Market Trends: Gold, Silver, and S&P 500

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Gold Prices Cool Down

The week begins with a rise in risk appetite, following a de-escalation between Israel and Iran. Various markets, including gold, silver, AUD, and US equities, have shown signs of recovery. The Aussie dollar, which correlates with risk assets, has demonstrated some resilience. For further insights, check the detailed AUD analysis.

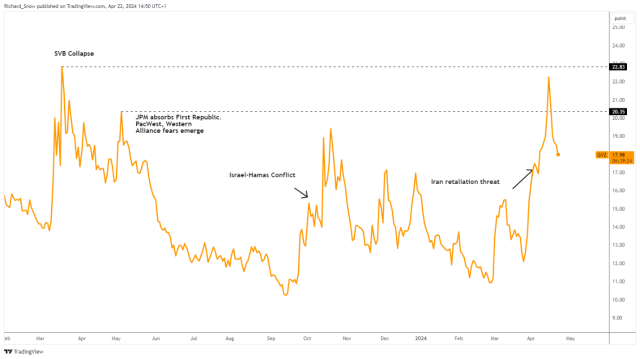

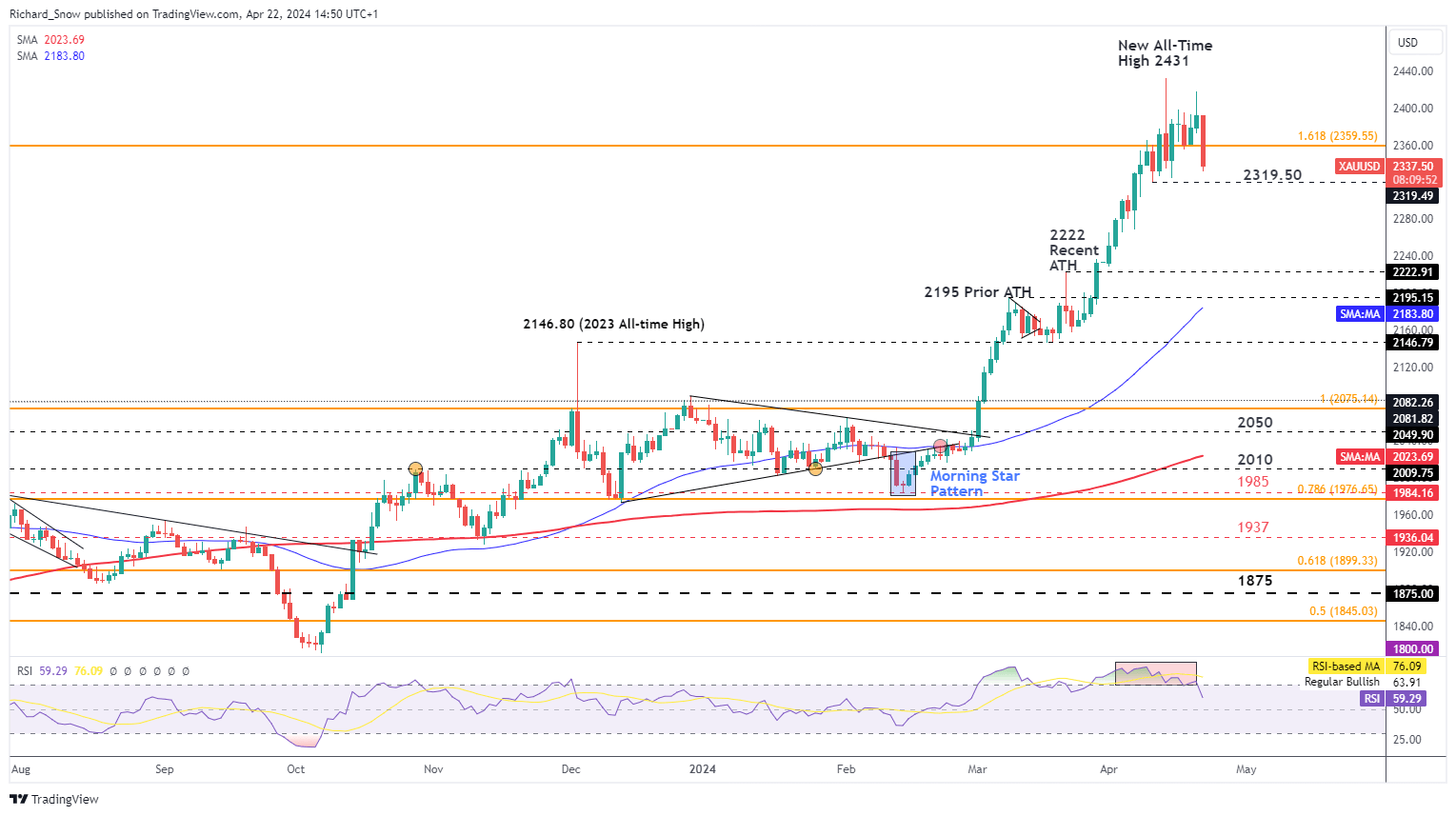

Gold, which had been enjoying a bullish streak, saw its appeal as a haven diminish this week, resulting in its steepest decline since March 9, 2022. Market volatility expectations for gold have decreased, suggesting a reduced chance of conflict in the Middle East.

Despite attempting a new all-time high near $2341 on Friday, gold experienced a significant drop on Monday. It is now approaching a support level at $2320, potentially leading to a pullback towards $2222. Gold has exited the overbought zone, becoming more vulnerable to a strengthening US dollar and rising US Treasury yields. With US data strengthening, expectations of delayed rate cuts are likely to support the dollar further, negatively impacting gold prices.

Silver Experiences a Drop

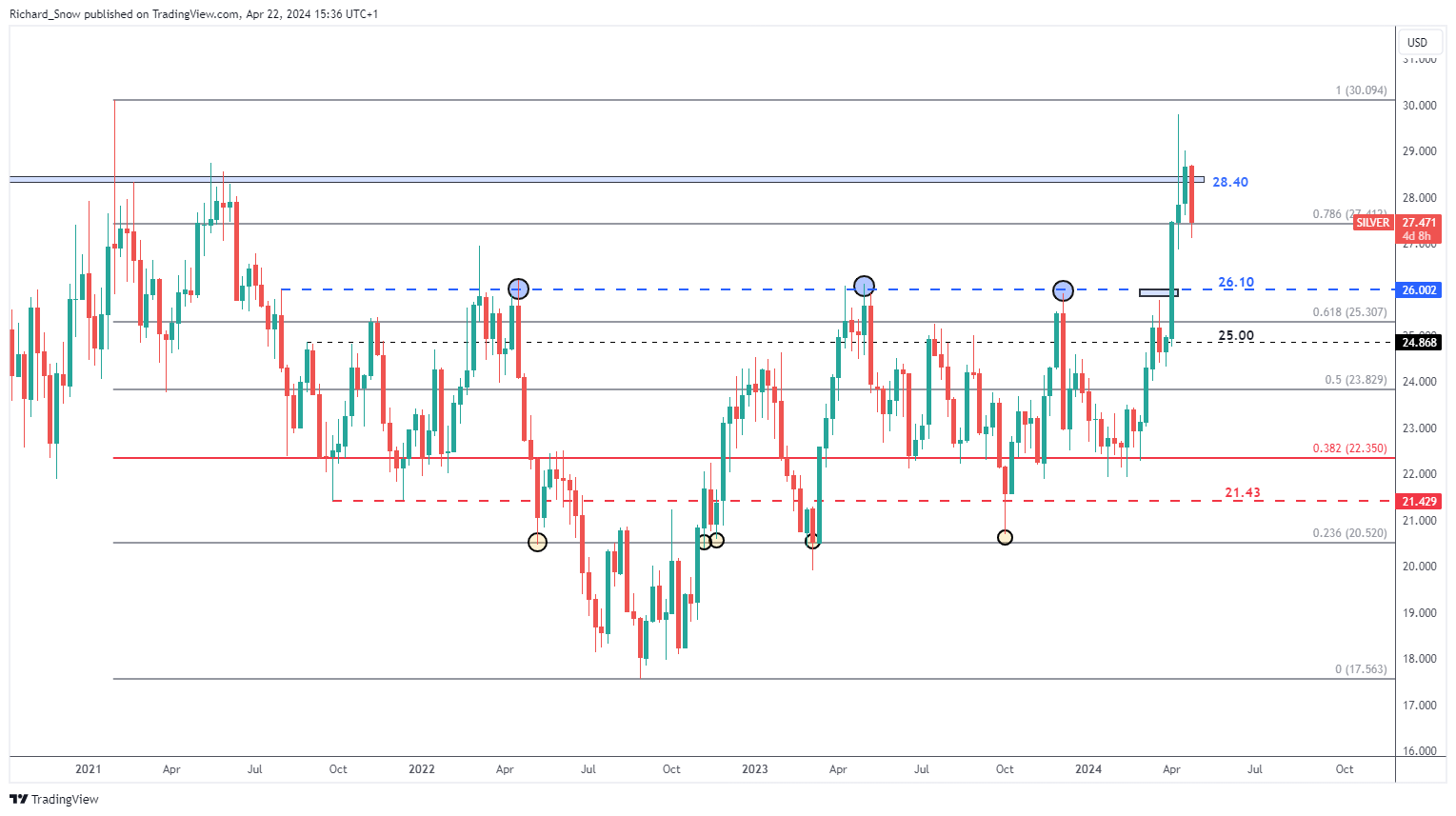

Similarly, silver has also faced a downturn, noticeable even on the weekly chart. The metal now trades below $28.40 and has breached the 78.6% Fibonacci level from its previous major decline. A continuation of this trend could bring the $26.10 resistance level into play, followed by the 61.8% Fibonacci level at $25.30.

S&P 500 Seeks Support from Tech Earnings

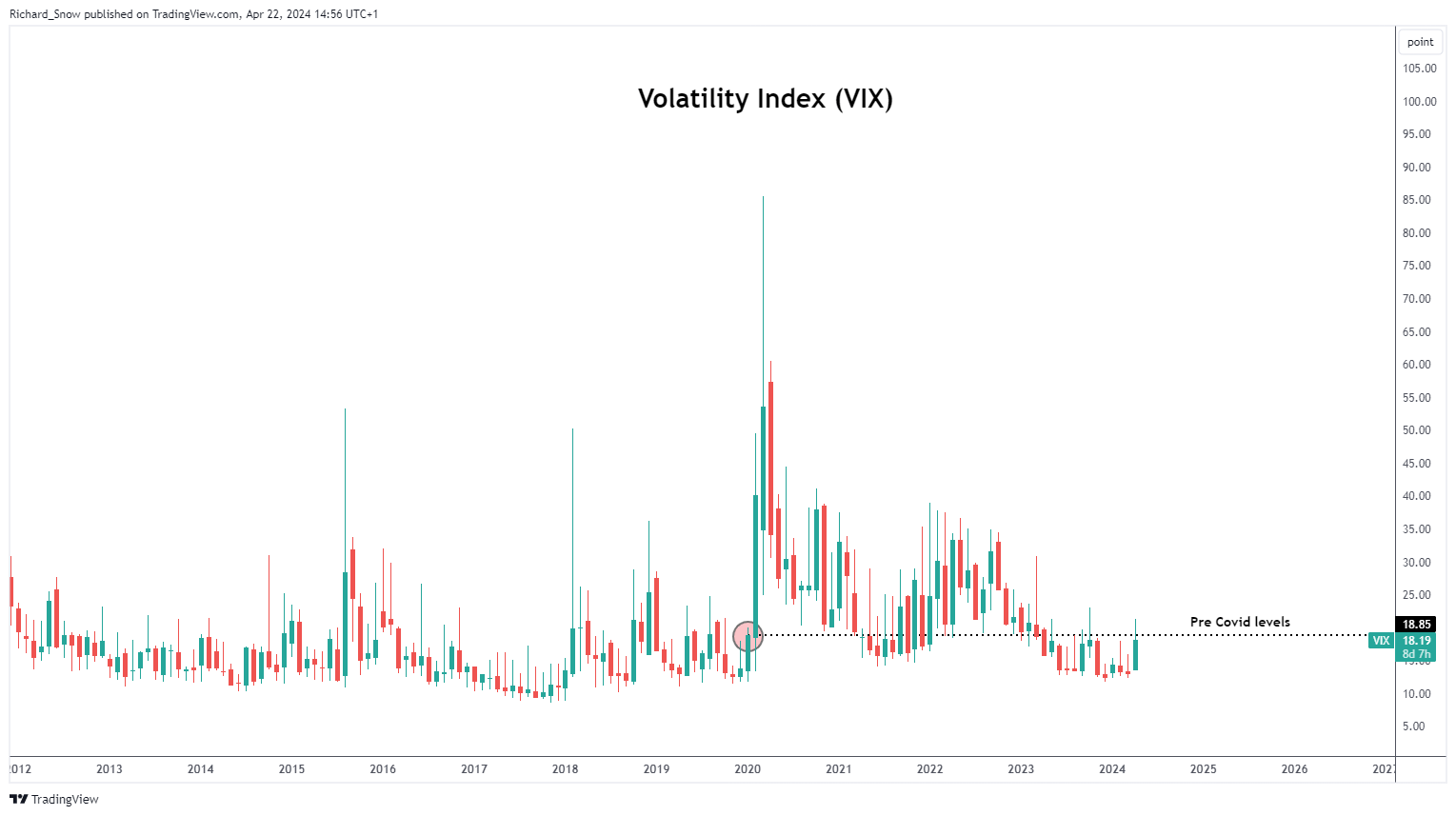

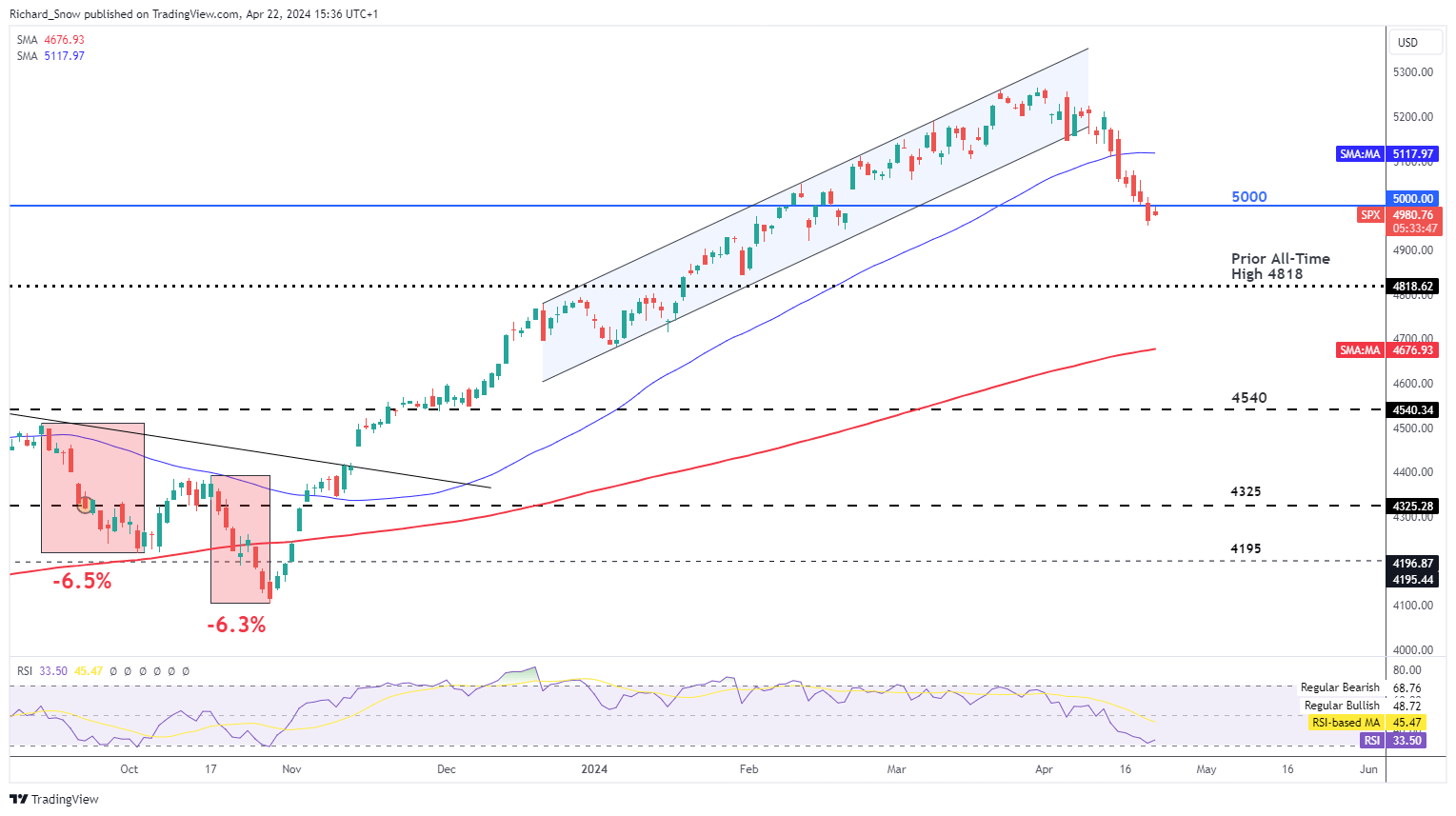

Despite low overall volatility, as shown on the VIX or ‘fear index', the S&P 500 has experienced significant fluctuations recently. This earnings season is critical, with major tech companies like Tesla, Meta, Alphabet, and Microsoft scheduled to report results.

The S&P 500 opened higher, nearly reaching the 5000 mark, influenced by Fed’s John Williams‘ hints at possible rate hikes due to recent inflation trends. This has shifted market expectations, with fewer anticipated rate cuts. This earnings season, tech stocks, particularly those focused on AI like Microsoft, will be key players. Their performance could potentially push US stocks back towards the 50-day SMA or lead to a reassessment of the recent all-time high of 4818.

This analysis provides a snapshot of the current market sentiment and potential future trends affecting gold, silver, and the S&P 500, which are crucial for investors looking to navigate these volatile markets.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.