Oil Price Outlook: OPEC+ Extends Supply Cuts into Q2, WTI & Brent Ease

By Daniel

March 5, 2024 • Fact checked by Dumb Little Man

OPEC+ Extends Supply Cuts for Q2, Russia Forced Into Further Cuts

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) have opted to extend supply cuts into Q2, with Russia subjected to additional reductions. This adjustment mandates a cut of 471,000 barrels per day, attributed to decreased refinery activity following Ukrainian drone strikes. Despite the anticipation of this move, the initial market response was subdued. This scenario unfolds amidst a backdrop where oil importers and consumers have seen benefits from reduced oil prices and a declining US dollar, contrasted against the slowdown in global growth. Notable is the stagnation in economies such as the UK, Japan, and the European Union, with China facing challenges in stimulating its economy.

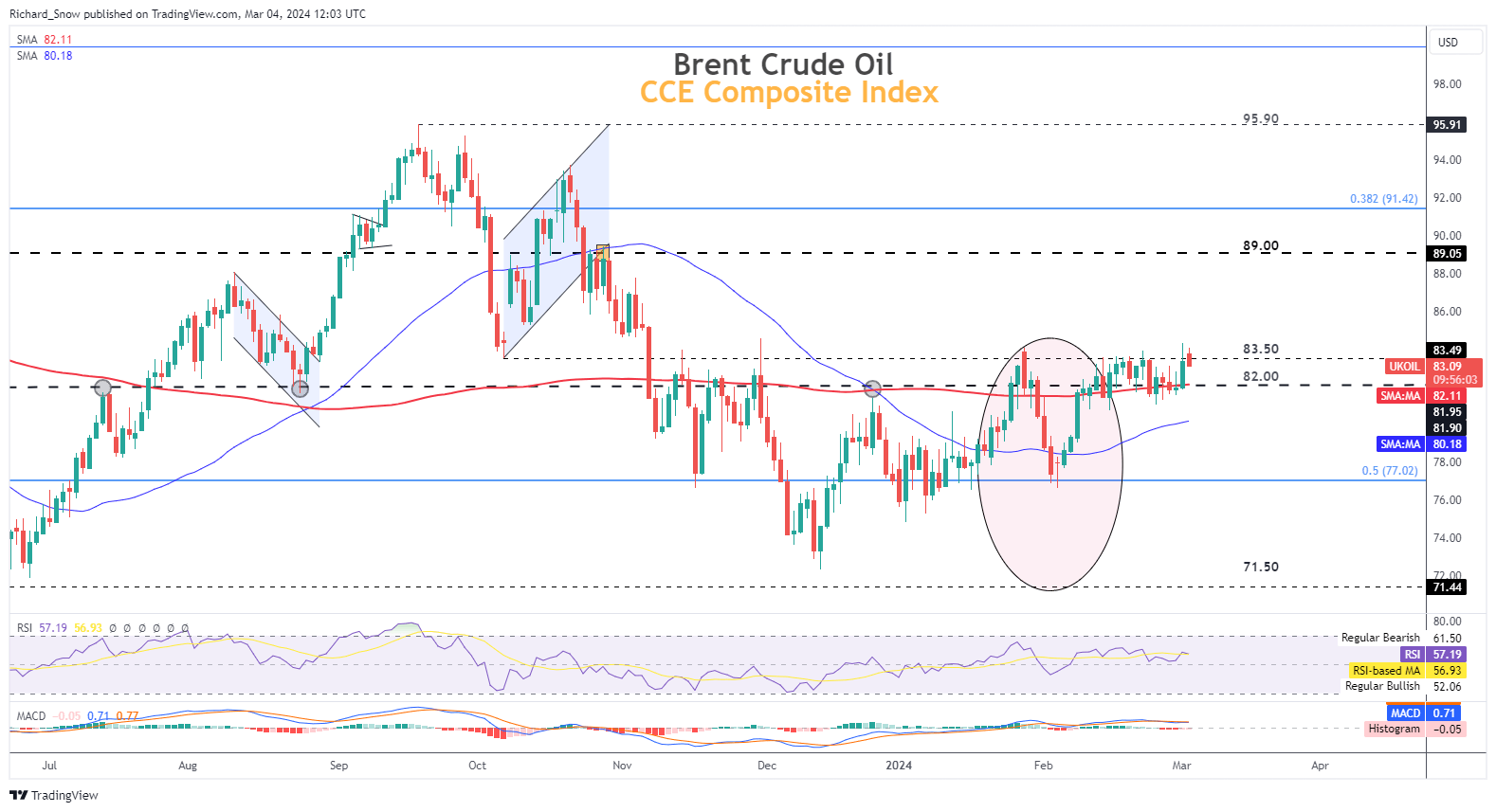

Brent Crude Oil Starts the Week on the Back Foot

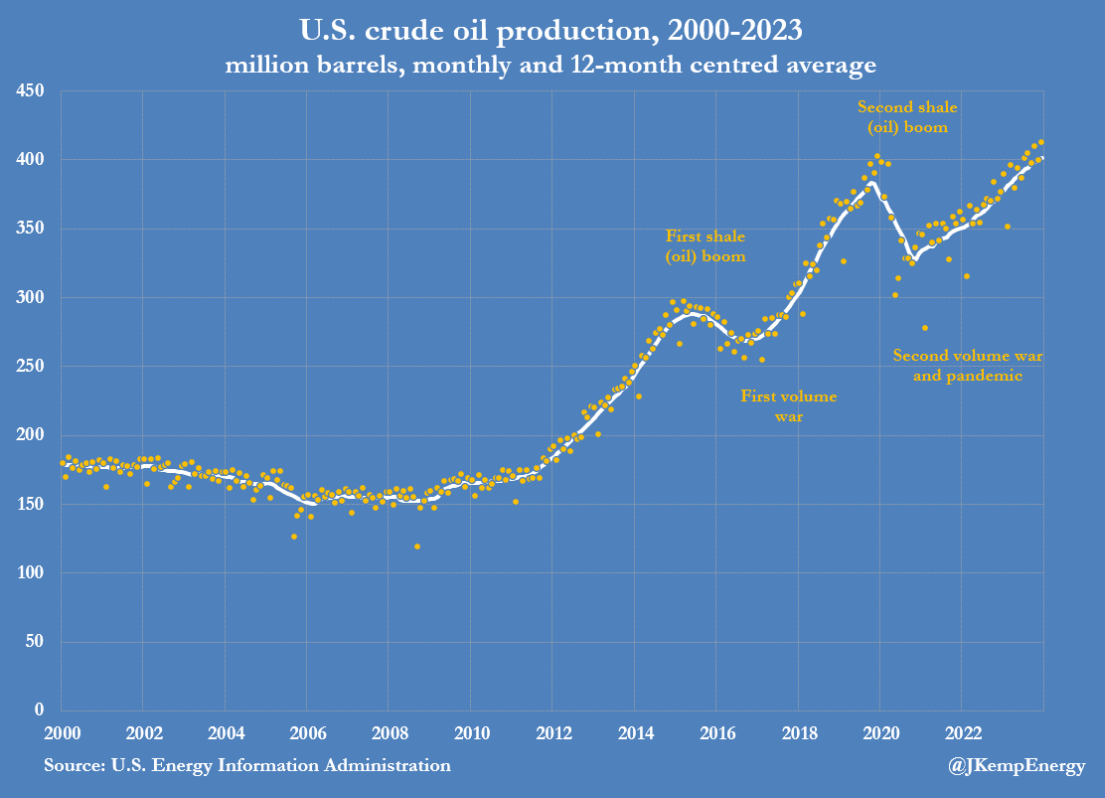

China is at a critical juncture, deliberating on growth targets and strategic actions to invigorate its economy, albeit with limited success from previous measures. A growth target consistent with 2023’s “around 5%” is anticipated. Concurrently, non-OPEC oil supply, particularly from the US, is hitting record levels, further influencing the market dynamics.

The Brent crude oil market demonstrated volatility, initially driven by a weaker dollar and concerns over US manufacturing data. Yet, the focus shifts towards US services data, pivotal for the country’s GDP. Brent crude starts the week with minor fluctuations but maintains a position above key resistance levels. Potential support and resistance levels are identified, indicating the market’s sensitivity to various economic indicators.

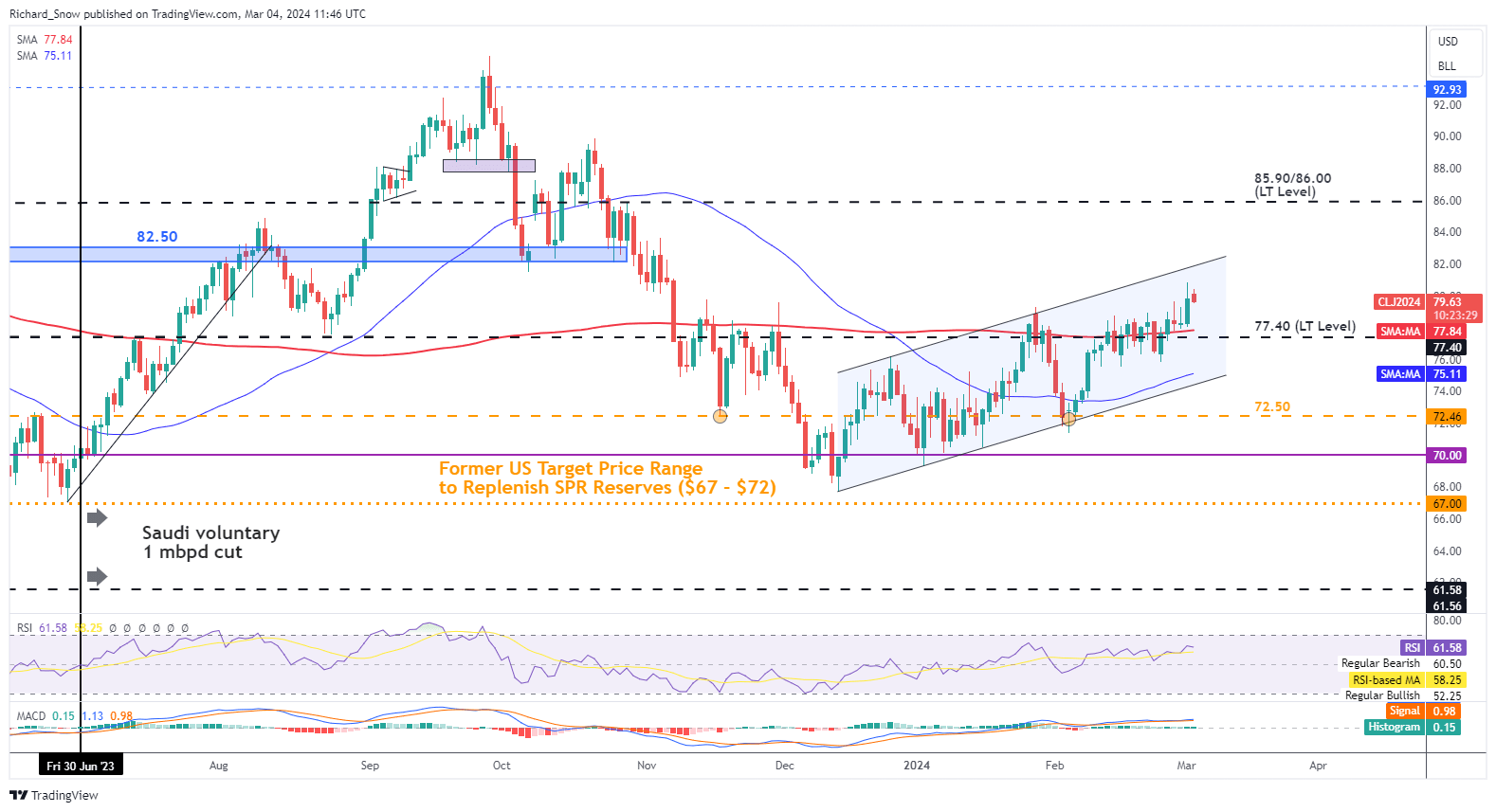

WTI Oil Signals Bullish Fatigue as Prices Pullback Towards Key Level

WTI oil shows signs of bullish fatigue, with potential pullback indicators aligning with key support levels. Upcoming US economic data and strategic meetings in China could significantly influence oil price trajectories. This complex interplay of demand and supply, geopolitics, and global economic growth underscores the multifaceted nature of the oil market, essential for traders to grasp.

Daniel

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.