Markets Week Ahead: Gold Climbs Amid Geopolitical Tensions, While Sterling Falls and USD Strengthens

By Daniel M.

March 24, 2024 • Fact checked by Dumb Little Man

Shift in Gold's Momentum Post-FOMC Meeting

After the Federal Open Market Committee (FOMC) meeting and its economic projections, gold went through a period of significant volatility, reaching new all-time highs.

The US dollar weakened which was in response to the Fed's decision to maintain its December projection of three 25 basis point hikes in 2024.

This went against the expectations of some in the market who believed the Fed might decrease the number of rate cuts. Consequently, there was a significant increase in gold prices followed by a sudden decline, suggesting a possible moderation in the coming week.

GBP Drops as Bank of England Holds Rates Steady

The Bank of England's decision to keep the bank rate unchanged, despite previous indications of potential adjustments, led to a dip in Sterling.

The vote concluded with eight members supporting the decision to maintain interest rates, which was influenced by the latest inflation data.

The upcoming week seems to have a relatively calm schedule in terms of risk events, indicating that the trading days ahead might be quieter, especially with the observance of Good Friday.

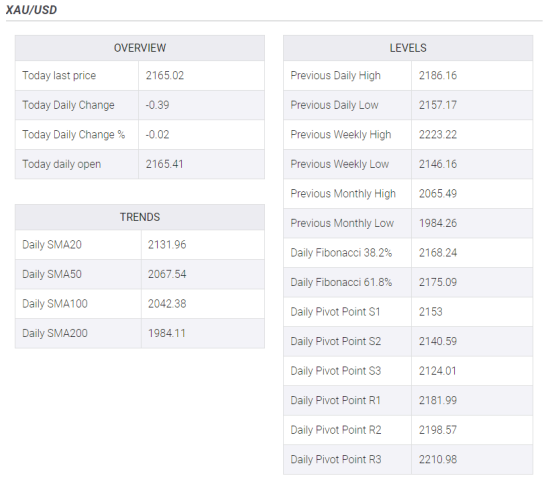

Gold Price Outlook: XAU/USD Holds Gains

Gold (XAU/USD) remains above the mid-$2,100s as investors eagerly await potential rate cuts from the US Federal Reserve in the coming months.

The optimism is further bolstered by escalating geopolitical tensions, notably in Ukraine, which increases the appeal of gold as a safe-haven asset. The current price of gold is approximately $2,168, indicating a slight uptick.

Investors eagerly await the release of the US Gross Domestic Product (GDP) data for Q4, with expectations of a 3.2% growth rate. The outcome of this report has the potential to impact the strength of the US dollar, which in turn could affect gold prices.

Furthermore, the market is currently focused on the possibility of rate cuts by the Federal Reserve, as there is a growing expectation of a reduction in the upcoming June meeting.

Final Thoughts

Traders are currently navigating through a week filled with geopolitical risks and important economic updates. The recent volatility in gold serves as a reminder of its sensitivity to shifts in US monetary policy and global uncertainties.

It is expected that the performance of Sterling will continue to be restrained as there are no significant UK economic events on the horizon. Meanwhile, the trajectory of the US dollar may be influenced by the upcoming GDP report and the ongoing geopolitical tensions.

Market participants should prepare for possible changes in market sentiment, closely monitoring economic indicators and geopolitical events that may impact trading strategies in the coming days.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.