Q2 Equities and BTC/S&P 500 Correlation: Insights into Record-Breaking Stocks and Bitcoin Price Forecast

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

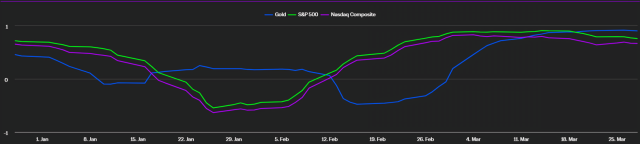

As we enter the second quarter of 2025, the financial landscape shows a particularly interesting pattern of growth and correlation between cryptocurrencies and major indices, most notably between the S&P 500 and Bitcoin.

The performance of the S&P 500, Nasdaq 100, and Dow Jones Industrial Average (DJI) as well as the connection between BTC and the S&P 500 are all examined in detail in this thorough analysis, which provides traders with market outlooks and insights.

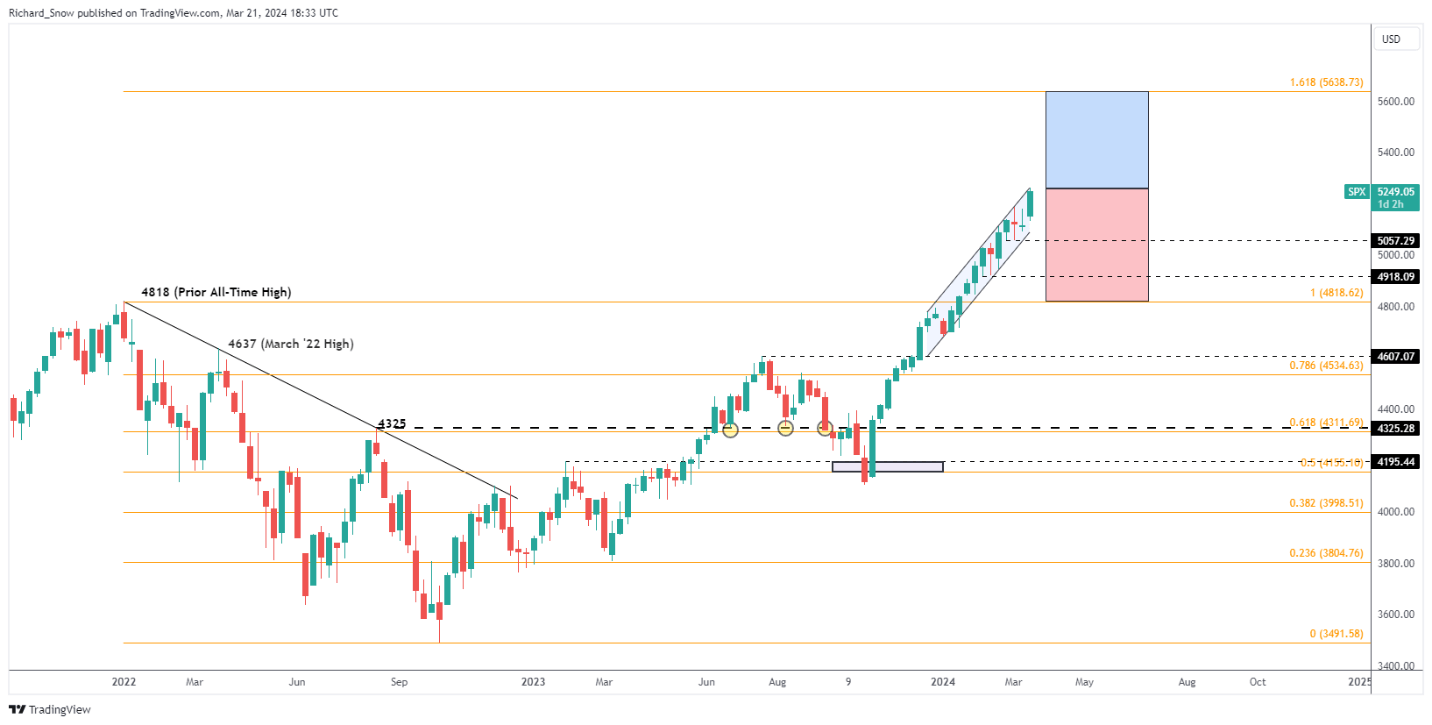

S&P 500: A Steady Climb Amidst Uncertainty

Beginning 2025 with a whopping gain of nearly 10% so far this year, the S&P 500 showed remarkable performance.

Despite recession predictions and high interest rates, the index hit many all-time highs in Q1 and there is little evidence to suggest that its positive trajectory is about to reverse.

With support levels located at 5057, 4918, and 4818, a technical perspective points to the 161.8% Fibonacci level at 5640 as a new objective, suggesting strong upside potential.

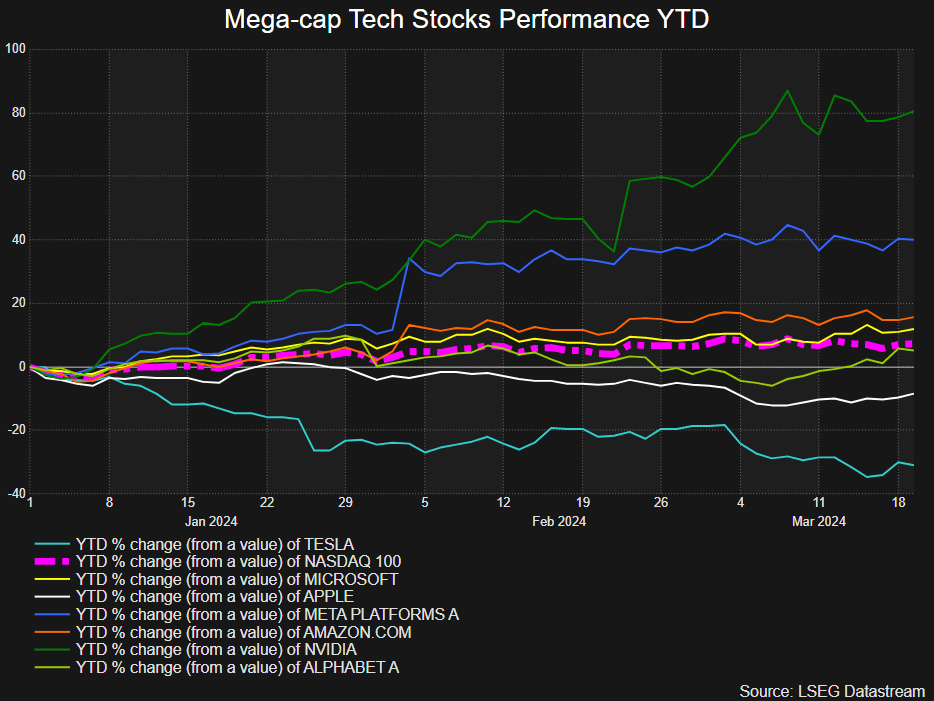

Nasdaq 100: Tech Giants Leading the Charge

While other IT giants like Apple and Tesla faced difficulties, the Nasdaq 100 experienced an 8.88% gain in Q1 thanks to exceptional results from Nvidia and Meta.

The index, which is trading at new all-time highs, indicates that more of a catalyst is required to break through the resistance level at 18,460. A cautious but upbeat attitude for sustained expansion is reflected in the upward prospects and support levels.

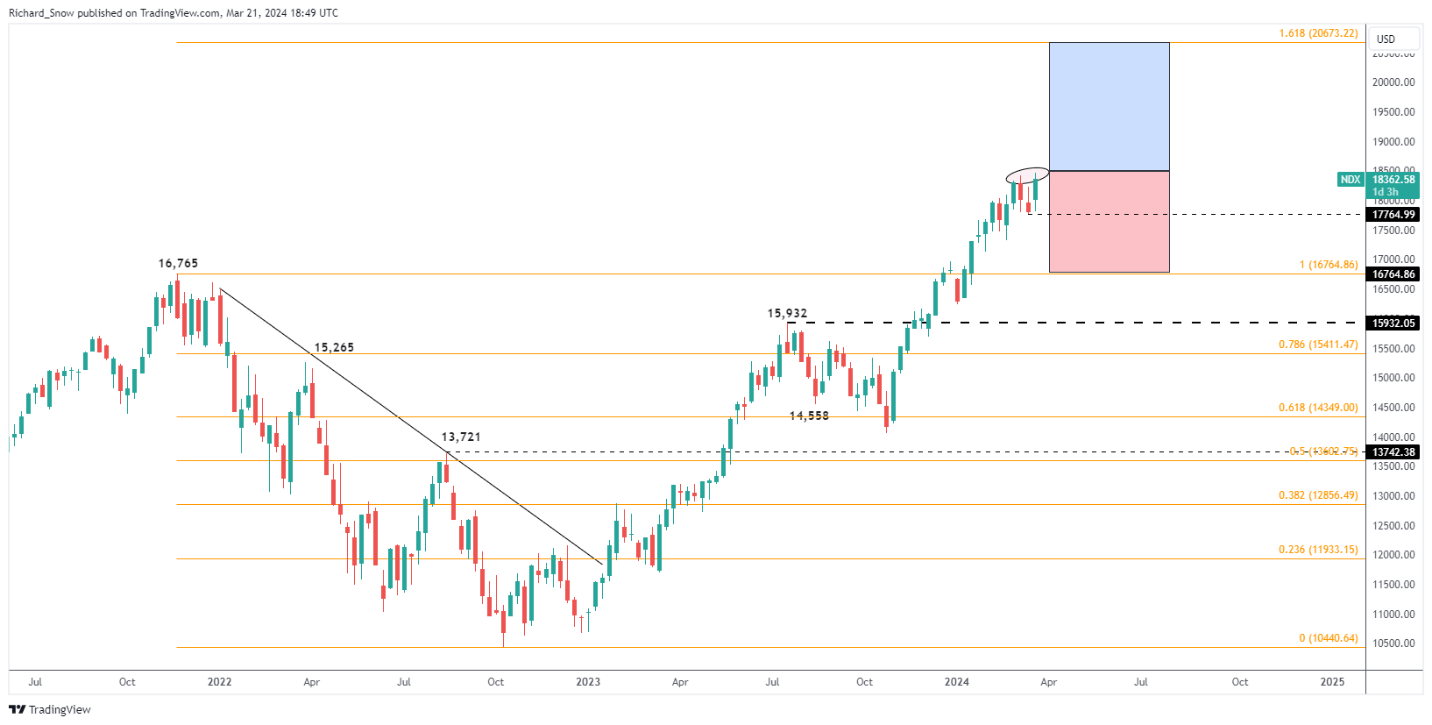

Dow Jones: Blue-Chip Resilience

With 30 big blue-chip stocks in the DJI, it concluded Q1 strongly, suggesting that the market's upward trend may be moderating rather than stopping.

As evidenced by the index, blue-chip resilience remains attractive even amid market uncertainty, with the 161.8% Fibonacci level projected beyond the 42,000 mark.

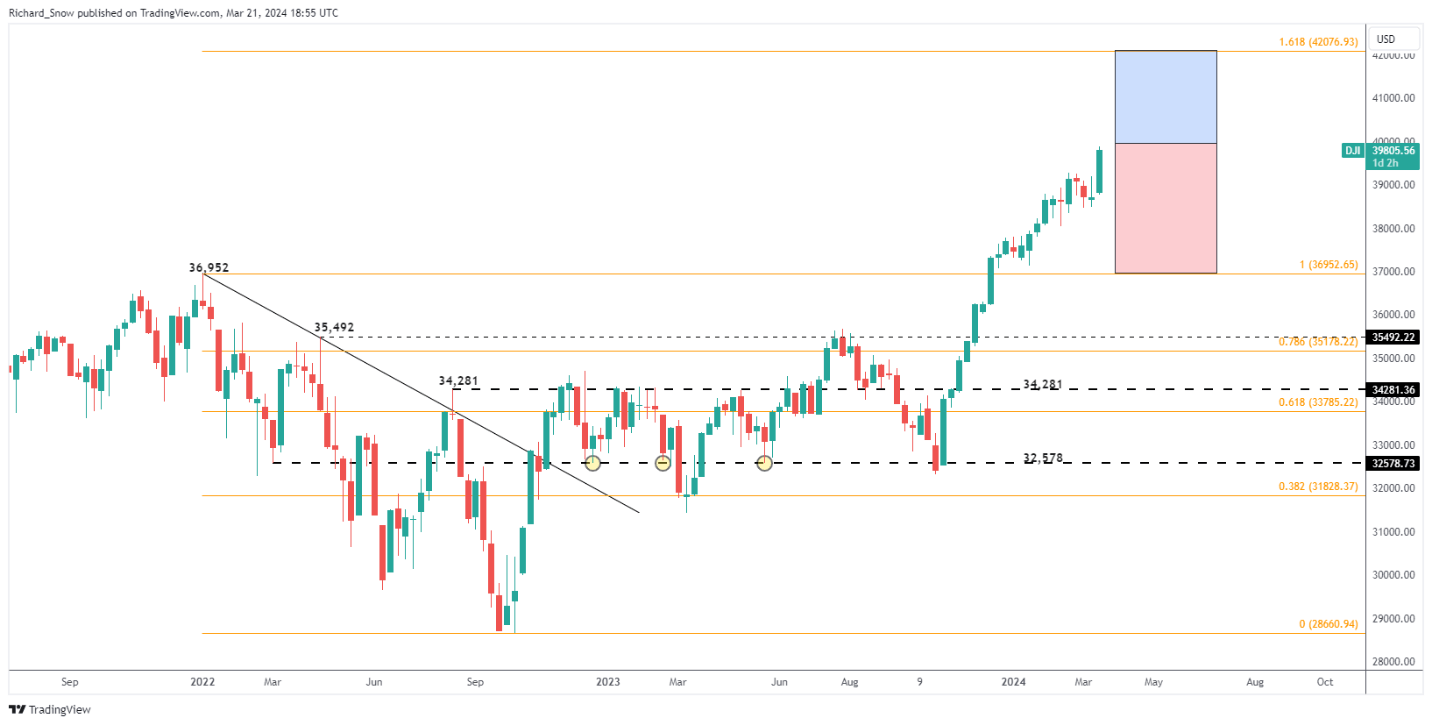

BTC/S&P 500 Correlation: A New Perspective on Bitcoin

Recently, there has been a noticeable change in the correlation between Bitcoin and the S&P 500, with positive correlations replacing negative ones.

This shift highlights how investors are beginning to view Bitcoin as a risk-on asset that is more in line with equities markets during strong economic times.

Bitcoin has the potential to yield large gains, but its extreme price changes also carry hazards. This is seen in its record, which saw it surge 160% in 2023 compared to the S&P 500's 23% increase.

Market Outlook

A complicated interaction of market factors is revealed by analyzing Q2 equities alongside the correlation between BTC and the S&P 500. Investors appear cautiously optimistic, based on the major indices' steady rise despite several obstacles.

Bitcoin presents traders with both opportunities and challenges because of its growing link with the stock market and its ability to yield sizable gains even in the face of volatility.

As a result, traders need to keep in mind how the futures of cryptocurrencies and stocks are connected as we move into Q2.

Although there is promise in the future, managing risk and seizing opportunities in the traditional and digital asset markets will require a calculated strategy.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.