Mixed Movements in Major Indices: Nasdaq 100, Dow, and Russell 2000

By Daniel M.

May 22, 2024 • Fact checked by Dumb Little Man

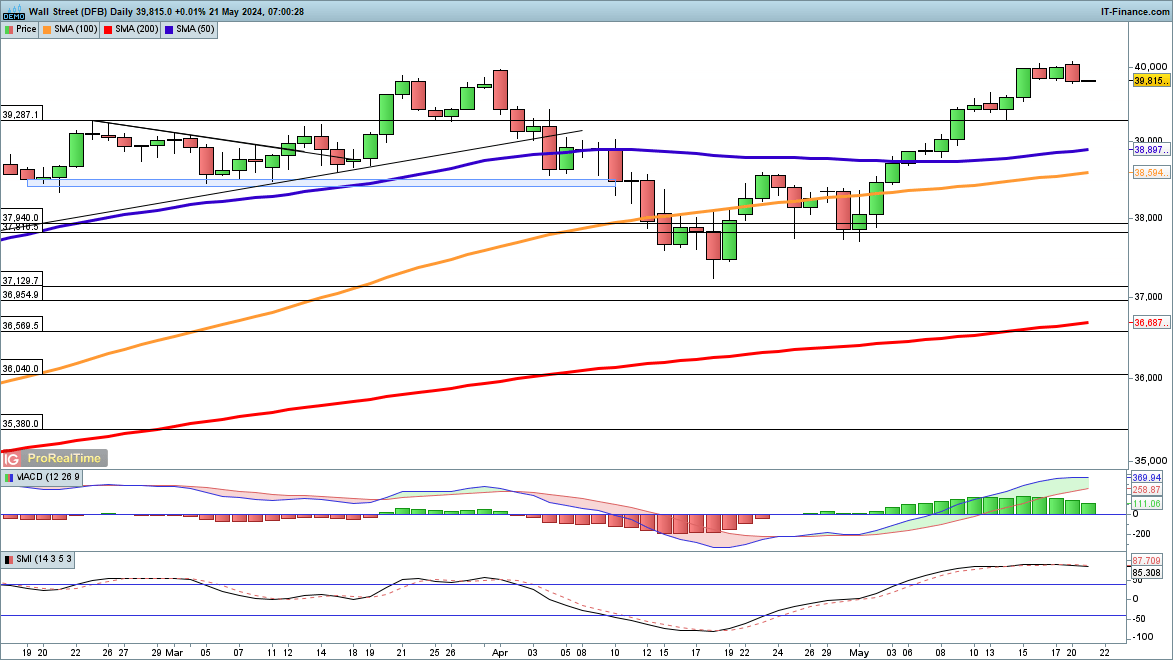

Dow Faces Resistance at 40,000

The Dow briefly surpassed 40,000, reaching a record high, before retreating. After its robust climb from late April, a period of short-term consolidation or pullback wouldn’t be unexpected.

The previous peak at 39,287 might offer some support, with additional support potentially coming from the 50-day simple moving average. Despite recent fluctuations, the overall bullish trend will persist unless the index falls below 38,500.

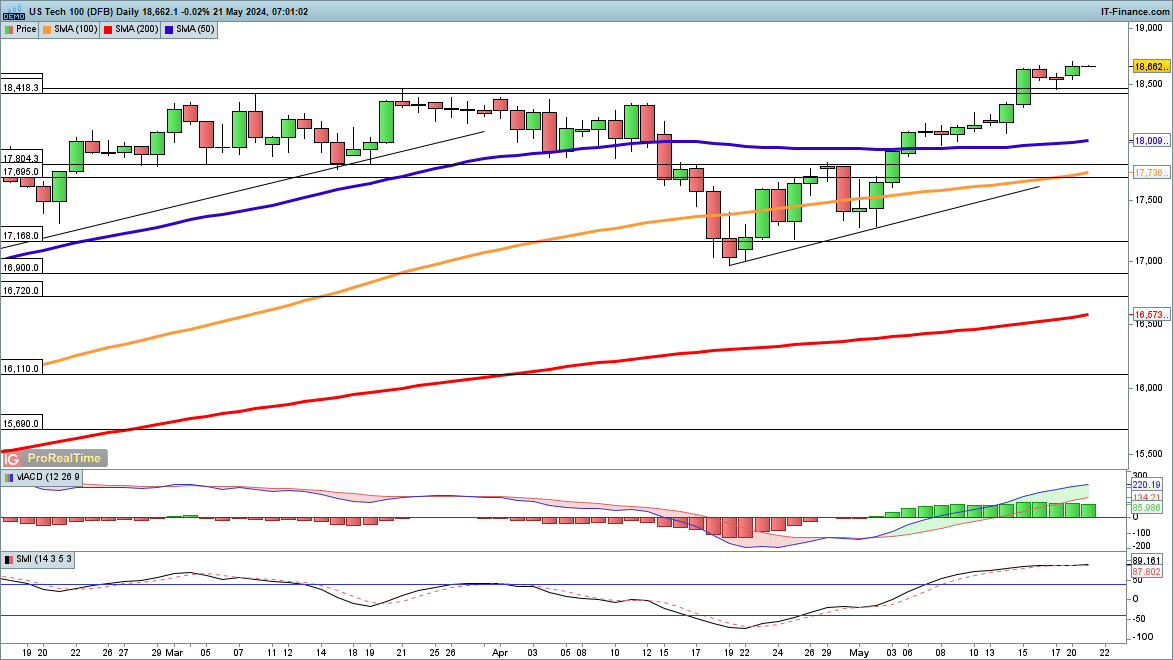

Nasdaq 100 Sets New Record

Similarly, the Nasdaq 100 marked a new high and maintained its upward trajectory. The bullish sentiment continues, with expectations for further record levels, though upcoming earnings from Nvidia could inject some volatility.

Should the index close below 18,400, it might suggest the formation of a short-term peak and a possible retest of the 18,000 level.

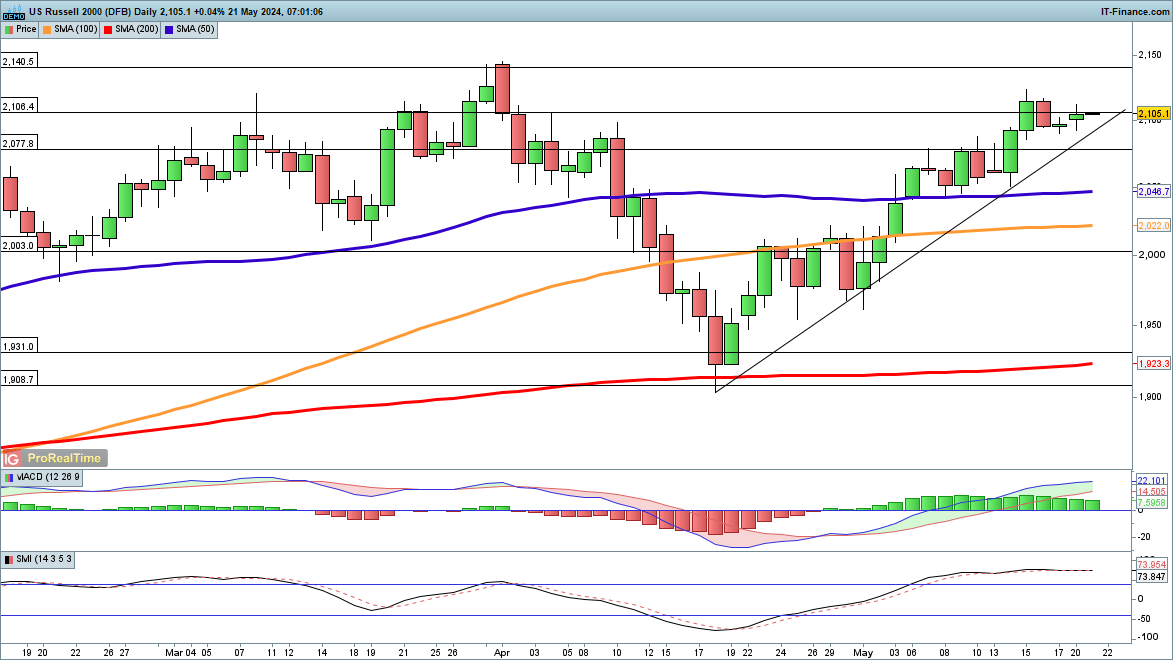

Russell 2000 Nears Previous Peaks

In contrast, the Russell 2000 still trails its 2024 high and remains significantly below its all-time high from November 2021. However, the index’s medium-term outlook is optimistic, aiming for the March high at 2140, with potential advancement towards the January 2022 intermediate peak at 2220.

While sellers have not yet taken control, a close below 2085 would break the short-term support trendline established since the April low.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.