S&P 500 Sector Earnings Growth in 2025

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Beyond Quarterly Earnings

While the focus often lies on quarterly earnings, especially among social media and financial news channels like CNBC, a broader perspective can be more insightful. Observing how annual sector growth rates evolve post-earnings can reveal underlying trends. Since hitting a low on April 12, 2024, the S&P 500's expected Q1 2024 earnings growth has shown a steady increase:

- 5/10/24: +7.4%

- 5/3/24: +7.1%

- 4/26/24: +5.6%

- 4/19/24: +2.9%

- 4/12/24: +2.7%

Ending Q4 2023 with a growth rate of +10.1%, it's feasible Q1 2024 might reach similar figures. Despite the variations, S&P 500 earnings remain robust.

Current S&P 500 Financial Indicators

- Forward 4-quarter estimate: Decreased slightly to $252.99 from $253.25.

- Price-to-Earnings (PE) ratio: Increased to 20.6 from 20.25.

- Earnings yield: Adjusted from 4.94% to 4.85%.

After 450 companies reported, the Q1 2024 earnings “upside surprise” stands at 8.3%, a notable increase from Q4 2023's 6.3%.

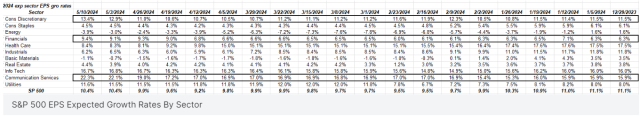

Sector Performance Highlights

Notable sectors such as consumer discretionary, financial services, and communication services have seen improved growth expectations since late December 2023 and further since April 1, 2024. Financial sectors are thriving, with reduced credit losses and fewer regulatory challenges.

Conversely, technology has not shown similar momentum, possibly due to market dynamics, with no significant change in expected growth for 2024. The upcoming earnings report from Nvidia on May 22, 2024, could potentially shift this trend, particularly as semiconductors drive advancements in AI.

Energy and healthcare sectors experienced the most substantial negative revisions, although energy has shown improvement since early April 2024.

Looking Ahead to 2025

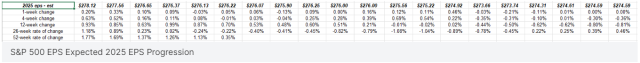

The expected 2025 EPS of $278.12 has increased by $2 since late March 2024 and $4 since the beginning of the year, counter to the usual downward trend observed in previous years.

Upcoming Earnings Reports

This week, major retailers Home Depot and Walmart, along with Cisco Systems, are scheduled to report their earnings, which may influence market sentiment and further demonstrate the robustness of the US economy through S&P 500 earnings.

Conclusion

The S&P 500 earnings data continues to reflect a strong business climate for its companies, with even the 2026 EPS estimates revised upwards from $300 to $312 over the past six weeks. This enduring strength showcases the resilience of the US economy, as seen through the lens of S&P 500 companies. The persistence of these trends underscores the ongoing solid performance of the US economy.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.