Root Insurance Reviews: Insurance Offers, Features, Cost, Pros & Cons

By Vanessa Richards

January 10, 2024 • Fact checked by Dumb Little Man

Accidents are unpredictable and can happen to anyone. In case of any health and financial problems, you need money immediately.

So that you can handle the problem within a short time. But sometimes, the accidents are big enough that can make you go bankrupt.

Especially the car accidents cost more money as both your health and car get damaged. Therefore you need to take car insurance.

Contact the right car insurance companies so that they provide you with future security. The auto insurance policy will provide you with money in any accidental situation so that you do not go bankrupt.

Most car insurance companies do not provide all the benefits that you need. But Root insurance is different from the many auto insurance companies.

That’s why in this article, we will discuss the root auto insurance in detail. So shall we start the discussion, without any further ado?

Root Insurance Review: What is Root Auto Insurance?

As the name says root auto insurance provides car insurance. So that in future if you have any accident you can get money from the car insurance companies.

Root insurance companies focus on driving behavior while making the quotes instead of demographics. These insurance providers think if you consider drivers

- Age

- Credit score

- Gender

- Zip code and other personal factors then the decision will be biased.

Therefore, safe drivers consult root auto insurance to take the car insurance. Moreover, root car insurance is a technology-driven firm.

It has an app the monitor’s drivers’ performance. Through the app, the root car insurance company checks the driving skills of the policyholders and drivers.

Also, if drivers show better performance then the root car insurance appreciates them and provides better policies.

In addition, if you compare car insurance companies with root car insurance. Then you will know to start the process you do not require any paperwork.

Furthermore, root car insurance work helps drivers to save hundreds of dollars per year. This is because it prioritizes skills over demographics, unlike other insurers.

Want to know the best part?

The root car insurance, also provide you

- Homeowners insurance policies

- Renters insurance policies

But the main focus of the root insurance policy is on better car insurance coverage. However, this is not the problem as you get better root claims on renters coverage and homeowners insurance.

It is founded in 2015, still, there is no root insurance review from the J.D Power and A.M. Butt, Reviews.com gives a 4.6 score to the root insurance work. It means you can trust the root policy.

How does Root Work?

The working of the root is so simple. You can use the root app or the online website to get the quote. As we discussed earlier, the root provides three types of insurance policies

- Car Insurance

- Renters Insurance

- Homeowners Insurance

For these purposes, you can contact through the company’s mobile app. Root provide better customer support to its customers and stay in touch with the policyholders.

Now have a look at what coverage options do root provides.

Root Car Insurance Coverage

As compared to other insurance commissioners, root auto insurance policies are much better. The reason is that they provide better coverage.

Here are three main types of coverage according to the root car insurance review. So have a look.

- Liability Coverage

- Car Coverage

- Medical Coverage

These are the main insurance coverage types that the root app provides. But this is not enough, there are a lot more services that you get by selecting any of these insurance coverages.

So let’s discuss what are these insurance coverages and what they offer to you.

Liability Coverage

You can get liability coverage when accidentally you damage another person’s property or anyone else gets injured. Following are some conditions of the coverage.

1. Bodily Injury Liability

You can use these coverage options when because of you another person gets badly injured or die. This liability coverage will pay you the associated costs.

2. Property Damage Liability

According to the national association of insurance, you will get this coverage when you accidentally damage someone’s property.

Based on these two accidents options the root will customize the policy for you. So that you get enough amount to avoid the circumstances.

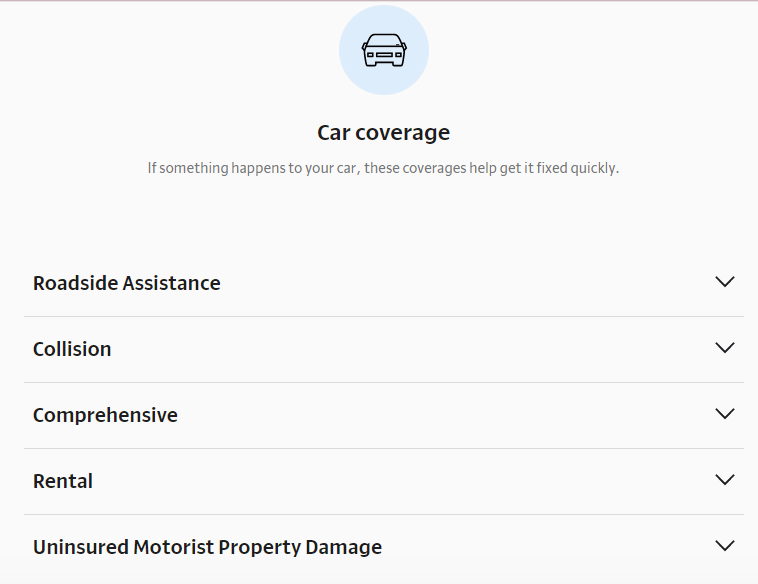

Car Coverage

If something happens to your car during an accident then you can use the following coverage options.

1. Roadside Assistance

Roadside assistance is important if you just started driving. Also, it is necessary for rash drivers so that they can avoid accidents.

Root provides the option of requesting roadside assistance on the app. So that you can easily start to work on your driving skills.

2. Collision

In collision coverage, the company will pay you to repair your vehicle no matter who is at the fault. The collision coverage is the better option for the people who buy their vehicle on the loan.

But if the person owns the car then he may pay for the car damages. Therefore, such drivers can choose to ignore this type of coverage.

3. Comprehensive

When your get damaged not because of the accident then you can use the comprehensive coverage. It is also useful when you want to repair your car.

Root does not provide this option itself. Rather he lets its customers decide whether they want comprehensive coverage in their policy or not.

4. Rental Coverage

When you need to repair your car because it gets damaged in an accident then you can this renters insurance.

According to the root renters insurance, you need an alternative vehicle when your car gets damaged in an accident.

Therefore, root gives you the rental reimbursement coverage to get a rental car until your damaged car is in the shop according to the root renters insurance policy.

5. Uninsured Motorist Property Damage

When your car gets damaged by an uninsured driver. Then you will get the uninsured damage liability.

Medical Coverage

When you and your family members get injured in the accident. Then the company gives you medical coverage of the following types.

1. Personal Injury Protection

In personal injury protection coverage, the company will pay the medical expenses and lost wages of you and your family. No matter who causes the accident.

2. Medical Payments

This payment policy covers the same coverage that personal injury protection provides. But here the company will not pay for the lost wages.

3. Uninsured And Underinsured Motorist Bodily Injury

According to the root car insurance review, the company will pay for the property damage and the medical expenses.

But this coverage is only applicable if you and your family get into trouble due to an underinsured motorist.

According to the research, uninsured motorist coverage is needed in the District of Columbia and other 19 states.

On the other hand, the 16 states needed underinsured coverage. Therefore, root helps its customers to decide which insurance coverage will help them.

All these types prove coverage is important to consider in any policy. So that on the lower premiums you can enjoy the better benefits.

What are the Features of Root Insurance?

As compared to the other insurance commissioners, root auto insurance companies provide better facilities.

The following is the proof of this. So have a look at these features and select the right insurance provider.

1. App-based

The first amazing feature of root insurance is that it provides a mobile application. Through this application, you can access all the functionalities of the root company.

You can also make claims and contact the company members. The main purpose of this mobile application is to provide ease to the customers which it provides.

There are many insurance companies but most auto insurers lack this facility. In addition, you can change your policy through the mobile app.

In short, through mobile, you can do all the things that you can do on the website. Therefore, root’s app is the best.

2. Full coverage available

Indeed, the coverage is not the type of insurance that root insurance provides. But coverage explains the ways to save money.

Coverage helps to cover risky drivers because accidents are unpredictable. When you do harsh driving there is a high chance of an accident.

Therefore, root insurance provides better coverage on insurance policies. We have discussed this in detail in the above section.

But for your help here we will review just the names so that you can easily recall the benefits of the root company.

1. Liability Coverage

- Bodily Injury

- Property Damage

2. Car Coverage

- Roadside Assistance

- Collision

- Comprehensive

- Rental

- Uninsured Motorist Property Damage

3. Medical Coverage

- Personal Injury Protection

- Medical Payments

- Uninsured and Underinsured Motorist Bodily Injury

First review, all these coverage types and then add them to your insurance policy to save money and secure the future.

3. Will file an SR-22 form

If you are one of the drivers that do harsh driving who must file a court-ordered SR-22 form. This form provides the proof of the auto insurance and Root can file this form for its policyholders.

4. Potential savings

Root auto insurance companies provide policies at low auto insurance rates. So that its customer can save more money.

Furthermore, the unique criteria for the driver selection allow the company to pass savings to the drivers. Also, with good coverage drives can make a huge profit to secure the future.

Click Here to Open an Account with Root (Official Page)

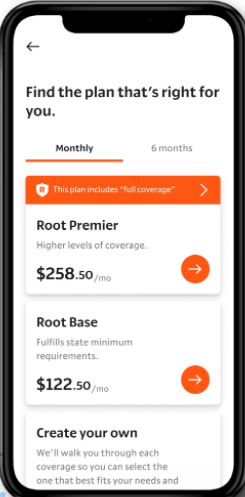

How much does Root Car Insurance Cost?

The cost of the roo insurance depends on the driving history, test drive, credit scores, and driving behaviors. Therefore, the cost of all drivers will not be the same.

Moreover, it does not provide discount like other insurance companies does. But the pricing is so low that you do not need any discount facility.

So focus on enhancing your credit score if you want a better return. Also, the types of coverage can change the pricing plan.

The more coverage plans you select the more cost you have to pay for the premium. So select everything wisely.

Who is Root Best For?

According to the root insurance review, it is suitable for drivers because the company mainly focuses on insurance policies.

To be precise, following the people that can use the root services and insurance policies.

1. Tech-Savvy

The root is a strong choice of the people who like to manage their insurance policies and the quotes through the mobile app.

The reason is that the root company provides a mobile app that allows you to do everything that you can do on the website.

In addition, the app

- Observes diving behaviors or driving habits

- Provide policy documents

- Show driving history

- Display credit history

- Show test-drive period

- Pay bills

- Handle root claims and much more

From all these features it is clear that the root’s app is fully functional and best for all the drivers.

2. Safe Drivers

The selection criteria of the root are different from the association of insurance commissioners. Therefore, you need more good driving habits to get a better discount.

The more you drive safe the more benefit you will get from the company. So focus on your driving skills and secure a future with better benefits.

3. Drivers with Poor Credit

According to the national association of insurance companies, the drivers that have poor credit can get the root policy.

Indeed, the policy is not better than the ones that have more credit. But many factors can reduce the premium rate of the policy.

Root Insurance Pros and Cons

Here are some pros and cons of the root car insurance that you should before getting auto insurance or life insurance.

So have a look at the advantages and limitations of this insurance company. This information will help you to compare car insurance companies with other companies.

| PROS |

|---|

| 1. The car insurance rates depend on the credit score and the driving behaviors. Instead of the zip code, marital status, and gender. Due to this, it is best for high-risk drivers |

| 2. This company provides a completely customizable app through which you can access all the features that you have used on the online website. |

| 3. Especially you can make claims and change your insurance policy based on the driving history the company gives safe driver discount within few weeks |

| CONS |

|---|

| 1. There are many customer complaints against the root company. However, it has an A+ BBB rating. But still, there are 350 complaints registered in the past few years. Also, according to the national association of insurance people register more complaints about root insurance than any other insurance company |

| 2. Like some insurance companies, root insurance does not give gap insurance. This is the type of insurance in which the policyholder gets the money when the policyholder owes more than the vehicle. But root company does not provide this facility |

| 3. JD Power and AM best does not give any rating to the root company yet. But it is reviewed by the third-party company that people find difficult to consider |

Click Here to Open an Account with Root (Official Page)

Root Insurance Compared to other Car Insurance Companies

Root Insurance vs Progressive

Progressive is another insurance company like Root insurance. Therefore it provides multiple insurances and better coverages.

Progressive is considered a high-level firm because of its high rating. That’s why there is no competition between progressive and root insurance.

Moreover, progress provides better options to people or drivers who need better policies. Furthermore, it provides better discounts so that more people can get insurance policies.

In addition, the progressive company offers multiple facilities like

- Custom equipment coverage

- Gap Insurance

- Pet Policy for furbabies

Progressive provides better customer support. Therefore, it is best for the people that need only the appropriate customer support.

Root Insurance

Root insurance is one of the auto insurance companies in the market. It is introduced in 2015 and mainly focuses on auto insurances.

Although, it provides renters insurance and homeowners insurance. It means you can have better benefits from the root insurance company.

The best thing about root insurance is that it provides huge coverage in all the policy plans. Moreover, the mobile app makes it easy for people to access all the features.

The best thing is that the customers can change insurance policies and ask for the claims through the mobile app.

Final Verdict: Root Insurance

That’s all folks, this is all that you should know about Root insurance. It is one of the best auto insurance companies that provide benefits at a low rate.

The best thing about this company is that its focus on driving skill instead of demographic factors.

It means you should focus on your driving skills to get a better premium rate. Moreover, root has an app through which you can manage all the features that you can access on the website.

In addition, you can change your insurance policies and get a quote. Although it has more complaints from the customer.

But everyone has their own experience. So give this company a try and see whether it works for you or not.

Root Insurance FAQs

Here are some questions that drivers mostly asked about the root instance so have a look.

What rating does Root insurance have?

Both the high-level companies like AM Best and JD power do not review the root insurance yet. It does mean that you can not trust Root insurance. Moreover, BBB gives the A+ rating to the root insurance.

Does Root insurance full coverage?

Yes, root insurance provides better coverage in all insurance policies. You can select the right coverage type in your policy plan after consulting the company advisors.

Is Root insurance effective immediately?

Yes, root insurance is effective. You do not need the document work to start the process. So just download the app and ask for the insurance policy. That’s it.

Vanessa Richards

Vanessa is a mom of 3 lovely children and a software geek. Outside of her career as a health and wellness instructor. She enjoys writing and researching on topics such as finance, software, health and culinary.