Japanese Yen Forecast: Yen Appeal Shows Short-Lived; Wage Data in Center

By John V

March 3, 2024 • Fact checked by Dumb Little Man

USD/JPY Surrenders Prior Gains Ahead of the Weekend

The Japanese Yen’s recent appeal has proven to be short-lived as the currency faces pivotal moments ahead, particularly with the upcoming wage data set to finalize around March 13th. Following a brief rebound from its late 2023 low, the Yen has risen beyond the 150.00 barrier versus the US dollar, owing to favorable words from Bank of Japan (BoJ) board member Hajime, who advocated for a policy shift with the bank’s 2% inflation target within reach.

This expectation is placed against the backdrop of ongoing wage discussions, in which labor unions are seeking for big increases and businesses, seeing that inflation has been above the 2% threshold for more than a year, appear willing to oblige. This scenario shows a potential drive toward the greatest wage hikes in years, with the goal of creating a ‘virtuous cycle’ between salaries and prices, as indicated by BoJ Governor Ueda, which could serve as a catalyst for a policy shift.

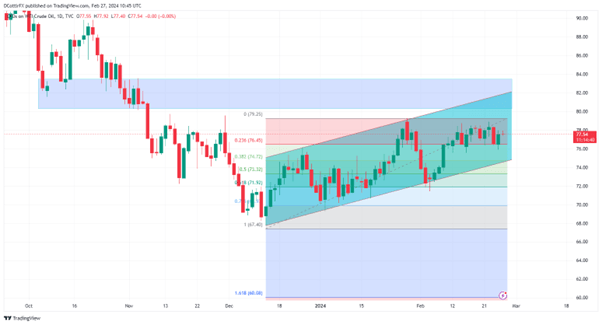

USD/JPY Daily Chart

EUR/JPY Finds Support Ahead of ECB Meeting Next Week

On the European front, the Euro finds its footing ahead of an important European Central Bank (ECB) meeting, The EUR/JPY pair found support at 161.70, indicating a bullish outlook. Despite slow economic growth in the Eurozone and imminent recession fears in Germany, the ECB is anticipated to hold off on interest rate reduction, emulating the US approach to monetary policy.

Meanwhile, the emphasis switches to Eurozone inflation statistics, which are likely to fall, potentially influencing the ECB’s monetary policy direction at the upcoming meeting. With both areas facing big event risks, such as Japan’s wage negotiations and the ECB meeting, traders should exercise caution, as these developments may cause volatility in the FX markets, emphasizing the necessity of risk management in these uncertain times.

EUR/JPY Daily Chart

Final Thoughts

Later today, Euro Area inflation is forecast to fall from 3.3% to 2.9% in February, with a comparable drop in the headline measure from 2.8% to 2.5%. A lower overall inflation reading is likely to focus attention on next week’s ECB monetary policy meeting, where there is little anticipation of a rate cut. Even though Europe’s economy is currently in need of help, markets expect the first rate cut to occur in June. The European Union has seen lackluster development overall, with quarterly GDP growth estimates hovering around 0% for the past five quarters.

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.