US Dollar Dips Ahead of Jobs Data; Eyes on EUR/USD, GBP/USD, USD/CAD, USD/JPY

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Dollar's Retreat from Peaks

The DXY index dropped by 0.2% to 104.75 on Tuesday, retreating from a five-month high, reflecting the weakening of the US dollar.

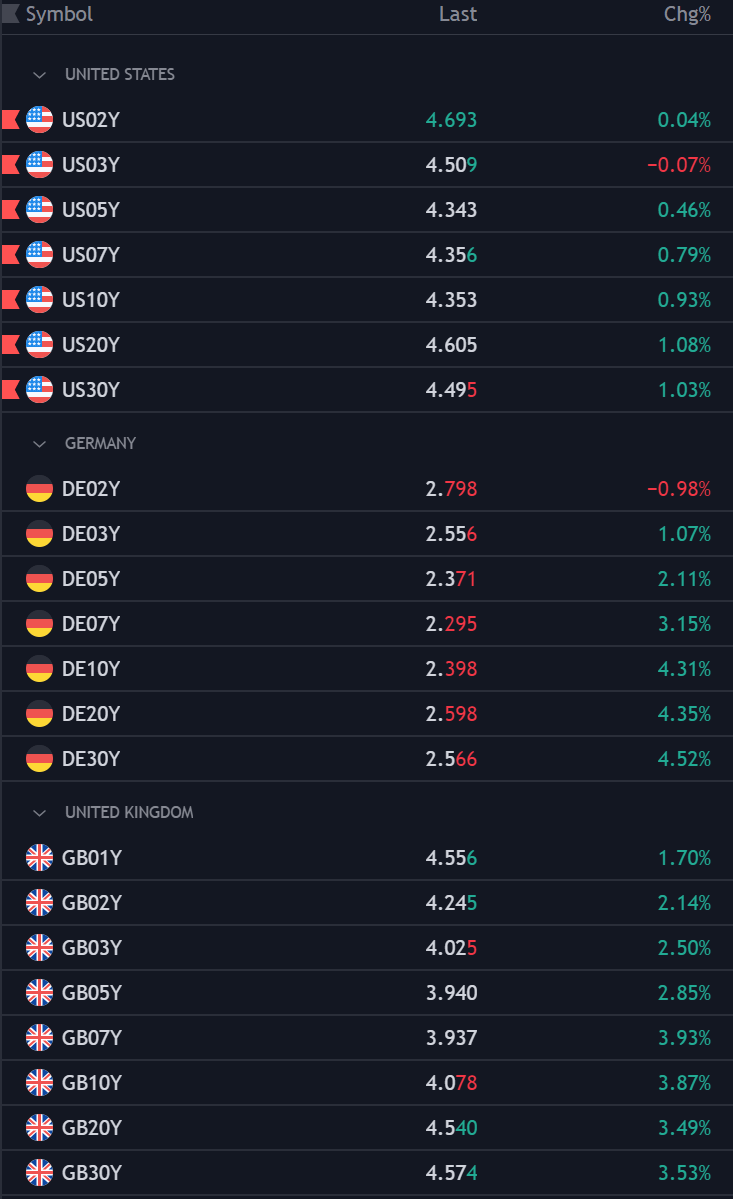

The dollar failed to benefit from an increase in government rates despite a more notable gain in global yields, particularly those from Germany and the UK.

This movement highlights the competitive nature of global financial markets by catching up to the current dynamics of the Treasury market.

Anticipation Builds Around Nonfarm Payrolls

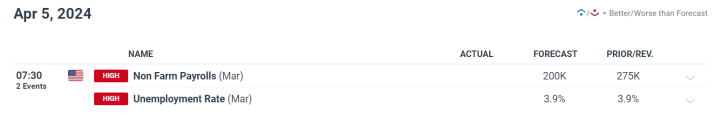

All eyes are now on the U.S. economic events that are coming up, most notably the nonfarm payrolls for March, which are expected this Friday. The Federal Reserve's monetary policy may be influenced by this important report.

200,000 new jobs were added last month, according to analysts, keeping the unemployment rate at 3.9%. The market is alert for potential surprises that might affect the Fed's policy on interest rates in 2024, given the current patterns of job growth exceeding forecasts.

EUR/USD Analysis

Key moving averages converge at 1.0800 and 1.0835, which could provide resistance for EUR/USD after recovery from the key support level at 1.0725.

In a bullish scenario, the pair would aim for these levels, but in a bearish market, it might drop below 1.0700 and 1.0640. This fluctuation follows the Euro Area Manufacturing PMI, which beat forecasts by a small margin and demonstrated resilience.

USD/JPY Analysis

As the USD/JPY trades close to the 152.00 resistance, it is still being monitored closely. If this level is broken, the Japanese government might step in, which might spark a swift correction.

In contrast, should this hurdle not be overcome, the pair may retreat in the direction of the 50-day simple moving average, which is located around 149.75. BoJ interventions have market participants on edge, which makes trading this pair require even more caution.

USD/CAD Analysis

Bullish indicators are present in the USD/CAD pair, which is still above key moving averages and a December trendline that provides support. 1.3695 is the target for additional gains, with resistance located at 1.3600.

Support for the downside is located between 1.3510 and 1.3480, which is necessary to keep the market optimistic. The technical position of USD/CAD indicates possible upward momentum, despite flat performance in the face of strong commodity markets.

GBP/USD Analysis

The GBP/USD pair has remained resilient, boosted by strong UK Manufacturing PMI data, which rose to 50.3 in March from 47.5 in February, exceeding analyst expectations.

This upward momentum suggests that the pair may try higher levels, with an immediate focus on breaking the 1.2600 barrier. A successful breach here could pave the way for resistance testing between 1.2650 and 1.2685.

The pound's strength against the dollar will most likely depend on sustained economic indicators surpassing forecasts, as well as market sentiment toward monetary policy tweaks by both the Bank of England and the Federal Reserve.

Economic Indicators and Market Reactions

While factory orders increased by 1.4% in February, in line with predictions, the JOLTs Job Openings data for the same month showed no change at 8.75 million.

Based on this data, it appears that traders are being cautious and may be taking gains close to recent highs. The Manufacturing PMI for the Euro Area performed better than anticipated in March, falling somewhat to 46.1 from a predicted decline of 45.7.

Comparably, the Manufacturing PMI for the UK showed growth, hitting 50.3 in March. These data, which show manufacturing sectors' resilience in the face of wider economic worries, indicate a small recovery in the EUR/USD and GBP/USD exchange rates.

Final Thoughts

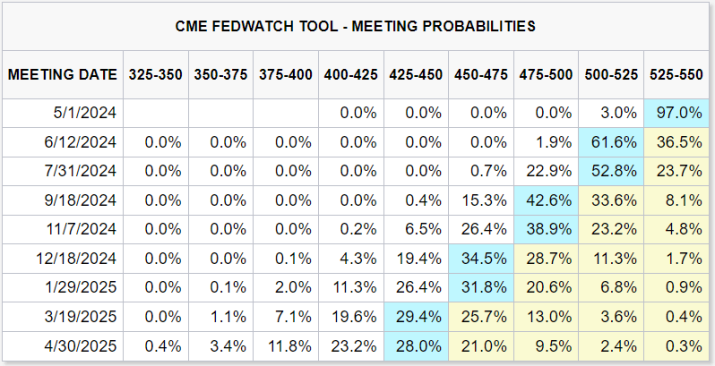

The trajectory of the US dollar is still strongly influenced by central bank signals and upcoming economic reports as traders maneuver around these events.

An important event that could support or contradict the current monetary policy view is the impending nonfarm payroll report.

Because the global currency market is responding to these subtle signals, traders and investors need to be on the lookout and base their decisions on technical-level analysis and economic fundamentals.

For market players, the coming days will be critical as the relative risk and opportunity in currency pairs such as EUR/USD, GBP/USD, USD/CAD, and USD/JPY will depend on these changing economic narratives.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.