Stock Market Outlook: High Volatility Expected from Key Events

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Market Reaction to Consumer Confidence Report

Stocks ended almost unchanged last Friday, impacted by a disappointing University of Michigan report that indicated a drop in consumer confidence and a rise in inflation expectations. The unexpected data prompted a sharp pivot in risk assets, and an increase in rates.

Anticipated Market Movements This Week

This week is packed with key economic indicators including inflation data, retail sales, and the May options expiration (Opex). Additionally, a series of Federal Reserve speakers and a Q&A session with Fed Chair Jay Powell on May 14 will likely influence market sentiment.

Expectations are set for a spike in trading volume compared to last week's subdued activity, which resembled holiday trading. This increase in volume might bring more legitimacy to market movements compared to last week's fluctuating indexes.

Volatility Predictions and Powell's Influence

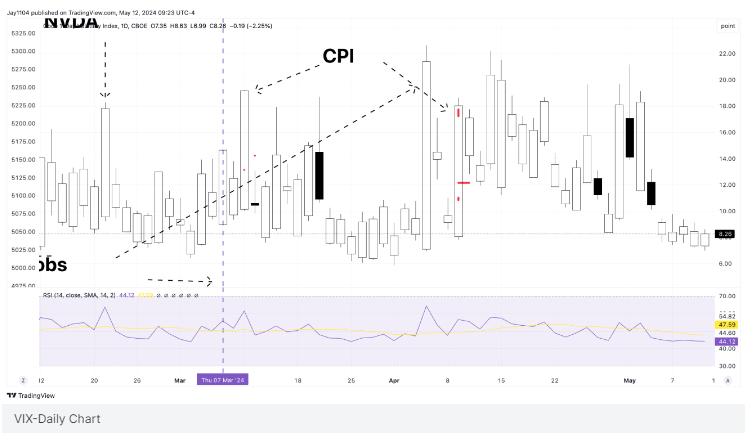

The lead-up to a Q&A session with Powell and the Producer Price Index (PPI) report on Tuesday could drive up implied volatility, with further increases possible into Wednesday's Consumer Price Index (CPI) report.

Historically, the VIX 1-Day has risen sharply prior to CPI announcements, with spikes to levels around 18 or 19 in recent months. A similar pattern is expected this Wednesday, with potential volatility compression post-CPI as market risks subside.

External Factors Impacting the Market

This week, the QYLD ETF will navigate significant options activity, with a notable covered call position set to be repurchased on May 16, just ahead of May Opex. This could exert upward pressure on the NASDAQ, assuming it remains above 17,250. Conversely, positioning for the June Opex on May 17 might introduce selling pressure.

Risks of Betting on Market Data

Several market mechanisms could lead to unusual market behaviors, such as unexpected rallies following the CPI report or shifts around Opex. Therefore, relying solely on economic data outcomes for trading decisions could be perilous, as market reactions may not align with expectations.

Overall, the upcoming week promises heightened market volatility with significant data releases and Fed communications on the horizon. Investors should brace for potential market swings and be cautious of placing heavy bets based on the anticipated data outcomes.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.