Silver Reaches a Multi-week High While The Gold Price Falls Further

By Daniel M.

March 14, 2024 • Fact checked by Dumb Little Man

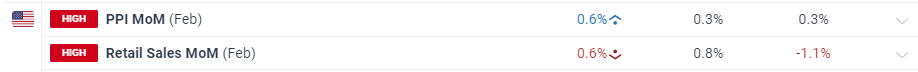

In recent market events, the latest US Producer Price Index (PPI) data, a measure of wholesale inflation, reported values that exceeded market expectations and the previous month's findings. Despite this, the US currency and projections for US interest rate reduction have remained relatively stable. Furthermore, US retail sales rose in February, signaling a turn toward positive growth, while falling short of market expectations.

This economic backdrop has kept the US dollar index sitting around 103.00, signaling a period of low trading activity. The expectation of the next Federal Open Market Committee (FOMC) meeting has kept the dollar in a tight trading range, impacting gold's price movement.

US Dollar Index Daily Chart

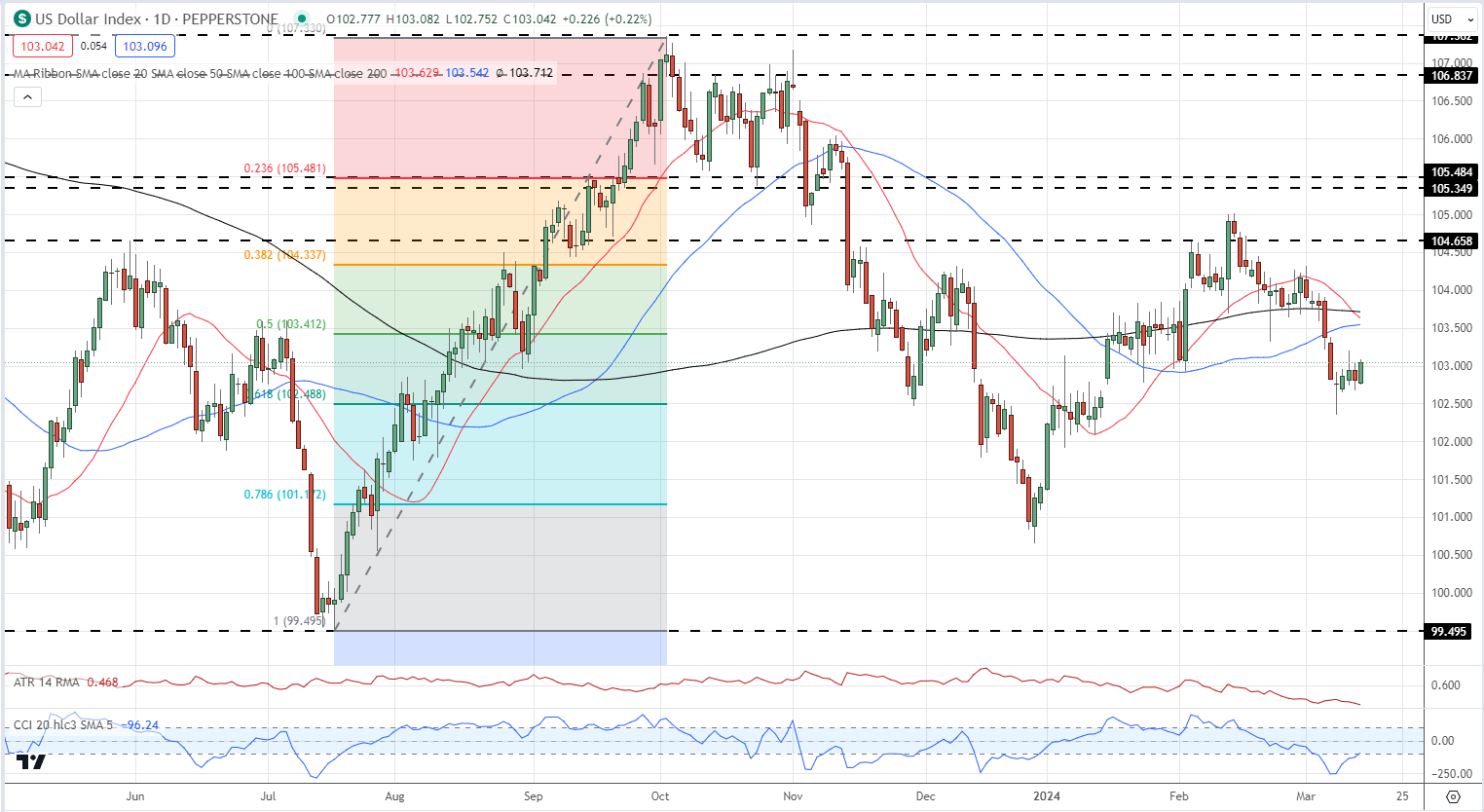

Gold has been consolidating, which suggests the construction of a bullish pennant pattern. However, validation of this trend requires additional observation. If this pattern occurs, gold prices will likely rise, potentially hitting new records. Gold's support levels are found around $2,148 per ounce, with secondary support at $2,128 per ounce.

Gold Daily Price Chart

Analysis of retail trader data reveals a mixed sentiment, with 40.95% of traders holding a net-long position in gold. This ratio suggests a cautious stance among traders, with an increase in both long and short positions compared to the previous day and week. Traditionally, a contrarian view of crowd sentiment indicates that the prevailing net-short position could signal a continued rise in gold prices.

Retail trader sentiment is mixed, with 40.95% of traders holding a net-long position in gold. This ratio suggests a cautious posture among traders, with an increase in both long and short holdings during the previous day and weeks. Traditionally, a contrarian assessment of crowd sentimentsuggests that the current net-short position may indicate a lengthy rise in gold prices.

Final Thoughts

As traders manage these market conditions, the relationship between US economic data and precious metal prices remains a key focus. With the FOMC meeting approaching and recent economic statistics showing a mixed picture, the possibility for volatility in the gold and silver markets has increased. Traders and investors should keep an eye out for new developments, as they may have an impact on future gold and silver prices.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.