SoFi Credit Card Review: Redeem Points Straight Into Crypto

By John V

January 12, 2024 • Fact checked by Dumb Little Man

SoFi Credit Card is a basic credit card that offers 2% cashback on all qualifying transactions, one of the best rates in its class. However, the construction is a little different from other similar-sounding schemes.

Technically, you get 1 cent worth of points. You must redeem those points for investing, bitcoin, saving, or paying down an approved SoFi loan to obtain the 2 percent rate. The value of other redemption possibilities isn’t as high.

It is not compulsory for you to be a SoFi customer to acquire the card, but those who have additional SoFi accounts will be able to redeem points at the most significant value. Alternative credit cards offer 2% cashback on purchases and have fewer hurdles to jump through if you don’t want to join the SoFi ecosystem.

Suppose you have other SoFi accounts, such as SoFi Money, SoFi Invest, SoFi student loans, or SoFi personal loans. In that case, the SoFi credit card makes it simple to spend your credit card rewards responsibly. SoFi made a major sensation when it offered banking and investing accounts.

Overview: SoFi Credit Card Review

| Card | Best For | Fee & Credit | More Details |

|---|---|---|---|

| Best For Investment Card Rewards | Annual Fee: $0 • APR: 12.99% to 24.99% • Feature: Encourage Healthy Financial Habits through Rewards |  |

What is SoFi Credit Card?

The SoFi credit card joins many others that provide limitless 2% cashback on all transactions. The card is particularly adept at avoiding fine print. There are no purchase category limits, yearly rewards ceilings, or cash-out minimums for starters.

There are no yearly charges or international transaction charges with this card. This is a simple card to carry in your wallet for consumers who like to set it and forget it.

Customers who want to accumulate savings, pay down debt, or start investing can benefit from SoFi’s card. This is the case because points are worth half as much if they don’t have a redeeming option in an approved SoFi account.

When you use the card, you’ll earn 2 points for every qualifying dollar you spend. It is worth half a penny in cashback when redeemed as a statement credit. If you utilize your rewards to pay off SoFi loans or put money into SoFi Money or Investment accounts, each point is worth one penny.

The opportunity to exchange your points for cryptocurrencies through a SoFi investing account is one of the card’s standout features. Of course, transferring rewards to your Money account allows you to use your balance for anything—bills, purchases, or cash withdrawals.

How does SoFi Credit Card work?

The SoFi Credit Card gently encourages you to make financial choices to help you achieve your financial objectives. Returning funds, savings, investment, cryptocurrencies, or debt reduction is a great way to make your hard-earned rewards work even harder for you.

Keep in mind, though, that it takes $1,250 in spending to earn $25 in cashback, providing you deposit the cashback in a method. That’s because it gives you the full penny-per-point value. To put it, the incentives are good, but they won’t wipe off significant debt.

If you don’t mind putting your rewards into your SoFi accounts or toward your SoFi loan, the SoFi Credit Card is a great flat-rate rewards card.

The SoFi Credit Card is a wonderful method to enhance your savings or pay down debt quicker because there aren’t many 2 percent cash back cards with no annual fee. If you aren’t a SoFi member or want cashback that you can use for anything, you may want to check other card possibilities.

How do Cashback rewards work?

On all purchases, the SoFi Credit Card gets 2% cashback. You may use your incentives to pay down a SoFi student, refinancing, or personal loan debt. You may also put your rewards into a SoFi Money or Invest account. Your rewards will be worth half as much if you choose to redeem for a statement credit.

The card’s primary selling point is its ease. SoFi is one of the few systems that allows you to manage all of your finances, investments, loans, and credit cards in one spot.

According to the company’s user-friendly website and app, users who sign up for all of SoFi’s accounts will be able to manage all of their finances in one location.

Click Here to Get Started With SoFi Credit Cards.

What are the Features of SoFi Credit Card?

Let’s consider the features in detail!

Rewards Earning Details

While advertising this card as getting cashback, it earns 2 points for every dollar spent. You will not earn points for your transactions posted to your account during a billing cycle if you do not make the minimum payment before the payment due date.

If the credit card company terminates your credit card account for any reason, you will lose your points. In addition, if SoFi determines that you have broken the conditions of its rewards program, it may cancel any or all of your issues.

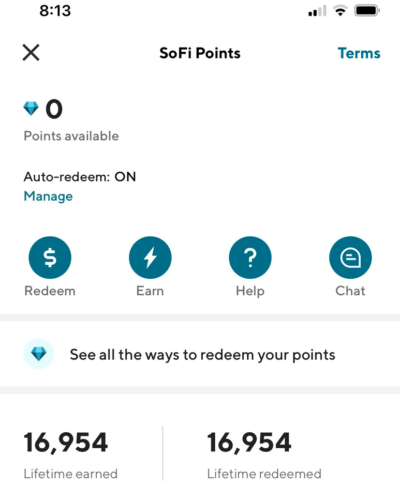

Rewards Redemption Details

- You may use your points to purchase the following items:

- On the redeem points page, there are promotional deals.

- Funds sent to your SoFi Money account

- You will credit your SoFi Invest account with shares.

- Cash applied to your SoFi student loan or SoFi personal loan balance

Cell phone protection

After paying a $50 deductible, you can receive the actual cost of replacing a stolen or damaged eligible phone up to twice per 12-month time duration. Up to $800 per claim and $1,000 per 12-month time duration if you charge an eligible phone bill to your card.

Security Features

It includes a Mastercard ID Theft Protection with this credit card. As per the Mastercard, once the service is set up, it will monitor the surface, dark, and deep web. It’s essential for compromised credentials and detrimental use of your registered personal information. Moreover, it will alert you to suspected identity theft.

Your Mastercard privileges also provide you access to emergency card replacement. In the United States, you can get a temporary card the same day, and in most other countries, you can get one in two business days.

A lower interest rate if you pay on time

If you make 12 continuous on-time payments of at least the minimum amount due, They will reduce your interest rate by 1% if you continue to pay on time. This function provides an additional motivation to fulfill financial objectives since paying credit card payments on time can help you get a good credit history.

SoFi Invest Account

SoFi is perfect for first-time investors in the United States. They seek an easy-to-use online trading platform and wish to create an active or automatic investment account, as well as learn about cryptocurrencies. It may not be the best alternative for sophisticated investors due to its limited investment selection and features.

The option is only accessible to residents of the United States. SoFi doesn’t need a minimum deposit to register an account, so you may get started even if you don’t have much to invest.

What is the Credit Score Requirement of SoFi Credit Card?

Let’s talk about the credit score requirement! The normal requirement is 700+ to qualify for good credit and enjoy maximum results. Furthermore, people having a SoFi account will likely benefit from this card. That’s because it comes with a 2% cashback rate. The option will redeem the points in SoFi eligible accounts.

Generally, it’s a limitation for people who don’t include SoFi accounts. Therefore, the student loan debt feature and SoFi money and invest accounts offer the best rewards.

The SoFi Credit Card is an ideal choice for people requiring an unlimited cashback option and other benefits. The financial accounts also have other perks for the accessible experience.

How much does SoFi Credit Card Cost?

Undoubtedly, the SoFi credit card is a low-cost card with different competing options. It comes with no annual fee or balance transfer fee with an ongoing APR. There are no foreign transaction fees with on-time payments to lower the interest rate by 1%.

Besides this, the SoFi cards are ideal with low-end striking distance and APR, making it reliable than many other credit card companies. It offers you a credit limit of $500 while considering the debt.

Click Here to Get Started With SoFi Credit Cards.

Who is SoFi Credit Card Best For?

If you want to utilize your credit card rewards to improve your financial condition rather than an attempt to spend them on other things, the SoFi credit card could be a good option for you.

The 2 percent equivalent payback return rate is only available. If you convert our credits into a SoFi Cash account, purchase assets via SoFi Invest.

You are using them to make payments the amount of your SoFi college loan or SoFi personal loan. People who want greater freedom and actual cashback without redeeming their rewards. A SoFi account may serve with a different credit card with a similar redemption value.

SoFi Credit Card Pros and Cons

Let’s consider the pros and cons in detail!

| 👍 PROS |

|---|

► Redeem Rewards to Save or Pay Off Debt You may put your rewards into your SoFi Money account to save, invest, or your SoFi student loan or SoFi personal loan account to pay off debt. Instead of spending your rewards on other things, you may use them to better your financial condition by using them for these redemption alternatives. ► Earn unlimited 2% cashback When used to invest, save, or pay down an eligible SoFi loan, the SoFi credit card delivers 2 percent unlimited cash back on qualifying purchases. The increased redemption rate is comparable to some of today's most popular no-annual-fee cashback credit cards. ► Lower Your APR after 12 On-Time Payments If you make 12 on-time payments of at least the minimum amount due, SoFi will reduce your credit card's APR by 1%. This is a good perk that can help you save money. However, it only seems to last as productively as possible at least adequate monthly costs on time. |

| 👎 CONS |

|---|

► High Balance Transfer and Cash Advance Charges This card charges higher balance transfer and cash advance fees than some competing credit cards (either $10 or 5% of each transaction, whichever is greater). Furthermore, SoFi is now only accepting balance transfers from people who have received promotional offers. If you're looking for a cash advance or a balance transfer, you might want to look elsewhere. ► Lower rewards value for some redemptions If you're looking for a statement credit, you're not going to get the most benefits from this credit card. This is because points are only worth half as much when redeemed this way, at a pitiful 0.5 penny apiece. |

SoFi Credit Card Compared to other Cards

| Credit Card | Annual Fee | Credit Requirement | Welcome Bonus |

|---|---|---|---|

| SoFi Credit Card | $0 | 700 | Up to $100 |

| Southwest Rapid Rewards | $69 - $149 | 670 or better | 40,000 bonus points |

| Discover It Cash Back | $0 | 690 or better | 5% Cashback Bonus |

| Petal 1 | $0 | None | Not Specified |

Click Here to Get Started With SoFi Credit Cards.

SoFi Credit Card vs. Southwest Rapid Rewards Priority Card

The SoFi credit card joins many others that provide limitless 2% cashback on all transactions. The card is particularly adept at avoiding fine print. However, Southwest Rapid Rewards is ideal for all the regular Southwest flyers with everyone who wants to earn a Southwest Companion Pass.

The SoFi Credit Card might be a useful addition to your wallet if you currently have one or more qualified SoFi accounts. Besides this, Southwest Rapid Rewards Priority comes with an effective credit score of 670 to help get approved with annual fee redeem rewards and hotel credit features.

>> Related Article: Best Chase Credit Cards • Compare Top Chase Credit Card of 2024

SoFi Credit Card vs. Discover It Cashback

The SoFi Mastercard encourages prudent financial practices and might be a useful method to keep on track while earning rewards at a competitive rate. However, you can earn rewards through a Discover card. It will not cost any annual fee. Although, it has more complicated reward policies.

The SoFi Credit Card might be a valuable addition to your wallet if you currently have one or more qualified SoFi accounts. Besides this, Discover card offers an unlimited cashback match at the end of the first year. You can earn 5% cashback on your everyday purchases from multiple places. Besides this, Discover card includes 1% cashback on other purchases.

>> Full Article: Discover It Cash Back Credit Card Review: Card With No Fee?

SoFi Credit Card vs. Petal 1

The SoFi credit card joins many others that provide limitless 2% cashback on all transactions. However, the Petal 1 card comes with $500 to $5000 limits to offer different benefits.

The SoFi Credit Card gently encourages you to make financial choices to help you achieve your financial objectives. But wait! Petal 1 helps get a credit limit increase option with no fees. The SoFi Credit Card might be a useful addition to your wallet if you currently have one or more qualified SoFi accounts. However, Petal 1 has 2-10% cashback factors on selective merchants with no deposits requirements.

Conclusion: Is SoFi Credit Card Worth it?

The features of this SoFi Mastercard encourage prudent financial practices and might be a helpful method to keep on track while earning rewards at a competitive rate.

With no annual fee and 2% cashback, you may put your rewards to work by using them to pay off a student or personal loan. It aims to increase savings or investment account balances.

The SoFi Credit Card might be a helpful addition to your wallet if you currently have one or more qualified SoFi accounts. Moreover, it is an excellent option if you wish to use your cashback rewards for financial objectives like debt repayment or investment.

Although the 2% cash back earning rate is suitable for a no-annual-fee credit card. Some cardholders may find the requirement to stay in the SoFi ecosystem inconvenient.

SoFi Credit Card FAQs

Is SoFi a real credit card?

YES! SoFi is a real credit card issuer with multiple eligible debt features and other partner rewards for eligible SoFi rewards points. The 2% unlimited cashback feature offers bonus rewards and cell phone insurance protection with grocery store purchases. It won’t change your annual fee or even a foreign transaction fee. You can get eligible purchases with eligible loan options for maximum benefit.

What credit score do you need for a SoFi credit card?

Basically, the SoFi Credit Card offers a minimum requirement of 700 or more to qualify for good credit. Generally, it’s a limitation for people who don’t include SoFi accounts. Therefore, the student loan debt feature and SoFi money and invest accounts offer the best rewards.

What bank issues SoFi cards?

The Bank of Missouri issues SoFi Credit Card account with the word elite Matercard and account opening feature. The SoFi credit card rewards with insurance coverage and credit report features are no exception.

The SoFi card grants cardholders access to that benefits portal, such as the outstanding balance and different bonus categories. Therefore, the world’s elite MasterCard benefits from SoFi reward points and a welcome bonus.

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.