Suzuki’s Yen Alert Ahead of Golden Week

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

UEDA, SUZUKI ADDRESS PARLIAMENT ON RATES AND THE STATE OF THE YEN

Bank of Japan Governor Kazuo Ueda and Minister of Finance Shunichi Suzuki provided updates to parliament regarding inflation, interest rates, and strategies to tackle yen weakness. Ueda hinted at possible rate hikes if inflation trends towards the 2% target, driven by factors like record wage growth and a weaker yen resulting in imported inflation. The market speculates on BoJ's move on Friday.

JAPAN, SOUTH KOREA, US TRILATERAL SUPPORT

Suzuki emphasized the recent trilateral meeting's significance, paving the way for Japan to take appropriate action in currency markets to address volatile yen movements not aligned with fundamentals. Golden Week holidays could create low liquidity, complicating potential interventions.

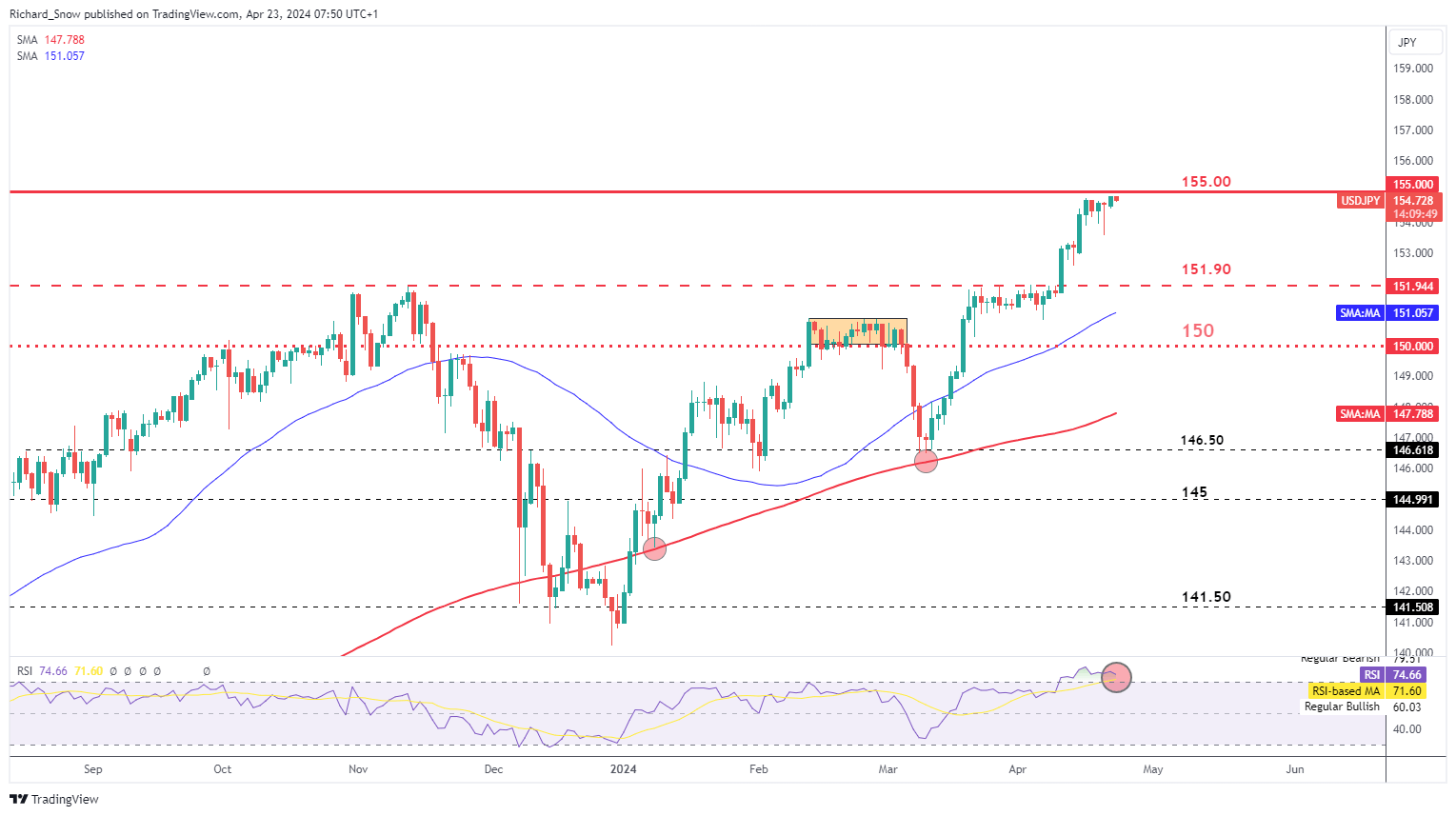

USD/JPY RESPECTS 155.00 RESISTANCE

Despite resistance at 155.00, markets anticipate possible breaches, akin to past breaches at 152.00. PCE data could fuel bullish momentum, supported by the interest rate differential favoring the dollar. Continued yen pressure is expected as markets postpone expectations of a Fed rate cut.

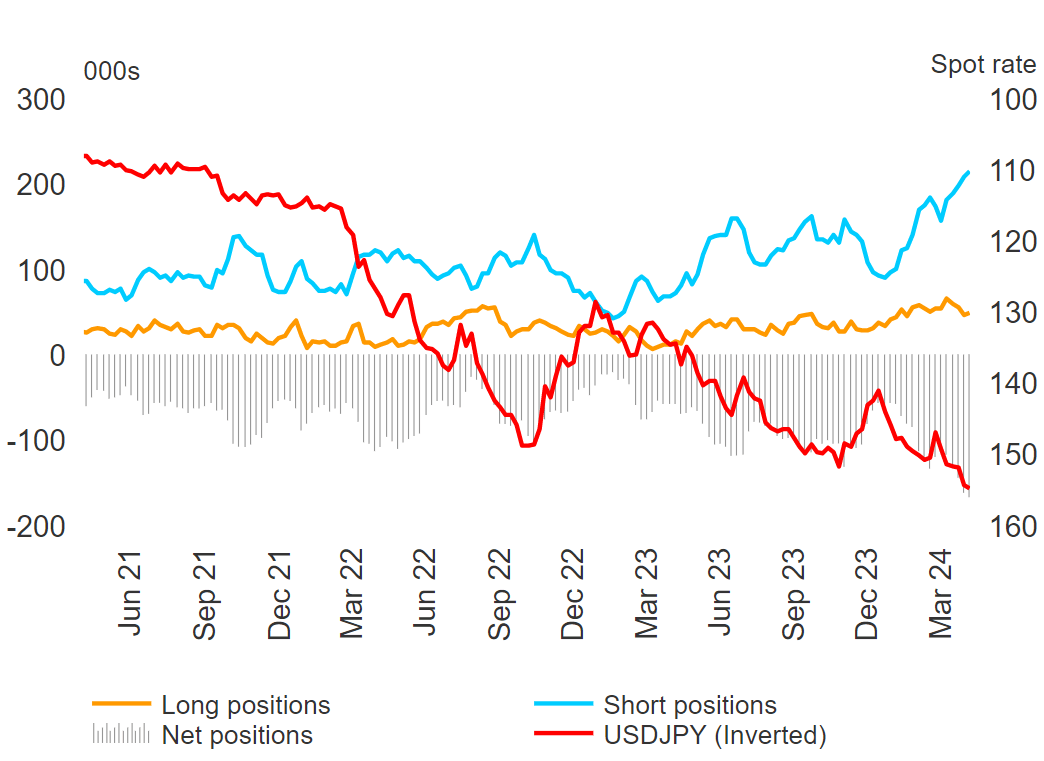

SHORT YEN POSITIONING RISK

Institutions hold significant short yen positions, vulnerable to rapid unwinding, potentially triggering sharp USD/JPY reversals. Previous interventions led to substantial volatility, highlighting risks associated with speculative positioning.

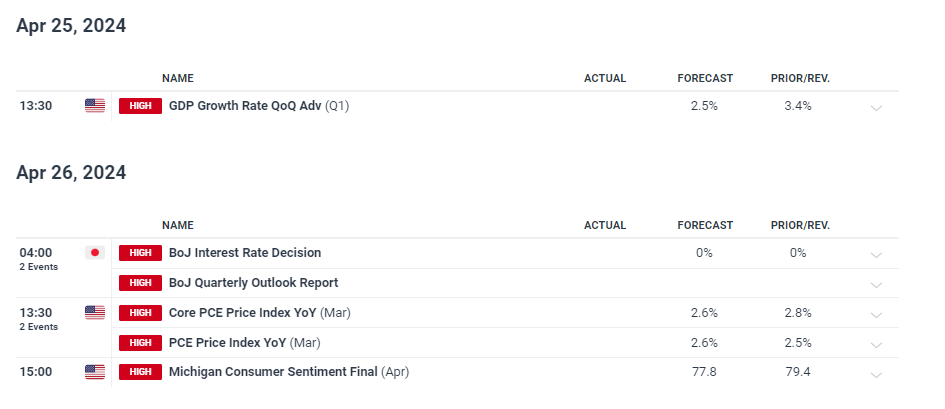

MAJOR RISK EVENTS THIS WEEK

US GDP and PCE inflation data, alongside the Bank of Japan rate announcement, dominate the week's economic calendar. The US GDP forecast suggests moderate growth, while PCE inflation data anticipates sustained heat. BoJ's outlook report to factor in wage growth, oil prices, and yen weakness, influencing future policy decisions.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.