Upgrade Personal Loan Reviews: Compare Top Lenders of 2025

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

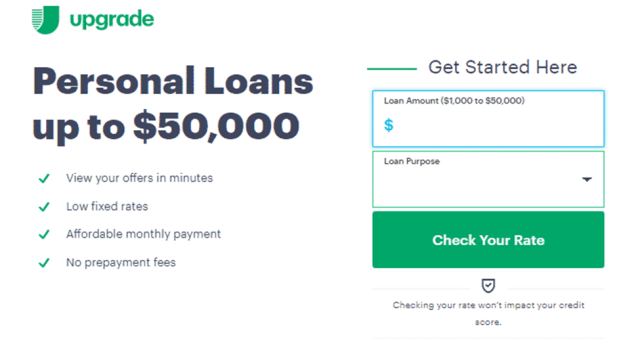

Intend Upgrade personal loans for a wide variety of credit ratings and incomes. The lender distinguishes itself with rate discounts for having debt consolidation loan payments. You can send it directly to creditors. It also offers secured and combined loans, quick funding, and various repayment arrangements.

An upgrade is a Consumer Financial Protection Bureau-accredited firm with an A+ rating from the BBB. It is a non-profit organization dedicated to consumer protection and trust.

The BBB assesses businesses by looking at how they respond to customer complaints and how honest they are in their advertising. Moreover, how transparent they are about their business processes. Let's take a detailed look!

Overview: Upgrade Personal Loan Review

| Card | Best For | Fee & Credit | More Details |

|---|---|---|---|

| Best For Less Perfect Credit | APR: 5.94 - 35.47% • Loan Amount: $1,000 - $50,000 • Loan Term: 2 to 7 years |  |

What is Upgrade Personal Loan?

Upgrade personal loans are designed to provide people with loans to start up their business and do something good. There are vast opportunities for genuine people who want to avail of a loan within the flexible return.

The lender differentiates itself with rate discounts which are best for having payments sent directly to creditors' loans. It also boasts secured and joint loan offerings, reasonably fast funding, and a wide range of repayment terms.

With an upgrade, you can easily apply for loans. You can avail of two categories of loans through this platform: personal loans and business loans.

With personal loans, you have the facility to visit their site and select the perfect return policy that might be best for you. Upgrade provides 10,000$ to 100,000 personal loan availabilities with the repayment range from 24 to 84 months.

What other Loans Offered by Upgrade?

The loans furnished by Upgrade are for individuals who have excellent or good credit. These loans are mostly unsecured. However, secured loans are available in some cases. These loans come in use for different purposes; though, not limited to:

- Home renovations

- Relocation costs

- Debt consolidation

- Major purposes

- Medical expenses

- Expanding or starting businesses

Although the loans aren't used to gamble, college expenses, investing, room or tuition and board.

How does Upgrade Personal Loan work?

One of the best features the Upgrade provides their customer is the flexible return policy with their account holders, which builds a vital trust cycle. Furthermore, they suggest that other businesses or personal family members trust their customers' upgrade process.

Upgrade's lending partners, Cross River Bank (Member FDIC) and Blue Ridge Bank, provide unsecured personal loans (Member FDIC). An unsecured and unauthorized personal loan does not need you to put up any type of collateral, such as a house or car. You can utilize a personal loan for a variety of reasons.

You should get your money within one business day after applying and have your loan authorized. With an Upgrade loan, you won't have to pay a prepayment penalty. You will have to pay an origination cost of 2.90 percent to 8%. If the lender doesn't receive your payment in full within 15 days of the due date, a charge of up to $10 will be accountable.

Depending on your needs, you can email the company's customer care account for assistance. You can also call from 6:00 a.m. to 6:00 p.m., Monday through Friday. Till 6 p.m. PT, or from 6:00 a.m. on weekends. From 5:00 p.m. to 5:00 p.m. PT.

What are the Features of Upgrade Personal Loan?

The following are some of the outstanding characteristics of Upgrade:

Autopay:

There is no information available. Moreover, review your loan options and disclosures after completing the loan pre-qualification form. It will help take benefit of the following discount and find out how much it will cut your rate.

Checking for Rewards:

When you register for a personal loan or credit card through Upgrade, you may be eligible for a rate up to 20% cheaper. Besides this, If you create an Upgrade Rewards Checking account.

Joint Applications

The Upgrade allows you to apply for a loan with a friend or family member. It allows you to qualify for more money or a lower interest rate than you could on your own.

The company will consider both you and the joint applicant's credit profiles, and you will both be responsible for repaying the loan. Select the “joint application” option to apply with another individual within the pre-qualification form.

Secured Loans

Upgrade may contact you after you complete your application to discuss the possibility of obtaining a personal loan.

These personal loans, known as secured auto loans, use your automobile as collateral. If you choose a secured loan over an unsecured personal loan, you may be able to acquire a higher loan amount. Furthermore, there is a cheaper interest rate.

Customer Experience

Upgrade received high rankings for an online application procedure and customer service available by phone seven days a week.

It also features a mobile application that enables borrowers to manage their loan payments. You will find ratings by Android and iPhone customers.

Upgrade Personal Loans Requirement?

Upgrade offers can also be availed to verify that you are not going to skip the process of giving back the payment. Otherwise, all is really good and flexible with the Upgrade. Upgrade does not include service borrowers in Iowa or West Virginia, so you won't be able to receive a personal loan in all 50 states.

Upgrade lists common reasons for taking out a personal loan on its home page. Credit card debt consolidation, home improvement, major purchases, and debt consolidation.

To apply, you must satisfy the following requirements:

- Be a US citizen or permanent resident, or have a valid visa to enter the US.

- You must be a minimum be of 18 years old (19 years old in Alabama)

- Have a bank account that you can verify.

How to Apply for Upgrade Personal Loans?

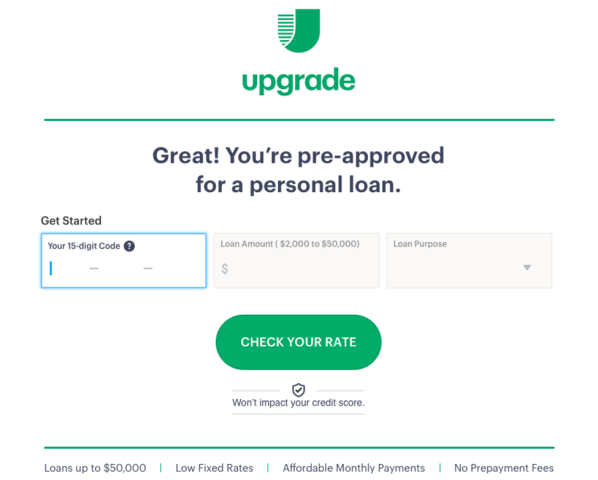

Prequalifying for a personal loan, completing a formal application, and waiting for loan approval are all common steps in the process. To apply for an Upgrade personal loan, follow these steps:

Check your rate.

Like many of its rivals, Upgrade has an online pre-qualification procedure that has no impact on your credit score. To find out what APR you'll get, enter the amount you want to borrow. It includes the reason for the loan, and your details. They will ask you if you want to submit an individual or joint application at this stage.

Submit a formal application.

When you are ready to apply for a loan, go online and fill out a formal application. This entails supplying evidence such as recent pay stubs and bank statements. In addition to this, giving a form of government-issued identification is a must.

You may monitor the procedure of your application after you've submitted all of the required documentation. You'll also get email updates on the status of your application.

Accept an offer.

You can accept and submit your bank information if you receive a loan offer that suits your criteria. Upgrade will run a soft credit inquiry at this time, but it will not appear on your credit record.

Await funds.

Upgrade does a rigorous credit investigation to validate your creditworthiness when your loan is authorized. This will appear on your credit history and may result in a temporary reduction in your credit score. After approval, cash for an upgrade personal loan is usually accessible within four business days. However, the actual duration depends on the bank institution receiving the funds.

Start making payments.

The first payment on a personal loan is due 30 days after the funds are released. You can make the following transaction automatically from the bank account. That's because you can specify during the application process, although it is possible to update it using the online account dashboard.

Although payments are due on the same day each month, Upgrade allows you to pick a payment date that fits your budget.

How much does Upgrade Personal Loan Cost?

Let's talk about the cost in detail!

- The loans are accessible between 5.94%-35.97% APRs. These are fixed rates. Therefore they don't expand the life of the loan. The APR of the borrowers depends upon the loan term, credit usage history, and credit score, including some other factors.

- To obtain the lowest rates available, the qualified borrowers should sign up for auto-payment and directly pay off other remarkable debt.

- Origination fees. The origination fees of all the loans are the same, from 2.9% to 8%. The loan proceeds then subtract the expenses.

- Late fees. A borrower's payment, which is over 15 days, is a fee for late payment of about 10 dollars per late payment.

- Prepayment penalties. The borrowers of Upgrade are free to pay off loans early with no increase in the overall fees of a loan.

- Title transfer fee. A personal price secured through a vehicle can require static title transfer charges. The government fee, calculated through a relevant domestic vehicle agency; as a result, Upgrade doesn't get funds.

- Insufficient funds fees. Likewise, all the borrowers from Upgrade have to pay non-refundable 10 dollars charges if the payment fails to go by properly.

Who is Upgrade Personal Loan Best For?

Upgrade personal loans are available the rates starting from just $1,000 to $50,000, which gives it a lead to be known as small loan providers. They also want to invest their money in small businesses. The Upgrade is an excellent choice for people looking for loans with bad credit options.

Generally, the payday loans and other minimum credit score features satisfy maximum borrowers with an effective origination fee and reliability. The credit bureaus offer effective loans for bad credit and credit check features to provide users with an excellent experience.

Upgrade Personal Loan Pros and Cons

| 👍 PROS |

|---|

► Quick loan disbursement Upgrade can transfer your money in as little as one business day after you approve the application. But wait! Some lenders might take many days to disburse loan cash. ► Secured loans available Upgrade now provides secured personal loans in addition to unsecured personal loans. Upgrade may offer you the choice of a secured personal loan to increase your chances of qualifying. ► A wide choice of loan amounts and payback terms Upgrade provides loans ranging from $1,000 to $50,000 to its customers. You may also pick a payback period between 24 and 84 months, which is convenient for individuals who want to be flexible. |

| 👎 CONS |

|---|

► Charges origination costs Upgrade's origination fee is a major disadvantage. It is because some online lenders don't charge application or origination fees. This cost, which may be as high as 8%, is withheld from your loan proceeds before it is disbursed. ► The Upgrade isn't a direct lender You'll apply for a loan through Upgrade, but the firm isn't the one who issues the loan. Instead, Cross River Bank and Blue Ridge Bank, Upgrade's lending partners, give personal loans. |

Upgrade Personal Loan Compared to other Lenders

| Lender | Est. APR | Loan Amount | Loan Term | Min. Credit Score |

|---|---|---|---|---|

| Upgrade | 5.94 - 35.47% | $1,000 - $50,000 | 2 to 7 years | 560 |

| SoFi | 12.99% - 24.99% variable | $5,000 – $100,000 | 2 to 7 years | 680 |

| LightStream | 2.49% – 19.99% | $5,000 – $100,000 | 2 to 7 years | 660 |

| PayOff | 5.99% – 24.99% | $5,00 - $40,000 | 2 to 5 years | 680 |

Upgrade Loan vs. SoFi

Upgrade personal loans are designed to provide people with loans to start up their business and do something good. Sofi's best personal loans for excellent credit are competitive with other borrowers with outstanding credit.

Upgrade personal loans are available the rates starting from just $1,000 to $50,000, which gives it a lead to be known as small loan providers. You can use SoFi loans for household, family, or personal uses; borrowers can receive funds in some days after they are approved.

With an Upgrade loan, you won't have to pay a prepayment penalty, but you will have to pay an origination cost of 2.90 percent to 8%. Sofi is one of the highest choices for a personal loan for potential borrowers, having excellent or good credit and having a free flow of money.

Upgrade Loan vs. LightStream

Upgrade offers can also be availed to verify that you are not going to skip the process of giving back the payment. A consumer lender provides unsecured best personal loans for excellent credit. LightStream enables the borrowers to choose when they receive money.

Upgrade personal loans are designed to provide people with loans to start up their business and do something good. Lightstream offers the customers a highly valuable credit history and minimum credit score with monthly payments to offer customers excellent benefits.

>> Read the Full Article: LightStream Personal Loan Reviews

Upgrade Loan vs. PayOff

Upgrade personal loans are available the rates starting from just $1,000 to $50,000, which gives it a lead to be known as small loan providers. Payoff offers personal loans on fixed rates to the borrowers exclusively to pay credit card debt.

Upgrade personal loans are designed to provide people with loans to start up their business and do something good. PayOff helps the borrowers focus on building credit by a loan through report payments to three major credit bureaus and providing free FICO score updates each month.

Final Verdict

If you need cash urgently, personal loans from Upgrade are a practical option. You can get a loan in only one day that comes in handy to cover unexpected costs. The borrowers who have less-than-seller credit become accessible to joint applicants and provide personal loans secured by the car. Choosing secured loans or adding joint applicants can increase the chance to qualify for a loan.

The customer reviews are usually powerful and highlight easy application processes and convenience. It also provides a rate discount from 1-5 points for the borrowers who receive debt consolidation loans and the lender directly paying other debts.

Such values are rare over personal loans, along with 5% points are heft slashes to the discounts provided by other lenders. Do you need loan early services within the bank processes? Upgrade loans offer fixed-rate loans with monthly payment and loan funds deposited.

This Upgrade personal loans review will help you know everything about loan funds, personal loan lenders, student loans, and fixed-rate personal loans. Moreover, this financial institution will let you know about interest rates, existing debt, verifiable bank account, and credit report.

Upgrade Loan FAQs

Is Upgrade com legitimate?

With effective rates, automatic payments, and Better Business Bureau rating, Upgrade is a safe and secured option for people with fair credit. Moreover, Anyone who wants a fair loan on practical terms will find UPgrade a top option.

What credit score do you need for Upgrade?

The minimum credit score requirement in Upgrade's personal loans is 560. that's beneficial for most lenders. The borrowers with bad credit will find Upgrade incredibly beneficial for different factors and loan costs. It has an effective loan application process with a designated account.

Does Upgrade loan affect credit score?

YES! An upgrade can affect the credit score. Whenever you check the rate for any personal loan, they perform an inquiry on the corresponding credit report. But wait! It won't affect the credit score. When you get a loan from Upgrade, a hard inquiry affects your credit score.

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.