Rising Money Supply: The Good and the Bad

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

The contraction in the money supply has ceased, marking an end to its anti-inflationary effects before full completion. Although it's early to draw conclusions from a single month, March's $92 billion increase in M2—the largest since 2021—is notable.

This increase translates to an annualized rate of 5.5%, suggesting that the situation is not escalating uncontrollably. Both the 3-month and 6-month changes in M2 are at their highest since early 2022, slightly above last October's lows, indicating a positive trend in the money supply.

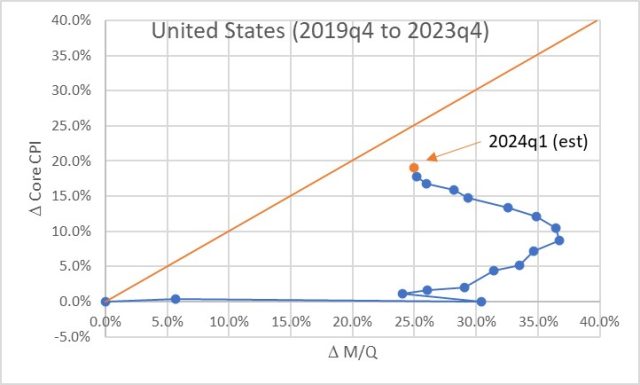

With the latest money supply data in and the advance Q1 GDP report imminent, we can revisit our November 2023 analysis on the remaining ‘potential energy' for inflation. The slight rise in M2 by 1.24% annualized from the previous quarter shows the M/Q ratio nearly unchanged, as illustrated in the chart.

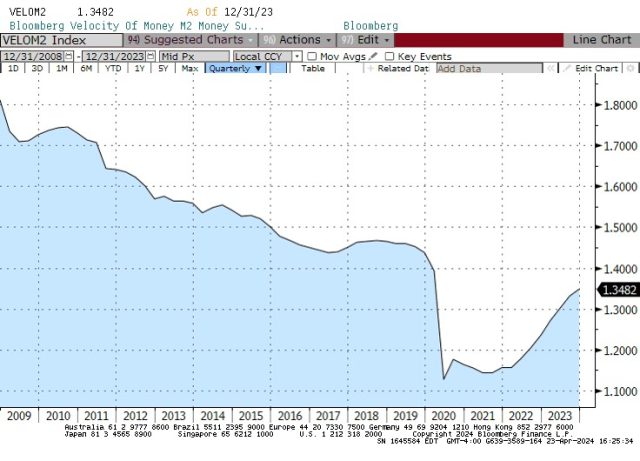

Despite claims of a permanent reduction in the velocity of M2, there is no supporting evidence. Expected to rise by about 1% this quarter, money velocity is nearing its early 2020 levels. Higher interest rates are generally associated with increased money velocity, suggesting continued economic activity.

While core inflation calculations exclude volatile elements like food and energy, incorporating these components shows we are approaching the limit of our ‘potential energy.' This suggests that, despite significant price increases—25% since the end of 2019—the economy is edging towards normalization.

The recent increase in M2 is timely, addressing the tightening of monetary conditions that could stifle economic activity. For price stability, changes in the money supply should ideally mirror GDP growth.

If the goal is 2% inflation, M2 should grow approximately 2% faster than GDP. With the long-term decrease in velocity ending and interest rates stabilizing, a 4% growth in money supply could realistically support a 2-2.5% inflation rate.

Although the outcomes might not align perfectly as predicted, the current trends and Federal Reserve actions suggest a viable route towards bringing inflation closer to informal targets.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.