Persistent Weakness in Japanese Yen Despite Possible Interventions

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Japanese Yen (USD/JPY) – Market Dynamics and Trends

For the fourth consecutive session, the USD/JPY has risen, despite signals from Japan hinting at potential measures to curb its strength. In contrast, the United States has maintained that currency market interventions should be ‘rare'.

The Japanese Yen continues to fall against the U.S. Dollar, reaching heights not seen in over three decades by 2025. This significant trend led to a multi-billion-dollar intervention by the Bank of Japan and the Ministry of Finance, attempting to moderate the Yen's rapid depreciation.

Tokyo has expressed concerns that the Yen's sharp drop is disorderly and misaligned with fundamental market conditions, potentially escalating domestic inflation by raising imported goods' prices.

Meanwhile, U.S. Treasury Secretary Janet Yellen has reiterated that frequent interventions are not favorable, setting the stage for possible tensions between these two economic powerhouses over currency stability.

Despite the Bank of Japan's shift from its extremely lax monetary stance earlier this year, the Yen's yields remain unattractive compared to the Dollar. The Dollar is expected to maintain its monetary advantage for the foreseeable future, suggesting a continuing weaker Yen.

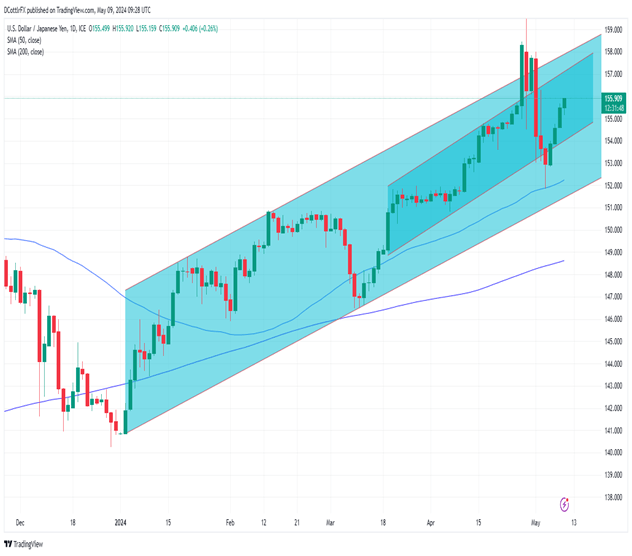

As of now, USD/JPY has not revisited its peak levels above 158.00 seen in late April before Japan's financial intervention, yet it still trades above 155.00 with an upward bias.

The optimal outcome Japanese policymakers can hope for, without a broader reason to sell the Dollar, is merely to decelerate the USD/JPY rise.

Recent discussions during the Bank of Japan’s April 26 rate-setting meeting focused on potential rate hikes to counteract the adverse effects of the Yen's weakness on imported inflation, signaling a potentially volatile period ahead for the currency.

USD/JPY Technical Insights

Currently, USD/JPY is tracing a respected and potentially significant uptrend within its broader rising pattern. This narrower band has consistently regained its footing whenever it has slipped and now provides support at 154.055, with resistance noted at 157.263.

Any push towards these upper levels might provoke temporary selling actions from Japanese authorities to mitigate the Dollar's ascent.

Last Friday, the Dollar found solid support at its 50-day simple moving average, positioned at 152.25. Even a drop to this level would not disrupt the overarching uptrend.

Retail sentiment shows a majority of traders are bearish at current levels, possibly reflecting some impact of Tokyo’s interventions in slowing the Yen’s descent.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.