Natural Gas Market Rebounds: Talking About the Shift

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

The natural gas market has witnessed a significant recovery, with prices climbing from lows of approximately $1.5/MMBtu. Chesapeake Energy (CHK) led the charge among U.S. gas producers by implementing a substantial production cut of about 0.73 Bcf/d, followed by EQT Corporation (EQT) announcing a reduction of approximately 1 Bcf/d for March.

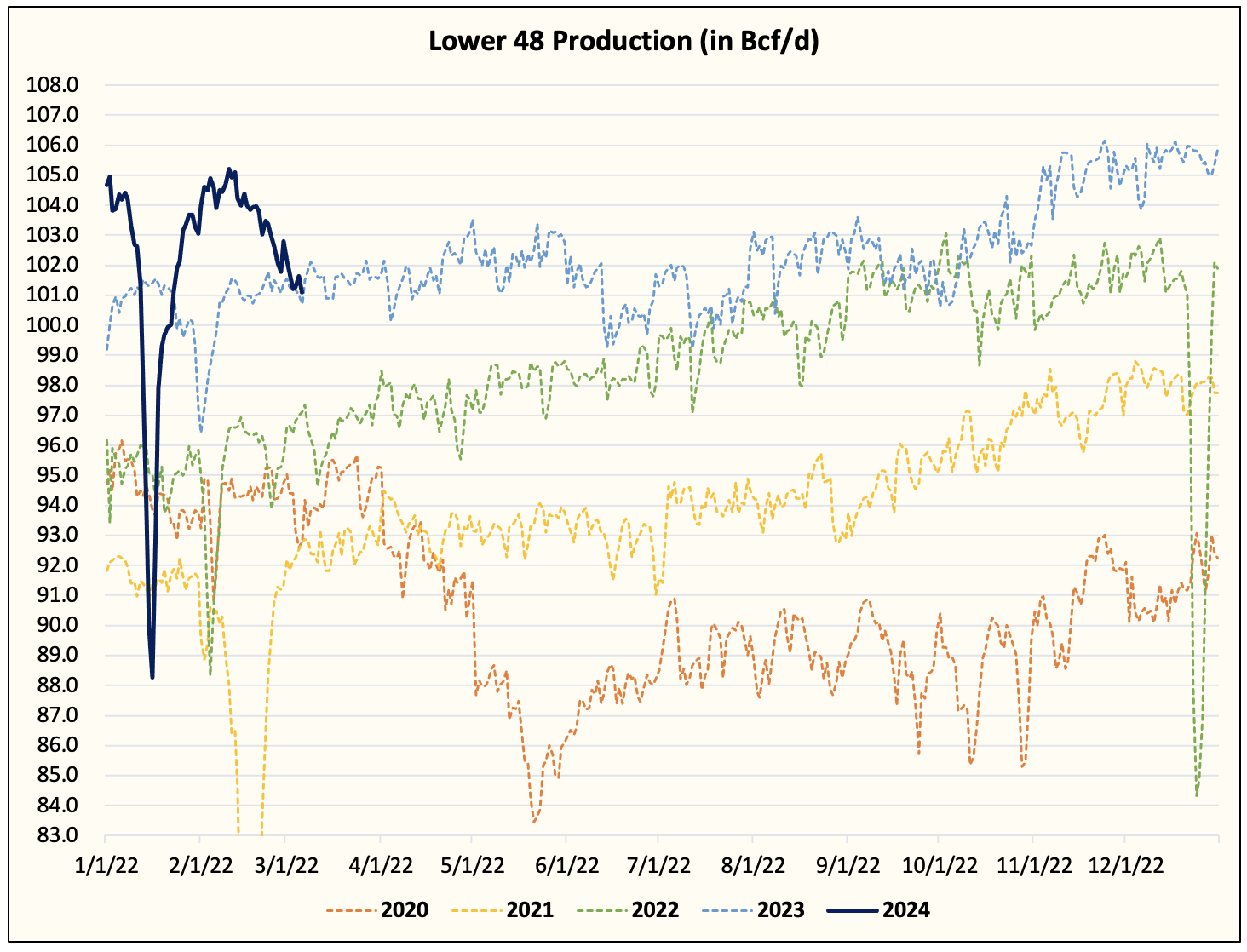

This strategic move aligns with the principle that “low prices cure low prices,” triggering a notable drop in production from ~105 Bcf/d to ~101 Bcf/d in the Lower 48, primarily due to market-driven shutdowns rather than maintenance activities.

With the onset of these production cuts, the market appears to have established a solid foundation, crucial for addressing the impending surplus in storage as winter concludes.

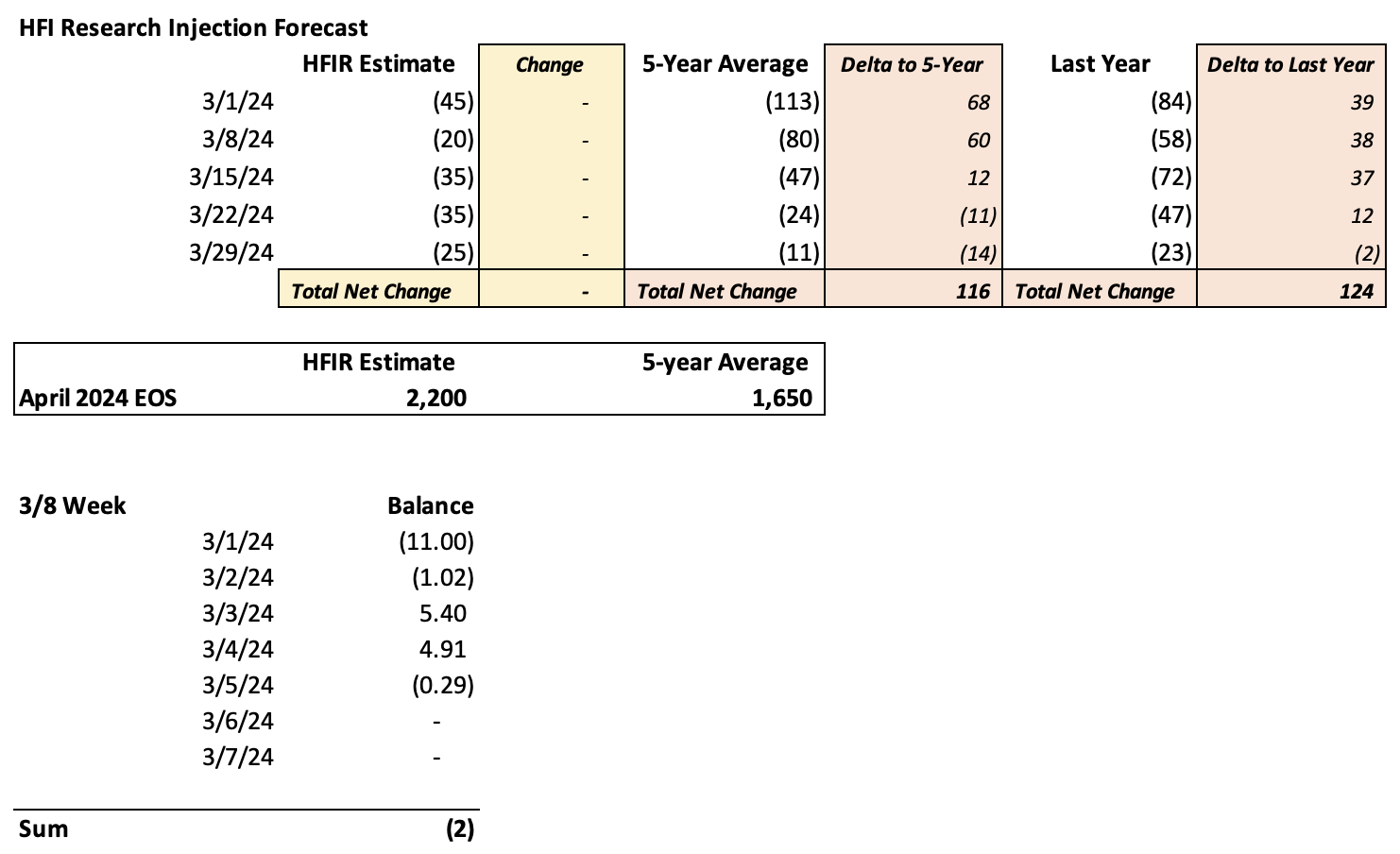

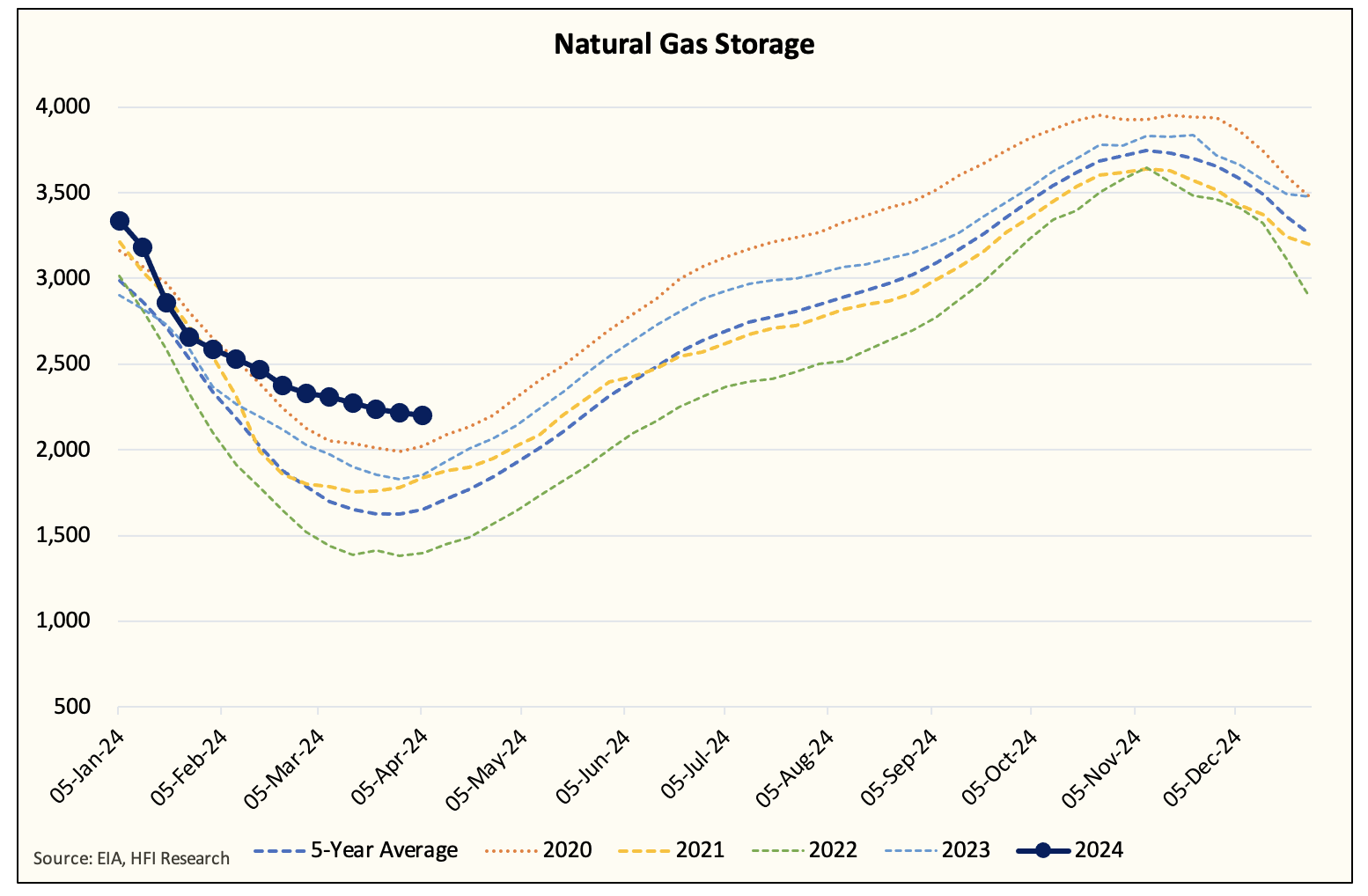

Current forecasts predict natural gas storage to end the withdrawal season at an impressive ~2.2 Tcf, significantly above the five-year average of 1.65 Tcf. This leaves the market with a daunting surplus of ~550 Bcf to reconcile.

Given the current production rate of 101 Bcf/d in the Lower 48, the U.S. natural gas market is poised for a deficit. With a normal summer cooling demand, we might see a deficit of about ~2.5 Bcf/d.

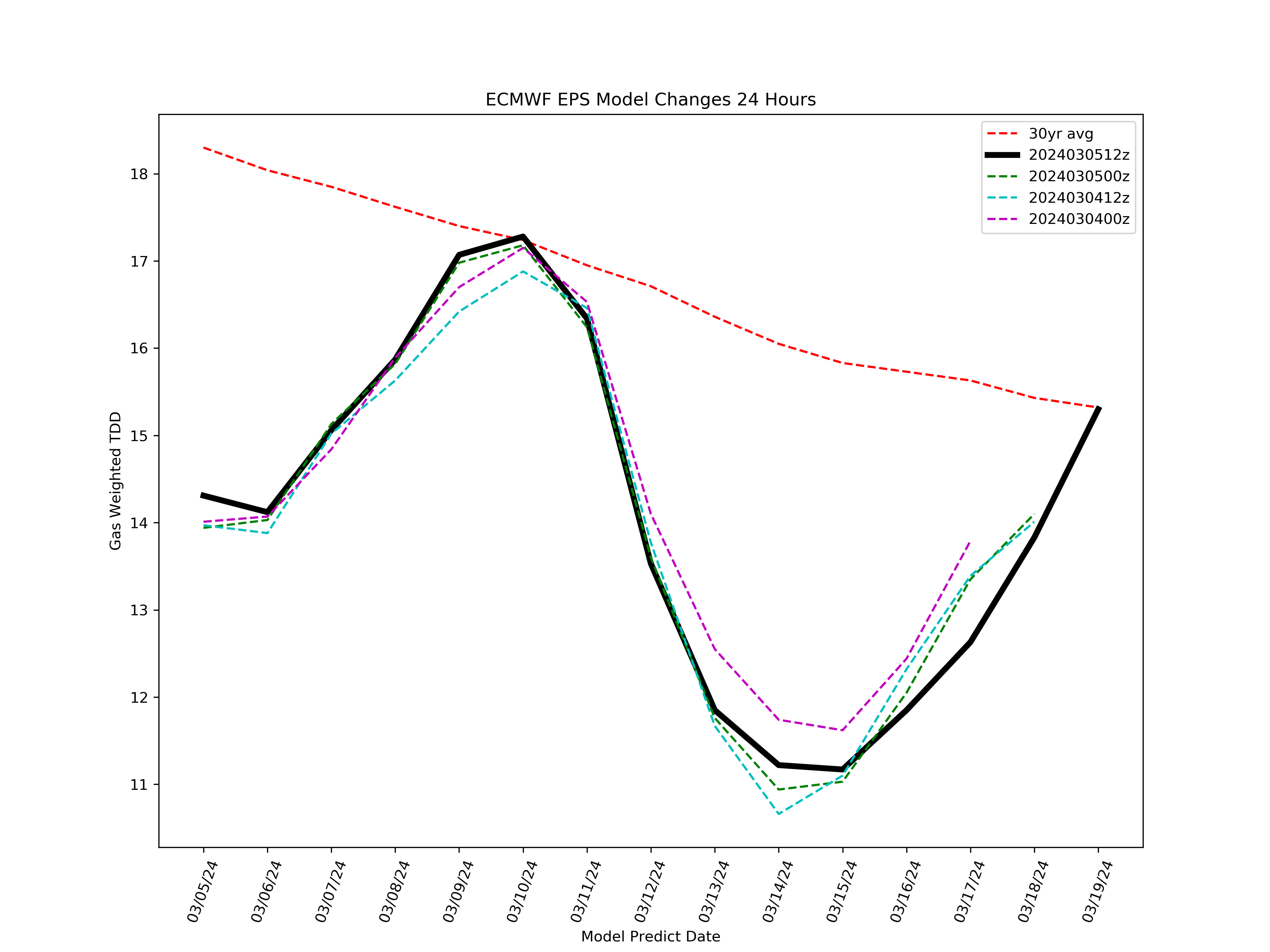

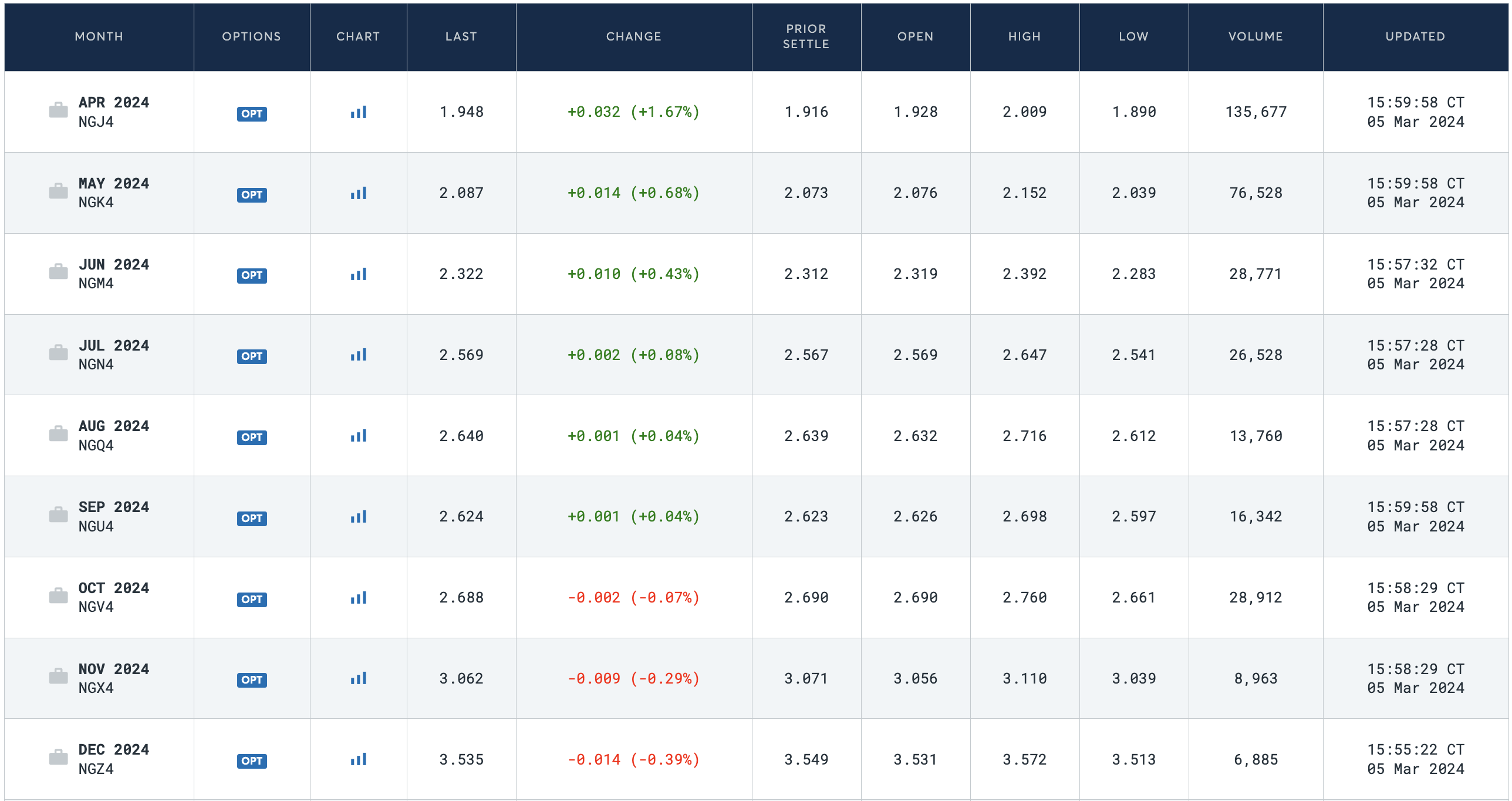

However, the future appears uncertain with the Henry Hub futures curve projecting prices around $2.569/MMBtu by July, which may prevent a decline in production.

Where do we start?

Anticipating average summer production to stabilize at ~103 Bcf/d, the market could face a slight deficit. Furthermore, increased demand from LNG exports and power generation is expected to exacerbate this deficit by an additional ~2 Bcf/d.

In total, the market could see a shift into a 2.5 Bcf/d deficit by mid-June. If production unexpectedly drops below 103 Bcf/d, the deficit could increase further. The existing 550 Bcf surplus necessitates balancing to return storage levels to the five-year average, suggesting that current production rates or prices below $2 are essential for this adjustment.

Production and Price Dynamics

The resurgence in natural gas prices, spurred by recent production cuts, introduces a paradox where increased prices could inadvertently lead to boosted production, thereby pressuring prices downwards again. This cycle highlights the fundamental principle that low prices are instrumental in self-correcting the market imbalance.

As the winter season has consistently underperformed in heating demand, resulting in storage levels ~550 Bcf above the five-year average, the focus now shifts to monitoring Lower 48 gas production. Maintaining production around ~101 Bcf/d through the upcoming seasons is critical for favorable injection rates.

The natural gas market's path to equilibrium will require patience, suggesting that a rapid return to $2.5/MMBtu prices is unlikely. As the industry navigates through these fluctuations, the market's ability to self-regulate will be key to achieving a balanced and sustainable future for natural gas.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.