Japanese Yen Outlook Amid Volatility Warnings

By Daniel M.

April 3, 2024 • Fact checked by Dumb Little Man

In the world of trading, embracing a contrarian approach can reveal distinct opportunities, particularly during times of intense market sentiment.

This analysis delves into the present sentiment surrounding the Japanese Yen, utilizing IG client sentiment data to provide a nuanced perspective for traders.

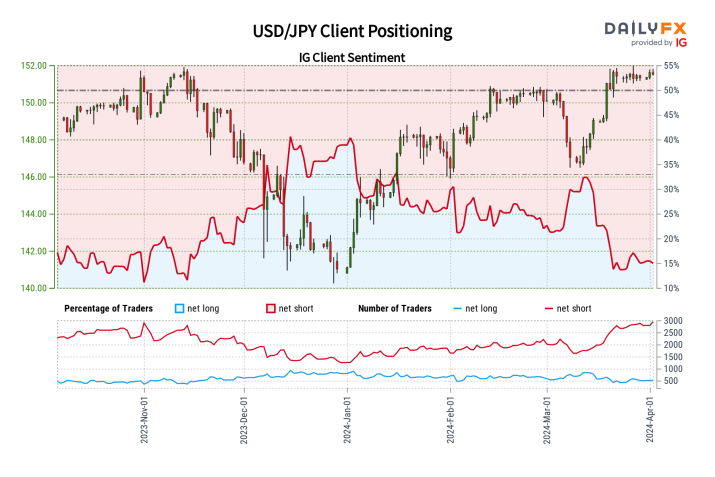

USD/JPY Market Sentiment

According to IG data, the sentiment towards USD/JPY is mostly bearish, as the majority of traders, 84.14% to be precise, hold net-short positions.

Given the prevailing pessimism and the recent surge in short positions, it seems that there may be a more optimistic perspective for USD/JPY, hinting at possible gains.

It’s important, though, to combine these signals with technical and fundamental analyses for well-informed trading decisions.

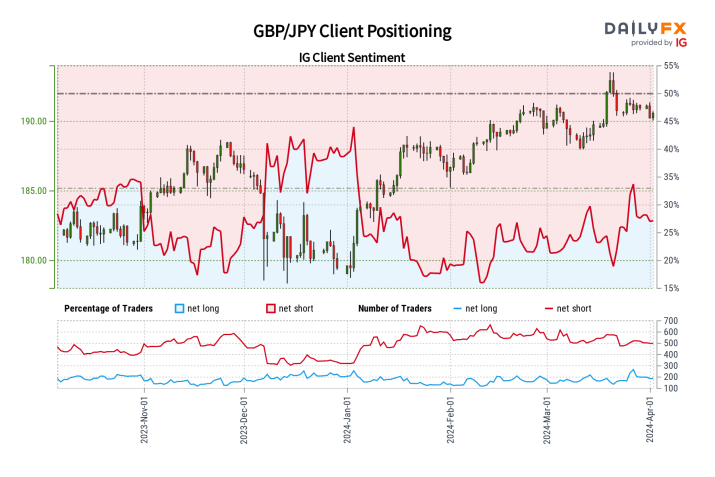

GBP/JPY Market Sentiment

In a similar vein, the GBP/JPY pair is currently experiencing a notable bearish sentiment, as a majority of traders, specifically 72.7%, are positioned on the net-short side.

The growing negativity and a decline in net-long positions highlight an optimistic contrarian prediction. It appears that there may be a potential for a rally in GBP/JPY, which could prompt traders to take into account contrarian signals within a wider analytical context.

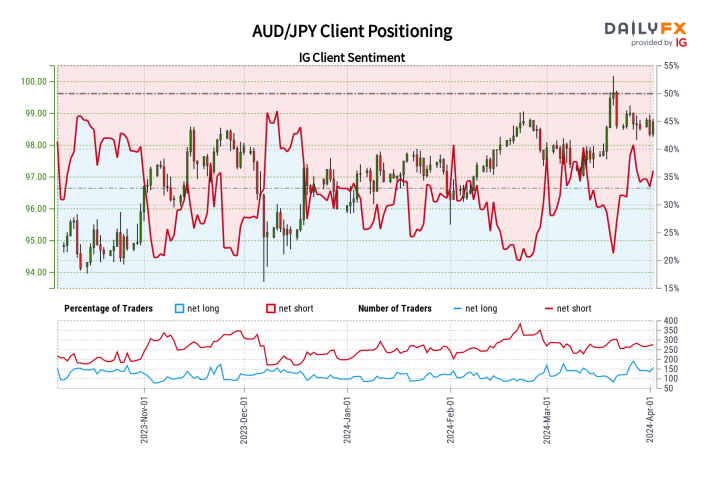

AUD/JPY Market Sentiment

The sentiment for AUD/JPY is in line with the overall Yen trend, with 65.19% of traders being net-short. With the bearish sentiment on the rise and a decline in net-long positions, there is a positive contrarian outlook for AUD/JPY, suggesting the possibility of an upward movement.

Market Outlook and Volatility Warnings

Japan’s Finance Minister Shunichi Suzuki has once again emphasized the importance of avoiding excessive Yen volatility and has expressed preparedness to take necessary measures to stabilize the currency.

Similar to a quantitative analyst, Tokyo is taking a cautious stance against destabilizing Yen declines, despite the absence of immediate “decisive action” threats. The continuous mention of intervention signals their vigilance.

Despite the Bank of Japan’s recent shift away from negative interest rates and their use of dovish language, the Yen’s downtrend remains unchanged.

Market expectations of a prolonged interest rate difference between the U.S. and Japan, supported by remarks from US Federal Reserve Chair Jerome Powell, continue to exert pressure on the Yen.

Given the current USD/JPY pair’s proximity to a 34-year high, traders are closely monitoring the situation for any signs of Tokyo intervention.

Conclusion

When analyzing the Japanese Yen’s future, traders should consider taking a contrarian approach to spot possible reversals or rallies during periods of extreme sentiment.

The current market sentiment towards USD/JPY, GBP/JPY, and AUD/JPY is bearish. This contrasts with official warnings against excessive volatility, creating a complex backdrop.

To effectively capitalize on the Yen’s dynamics, traders will need to employ a comprehensive trading strategy that combines sentiment analysis, technical patterns, and fundamental insights.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.