Japanese Yen: Sentiment & Technical Analysis

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Market Sentiment Overview

In the world of trading, following the majority may seem enticing, but experienced traders frequently find value in contrarian techniques.

Tools such as IG client sentiment provide insights into the market sentiment, indicating probable direction swings when optimism or pessimism peaks.

Contrarian signals, on the other hand, should be used in conjunction with technical and fundamental investigations to improve trading techniques.

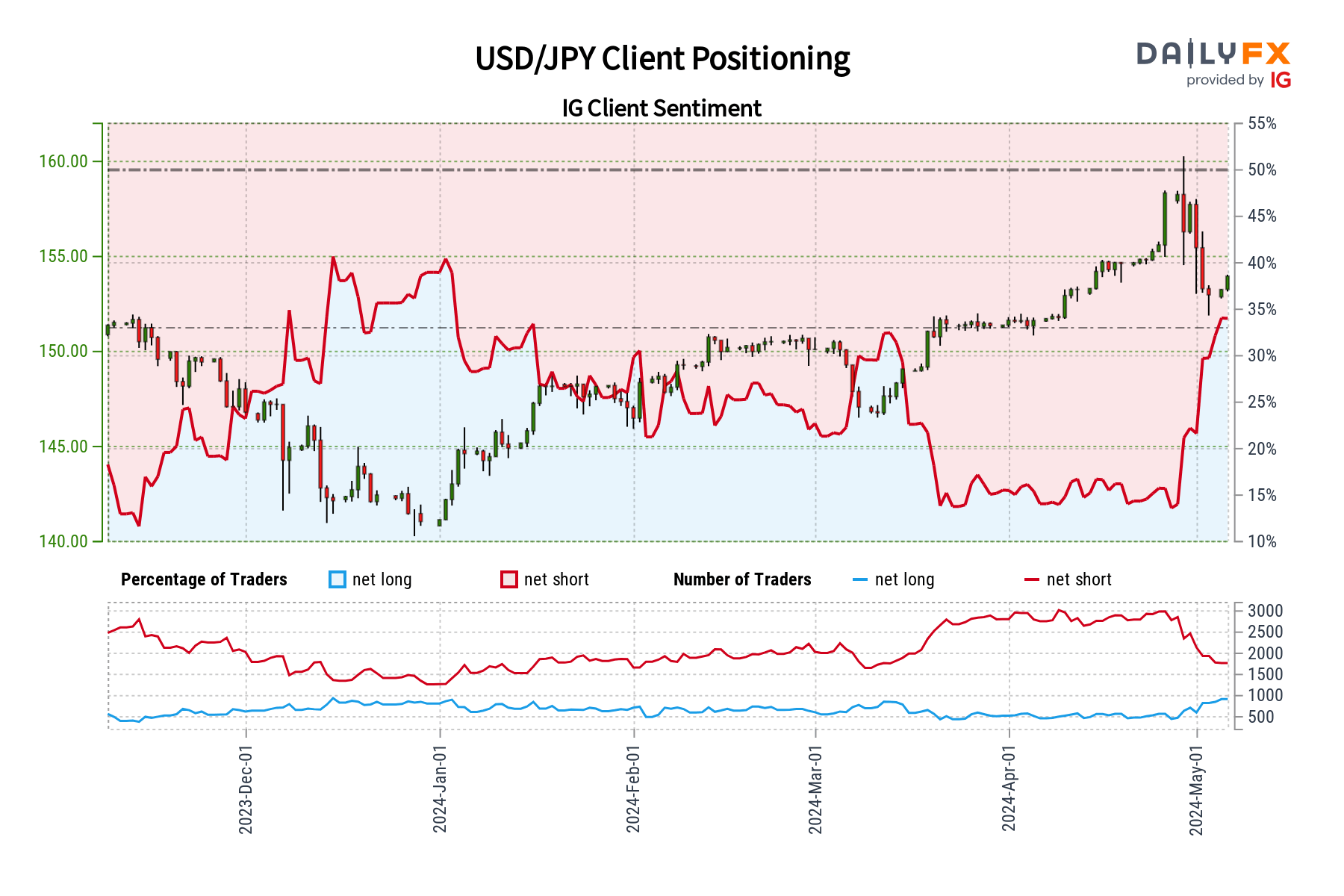

USD/JPY Analysis

IG figures show a bearish sentiment, with 65.61% of traders holding net-short positions. Although bearishness has diminished marginally, recent market activity has produced mixed signals, indicating a cautious attitude.

The likely reversal to a lower trend emphasizes the significance of combining contrarian views with extensive market analysis to accurately forecast USD/JPY movements.

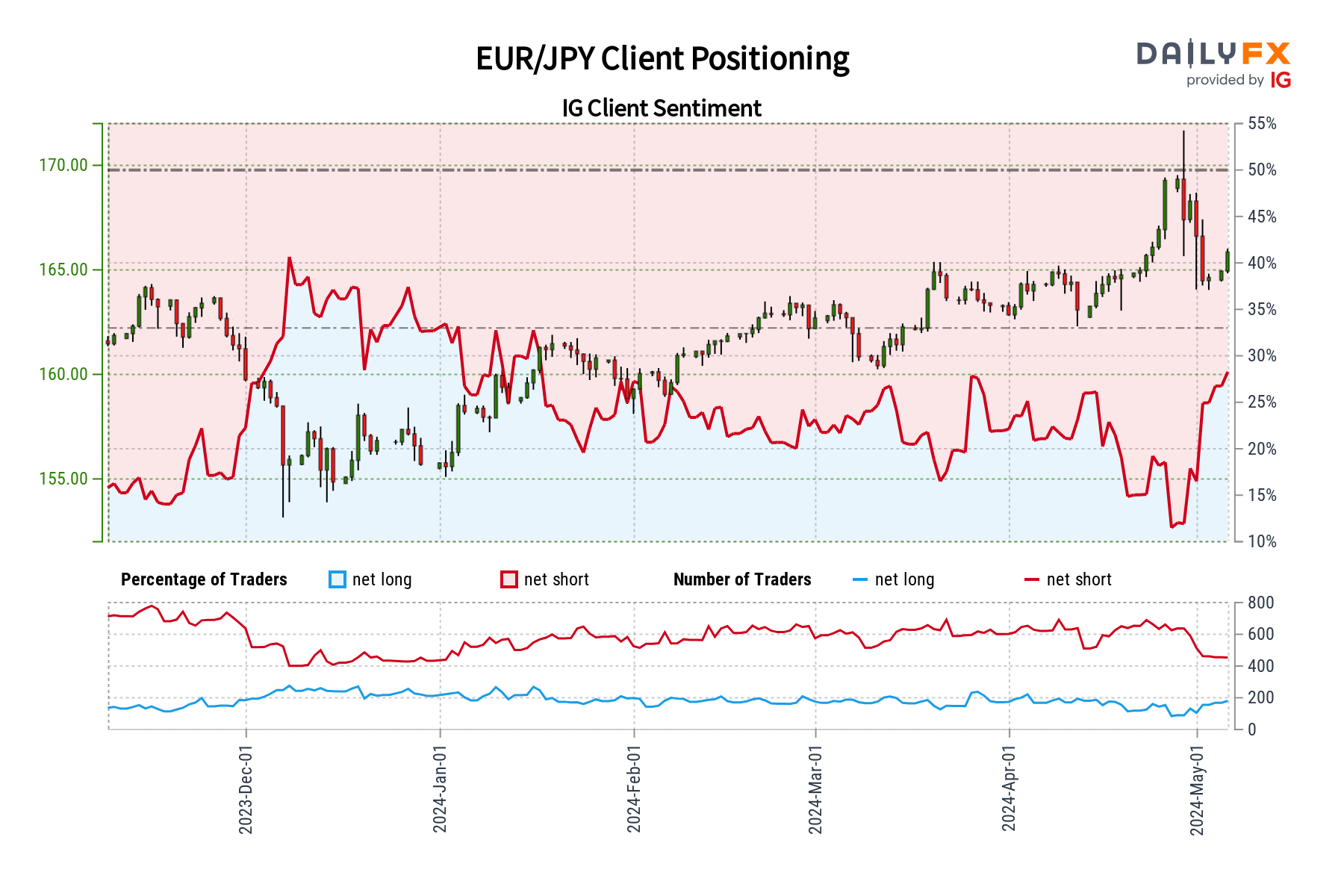

EUR/JPY Outlook

The EUR/JPY remains strongly bearish, with 69.73% of clients opting to sell. The minor decrease in negative positions creates uncertainty, possibly indicating a change toward a lower trend.

Traders should use a detailed analysis method to navigate these contradictory signals and seize potential market chances.

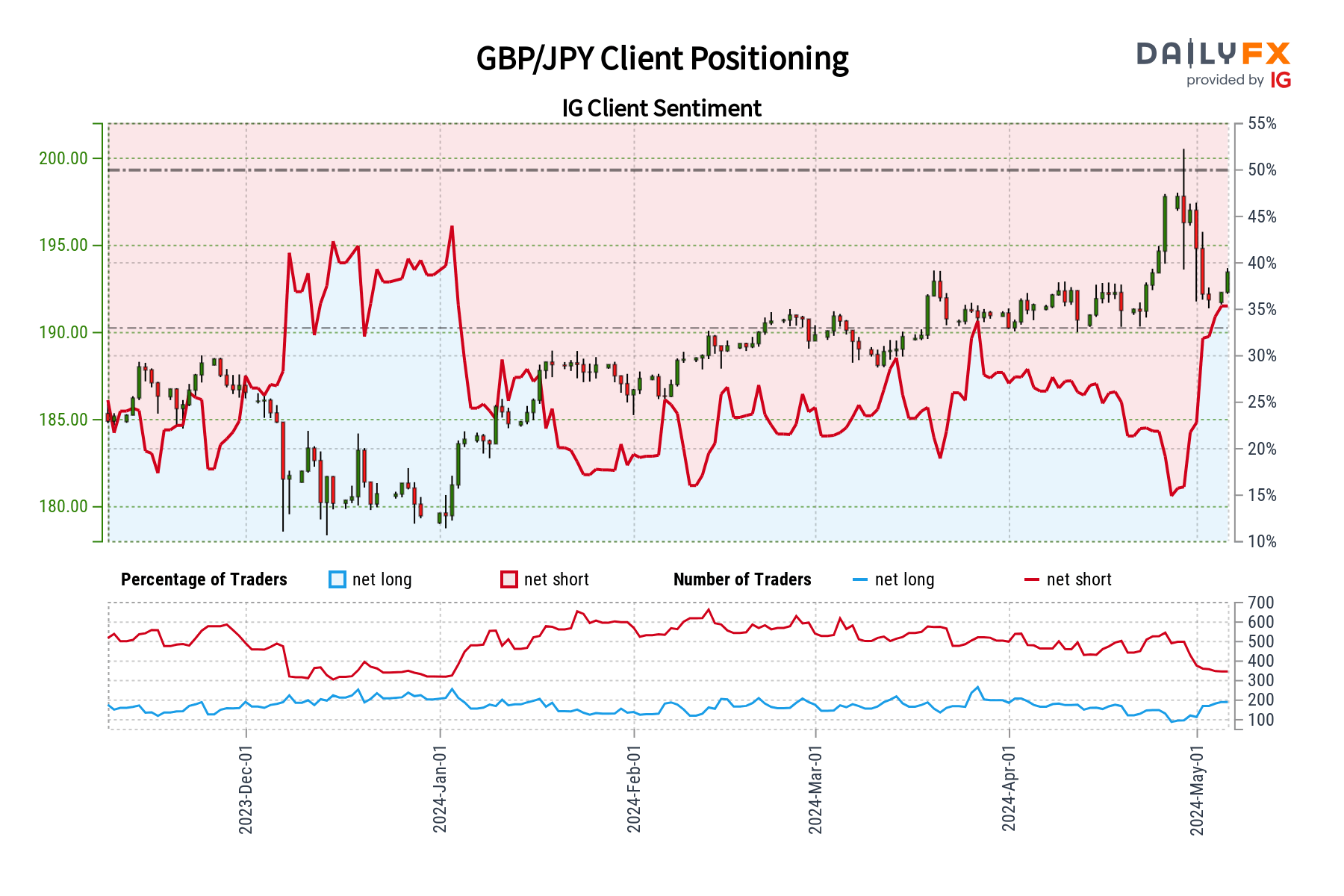

GBP/JPY Forecast

For the GBP/JPY, 65.45% of traders expect a decline, with a recent drop in bearish holdings compared to the previous week. This shifting opinion signals a probable increase, however overall confidence in this projection remains low.

Given the contradicting signals, taking a neutral attitude supported by an in-depth investigation is recommended.

Technical Analysis and Key Levels

Recent USD/JPY swings have been influenced by suspected Bank of Japan interventions, especially following critical events such as the FOMC rate decision. The important support level of 151.95 has shown to be significant, indicating a possible turning point in future market moves.

Looking ahead, the 155.00 level is key, with the possibility of further interventions by the Bank of Japan if the price hits this level. Support levels to be aware of include 150.87 and the psychologically significant 150.00 mark.

For resistance, 156.07 is a major level formed by past trading activity.

Short-Term Trading Dynamics

In early trade, USD/JPY has demonstrated positive momentum, with higher highs and lows following last week's support test at 151.95.

The market's dynamics are muddled further by rollover effects, which allow long positions to profit from rollover credits, discouraging negative moves. Traders should keep an eye out for possible Bank of Japan actions, which might have a substantial impact on market trajectory.

Market Outlook

In conclusion, while the Japanese yen exhibits mixed signals across different pairs, the overall theme is the importance of taking a balanced approach that incorporates both contrarian thoughts and thorough market research.

To make informed decisions in unpredictable trading settings, traders need to stay up to speed on central bank activity and market sentiment.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.