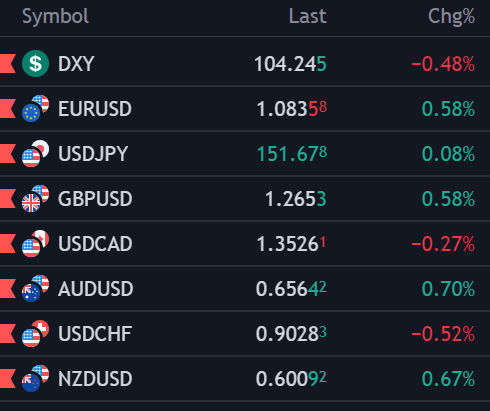

With a 0.48% decline, the DXY index—which gauges the strength of the dollar relative to a basket of currencies—moved away from its recent multi-month highs.

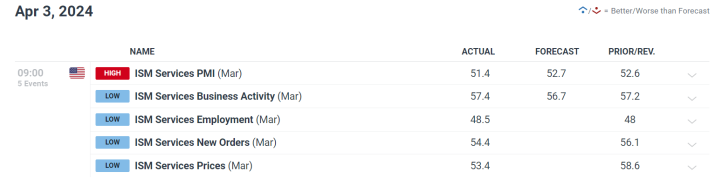

The weak March ISM Services PMI, which signaled a slowdown in the services sector—a vital part of the US GDP—was a major contributing factor to this fall.

Powell's Cautious Approach

Despite market expectations for easing in 2024, Jerome Powell emphasized the Federal Reserve's continued cautious approach to rate cuts in an address at the Stanford Business, Government, and Society Forum.

Powell underlined that before considering rate changes, there must be more convincing proof that inflation is headed toward the Fed's 2% target.

His remarks demonstrate his unwavering commitment to striking a balance between the dangers of premature rate cuts and those of an overly restrictive monetary policy.

Focus on Labor Market Data

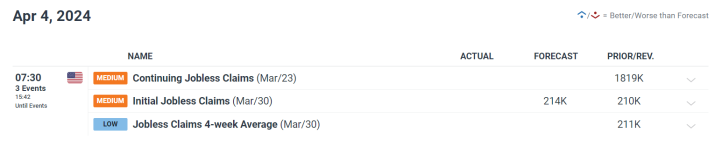

The next nonfarm payrolls report and the U.S. unemployment claims data will now be the focus of attention as they are widely watched for clues about the state of the labor market in the United States.

Initial jobless claims are expected to show a minor increase for the week ending March 30.

These numbers are very important since they provide direct information about the state of the labor market and, consequently, about any changes to the Federal Reserve's monetary policy.

Technical and Market Perspectives

If the current losses in the U.S. dollar index persist, support may be found at the 104.00 level, which is indicated by the intersection of the 50% Fibonacci retracement and a short-term ascending trendline.

On the other hand, a bullish market reversal would come from the psychological 105.00 level.

Market participants continue to pay close attention to these technical levels, adjusting their plans in response to statements about policy and possible changes in market sentiment.

Fed Officials Echo Powell's Sentiment

Powell's cautious stance was repeated by other Federal Reserve officials, such as Raphael Bostic, President of the Atlanta Fed, who said that any rate cuts would probably wait until the fourth quarter of 2025.

All Fed members agree that data-driven policymaking is critical, with inflation and labor market dynamics playing a major role in influencing future decisions.

Final Thoughts

Traders must comprehend the complicated relationships between labor market data, inflation, and Federal Reserve policy decisions as they navigate the current economic landscape.

Recent statements by Jerome Powell and depressing economic data highlight the careful balance that the Fed aims to keep.

To effectively react to market swings, traders need to be alert as new data becomes available and incorporate technical analysis and macroeconomic factors into their tactics.

In the upcoming months, the trajectory of the US dollar and market expectations will be greatly influenced by the Fed's remarks and the changing economic indicators.

The trading community will be intently observing these developments to assess the possible impact on currency markets and wider financial landscapes, as important labor and inflation data are about to be released.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.