Oil Prices Surge on IEA’s Revised Market Tightness Forecast

By Daniel M.

March 14, 2024 • Fact checked by Dumb Little Man

IEA Predicts 2024 Improved Oil Prospects

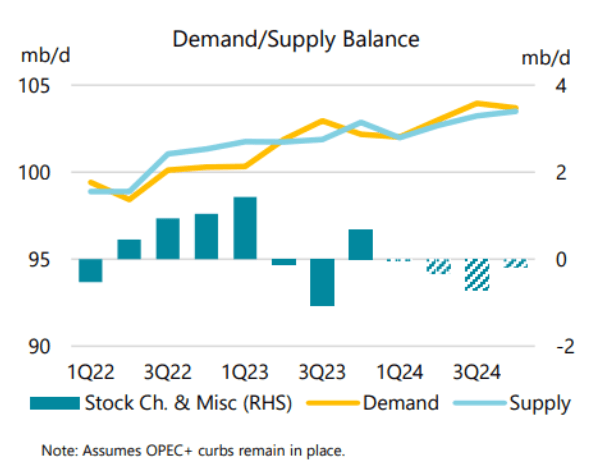

The International Energy Agency (IEA) has revised its full-year outlook for oil demand growth, attributing it to Houthi attacks in the Red Sea and an improved U.S. outlook. Despite the upward adjustment by 110,000 barrels per day (bpd), reaching 1.3 million bpd, it still lags behind OPEC's forecast.

The Houthi attacks have caused shipping disruptions, requiring tankers to reroute, increasing fuel consumption, and causing supply delays. notwithstanding prolonged OPEC+ cuts, the demand/supply balance is moving closer to a small deficit notwithstanding ongoing economic uncertainty.

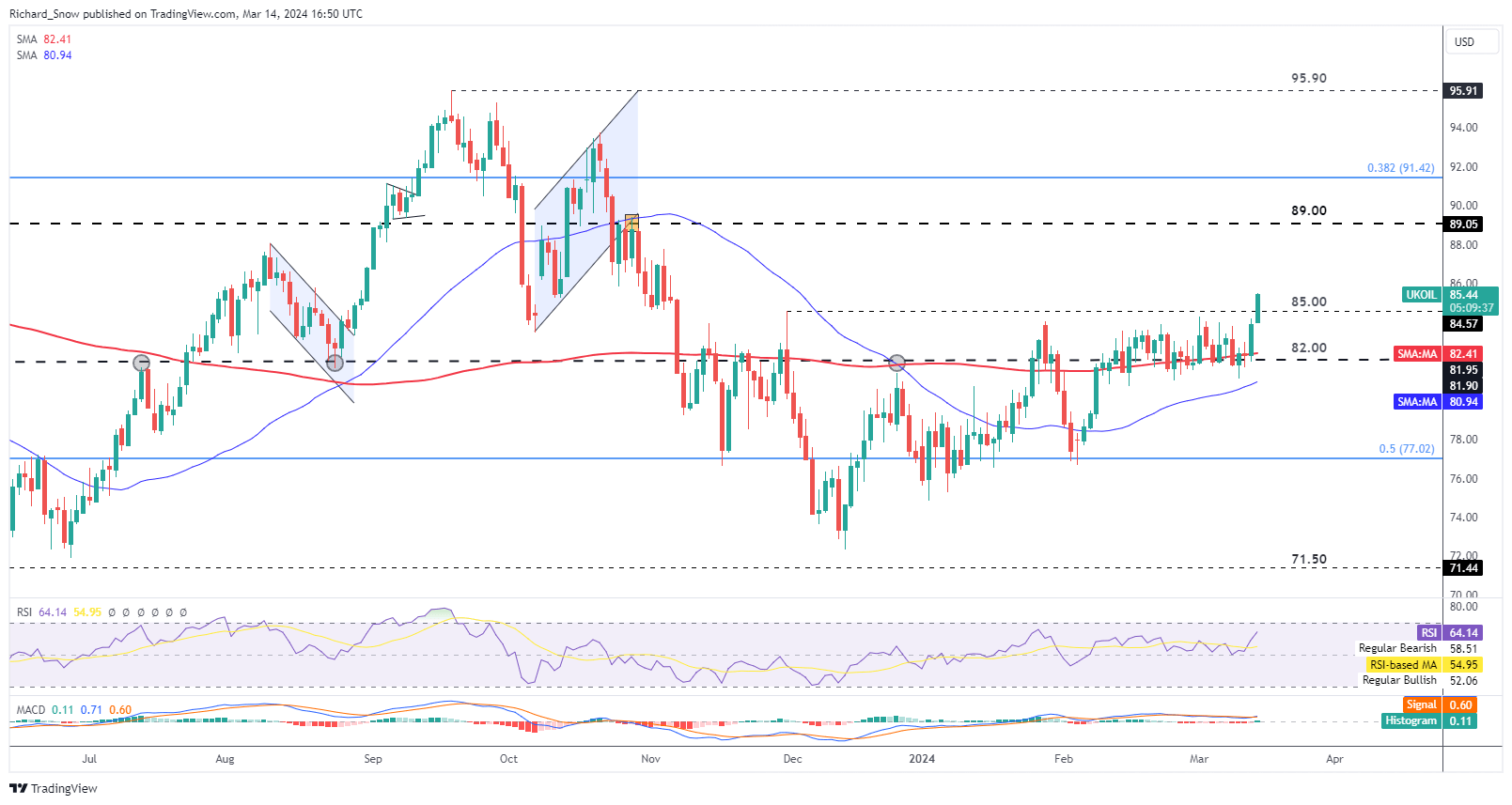

Brent Crude Oil Exceeds $85 per Barrel Threshold

When Brent crude rises above $85, it may indicate that the bullish trend will continue. The 200-day simple moving average bounce supports the optimistic outlook. The next level of interest is $89, with $85, serving as immediate support.

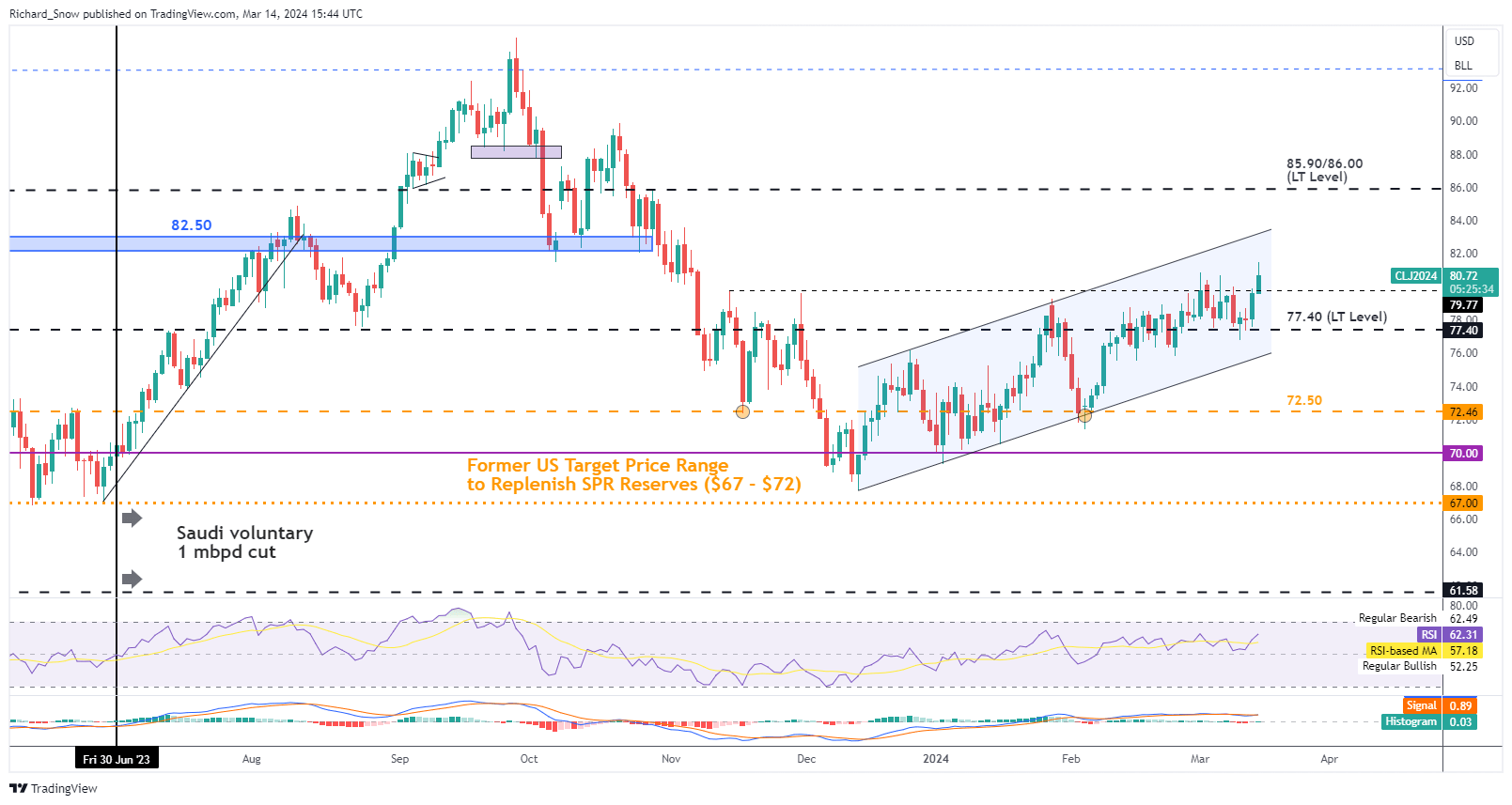

WTI Crude Oil Surpasses Previous Resistance, Reaches Three-Month Peak

WTI crude oil trades at a three-month high inside an ascending channel, breaking above the previous barrier. The $79.80 breach allows for $83/$84 and then $86.

The IEA raised its forecast for oil demand growth in 2024 and predicted a tighter market, which caused oil prices to soar to four-month highs. WTI settles at $81.26 and Brent at $85.42.

The IEA projects that supply will reach 102.9 million bpd, while demand will increase by 1.3 million bpd, or 110,000 bpd. Strong refining margins are offset by the impact on exports of Ukrainian attacks on Russian refineries.

US stockpiles fall, pushing up gas prices. In June, traders may lower interest rates, which would affect consumer borrowing costs and the demand for oil. Near-term oil production growth is anticipated to be driven by the United States, Guyana, Canada, and Brazil, countering OPEC+ cuts.

Final Thoughts

Trader conditions in the volatile oil market are influenced by supply disruptions, geopolitical tensions, and economic uncertainty. Although the IEA's updated view highlights the need for caution in the face of persistent economic volatility, it does offer a ray of optimism with its upward revision in oil demand growth.

Traders need to be flexible as the ever-changing supply and demand landscape forces them to use strategic risk management to avoid mistakes and take advantage of new opportunities.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.