Japanese Yen: Insightful Market Analysis and Investor Sentiment on USD/JPY, EUR/JPY, GBP/JPY

By Daniel M.

March 20, 2024 • Fact checked by Dumb Little Man

Many investors follow the trend, investing in assets on the rise and retreating at the first sign of a downturn. Contrary to this common strategy, indicators like IG client sentiment propose a different approach, highlighting that contrarian opportunities often present the best returns. These indicators gauge the market’s mood—be it overly positive or negative—to signal potential market shifts.

Leveraging contrarian indicators should be one aspect of a comprehensive trading strategy. They are not to be used in isolation for making investment decisions. By integrating contrarian signals with fundamental and technical analyses, investors can gain a deeper understanding of market dynamics, possibly uncovering overlooked opportunities. Let’s explore the insights provided by IG client sentiment on the Japanese yen.

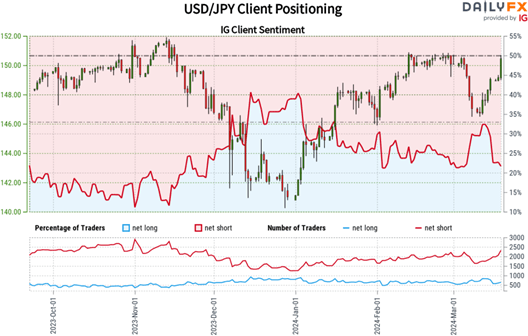

USD/JPY Market Sentiment

IG client sentiment data showcases a significant bearish outlook on USD/JPY, with 70.65% of investors betting against the U.S. dollar, reflected in a short-to-long ratio of 3.91 to 1. This bearish sentiment has grown, evidenced by a 9.34% increase in traders holding net short positions since yesterday and a 35.63% increase from the previous week.

This strong contrarian signal suggests a potential for reversal, indicating USD/JPY might rise. Contrarian trading thrives on the premise that the majority can be wrong, especially under extreme emotional reactions. Although not guaranteed, this severe negative sentiment among retail traders could signify an overreaction, setting the stage for potential gains in the U.S. dollar.

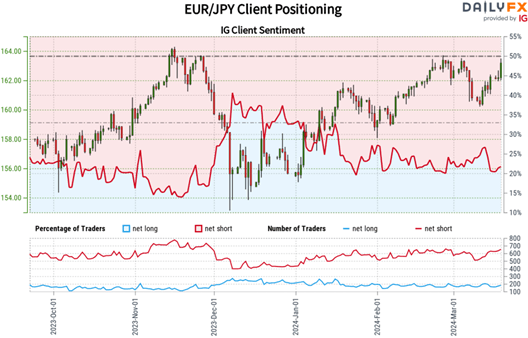

EUR/JPY Market Sentiment

IG client sentiment data indicates that 81.19% of retail investors anticipate a decline in EUR/JPY, with a 4.32 to 1 ratio of bearish to bullish positions. The net-short positions have seen a slight increase of 0.16% since yesterday and a significant 13.72% rise from last week. Meanwhile, net-long positions have decreased by 25.51% since the previous session and 26.63% from the last week.

Typically, a contrarian perspective to crowd sentiment suggests that EUR/JPY prices might ascend. The pronounced net-short positioning on EUR/JPY, compounded by an increase in bearish sentiment from yesterday and last week, strengthens this bullish contrarian outlook. This could imply that the market sentiment is overly pessimistic, potentially offering a conducive scenario for EUR/JPY to advance.

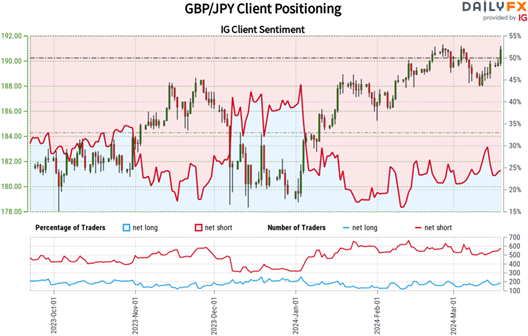

GBP/JPY Market Sentiment

According to IG sentiment data, a dominant portion of retail clients are bearish on GBP/JPY. As of the latest data, 79.01% of traders are in short positions, leading to a short-to-long ratio of 3.76 to 1. This negative sentiment has intensified, with net-short positions increasing by 4.79% since yesterday and 13.65% since last week.

Adopting a contrarian view, the substantial net-short positioning indicates potential upward movement for GBP/JPY in the short term. The growing pessimism, both on a daily and weekly basis, underscores a contrarian bullish perspective, suggesting that the market may be overly negative, thereby opening up opportunities for further GBP/JPY gains.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.