Netflix Earnings Insight: Key Drivers and Forecast

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Netflix's Impressive Stock Performance

Netflix's stock has surged by over 26% since the start of the year, continuing its upward trend from mid-2022. Despite some volatility, the stock's trajectory remains strong.

Quarterly Results in Focus

Investors are keenly awaiting today's post-market earnings release. This report will determine if Netflix can sustain its upward momentum.

Subscribers Increase Following Policy Change

Investors are particularly interested in subscriber growth, which saw a notable increase in Q4 2023 after Netflix implemented its new policy on account sharing. This strategy contributed significantly to their recent success, with a 12% rise in subscribers in just one quarter, reaching 260.8 million.

Challenges from Economic Conditions

However, potential high-interest rates set by the Federal Reserve through early 2025 to combat disinflation could impact the broader market and Netflix's performance.

Successful Password Sharing Crackdown

Netflix's decision to enforce its password-sharing policy has effectively boosted subscriber numbers. The policy led to an addition of 13.1 million subscribers in Q4 2023, affirming Netflix’s dominance over competitors like Disney+ and Amazon Prime.

Advertising Revenue Adds to Growth

Alongside subscriber gains, Netflix's focus on ad-supported revenue streams has also enhanced their financial outlook, indicating robust growth as we move into Q1 2024.

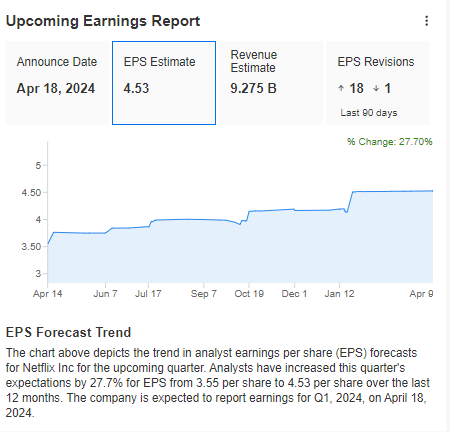

Anticipation for Earnings Report

With positive revisions dominating and a historical reaction to earnings reports causing significant stock rallies, all eyes are on the potential impact of today's financial disclosures.

Netflix Stock: A Technical Perspective

Netflix's stock pattern shows a consolidation phase with a potential breakout depending on today's earnings. A positive surprise could push the stock toward new heights, whereas disappointing results might lead to a price correction.

Potential Stock Movements

The stock could ascend to new peaks around $700 in a bullish scenario. Conversely, a bearish outcome might see prices falling to the $570-$580 range.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.