Market Trends: Gold, Dow Jones, USD/JPY – Who Leads?

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

In the fast-paced trading world, it’s easy to follow the crowd—buying when markets rise and selling during declines. Yet, experienced traders often find value in the path less traveled. Contrarian trading isn’t just about opposing the crowd; it’s about recognizing when the majority could be mistaken and capitalizing on these moments. Tools like IG client sentiment help spot extreme optimism or pessimism, potentially signaling market reversals.

Contrarian indicators alone don’t guarantee success; they shine when part of a broader strategy that includes technical and fundamental analysis. This multifaceted approach can reveal market dynamics that often go unnoticed by the majority.

Let’s delve into the IG client sentiment for three key assets—gold, the Dow Jones 30, and USD/JPY—and explore the implications of contrarian thinking.

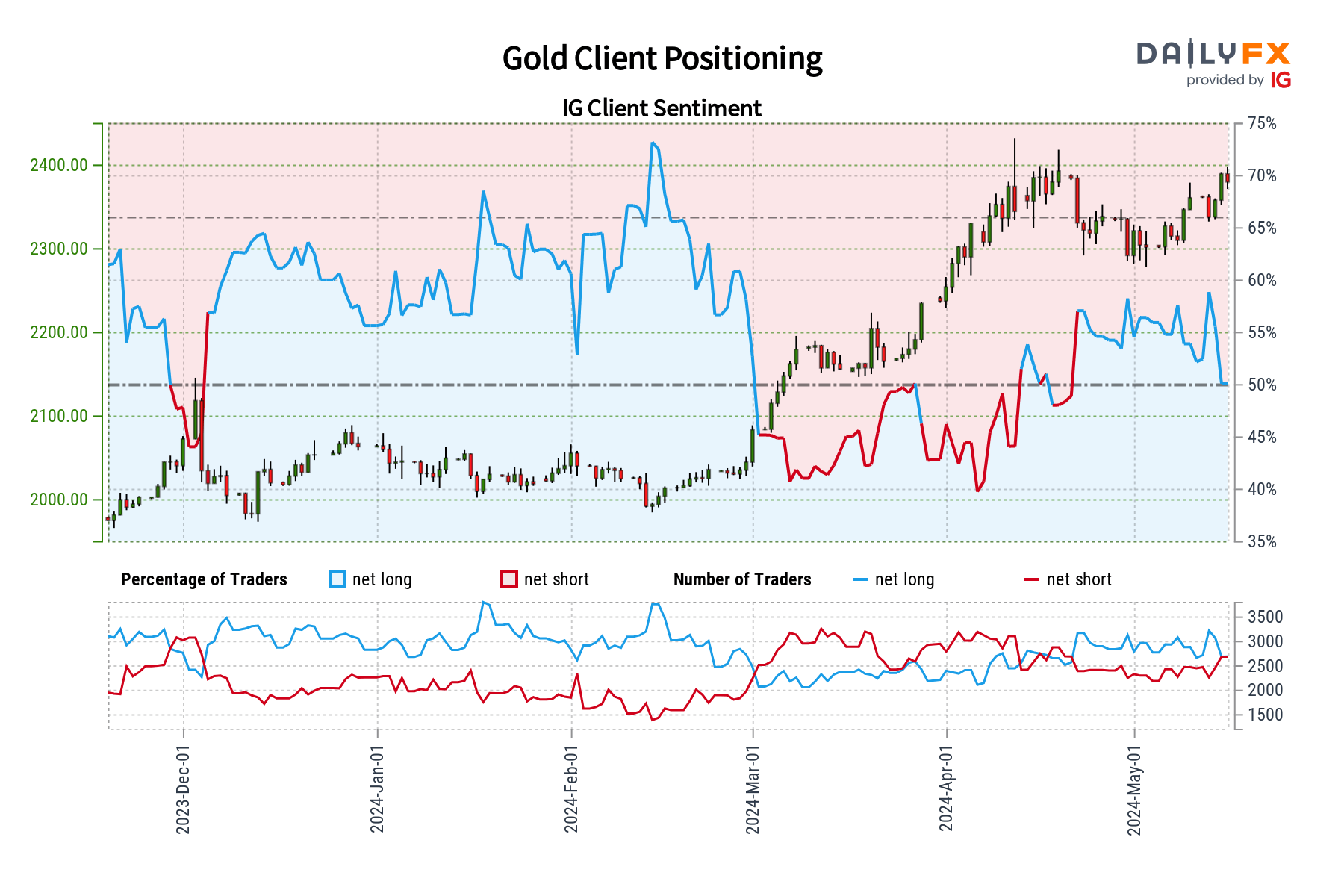

Gold Price – Market Sentiment

IG data indicates that 54.01% of traders are net-long on gold, with a buyer-to-seller ratio of 1.17 to 1. Net-long positions have increased by 8.22% since yesterday and 1.60% from last week, while net-short positions have decreased by 3.65% from yesterday but increased by 2.22% from last week.

Contrarian view: The increase in bullish sentiment among retail traders suggests a potential pullback in gold prices. However, the mixed changes in positioning compared to last week introduce uncertainty, leading to a complex outlook for gold.

Key Takeaway: Contrarian indicators are insightful but work best alongside technical and fundamental analysis, especially in ambiguous market conditions like those currently seen in gold.

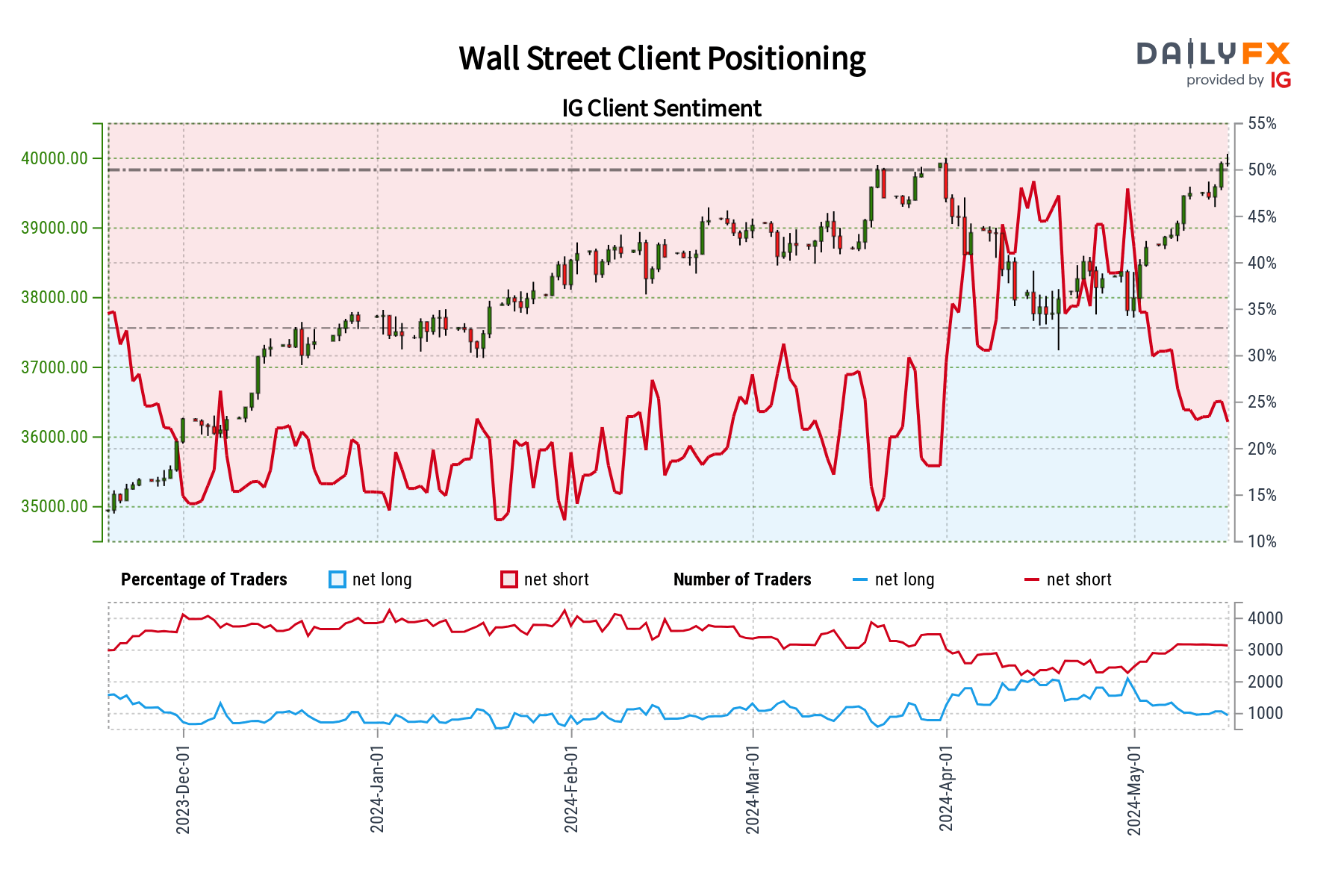

Dow Jones 30 – Market Sentiment

75.94% of traders are positioned for a decline in the Dow Jones 30, with a short-to-long ratio of 3.16 to 1. The number of bearish traders has risen by 9.59% since yesterday and 8.17% from last week. Conversely, bullish positions have decreased by 6.93% from yesterday and 10.37% from last week.

Contrarian view: The overwhelming pessimism toward the Dow suggests a potential upside surprise may be near. The increase in bearish bets reinforces a bullish contrarian outlook.

Key Takeaway: While contrarian signals are valuable, they are most effective when combined with comprehensive technical and fundamental analyses to support trading decisions in the Dow Jones.

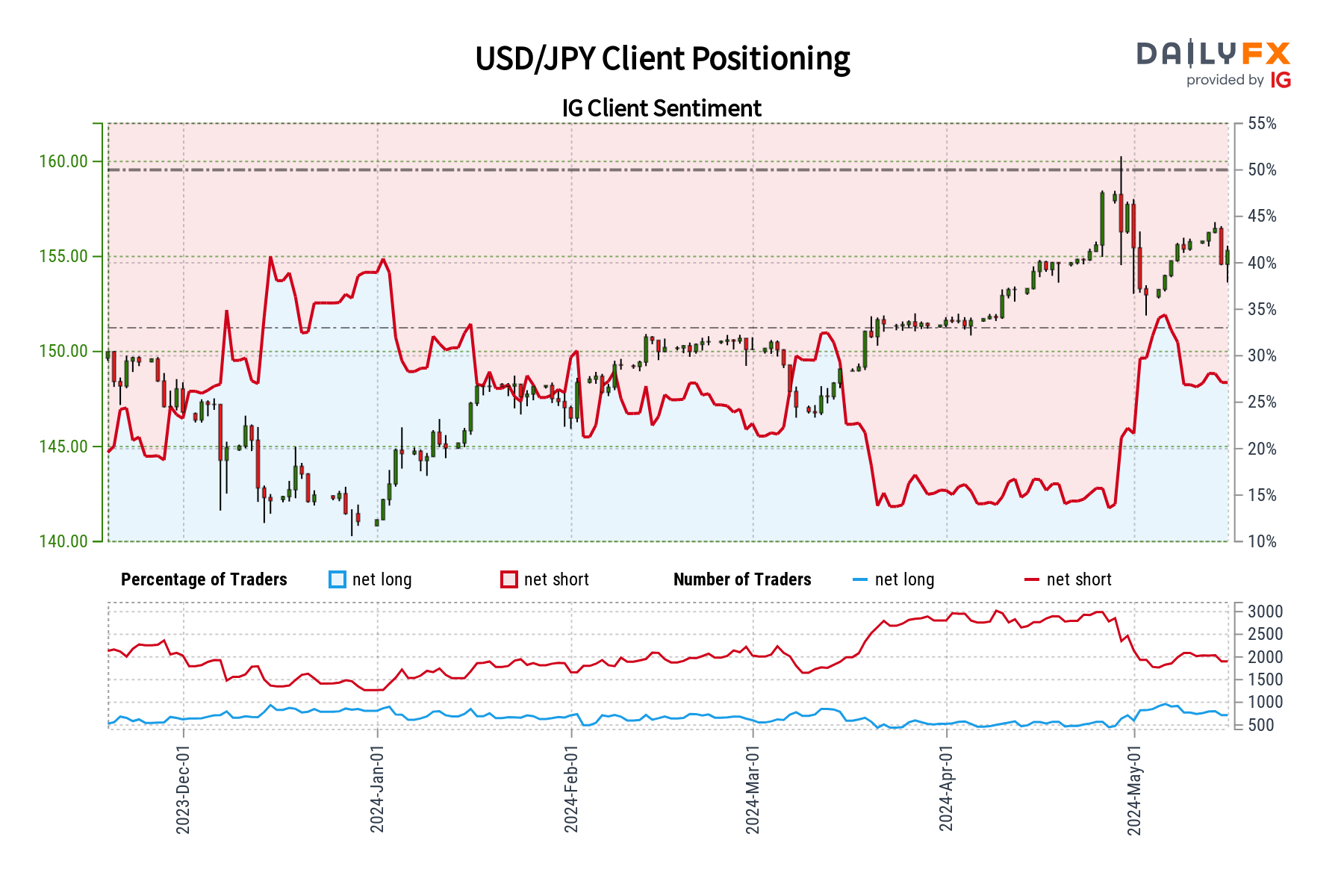

USD/JPY – Market Sentiment

The sentiment for USD/JPY is heavily bearish, with a short-to-long ratio of 2.37 to 1. The number of bearish positions has decreased slightly by 0.85% since yesterday but is down by 8.77% over the past week. Bullish positions have increased by 9.28% since yesterday, though they remain 4.13% lower than last week.

Contrarian view: The high volume of bearish bets indicates potential upside for USD/JPY. However, the recent reduction in selling pressure and mixed trends suggest caution, indicating a possible shift in the market trend.

Key Takeaway: Relying solely on contrarian indicators is insufficient. A robust strategy for USD/JPY should integrate an analysis of price movements and fundamental factors with sentiment data.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.