The Euro (EUR/USD) Drifts Downward After the ECB Maintains All Policy Rates Unchanged

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

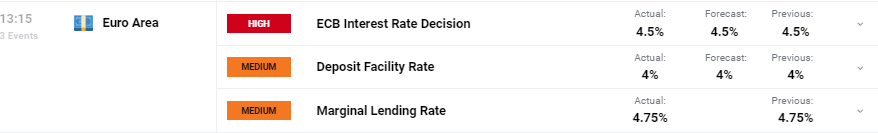

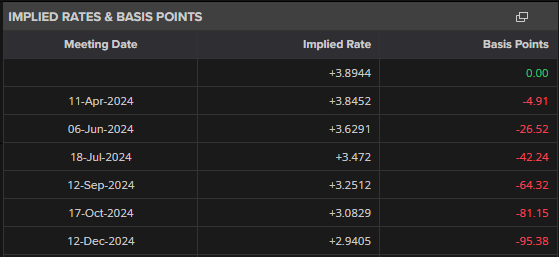

The European Central Bank in its latest meeting decided to keep all three key interest rates steady, as expected by the market. The central bank also changed its staff predictions for inflation and growth.

The ECB's updated staff forecasts now staff expect inflation to average 2.3% in 2025, 2.0% in 2025, and 1.9% in 2026. Inflation predictions, excluding energy and food, have been lowered down to 2.6% in 2025, 2.1% in 2025, and 2.0% in 2026.

Staff's growth projection for 2025 has been reduced to 0.6%, as economic activity is projected to remain weak in the short term. Staff predict the economy will start up and grow at 1.5% in 2025 and 1.6% in 2026, initially driven by consumption and later by investment.

ECB Monetary Policy Decision

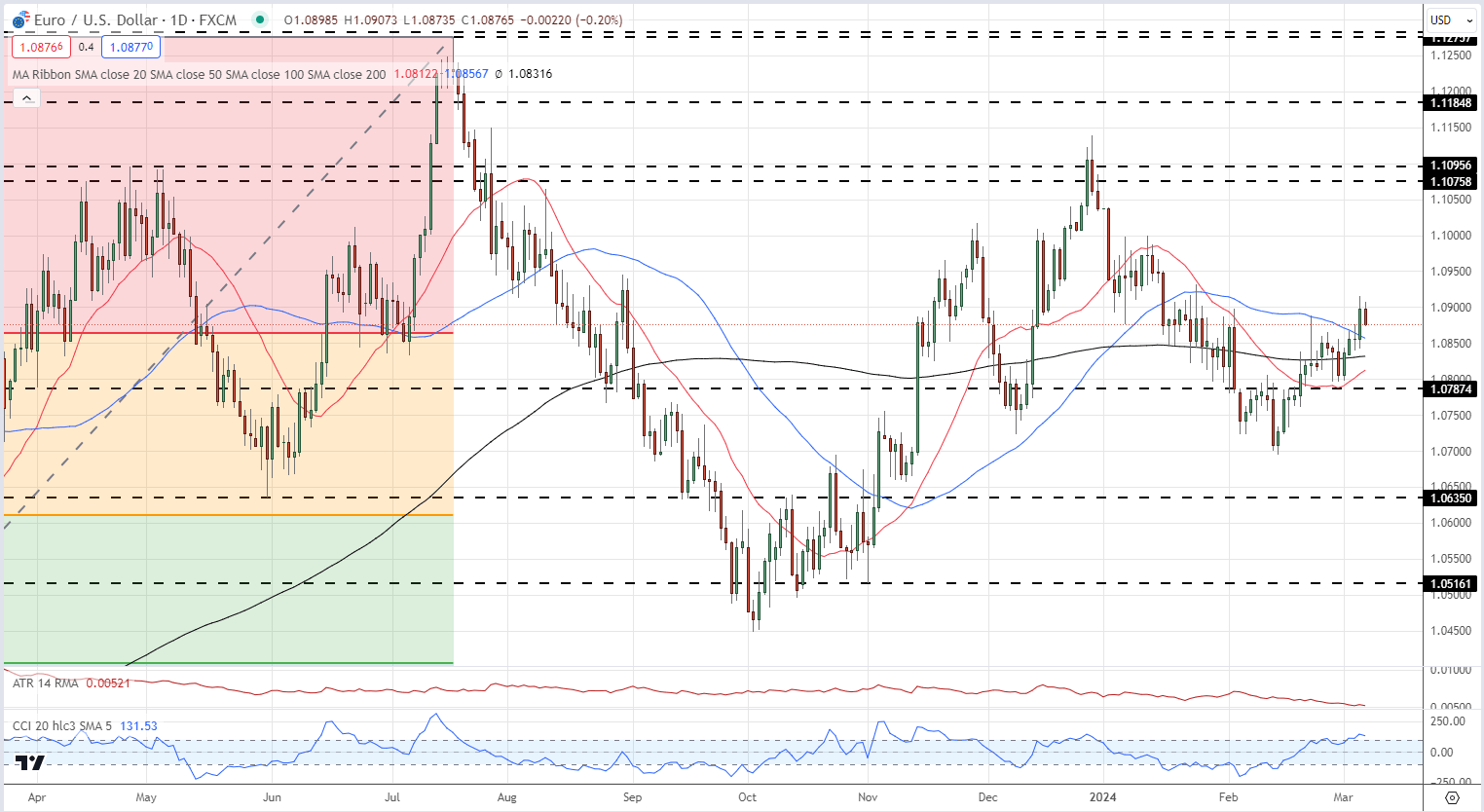

The market reaction to the ECB's policy decision and economic projections was relatively muted with EUR/USD falling slightly post-decision after testing and rejecting the 1.09 level yesterday and today. A cluster of recent highs and lows, as well as the 50- and 200-day simple moving averages, protect the path back down to 1.0800, while a confirmed break above 1.0900 brings 1.0950 and 1.1000 into sight.

EUR/USD Daily Price Chart

Technical analysis shows that the currency pair now hovers around a changing area, with a series of recent highs and lows forming a protective barrier. Retail trader data shows that 42.38% of traders are net-long, with a short-to-long ratio of 1.36 to 1.

The number of traders net-long is 1.91% lower than yesterday and 10.73% lower than last week, while the number of traders net-short is 4.39% higher than yesterday and 18.79% higher than last week.

Final Thoughts

The ECB's new monetary policy stance, together with altered economic estimates, suggests cautious optimism. While immediate economic prospects are limited, the medium-term forecast indicates a steady, albeit slow, recovery.

Traders and investors will most likely keep a close eye on future ECB communications and Eurozone economic indicators as they navigate the complex environment of Euro trading in the aftermath of the central bank's choices. We normally adopt a contrarian approach to crowd mood, and the fact that traders are net-short signals that EUR/USD prices may continue to climb.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.